[ad_1]

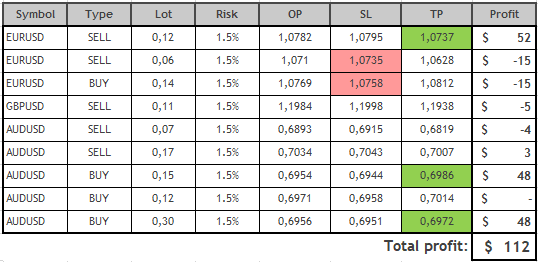

As we speak I current you an outline of offers made utilizing the Owl technique – sensible ranges for the EURUSD, GBPUSD and AUDUSD foreign money pairs for the week from February 6 to February 10, 2023.

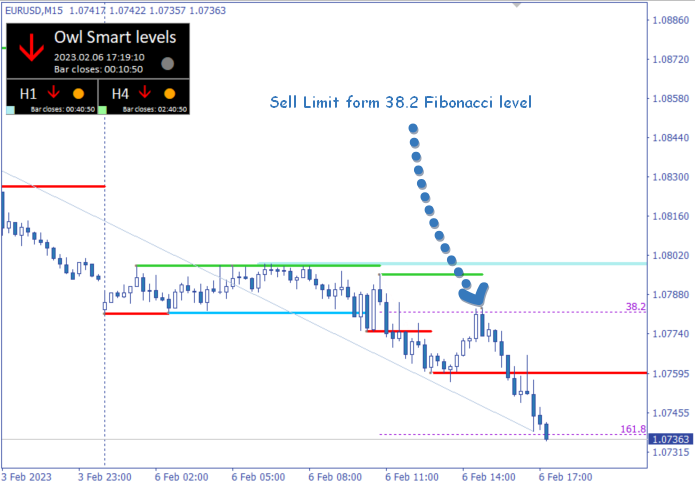

EURUSD trades

Monday, February 6, began with EURUSD fluctuating in a small worth vary. The primary sign, which appeared round 3:00 GMT, was ignored as a result of the primary rule of buying and selling on Monday is:

—> Ignore indicators obtained earlier than 8:00 GMT on Monday.

The subsequent Promote Restrict sign was obtained round 12:00. The pending order was triggered inside an hour and a half, and the market shortly started to maneuver within the route we would have liked. The primary deal of the week and now we have already taken a revenue.

Determine 1. EURUSD SELL 0.12, OpenPrice=1.0782, StopLoss=1.0795, TakeProfit=1.0737, Revenue=+52$

As you might have seen, one of many benefits of the buying and selling system Owl Good Ranges is the truth that from the second of receiving the sign you’ve sufficient time to put a pending order, a complete hour, to have time to put the order in your account.

Then, on February 7, the primary sign timeframe turned towards the older ones, and trades couldn’t be opened. Within the afternoon the sign was obtained once more however by a pointy upward correction we made a loss on this commerce. After that, a lifeless zone was shaped on EURUSD, wherein it isn’t really helpful to commerce in accordance with the buying and selling system guidelines. The lifeless zone continued on Wednesday and half of Thursday, on account of which there was a reversal of the Valable ZigZag Indicator (which is liable for the buying and selling route) on all 3 timeframes, so we bought a sign to put a Purchase Restrict order. The order was shortly closed with a loss as a result of in all probability it was a correction to the primary route downwards wherein the pair turned final week.

For comfort and well timed receipt of indicators I take advantage of the Owl Good Ranges Indicator. The principle buying and selling timeframe is M15, whereas the H1 and H4 timeframes are used to verify the pattern route of the upper timeframe.

The Euro was buying and selling within the lifeless zone all Friday. The results of the week is +12$, although there have been 2 unfavorable and 1 constructive offers. As a consequence of profitability index 3.24 (TakeProfit/StopLoss ratio) we earned cash this week.

GBPUSD trades

The British pound began the week with completely different indications of the Valable ZigZag Indicator (a part of the Owl Good Ranges Indicator), so I spent the primary half of the day ready. Solely within the night there was a sign to put an order however I needed to cancel it quickly as a result of the buying and selling system rule states:

Pending order must be canceled if it was not executed inside 24 candles of the working timeframe or if the indicator Valable ZigZag modified its route.

One other sign for putting a Promote Restrict order was obtained solely at 15:00 on February 7. The order labored however on the subsequent candle the deal needed to be closed with a small loss, as a result of the Valable ZigZag Indicator turned up once more.

Determine 2. GBPUSD SELL 0.11, OpenPrice=1.1984, StopLoss=1.1998, TakeProfit=1.1938, ClosePrice=1.1989, Revenue=$5

All future indicators on this pair had been canceled both by the 24 candles rule or due to the in a different way directed indications of the Valable ZigZag Indicator.

Consequence: small lack of 5$ as a result of correctional market conduct this week.

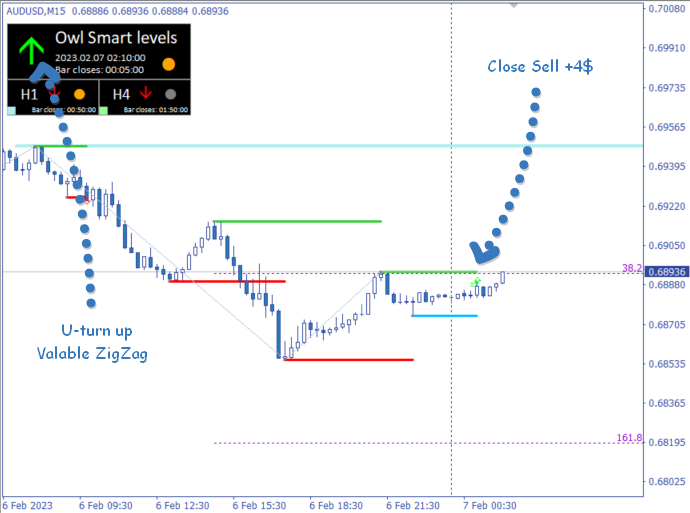

AUDUSD trades

The primary place of AUDUSD was closed earlier with a small revenue, as Valable ZigZag Indicator modified its route. The second commerce was closed by the identical rule, however with a slight minus.

Determine 3. AUDUSD SELL 0.07, OpenPrice=0.6893, StopLoss=0.6915, TakeProfit=0.6819, ClosePrice=0.6887, Revenue=+4$

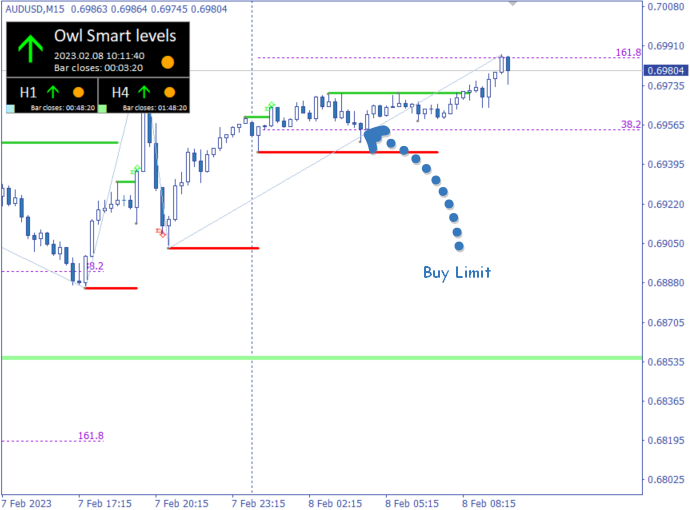

In a single day trades might be very worthwhile however generally it’s important to watch for the revenue all night time. So it occurred with AUDUSD on February 8, a commerce opened at 3:15 and closed with revenue solely 7 hours later. We needed to shut the subsequent commerce at 0 as a result of once more the rule of Valable ZigZag reversal was utilized towards us. This rule successfully protects our deposit from pointless losses and retains the technique profitability at a excessive stage.

Determine 4. AUDUSD BUY 0.15, OpenPrice=0.6954, StopLoss=0.6944, TakeProfit=0.6986, ClosePrice=0.6986 , Revenue=+$48.

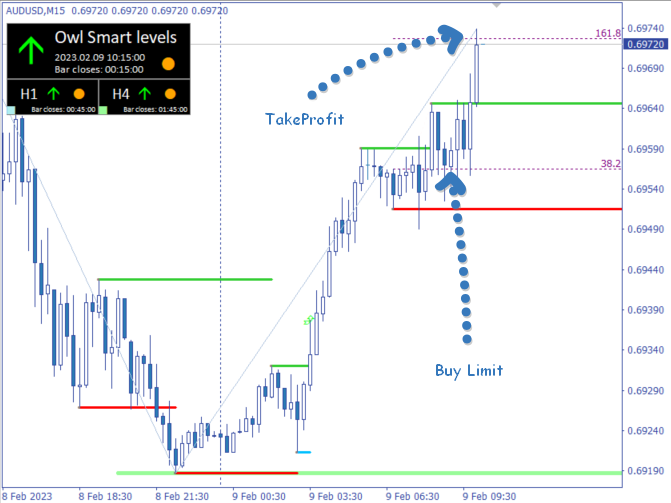

The market entry sign at 8:00 has completely proven how effectively the Owl Good Ranges technique works. Revenue after 1 hour of buying and selling which is to be anticipated from methods that work within the route of the pattern.

Determine 5. AUDUSD BUY 0.30, OpenPrice=0.6956, StopLoss=0.6951, TakeProfit=0.6972, ClosePrice=0.6972 , Revenue=+$48.

The remaining time AUDUSD pair entered the lifeless zone, and buying and selling until the top of the week was prohibited by the technique guidelines.

On time obtained indicators from the Owl Good Ranges Indicator permits me to not miss offers and get a steady revenue even within the weeks when the market is in an area correctional motion. And strict following the principles of the buying and selling system permits you to scale back losses. These guidelines helped me earn cash even in such a troublesome buying and selling week.

Obtain the Owl Good Ranges Indicator and examine all of the trades within the desk your self for accuracy.

I am Sergei Ermolov, observe me and do not miss extra helpful instruments for worthwhile buying and selling on Forex.

[ad_2]