[ad_1]

There isn’t a debate in terms of concluding that 2022 has been a uneven yr for equities globally. The markets needed to take care of all types of issues; rising inflation, concern of recession, geopolitical tensions, and a slew of price highs from the central banks all around the world. Having stated this, these conditions offered us with a necessity nearly on a regular basis to remain invested in a sector that’s resilient and presents stability to at the least a portion of any investor’s portfolio. The NIFTY PSE Sector, represented by NIFTY PSE Index ($CNXPSE) is one such sector.

The NIFTY PSE Index includes of firms wherein 51% of excellent share capital is held by the Central Authorities and/or State Authorities, instantly or not directly.

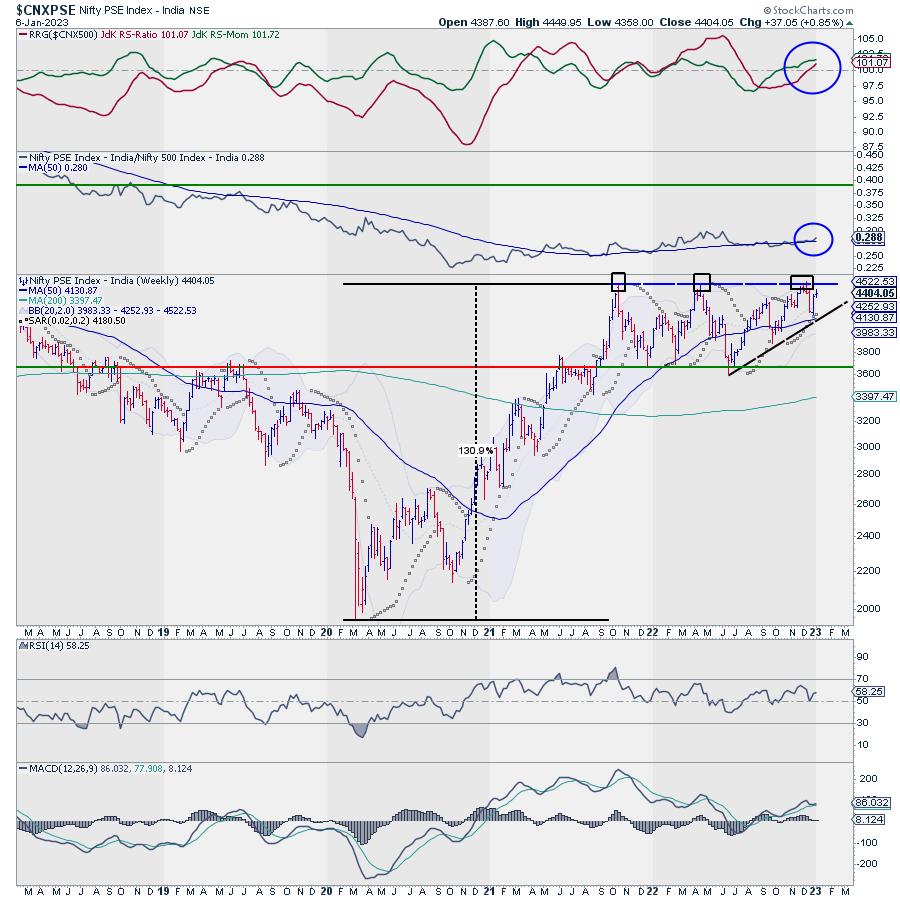

A look on the weekly charts presents an attention-grabbing image; a look on the long-term month-to-month charts presents an much more attention-grabbing image which is the true supply of pleasure. Allow us to start with the weekly chart first.

After forming the pandemic lows in March 2020, $CNXPSE has risen 130% as of immediately. It rose from the lows fashioned close to the 1960-1990 zones and fashioned its peak above 4400 ranges in October 2021. Regardless of resilient relative efficiency many instances previously yr, this sector has not returned something virtually over the past 14 months because it stays on the similar degree that was seen in October 2021.

Wanting from a brief to medium-term perspective, it’s seen oscillating in a buying and selling vary of 3650-4450 ranges. The extent of 4400 has been examined at the least thrice since October 21; it seems to be making greater bottoms inside this space sample and should stage a breakout if it strikes meaningfully above 4500 ranges.

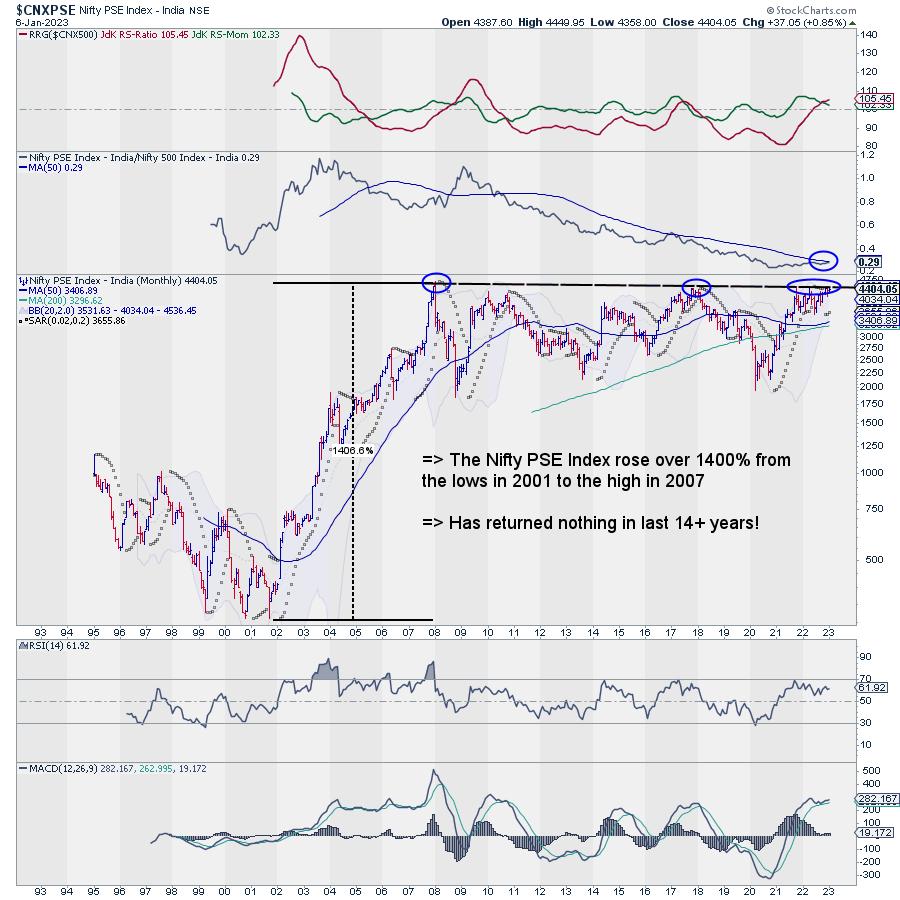

That isn’t all. If we zoom out and take a long-term view, that is the place the true pleasure is available in. Allow us to check out the long-term month-to-month chart of $CNXPSE.

Following its inception in January 1995, the NIFTY PSE Index marked its low level close to 325-330 ranges in September 2001. Starting from this time till the height fashioned close to 4400 in January 2008, this index ended up returning spectacular 1400+% returns in simply over 6 years. Nevertheless, from January 2008 till now, the index has not returned something in 14 years because it stays on the similar degree immediately because it was in January 2008.

Intermittent outperformance aside, the Index examined the 4400-4500 ranges in January 2008, a couple of instances between September and December 2017, and some instances over the previous 14 months.

This interprets into the truth that except you invested within the PSE pocket throughout pandemic lows, you’ve gotten acquired effectively over 130% returns; nonetheless, if you’re invested since 2008, you’ve gotten acquired nothing over the previous 15 years.

How would Traders monitor and keep invested on this pocket?

The reply to this may very well be in maybe two methods.

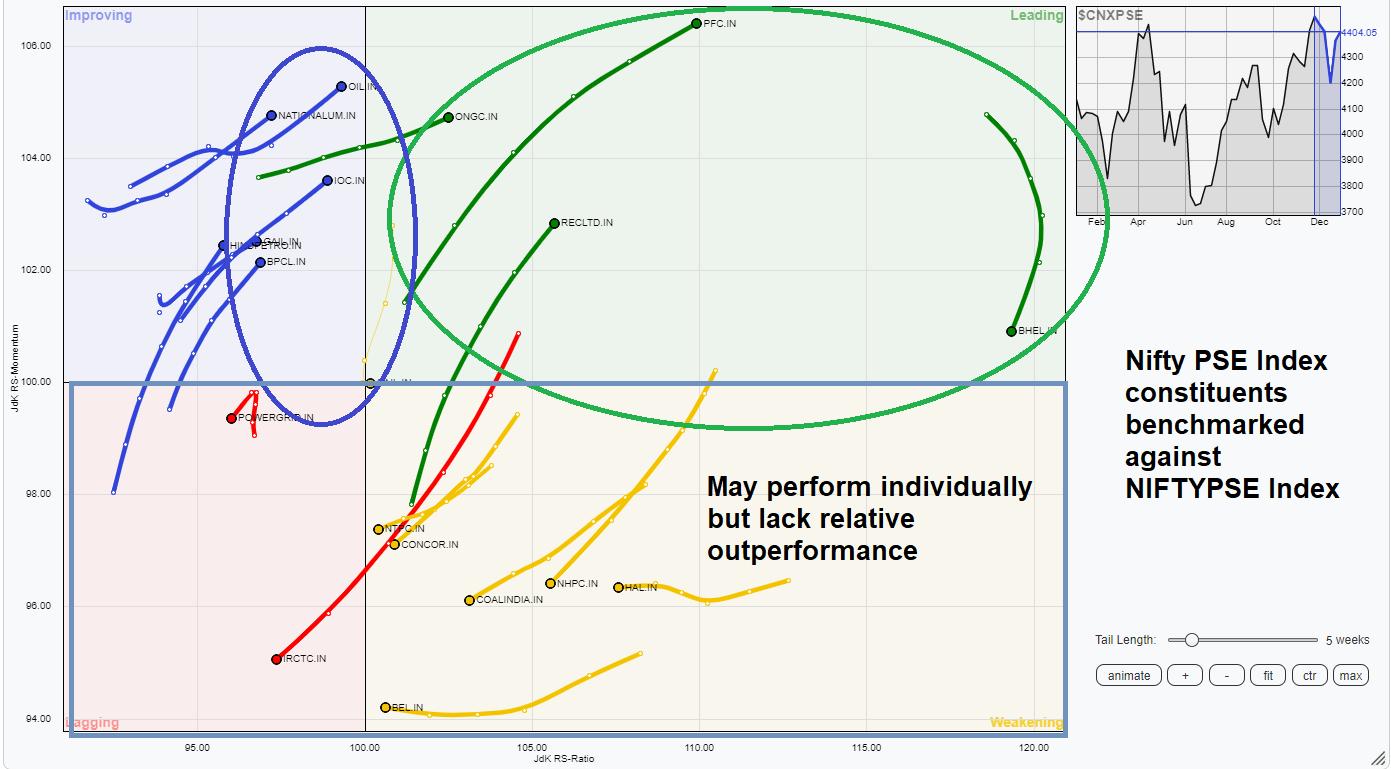

For Energetic Traders, it will imply actively monitoring the rotations and staying invested within the shares with sturdy relative momentum inside the Nifty PSE Index. As of now, the image stands as beneath:

The above RRG exhibits NIFTY PSE Constituents benchmarked towards the NIFTY PSE Index. Those circled in blue and inexperienced are those which can be seen comparatively outperforming the benchmark.

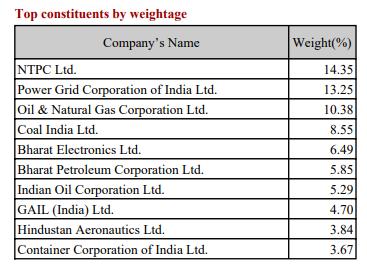

For Passive Traders, the method could also be barely completely different. They might simply keep invested within the Index constituents within the proportion of their weight within the Index.

Apparently, the NIFTY PSE Index is made up of 20 shares. Nevertheless, the highest 10 shares characterize 76.37% of the Index. Monitoring and staying invested in these shares ought to serve the aim sufficient!

What makes this pocket resilient and secure?

This group enjoys a constructive to strongly constructive correlation with the frontline NIFTY 50 Index. Over the previous yr, it has seen a correlation of 0.63, however over 5 years and since inception, it has seen a correlation of 0.70 and 0.74 with the Nifty.

The protection and resilience include the Beta that this sector has towards the NIFTY. It has a Beta beneath 1. During the last one yr, it has seen a Beta of 0.71. During the last 5 years and since inception, it has a Beta of 0.83 towards the NIFTY. This has ensured that in turbulent instances, this group of shares has declined lower than the frontline index.

Conclusion?

Just about simple and easy. Be careful for a significant transfer above 4450-4500 on this index and we could also be in for a multiyear breakout on this index!

Milan Vaishnav, CMT, MSTA | Founder and Technical Analyst | www.equityresearch.asia |www.chartwizard.ae

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near 20 years. His space of experience consists of consulting in Portfolio/Funds Administration and Advisory Companies. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Companies. As a Consulting Technical Analysis Analyst and along with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Impartial Technical Analysis to the Purchasers. He presently contributes every day to ET Markets and The Financial Instances of India. He additionally authors one of many India’s most correct “Every day / Weekly Market Outlook” — A Every day / Weekly Publication, presently in its 18th yr of publication.

Subscribe to Analyzing India to be notified at any time when a brand new submit is added to this weblog!

[ad_2]