[ad_1]

Value charts are sometimes a cluttered mess. That is very true for brand new merchants. New merchants would take a look at chart and would usually really feel flustered not figuring out make sense of what the chart is exhibiting.

Whereas it’s true that the majority tradeable market is a chaotic confusion of worth actions and that the foreign exchange market is likely one of the most risky and unpredictable market, there are numerous situations whereby the worth chart is exhibiting clear indicators concerning what it desires to do. Merchants who can learn what the market is about to do are those who can persistently earn income from the foreign exchange market.

So, how will we make sense of an in any other case complicated worth chart? New merchants could discover it tough to decipher what the market is doing on a unadorned worth chart. New merchants could make use of technical indicators to assist them see clearly what the market is doing. The appropriate mixture of complementary technical indicators can imply the distinction between having no clue concerning market actions and making sense of what the market may most likely do. Indicators don’t give the precise reply as to what future costs can be, but it surely gives merchants some clues.

Some indicators assist merchants determine development path. Some indicators assist merchants determine overbought and oversold market costs. Some indicators give merchants a clue if the market is about to reverse. mixture of such indicators will help merchants determine commerce path and potential commerce setups.

Quick Indicators

Quick Indicators is a customized technical indicator which helps merchants determine potential imply reversal indicators based mostly on reversals coming from excessive worth factors.

The Quick Indicators indicator plots two dotted traces that types a channel like construction, which might often envelope worth motion. The decrease line is a blue dotted line which acts as a dynamic assist. The higher line is a purple dotted line which acts as a dynamic resistance line.

Value tends to push in direction of the extremes. This might trigger worth to cross past the vary of the channel. The market may be thought-about overbought if worth crosses above the higher line of the channel. The market can be thought-about oversold if worth crosses beneath the decrease line of the channel.

Nonetheless, worth would usually reverse in direction of its imply after being overbought or oversold. The Quick Indicators indicator plots an arrow pointing the path of a reversal at any time when it detects a possible imply reversal. These arrows can function an entry sign for imply reversal setups.

Stochastic Oscillator

The Stochastic Oscillator is a basic momentum technical indicator which many merchants use. It detects momentum, development and overbought or oversold worth situations.

The Stochastic Oscillator plots two traces derived from historic worth actions. These traces oscillate throughout the vary of 0 to 100.

Pattern or momentum may be recognized based mostly on how the 2 stochastic traces overlap. Momentum is bullish if the quicker line is above the slower line. Momentum is bearish if the quicker line is beneath the slower line. Crossovers between the 2 traces are thought-about as a reversal sign.

The Stochastic Oscillator vary additionally usually has markers at degree 20 and 80. These ranges point out worth extremes. Stochastic traces dropping beneath 20 point out a mathematically oversold market. Stochastic traces breaching above 80 point out a mathematically overbought market. Crossovers occurring in these areas might point out a excessive chance of a possible imply reversal.

Buying and selling Technique

Quick Sign Imply Pattern Foreign exchange Buying and selling Technique is a imply reversal technique which isolates trades which agree with the path of the long-term development.

The path of the long-term development is recognized based mostly the 100-period Exponential Transferring Common (EMA) line. That is based mostly on the situation of worth motion in relation to the 100 EMA line, in addition to the slope of the 100 EMA line. Pattern path must also be visually confirmed based mostly on the swing factors of worth motion. Commerce setups ought to solely be taken within the path of the long-term development.

The Quick Indicators channel would function a marker to assist us determine overbought or oversold worth candles on the worth chart. Overbought and oversold costs ought to then be confirmed by the Stochastic Oscillator.

As worth begins to revert again to its imply, the Quick Pattern indicator ought to plot an arrow pointing the path of the reversal. This could then be adopted by the crossing over of the Stochastic Oscillator traces coming from an overbought or oversold degree.

Indicators:

- Fastsignals

- 100 EMA

- Stochastic Oscillator

Most well-liked Time Frames: 30-minute, 1-hour, 4-hour and every day charts

Foreign money Pairs: FX majors, minors and crosses

Buying and selling Periods: Tokyo, London and New York classes

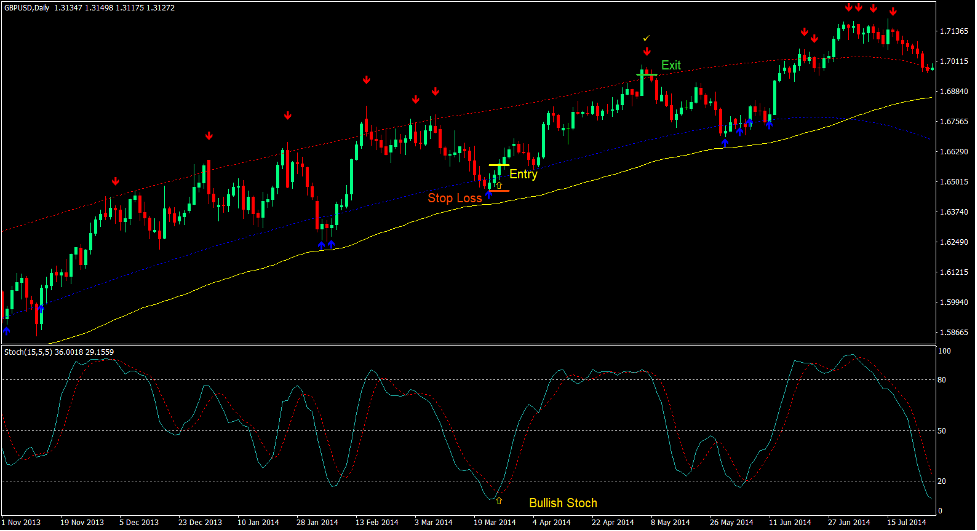

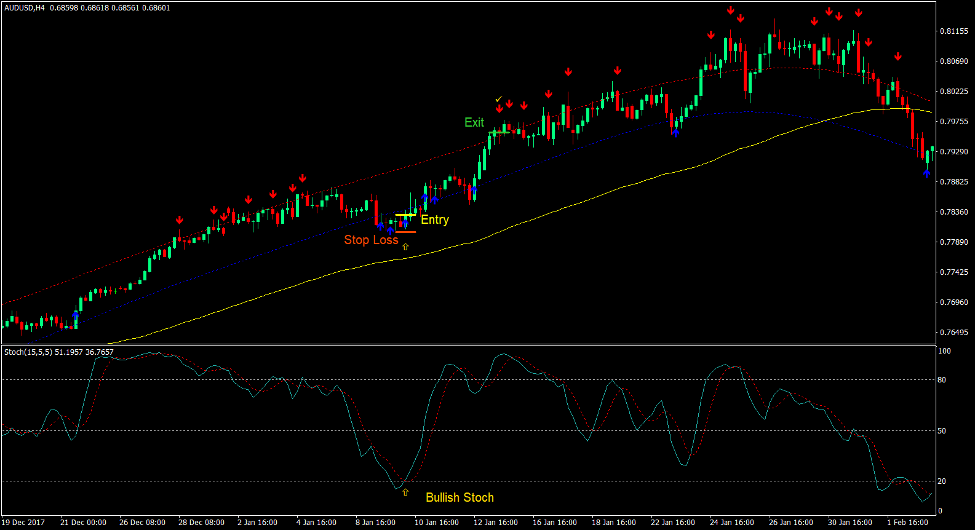

Purchase Commerce Setup

Entry

- Value motion needs to be above the 100 EMA line.

- Value motion needs to be in an uptrend.

- The 100 EMA line ought to slope up.

- The Quick Indicators channel ought to slope up.

- Value ought to pull again beneath the dotted blue line.

- The Stochastic Oscillator traces ought to drop beneath 20.

- The Quick Indicators indicator ought to plot an arrow pointing up.

- Enter a purchase order as quickly because the quicker line of the Stochastic Oscillator crosses above the slower line.

Cease Loss

- Set the cease loss on the assist beneath the entry candle.

Exit

- Shut the commerce as quickly because the Quick Indicators indicator plots an arrow pointing down.

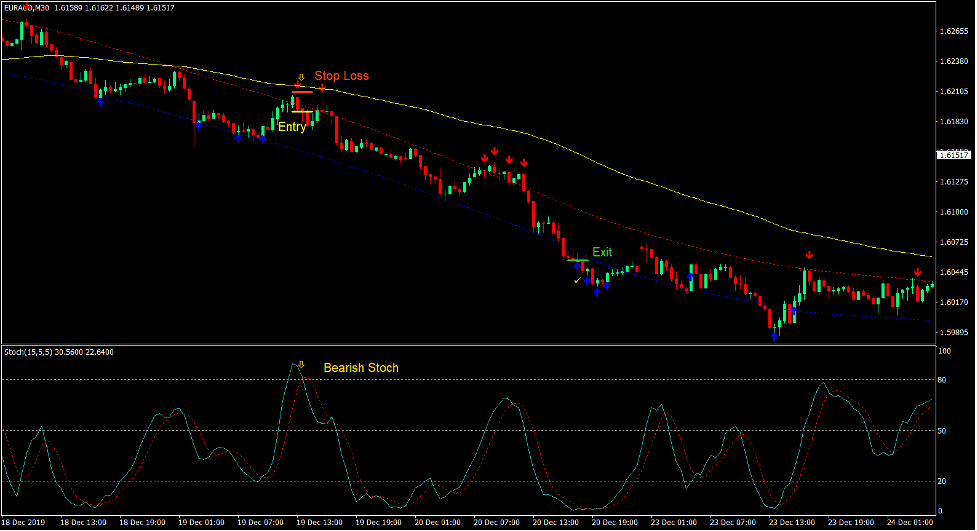

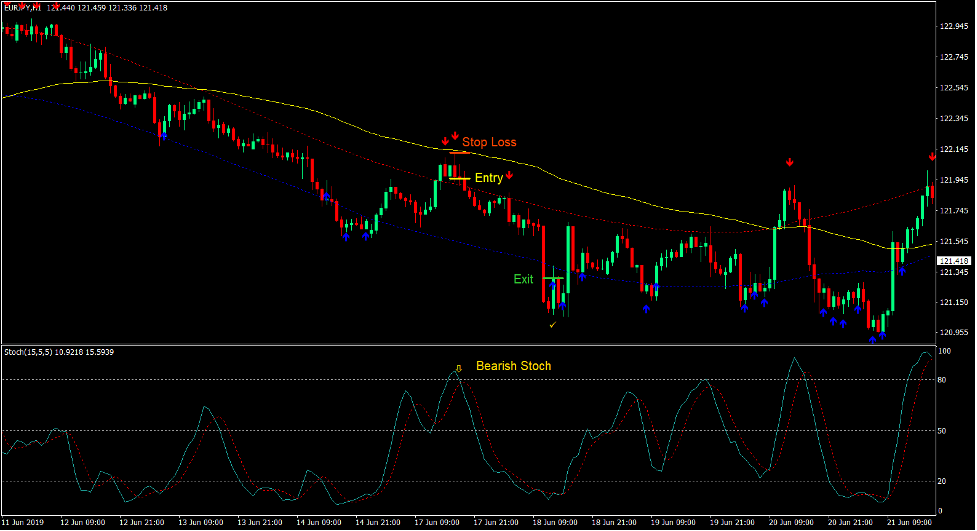

Promote Commerce Setup

Entry

- Value motion needs to be beneath the 100 EMA line.

- Value motion needs to be in a downtrend.

- The 100 EMA line ought to slope down.

- The Quick Indicators channel ought to slope down.

- Value ought to pull again above the dotted purple line.

- The Stochastic Oscillator traces ought to breach above 80.

- The Quick Indicators indicator ought to plot an arrow pointing down.

- Enter a promote order as quickly because the quicker line of the Stochastic Oscillator crosses beneath the slower line.

Cease Loss

- Set the cease loss on the resistance above the entry candle.

Exit

- Shut the commerce as quickly because the Quick Indicators indicator plots an arrow pointing up.

Conclusion

This technique is an efficient imply reversal technique.

Though this technique will not be good, it does produce commerce setups with a good mixture of excellent win charges and risk-reward ratios.

This technique has the potential to supply constant income when utilized in the appropriate market situation.

Foreign exchange Buying and selling Methods Set up Directions

Quick Sign Imply Pattern Foreign exchange Buying and selling Technique is a mix of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to rework the gathered historical past knowledge and buying and selling indicators.

Quick Sign Imply Pattern Foreign exchange Buying and selling Technique gives a chance to detect varied peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Based mostly on this info, merchants can assume additional worth motion and alter this technique accordingly.

Advisable Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

Learn how to set up Quick Sign Imply Pattern Foreign exchange Buying and selling Technique?

- Obtain Quick Sign Imply Pattern Foreign exchange Buying and selling Technique.zip

- *Copy mq4 and ex4 recordsdata to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you wish to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out Quick Sign Imply Pattern Foreign exchange Buying and selling Technique

- You will notice Quick Sign Imply Pattern Foreign exchange Buying and selling Technique is accessible in your Chart

*Word: Not all foreign exchange methods include mq4/ex4 recordsdata. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain:

[ad_2]