[ad_1]

Retention isn’t a silver bullet, however in SaaS, it’s the closest factor to it.

Excessive retention signifies sturdy product-market match. It’s proof that you’re fixing an actual downside and are including worth to your clients.

Excessive retention additionally means higher progress. Firms with best-in-class retention develop no less than 1.5x-3x sooner.

Lastly, excessive retention means a extra capital-efficient enterprise. In SaaS, buying clients is the most expensive a part of operating your corporation. Even at scale, gross sales and advertising bills make up nearly all of your expenditure. If you’re unable to retain these expensive-to-get clients, your corporation goes to be much less environment friendly and price extra to scale.

It’s no shock, given all this, that corporations with larger web income retention usually command larger valuations.

How can corporations know if their retention price is as much as par? And with the current market downturn, is retention decrease than it was once?

There’s no higher approach to reply that than to take a look at actual knowledge. At ChartMogul, we studied greater than 2,100 SaaS companies to deliver retention benchmarks and tendencies to the SaaS group. Listed below are our key takeaways.

Retention in 2022 was tougher than ever

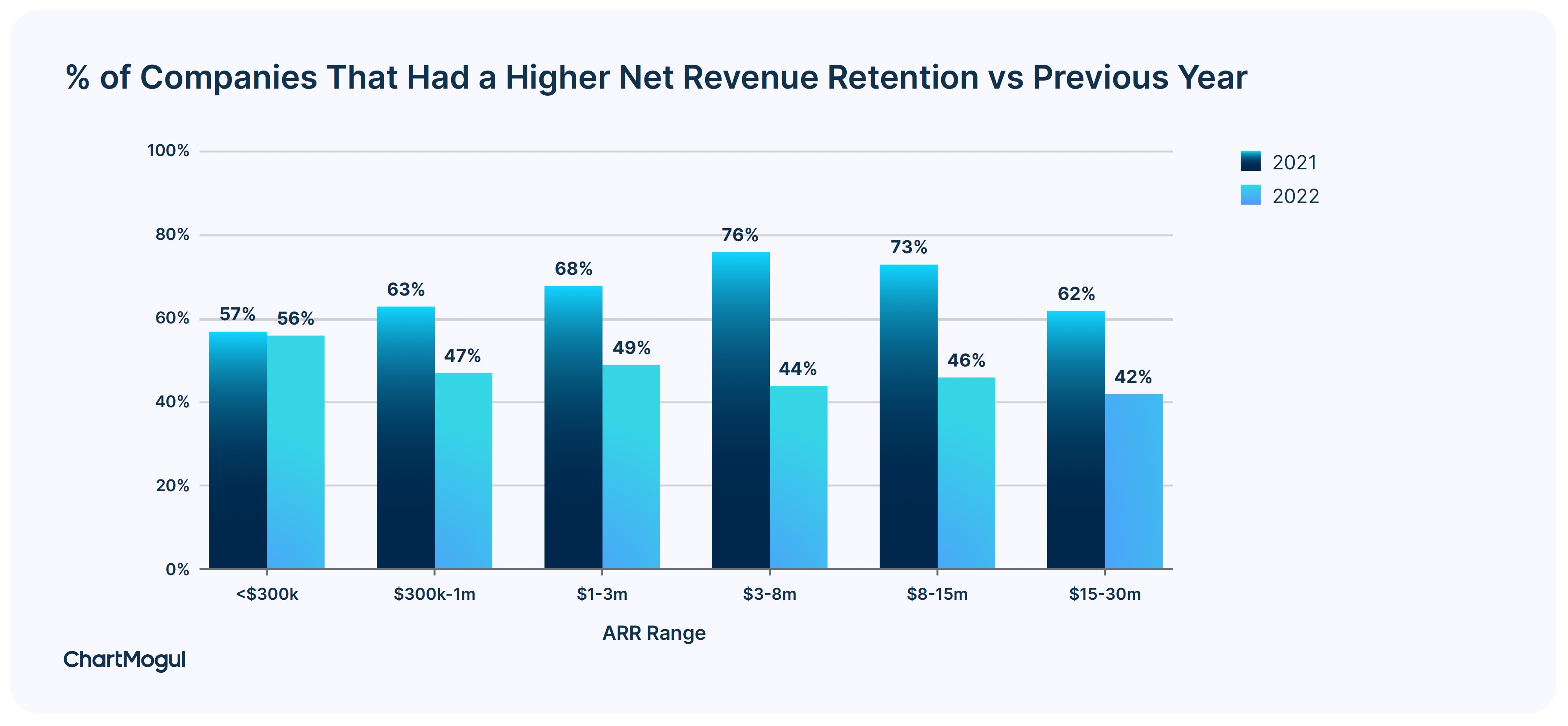

Greater than half of SaaS companies had decrease retention in 2022 when in comparison with 2021. A difficult macroeconomic surroundings meant subscribers reassessed and minimize their SaaS spend. That is in sharp distinction to 2021, which noticed nearly 70% of companies having the next retention price in 2021 when in comparison with 2020.

Share of corporations that had the next web income retention vs. earlier 12 months. Picture Credit: ChartMogul

This development of retention being decrease in 2022 vs. 2021 will not be distinctive to SaaS startups. SaaS behemoths like Snowflake additionally noticed their retention come down from the highs of 2021.

SaaS companies over $3m in ARR ought to goal a web retention price of over 100%

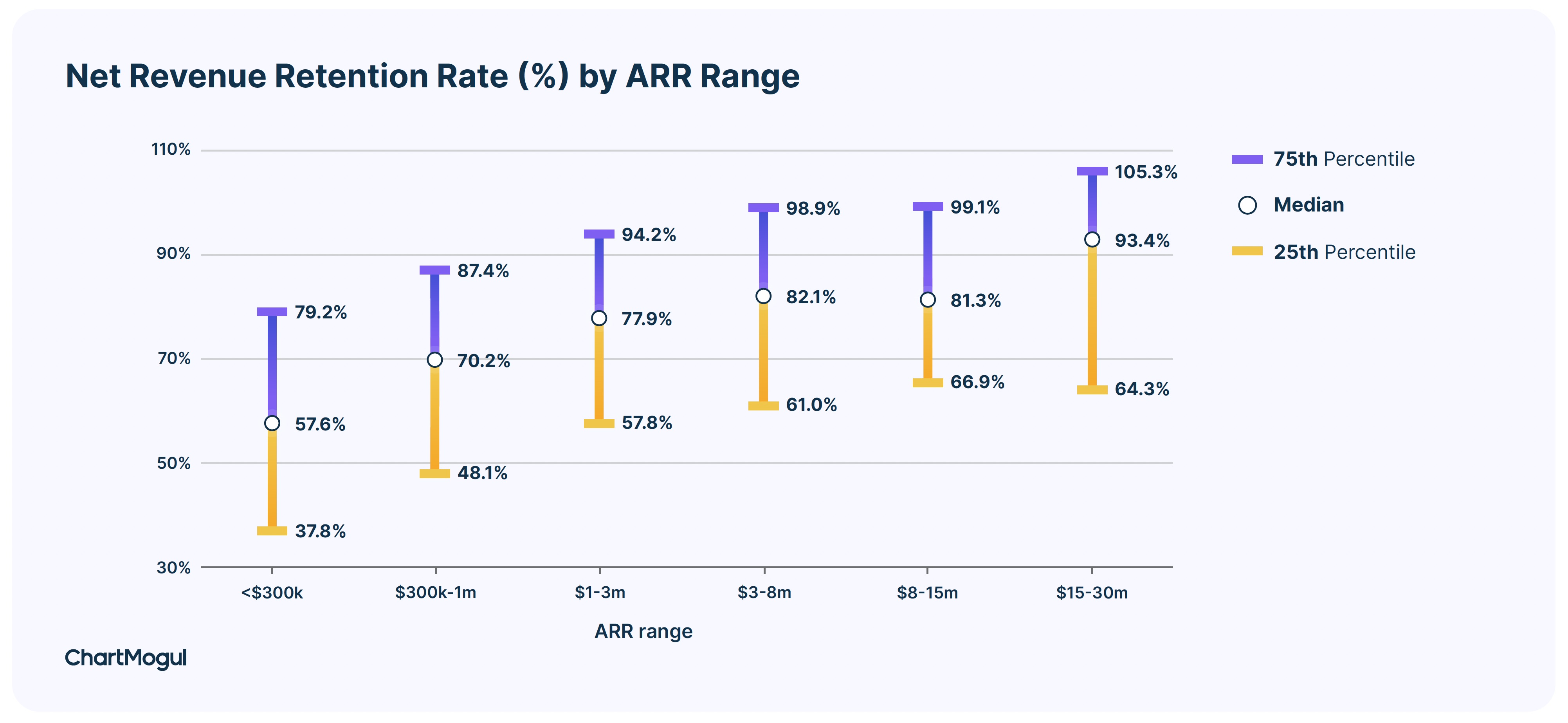

What is taken into account a great web retention price differs by the stage of your corporation.

Within the pre-product-market-fit stage of the enterprise, web retention is normally poor. As startups develop and discover product-market match, web retention improves. Lastly, as corporations attain scale and develop into class leaders, web retention usually goes over 100%.

When benchmarking, at all times preserve the stage of your corporation in thoughts. Companies with ARR within the vary of $1 million-$3 million have a prime quartile web retention price of 94%. These within the $3 million-$15 million ARR phase have a prime quartile web retention price of 99%. Companies at scale with ARR within the vary of $15 million-$30 million have a prime quartile web retention price of over 105%.

Web income retention price (%) by ARR vary. Picture Credit: ChartMogul

A web retention price of lower than 100% signifies that your ARR decays, which implies that you’ve much less ARR at the moment than a 12 months in the past from the identical set of shoppers. A web retention price of over 100% signifies sturdy product-market match and showcases your capacity to compound your income out of your current buyer base.

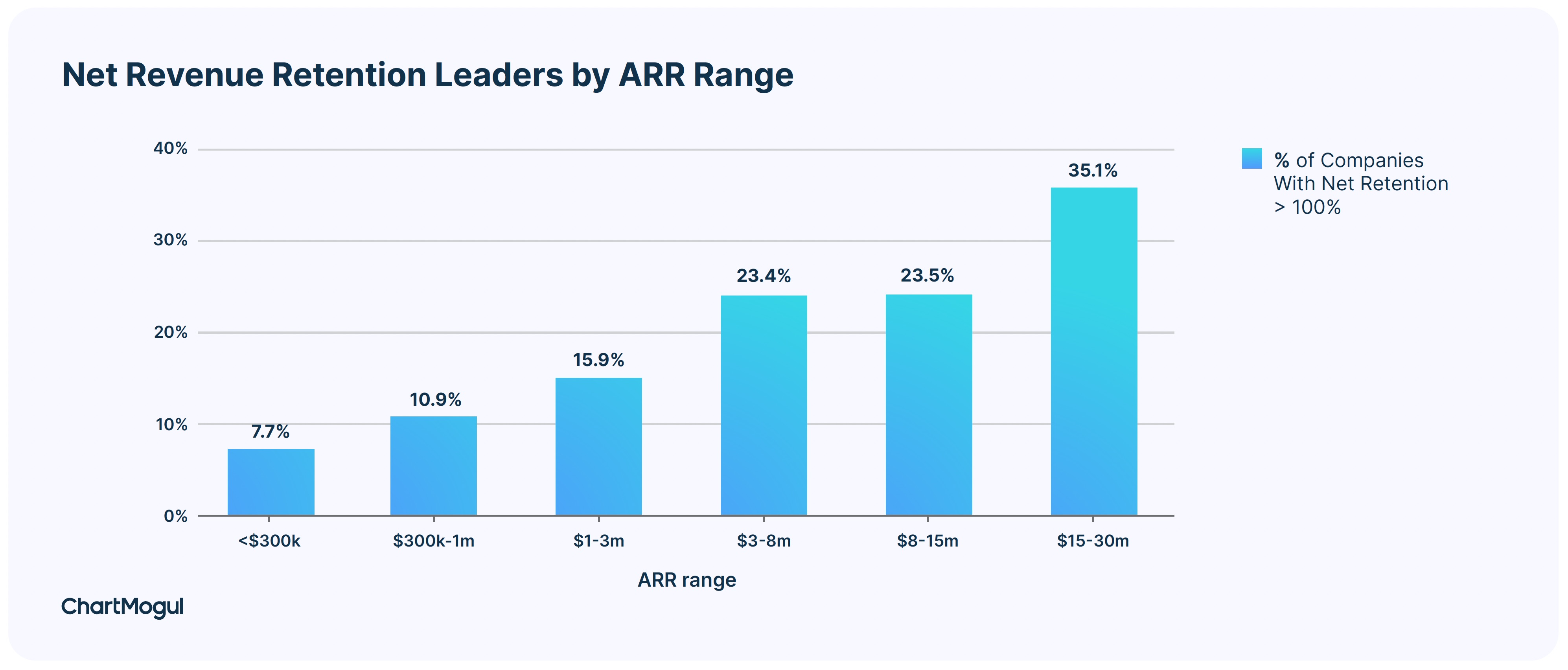

Amongst larger ARR ranges, extra companies have a web retention price over 100%. Simply over 35% of SaaS companies within the $15 million-$30 million ARR vary have a web retention price of over 100%.

Web income retention leaders by ARR vary. Picture Credit: ChartMogul

[ad_2]