[ad_1]

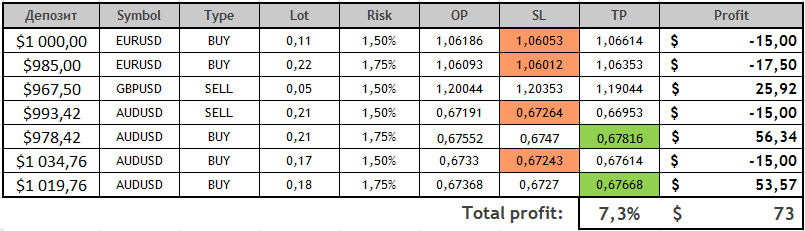

Right now I current you an outline of offers made utilizing the Owl technique – good ranges for the EURUSD, GBPUSD and AUDUSD foreign money pairs for the week from February 27 to March 03, 2023.

For comfort and well timed receipt of indicators I take advantage of the Owl Sensible Ranges Indicator. The primary buying and selling timeframe is M15, whereas the H1 and H4 timeframes are used to substantiate the pattern route of the upper timeframe.

The week was demonstrative for the work with the ignored indicators. There have been rather more of them than trades. This delivered to the forefront not a lot the indicator’s work as the principles for its use that are described intimately right here and about which I by no means get drained to remind.

So, let’s start.

EURUSD evaluation.

Virtually all Monday and appreciable intervals of Thursday and Friday the market was within the useless zone which was proven by the dark-red space on the chart. Nonetheless, there have been trades on every of the devices into consideration.

We ignore the primary sign as a result of there are clear guidelines within the instruction when the sign shouldn’t be considered.

Determine 1: The sign is ignored in line with the rule: in the intervening time the sign appeared the value was already on the opening degree.

The following two trades had been each detrimental. Not week for the EURUSD foreign money pair. You may see considered one of them within the image beneath.

Determine 2. EURUSD BUY 0.22, OpenPrice=1.06093, StopLoss=1.06012, TakeProfit=1.06012, Revenue=-17.50$

The final sign of this week on EURUSD we ignore in line with the rule:

If in the intervening time the sign seems the value is beneath or has already been on the order opening degree, the sign ought to be ignored.

Determine 3: Instance of a sign that ought to be ignored.

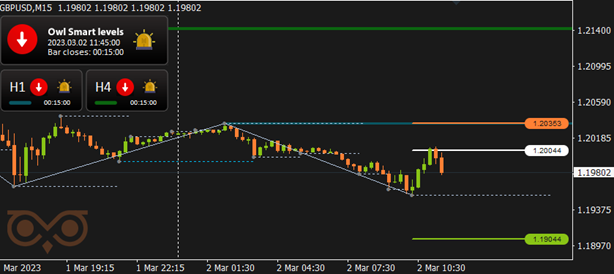

GBPUSD evaluation.

About half of the time the market on this foreign money pair was within the useless zone – initially and on the finish of the buying and selling week. The Owl Sensible Ranges indicator gave the primary sign round 00:00 GMT on March 01, it was ignored in line with the rule described above. The primary deal on this asset occurred in the midst of the day.

Determine 4. GBPUSD SELL 0.05, OpenPrice=1.20044, StopLoss=1.20353, TakeProfit=1.19044, Revenue=+25.92$

The commerce was closed earlier than the market reached the StopLoss or TakeProfit degree in line with the rule:

If the Valable ZigZag Indicator has modified its route (the arrow within the data panel has modified route) the commerce ought to be closed on the market worth.

AUDUSD evaluation.

The primary commerce on the AUDUSD pair was in a short time closed with a minus on a pointy upward worth motion.

Determine 5. AUDUSD SELL 0.21, OpenPrice=0.67191, StopLoss=0.67264, TakeProfit=0.66953, Revenue=-15$.

Then the market was within the useless zone more often than not on February 28, and the following commerce was opened early within the morning of March 01. We earned revenue on it solely within the night. We needed to ignore a number of indicators on that day in line with the rule:

Ignore the indicators if there may be already an open place out there.

Determine 6. AUDSD BUY 0.21, OpenPrice=0.67552, StopLoss=0.67470, TakeProfit=0.67816, Revenue=+56.34$.

The following commerce opened on Friday and closed with revenue solely on the finish of the day closing the week on constructive observe.

Fig. 7. AUDSD BUY 0.18, OpenPrice=0.67368, StopLoss=0.67270, TakeProfit=0.67668, Revenue=+53.57$.

Let’s sum up.

It hasn’t been a straightforward week and solely cautious adherence to the principles of working with the indicator has allowed us to keep away from losses. That is why you will need to strictly comply with the principles whereas utilizing the indicator.

See different opinions of the Owl Sensible Ranges technique:

I am Sergei Ermolov, comply with me and do not miss extra helpful instruments for worthwhile buying and selling on Forex.

[ad_2]