[ad_1]

This week, buyers shall eye-on earnings from the 2 behemoths of the retail commerce sector – Dwelling Depot and Walmart. Typically, Dwelling Depot sells instruments, building produces, home equipment and providers whereas Walmart operates a sequence of hypermarkets, low cost shops and grocery shops. By market capitalization within the world retail sector, each have been ranked 3rd and a couple ofnd respectively, proper after Amazon.

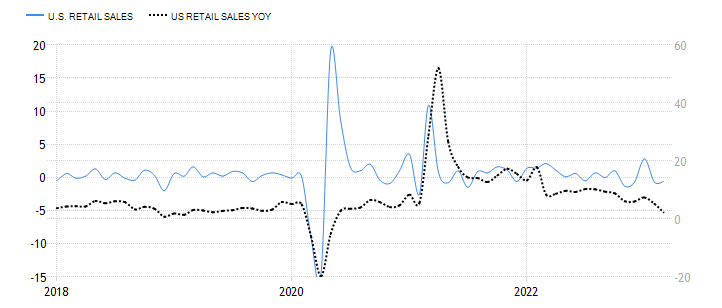

Fig.1: US Retail Gross sales. Supply: Buying and selling Economics

The March 2023 knowledge displayed US retail gross sales fell for 2 consecutive months, at -0.6% (was -0.7% in February), affected by the Fed’s restrictive financial coverage as a imply to fight rising inflationary pressures. Regardless of the year-on-year knowledge which elevated 2.3% (was 5.2% in February), it was nonetheless the smallest features since Could 2020 – which might suggest the outlook for the retail sector stays bleak.

Dwelling Depot

The corporate shall launch its Q1 2023 earnings outcome on 16th Could (Tuesday), at pre-market open.

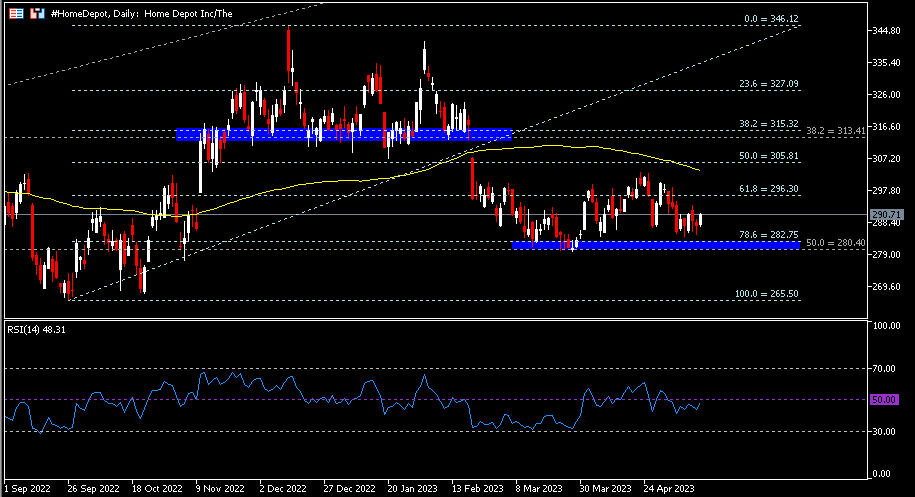

Fig.2: Reported Gross sales of HD versus Analyst Forecast. Supply:CNN Enterprise

Fig.2: Reported Gross sales of HD versus Analyst Forecast. Supply:CNN Enterprise

Dwelling Depot posted its gross sales income that barely shy off consensus estimates for the primary time since November 2019, at $35.8B (additionally the bottom print since This fall 2022). This was attributable to a slowdown in house enchancment class as shoppers turned extra cautious of their spending within the midst of robust macroeconomic scenario. The general gross sales in 2022 have been reported at $157.4B, up over 4% from a yr in the past. Its internet earnings was $3.36B, up solely 0.3% from a yr prior.

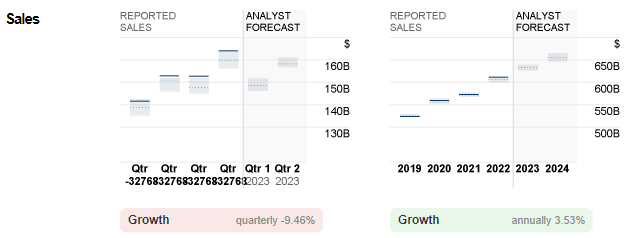

Fig.3: Reported EPS of HD versus Analyst Forecast. Supply:CNN Enterprise

Fig.3: Reported EPS of HD versus Analyst Forecast. Supply:CNN Enterprise

Equally, it recorded the bottom EPS all year long, at $3.30. It was down over -22% from the earlier quarter, however up over 15% from the identical interval final yr. The ultimate EPS in 2022 hit $16.69, up over 7% from that in 2021.

The administration projected the demand for house enchancment to be in “moderation” all year long, following a shift in shopper spending. Its resolution to lift hourly wages not too long ago (which shall incur $1 billion this yr) underneath circumstances of tight labor market with low unemployment, would have pressured on the gross margin and bills within the close to time period.

Within the coming announcement, market members count on HD’s gross sales to succeed in $38.3B, up almost 7% from the earlier quarter, however down -1.54% from the identical interval final yr. Consensus forecast for EPS stood at $3.81, up 15.5% from the earlier quarter, however down -6.85% from the identical interval final yr.

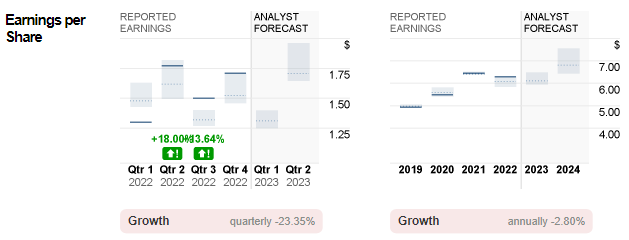

Technical Evaluation:

#HomeDepot (HD.s) share worth stays traded in consolidation after breaking beneath 100-day SMA, printing a yearly excessive at $341.40. The RSI indicator hovered close to 50, suggesting a scarcity of course for the time being. $296.30 (or FR 61.8% prolonged from Sept low to Dec excessive in 2022) serves as the closest minor resistance, adopted by the dynamic resistance 100-day SMA and $305.80 (FR 50..0%). A robust bullish breakout above the latter might imply a shift in main pattern. In any other case, so long as these ranges stay intact, the bears wish to push the asset worth decrease, in the direction of assist zone $280.40-282.70, adopted by the Sept low in 2022, at $265.50.

—————————————————————————————————

Walmart

The corporate is anticipated to report its earnings for Q1 2023 on 18th Could (Thursday), at pre-market open.

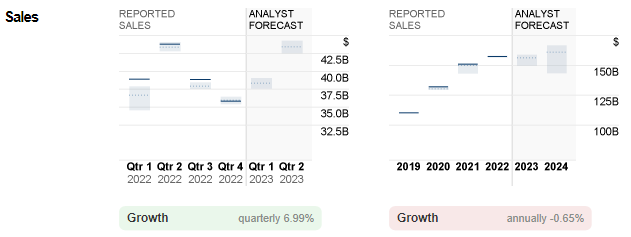

Fig.4: Reported Gross sales of Walmart versus Analyst Forecast. Supply: CNN Enterprise

Walmart posted better-than-expected leads to the earlier quarter. About 50% of its $164B gross sales was contributed by higher-income teams.It ended the yr with whole gross sales recorded at $611.3B, up 6.72% from 2021. Typically, the corporate’s stable gross sales development was backed by broad-based energy in all segments, shops and e-commerce operations.

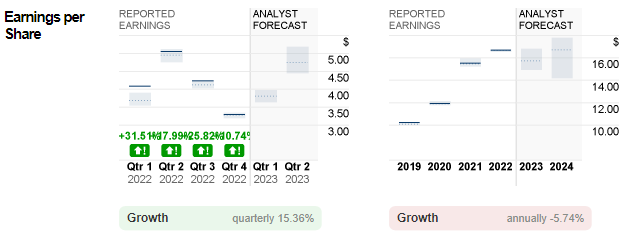

Fig.5: Reported EPS of Walmart versus Analyst Forecast. Supply: CNN Enterprise

EPS was reported at $1.71, up 14% from earlier quarter, and up 23% from the identical interval final yr. The ultimate EPS in 2022 stood at $6.29, barely down -2.63% from these in 2021. Much like the case in Dwelling Depot, the administration sees muted development this yr, because the financial system continued to be damage by a rise in bills, together with internet curiosity bills, non-controlling curiosity and efficient tax price. The truth is, the corporate has closed lots of its bodily shops following inevitable headwinds. Consensus estimates for gross sales and EPS within the coming quarter are $148.5B and $1.31, respectively.

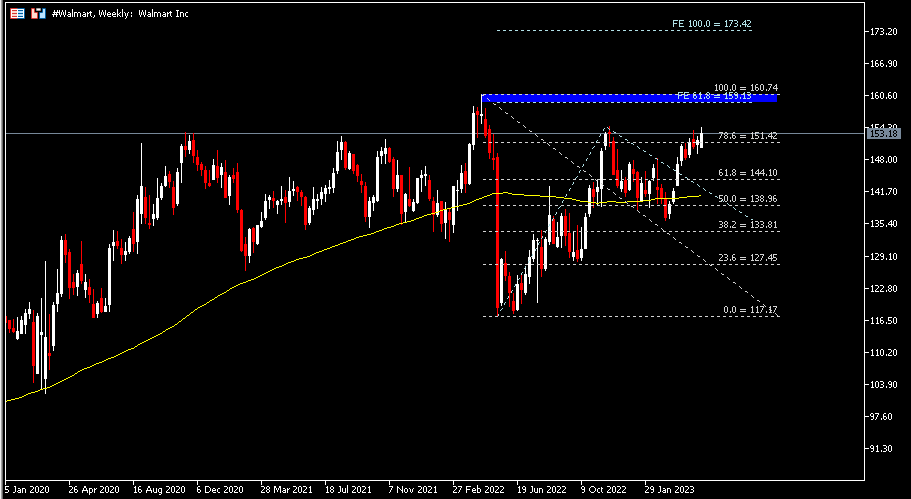

Technical Evaluation:

#Walmart (WMT.s) share worth final closed at $153.18, barely beneath the highs seen in November final yr ($154.57). Earlier resistance $151.40 has now turned to assist. A greater-than-expected earnings report could function a optimistic catalyst to drive the inventory worth increased, in the direction of the following resistance zone $159.10 – $160.74 (ATH). Then again, a retrace beneath the stated assist could recommend a short-term worth correction, in the direction of $144.10 and the dynamic assist 100-week SMA.

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst

Disclaimer: This materials is offered as a normal advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or must be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]