[ad_1]

Value Motion, one of the broadly used phrases in buying and selling, but completely different merchants have completely different descriptions of it. Some recommend that it’s an evaluation of the fundamental actions of worth which generate entry and exit alerts and that it stands out for not requiring the usage of indicators. Some merchants establish it because the actions of a safety’s worth plotted over time. These descriptions could also be clear to some merchants, but it is also very imprecise to some.

Personally, I’d describe worth motion because the traits of worth actions plotted on a worth chart which might assist point out development course, momentum, reversals, continuations and plenty of different market situations that would happen. This can be imprecise but for those who would scrutinize every considered one of these circumstances, you’d see worth motion traits that would assist us establish every. For instance, uptrends might be recognized primarily based on rising swing highs and swing lows, whereas downtrends will be recognized by a relentless drop of the swing factors. Momentum will be recognized primarily based on full-bodied lengthy candles pushing in a single course. Reversals will be recognized primarily based on worth rejection traits equivalent to wicks pushing towards a worth stage. Continuations will be recognized by a sudden push within the course of the development proper after a retracement or contraction.

Right here, we will probably be a development continuation situation wherein entries are recognized primarily based on worth rejections. Pure worth motion merchants can also argue that worth motion requires the usage of bare charts. Nevertheless, no rule is stopping us from utilizing just a few technical indicators to help us in figuring out commerce setup.

HAMA

HAMA, Heiken Ashi Transferring Common, or Heiken Ashi Smoothed, they can be utilized interchangeably. HAMA is a development following technical indicator which excels in serving to merchants clearly establish development course. It’s characteristically very responsive to cost motion actions, whereas on the identical time it’s not too fickle to simply produce false alerts.

HAMA is an offshoot or by-product of the Heiken Ashi Candlesticks and a primary Exponential Transferring Common (EMA) line. It produces bars that modifications shade to point the course of the development, whereas on the identical time it plots these bars with the identical responsiveness because the EMA line.

Heiken Ashi in Japanese actually means common bars. In a way, that is what the HAMA does. It averages out historic worth knowledge. The ensuing computation is then plotted as bars overlaid on the value chart. The colour of the bars change relying on the course of the development. Blue bars point out a bullish development whereas pink bars point out a bearish development. Consequently, shade modifications might point out a possible development reversal.

RAVI

RAVI principally stands for Vary Motion Verification Index. This indicator represents the relative convergence or divergence of an underlying shifting common of a tradeable instrument, elevated 100 time. The primarily based RAVI configuration is predicated on an underlying 13-period Easy Transferring Common (SMA). It was initially primarily based on a 13-week interval which is equal to a 3-month interval. Nevertheless, given the expertise and velocity of buying and selling these days, it may also be utilized on the decrease timeframes.

The RAVI indicator is an oscillator kind of technical indicator. It plots bars that oscillate round its midline, zero. Optimistic bars point out a bullish development bias, whereas adverse bars point out a bearish development bias.

The strengthening of a development momentum may also be recognized primarily based on the colour of the bars. Inexperienced bars point out a strengthening bullish development, whereas pink bars point out a strengthening bearish development. Gray bars however point out a impartial momentum whether or not bullish or bearish.

Merchants can use this indicator as a development reversal entry sign primarily based on the shifting of the bars. It may also be used as a development course filter to assist merchants keep away from buying and selling towards the development.

Buying and selling Technique

RAVI HAMA Push Foreign exchange Buying and selling Technique trades with the course of an present development utilizing worth rejection as the principle entry sign.

First, development course is recognized primarily based on the colour of the HAMA bars. Such development course is then confirmed primarily based on the rising or dropping swing level sample of worth motion. The RAVI bars must also verify the development course primarily based on whether or not the bars are usually constructive or adverse. Trades are taken completely within the course of the development.

As quickly as we isolate the development and commerce course, we then anticipate worth to retrace in direction of the realm of the HAMA bars. Value motion ought to present indicators of worth rejection because it nears or touches the HAMA bars. That is primarily based on wicks pushing towards the HAMA bars. This may be our entry sign.

Indicators:

Most popular Time Frames: 30-minute, 1-hour, 4-hour and day by day charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York classes

Purchase Commerce Setup

Entry

- The HAMA bars needs to be blue.

- The swing highs and swing lows needs to be rising.

- The RAVI bars needs to be constructive.

- Value ought to retrace in direction of the HAMA bars.

- Value ought to reject the HAMA bars worth stage indicated by wicks pushing towards it.

- Enter a purchase order on the affirmation of the circumstances above.

Cease Loss

- Set the cease loss on the help beneath the entry candle.

- Set the cease loss beneath the HAMA bars.

Exit

- Shut the commerce as quickly because the HAMA bars change to pink.

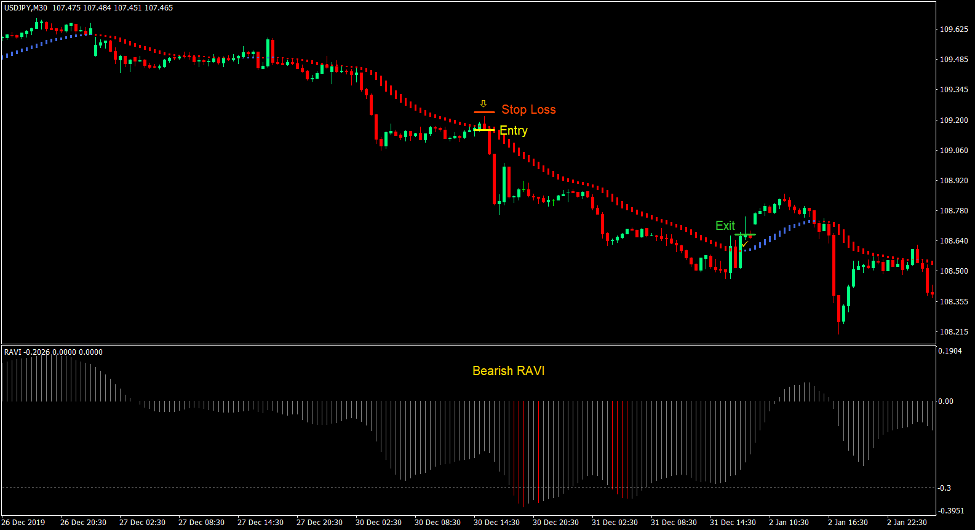

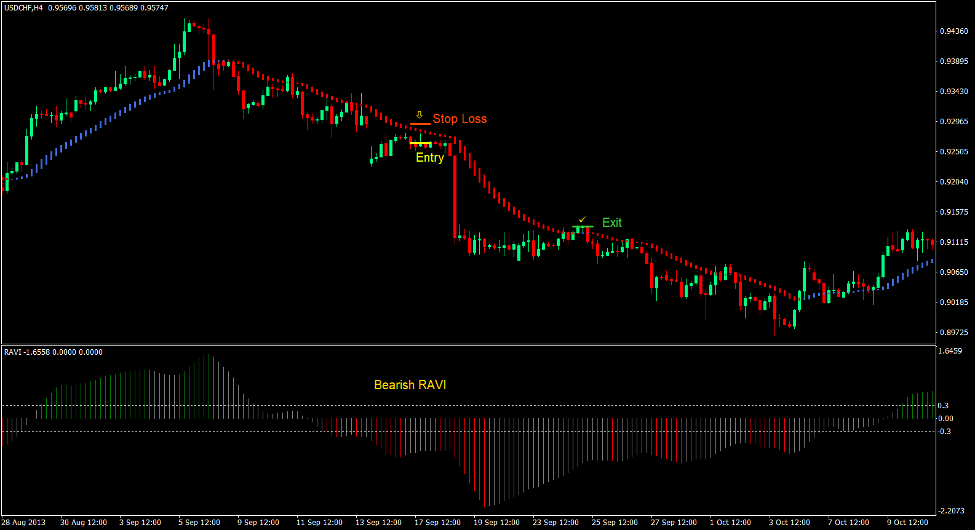

Promote Commerce Setup

Entry

- The HAMA bars needs to be pink.

- The swing highs and swing lows needs to be dropping.

- The RAVI bars needs to be adverse.

- Value ought to retrace in direction of the HAMA bars.

- Value ought to reject the HAMA bars worth stage indicated by wicks pushing towards it.

- Enter a promote order on the affirmation of the circumstances above.

Cease Loss

- Set the cease loss on the resistance above the entry candle.

- Set the cease loss above the HAMA bars.

Exit

- Shut the commerce as quickly because the HAMA bars change to blue.

Conclusion

This buying and selling technique is a primary development following and development continuation technique, which includes worth rejection as a way to establish particular entry factors. This enables us as merchants to enter at a greater worth quite than being too late to enter a development.

This technique can produce constant income when utilized in the correct trending market situation.

Foreign exchange Buying and selling Methods Set up Directions

RAVI HAMA Push Foreign exchange Buying and selling Technique is a mixture of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to rework the collected historical past knowledge and buying and selling alerts.

RAVI HAMA Push Foreign exchange Buying and selling Technique gives a possibility to detect varied peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Primarily based on this info, merchants can assume additional worth motion and regulate this technique accordingly.

Advisable Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

Tips on how to set up RAVI HAMA Push Foreign exchange Buying and selling Technique?

- Obtain RAVI HAMA Push Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 information to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you wish to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick RAVI HAMA Push Foreign exchange Buying and selling Technique

- You will note RAVI HAMA Push Foreign exchange Buying and selling Technique is obtainable in your Chart

*Word: Not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain:

[ad_2]