[ad_1]

Whereas dwelling off money sounds logical, the truth is you find yourself with much less cash in the long term than from fairness investing

Evaluations and suggestions are unbiased and merchandise are independently chosen. Postmedia could earn an affiliate fee from purchases made via hyperlinks on this web page.

Article content material

In 2020, when the nation entered lockdown to stop the unfold of the fast-emerging COVID-19 virus, Invoice* was provided and took a buyout package deal from his longtime employer, Bell Canada.

Commercial 2

Article content material

He was 58 and had labored for Bell for 32 years, or greater than half his life. Divorced with two grownup kids, it was proper across the time he and his ex-wife bought the household house that they had bought collectively. They break up the sale worth of $635,000.

Article content material

“We simply missed the shopping for frenzy,” he mentioned.

Invoice opted to maneuver right into a rental in Ottawa’s Byward Market reasonably than buy one other house. It was a part of his technique to make sure he has sufficient wealth to see him via retirement. His authentic plan was to retire at 60 — his present age — or presumably 61.

Article content material

“I’ve a defined-contribution pension. It’s actually a pot of cash. It’s not a assured cheque every week or month,” Invoice mentioned.

Thus far, Invoice hasn’t touched the pension funds ($834,320) or any of his different investments. These embrace a registered retirement financial savings plan ($172,000) tax-free financial savings account ($74,000 invested in a balanced progress fund) BCE Inc. inventory (price $127,000 and pays quarterly dividends of $1,775), a non-registered funding account ($92,000 largely invested in bonds) and cryptocurrency shares ($7,000).

Article content material

Commercial 3

Article content material

As a substitute, he’s drawing down from his money financial savings ($217,000) to pay his dwelling bills. He carries no debt, and his largest price is hire, at $1,675 a month. In whole, he spends about $3,200 every month, however he hasn’t began to journey but, one thing he’d love to do.

This summer season, Invoice plans to take a two-week journey to Paris. Within the winter, he could go to Florida and hire for a couple of months. He additionally has a pal with a spot in Ecuador that he may cheaply hire. Total, he anticipates his retirement will embrace a few journeys a yr. He additionally needs to go away cash for his kids if he can.

At this level, he plans to go away his pension with Bell, which has low administration charges, after which convert it right into a locked-in retirement account and withdraw funds as wanted.

Commercial 4

Article content material

“My mother and father each lived into their 80s. I’m in search of a path to verify I don’t run out of cash,” Invoice mentioned. “I’m planning to begin taking CPP (Canada Pension Plan) and OAS (Outdated Age Safety) at 65, however would it not be higher to carry off till I’m 70? Am I spending an excessive amount of? Do I’ve an excessive amount of money? Ought to that cash be put elsewhere? How ought to I be drawing down funds to verify it’ll final?”

What the specialists say

“I’ve had many individuals come to me through the years in the identical place as Invoice. In the course of the build-up years, they knew what to do, however they’re not so certain about how finest to take that cash out,” mentioned Ed Rempel, a fee-for-service monetary planner, tax accountant and blogger.

Invoice’s whole investments are a bit greater than $1.5 million. A great quantity and one Rempel believes is sufficient for Invoice to have the ability to benefit from the retirement he needs if he shifts money into investments that replicate his danger profile and desired price of return, and withdraws an acceptable proportion based mostly on the sorts of investments he’s in (that’s, conservative, average progress).

Commercial 5

Article content material

“Make investments long run after which arrange computerized month-to-month withdrawals to make sure tax effectivity,” Rempel mentioned.

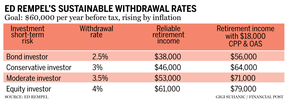

Primarily based on present bills and factoring a further $10,000 every year wanted for journey, Invoice will spend about $48,000 internet every year. Meaning he wants about $60,000 earlier than tax, Rempel mentioned.

“So long as he doesn’t get too conservative along with his investments and he can make investments successfully and tax-efficiently, I believe he could be assured and stay the life-style he needs,” he mentioned.

Rempel mentioned that dwelling off money sounds logical, however the actuality is you find yourself with much less cash in the long term than from investing in equities.

“It’s a 30-year retirement and money earns little or no return,” he mentioned. “Seventy to 80 per cent of retirement revenue is progress after retirement. If he’s 70-per-cent invested in equities, that generates extra progress over time and he can take 4 per cent a yr out. If he’s extra of a average investor, I counsel withdrawing 3.5 per cent a yr. That plus CPP will present rather more than he’s dwelling on now.”

Commercial 6

Article content material

It’s a 30-year retirement and money earns little or no return

Ed Rempel

Rempel mentioned the one purpose to carry money is for important uncommon purchases inside a yr or so, whereas an unsecured line of credit score can be utilized to cowl any emergencies.

Allan Small, senior funding adviser at iA Non-public Wealth Inc., agrees Invoice has an excessive amount of money and will use that cash to take a position.

Step one shall be for Invoice to find out his danger tolerance. For instance, if he needs to remain in low-risk investments, short-term bonds and high-interest financial savings accounts are paying shut to 5 per cent and a few money-market devices are paying greater than 5 per cent when upwards of $100,000 is invested.

“If he’s keen to tackle medium danger, I’d counsel shopping for dividend-paying shares,” Small mentioned. “Finally, it is a dialog he ought to have with a wealth administration adviser and tax skilled.”

Commercial 7

Article content material

Small additionally recommends changing the defined-contribution pension plan into an RRSP or locked-in retirement account to realize flexibility.

“If he takes that cash and places it into investments that generate a five-per-cent price of return, that’s virtually $42,000 that he can draw on that doesn’t contact the principal,” he mentioned. “Or he may select to develop these funds, and when he is able to take an revenue, he can have extra money to work with.”

Small factors out that changing the pension plan will enable Invoice to call his kids as beneficiaries, giving them entry to all of the remaining funds within the account. This is probably not the case with the pension plan.

With respect to when Invoice ought to begin taking CPP and OAS, Rempel mentioned crucial issues are how he invests and taxes.

-

Couple need to retire early, however are their authorities pensions sufficient?

-

Can we retire on $170,000 in financial savings and keep our life-style?

-

What you have to learn about selecting an executor on your will

“I like to recommend he begin CPP now and OAS at 65. This can enable him to pay the least quantity of tax,” he mentioned. “As effectively, he can’t depart CPP and OAS to his children, whereas taking them early permits him to go away extra of his investments in his property.”

*Title has been modified.

[ad_2]

Feedback

Postmedia is dedicated to sustaining a full of life however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the positioning. We ask you to maintain your feedback related and respectful. We’ve got enabled e mail notifications—you’ll now obtain an e mail if you happen to obtain a reply to your remark, there’s an replace to a remark thread you comply with or if a consumer you comply with feedback. Go to our Neighborhood Pointers for extra info and particulars on the way to regulate your e mail settings.

Be a part of the Dialog