[ad_1]

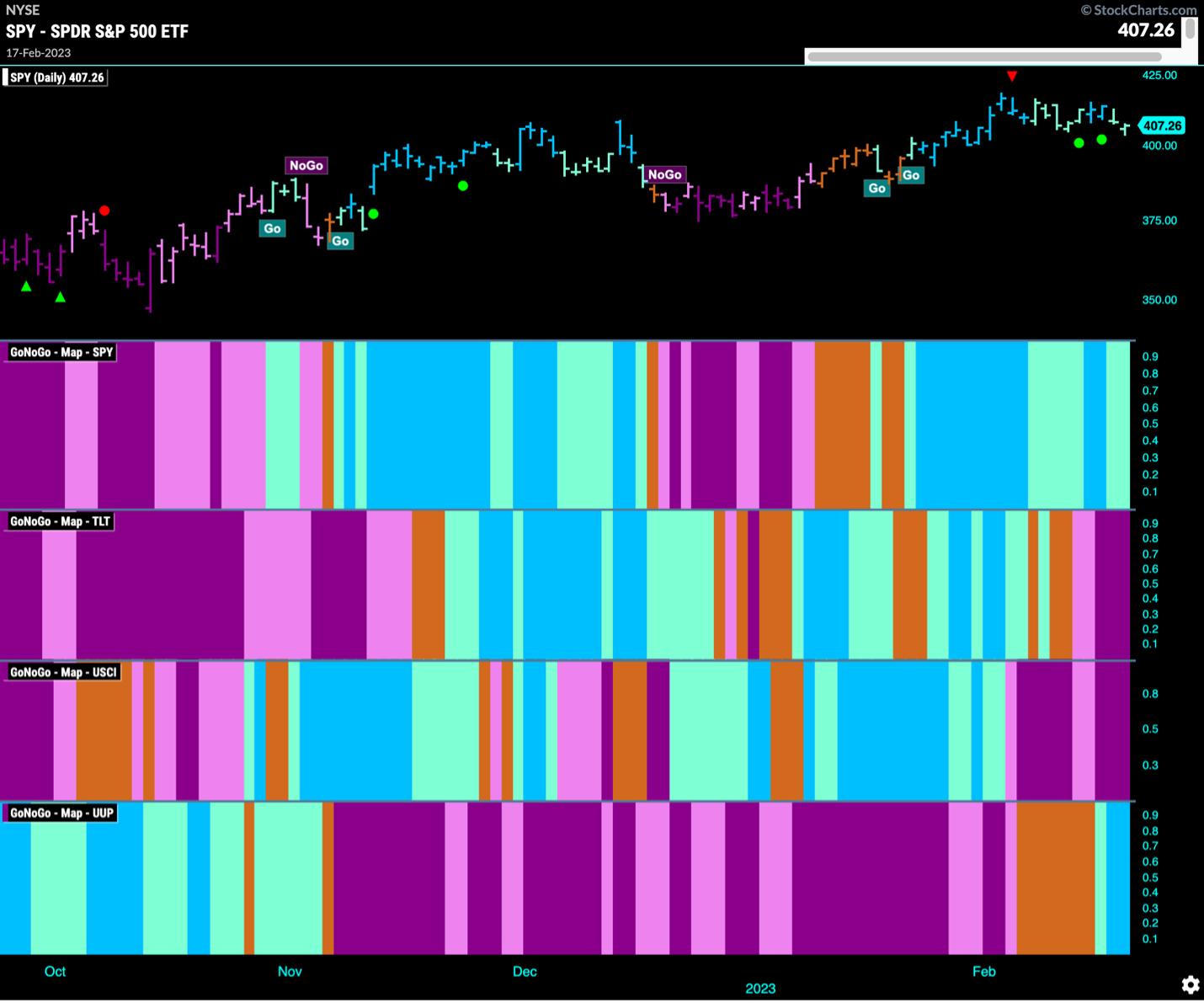

Equities are sustaining their “Go” pattern standing this week, however there might be weak spot forward. Treasury bonds and commodities battle whereas the US greenback finds its toes in a brand new pattern.

Equities Proceed To Pull Again From Latest Excessive

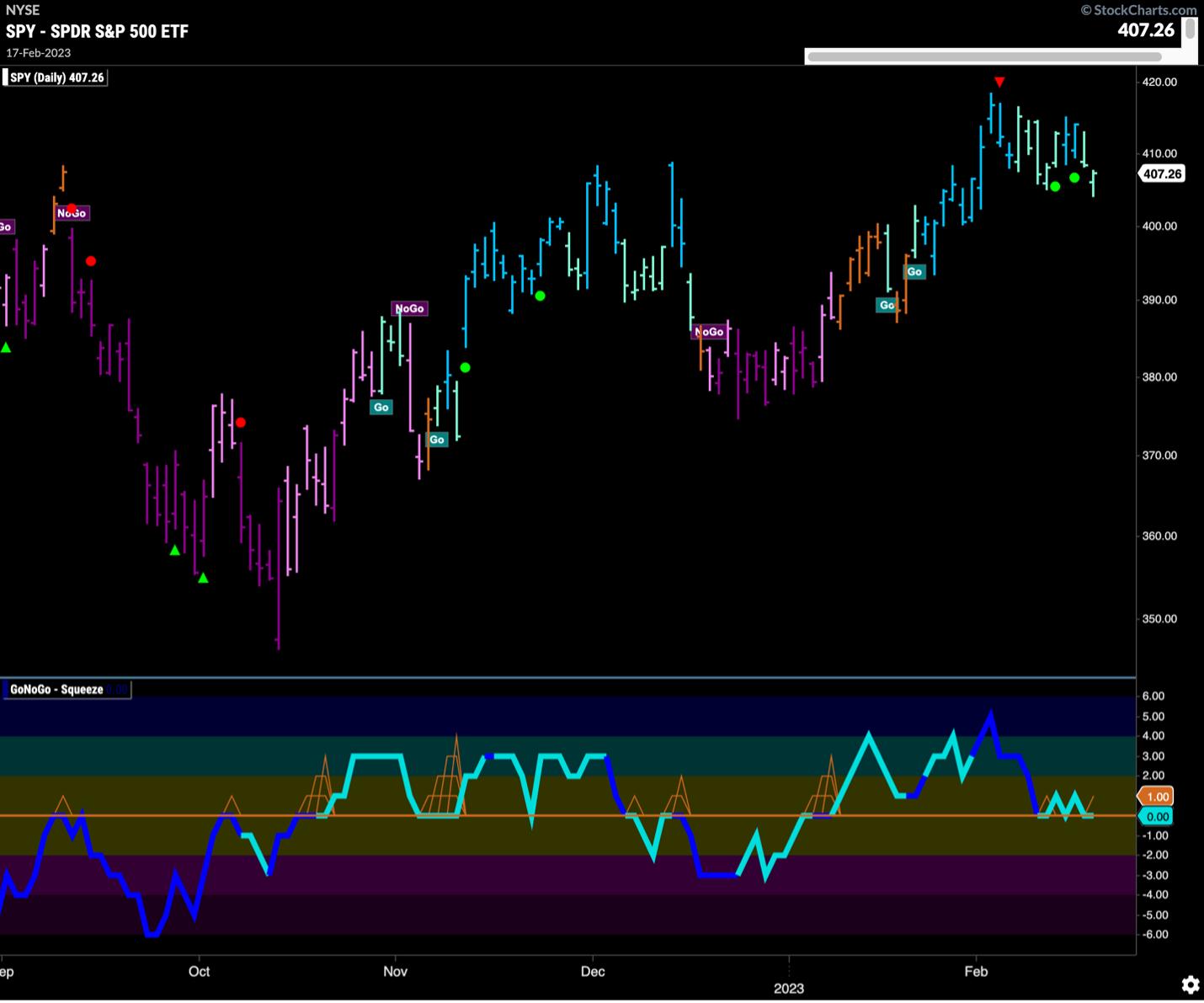

Trying on the chart of iShares S&P 500 ETF (SPY), GoNoGo Pattern exhibits that the “Go” pattern stays. Nevertheless, costs have fallen into paler aqua bars at week’s finish. SPY is testing assist from November highs. The query is that if the correction will cease right here. GoNoGo Oscillator is as soon as once more on the zero line, and if the “Go” pattern is to proceed, we’ll must see the oscillator discover assist on the zero degree.

The longer-term weekly SPY chart exhibits one other amber “Go Fish” bar (see chart under). This has been a string of uncertainty as value is ready to climb above the downward sloping trendline and consolidate above. GoNoGo Oscillator stays in optimistic territory however not overbought after rallying off the zero line a number of weeks in the past.

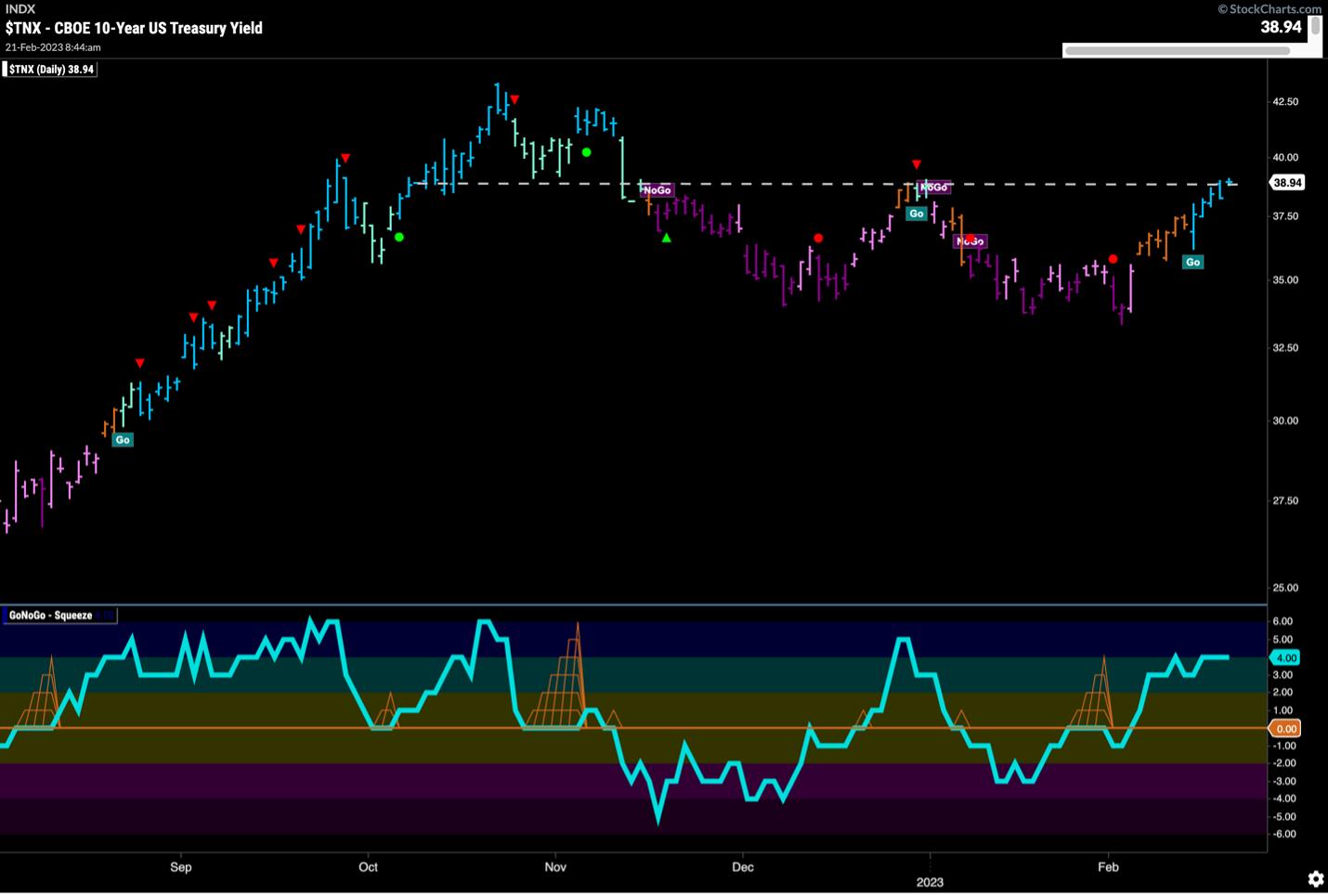

Treasury Charges Again in “Go” Pattern

Treasury charges continued to rally and GoNoGo Pattern was capable of paint sturdy blue “Go” bars this week as value rises to check resistance from prior excessive (see chart of 10 12 months US Treasury Yield under). We will probably be noting whether or not this stops charges in its tracks or if it will set a brand new excessive as GoNoGo Oscillator exhibits optimistic momentum.

US Greenback Enters “Go” Pattern

Nearly in lockstep with treasury charges, the US greenback is getting into a “Go” pattern this week after a interval of uncertainty. There’s some overhead resistance which you could see within the chart under within the type of the horizontal line. GoNoGo Oscillator is in optimistic territory however not overbought. Quantity is heavy. Do not be stunned to see just a little battle right here but when value strikes above resistance, it might sign additional features for the dollar.

Gold Turns Tail and Enters “NoGo”

Gold costs moved decrease this week, and GoNoGo Pattern painted sturdy purple “NoGo” bars. This pattern change got here a number of weeks in the past after GoNoGo Oscillator broke under the zero line on heavy quantity. At the moment, GoNoGo Oscillator exhibits that momentum is in unfavourable territory however not but oversold. With no apparent assist at these ranges $GLD might fall just a little additional (see GLD chart under).

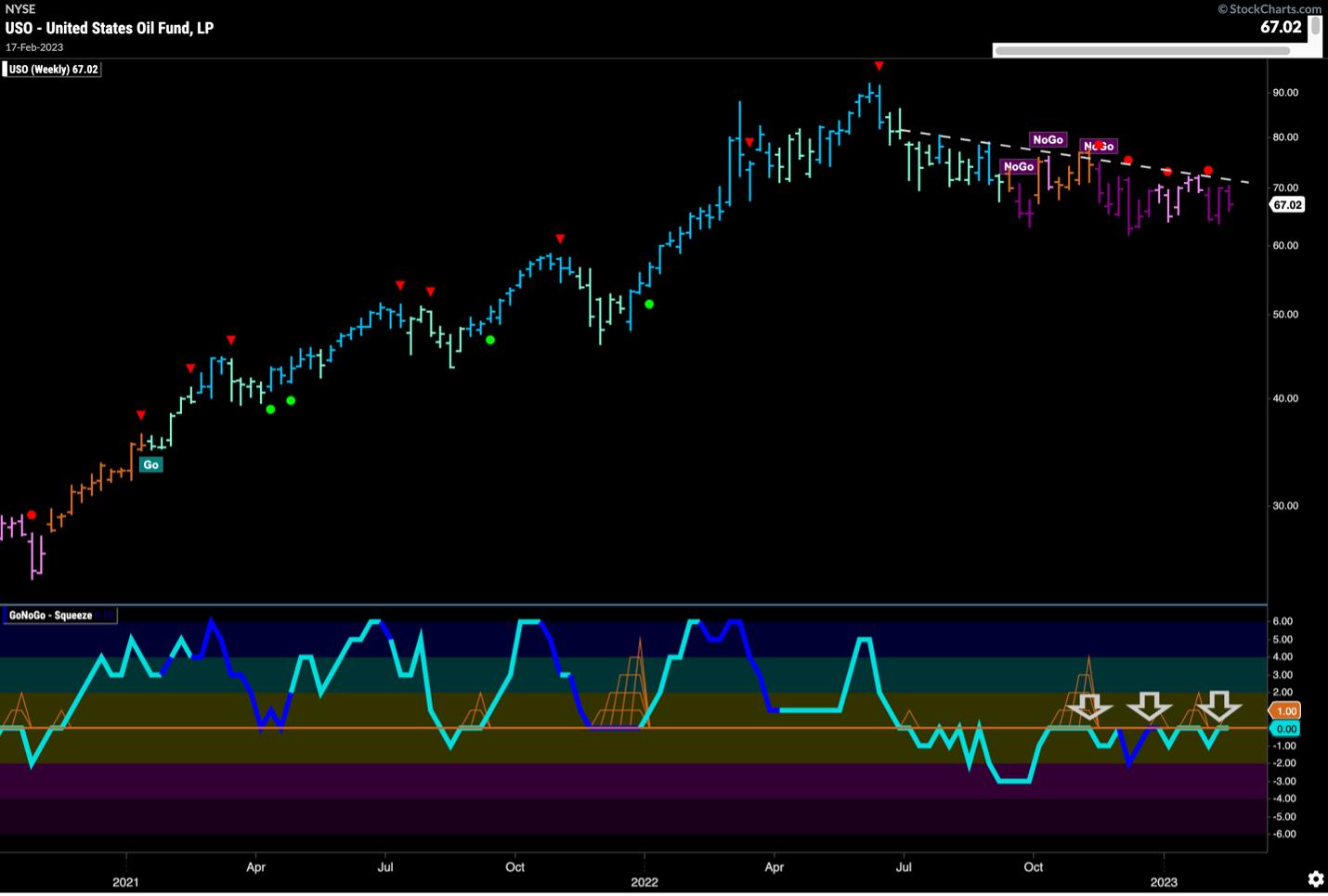

Oil Slowly Grinds Decrease

The weekly chart of United States Oil Fund (USO) exhibits that every one the uneven motion on the day by day chart hasn’t completed a lot to alter the bigger time-frame pattern, which stays a “NoGo,” and costs are transferring decrease slowly respecting the downward sloping pattern line. GoNoGo Oscillator has had issue getting distant from the zero line however hasn’t but been capable of break into optimistic territory. We’ll watch to see if it will get rejected once more at this degree.

The Backside Line

The inventory market is at a important juncture, which makes it much more necessary to control intermarket relationships. A change in pattern might be an early indication of which means equities might transfer.

Alex Cole, CEO and Chief Market Strategist at GoNoGo Charts, is a market analyst and software program developer. Over the previous 15 years, Alex has led technical evaluation and information visualization groups, directing each enterprise technique and product growth of analytics instruments for funding professionals. Alex has created and carried out coaching packages for big companies and for personal purchasers. His instructing covers a large breadth of Technical Evaluation topics from introductory to superior buying and selling methods.

Study Extra

Subscribe to GoNoGo Charts to be notified every time a brand new put up is added to this weblog!

[ad_2]