[ad_1]

Pattern reversals are wonderful buying and selling alternatives. It permits merchants to revenue from the market as value motion begins to reverse towards a longtime development. This kind of market situation offers the likelihood that value could attain the place to begin of the earlier development and even breach it, leading to trades with increased yields for merchants who had been in a position to capitalize on such buying and selling alternative.

This buying and selling technique is an instance of how merchants could observe and anticipate potential development reversals primarily based on value motion and momentum breakouts.

Trendlines as Assist and Resistance Ranges

In a trending market, value motion would typically have an observable sample primarily based on its swing factors. In an uptrend market, the swing highs and swing lows are inclined to rise persistently, whereas in a downtrend market, the swing highs and swing lows would persistently drop. These value swings typically create a channel like construction the place merchants could anticipate the worth swings to reverse on the short-term relying on the trajectory of the development.

Trendlines are strains that merchants could plot on the worth chart to attach the swing highs and swing lows of value motion. It’s on these strains the place merchants would observe for potential bounces because the market continues its trending traits.

The belief is that the market would proceed to development so long as the market respects the trendline. For that reason, merchants may additionally contemplate trendlines as assist and resistance ranges.

Though the market does are inclined to respect trendlines throughout a trending market, the market does finally break the recognized assist and resistance ranges. This signifies the tip of the development and a possible market reversal.

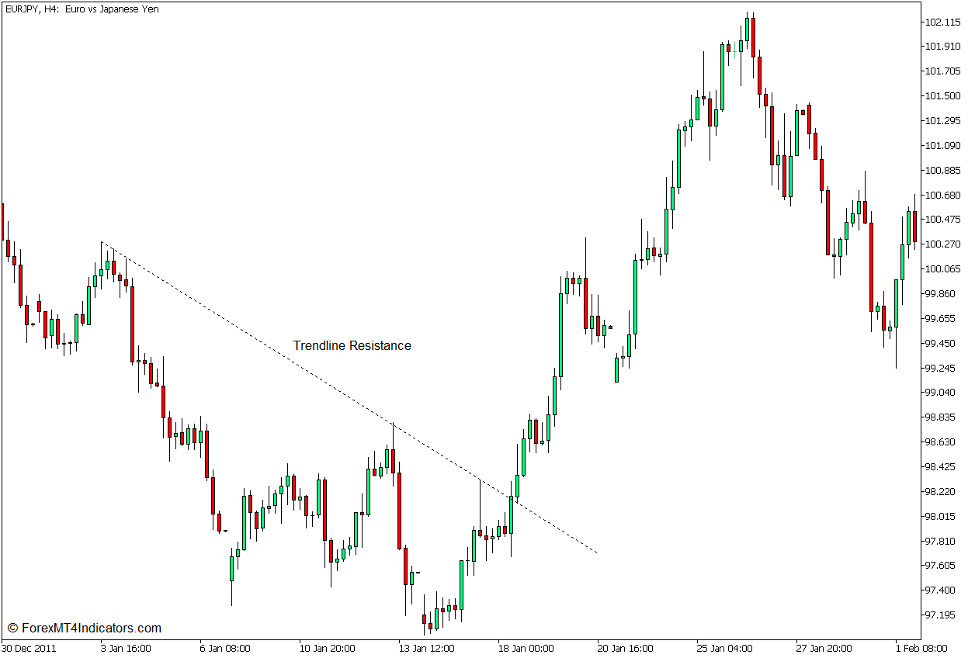

The pattern chart beneath reveals a resistance trendline. This trendline connects three swing highs that are persistently dropping. Worth then broke by means of the trendline and began to reverse to the upside.

The second pattern chart beneath reveals a trendline thought-about as a assist line. It has a number of minor swing lows that didn’t cross beneath the trendline. Nonetheless, as with all tendencies, it ended and reversed because the market broke beneath the assist trendline with sturdy momentum.

Quantity Charge of Change Indicator as a Momentum Breakout Affirmation

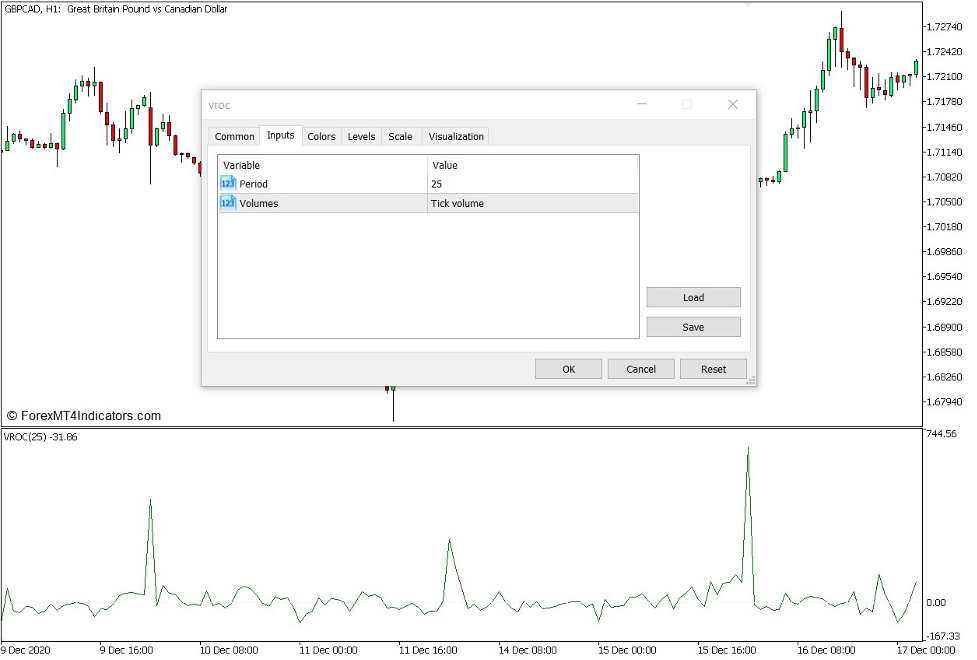

Quantity Charge of Change (VROC) is a technical buying and selling software which was developed to assist merchants observe the power of a value motion primarily based on quantity. It’s a easy technical indicator which plots a line that’s primarily based on the amount of a sequence of historic value candles. This line is drawn on a separate indicator which oscillates round a dashed line, which is ready at zero.

Customers could modify the traits of the VROC line by manipulating the variables throughout the indicator’s settings.

“Interval” permits customers to change the variety of candles or bars which the indicator would use to calculate for the VROC line.

“Volumes” permits customers to change the kind of quantity which the indicator would use for its calculations. “Tick quantity” relies on the variety of value actions throughout the candle, whereas “Actual quantity” relies on the precise quantity of every commerce transaction from the dealer. “Actual quantity” is ideally used nonetheless this knowledge isn’t at all times accessible for many dealer servers.

Buying and selling Technique Idea

Pattern reversals primarily based on trendline assist and resistance breakouts are wonderful buying and selling alternatives. It permits merchants to money in on worthwhile trades because the market begins to reverse in direction of the other way. Nonetheless, there are additionally many situations whereby the market would “faux out” merchants into considering that value motion is reversing towards the development. This typically leads to a fast loss proper after merchants enter the market assuming that the development is reversing.

The important thing to figuring out a excessive chance development reversal is by on the lookout for breakouts with sturdy momentum. Most merchants would observe momentum solely primarily based on the scale and traits of the breakout candle. Though this technique may fit, it’s not at all times dependable.

One other technique which {many professional} merchants use to substantiate a breakout is by taking a look at quantity. Quantity spikes point out {that a} sign candle has vital momentum behind it, leading to breakout commerce alerts which have increased tendencies to proceed within the course of the reversal as a result of momentum of the breakout.

The Quantity Charge of Change (VROC) indicator is a superb software for figuring out such momentum breakout alerts. Merchants could affirm whether or not a breakout sign has momentum or not primarily based on whether or not the sign candle is in confluence with a quantity spike on the VROC line.

Purchase Commerce Setup

Entry

- Establish a resistance trendline by connecting swing highs.

- The resistance trendline ought to have three or extra swing highs to be thought-about as a sound trendline.

- Await a robust momentum candle to interrupt above the trendline.

- The bullish momentum breakout must be in confluence with a quantity spike on the VROC line.

- Enter a purchase order on the confluence of those circumstances.

Cease Loss

- Set the cease loss beneath the entry candle.

Exit

- Set the goal take revenue on the subsequent swing excessive noticed on the worth chart.

Promote Commerce Setup

Entry

- Establish a assist trendline by connecting swing lows.

- The assist trendline ought to have three or extra swing lows to be thought-about as a sound trendline.

- Await a robust momentum candle to interrupt beneath the trendline.

- The bearish momentum breakout must be in confluence with a quantity spike on the VROC line.

- Enter a promote order on the confluence of those circumstances.

Cease Loss

- Set the cease loss above the entry candle.

Exit

- Set the goal take revenue on the subsequent swing low noticed on the worth chart.

Conclusion

Pattern reversal methods which give development reversal alerts primarily based on breakouts from a trendline assist or resistance are fundamental commerce setups that {many professional} merchants use. Though such buying and selling technique are usually very efficient, it might additionally present numerous false alerts which we referred to as “faux outs”.

This technique improves on the fundamental trendline breakout development reversal technique by including a affirmation primarily based on quantity. This improves the standard of the breakout sign because it additionally confirms the presence of a robust momentum through the breakout.

Foreign exchange Buying and selling Methods Set up Directions

Quantity Charge of Change Breakout Foreign exchange Buying and selling Technique for MT5 is a mix of Metatrader 5 (MT5) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the amassed historical past knowledge and buying and selling alerts.

Quantity Charge of Change Breakout Foreign exchange Buying and selling Technique for MT5 offers a possibility to detect numerous peculiarities and patterns in value dynamics that are invisible to the bare eye.

Based mostly on this info, merchants can assume additional value motion and alter this technique accordingly.

Really helpful Foreign exchange MetaTrader 5 Buying and selling Platforms

#1 – XM Market

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

#2 – Pocket Choice

- Free +50% Bonus To Begin Buying and selling Immediately

- 9.6 Total Ranking!

- Robotically Credited To Your Account

- No Hidden Phrases

- Settle for USA Residents

Tips on how to set up Quantity Charge of Change Breakout Foreign exchange Buying and selling Technique for MT5?

- Obtain Quantity Charge of Change Breakout Foreign exchange Buying and selling Technique for MT5.zip

- *Copy mq5 and ex5 information to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you need to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick Quantity Charge of Change Breakout Foreign exchange Buying and selling Technique for MT5

- You will notice Quantity Charge of Change Breakout Foreign exchange Buying and selling Technique for MT5 is out there in your Chart

*Notice: Not all foreign exchange methods include mq5/ex5 information. Some templates are already built-in with the MT5 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain:

[ad_2]