[ad_1]

- Jeremy Grantham expects shares to tank, a recession to chew, and extra monetary disasters to happen.

- The S&P 500 will plunge by no less than 27%, and will plummet by greater than 50%, the GMO cofounder says.

- Grantham predicts stress on the monetary system will result in additional disasters like SVB’s collapse.

Put together for US shares to plunge, the economic system to droop, and extra monetary fiascos to emerge, Jeremy Grantham has warned.

The S&P 500 will dive no less than 27% to round 3,000 factors, and may solely backside out subsequent 12 months, the market historian and GMO cofounder mentioned in a current CNN interview.

The benchmark inventory index may plummet by greater than 50% to round 2,000 factors in a worst-case situation, he added.

Grantham has been sounding the alarm on a large bubble in asset costs, and predicting a devastating market crash, for greater than two years.

-

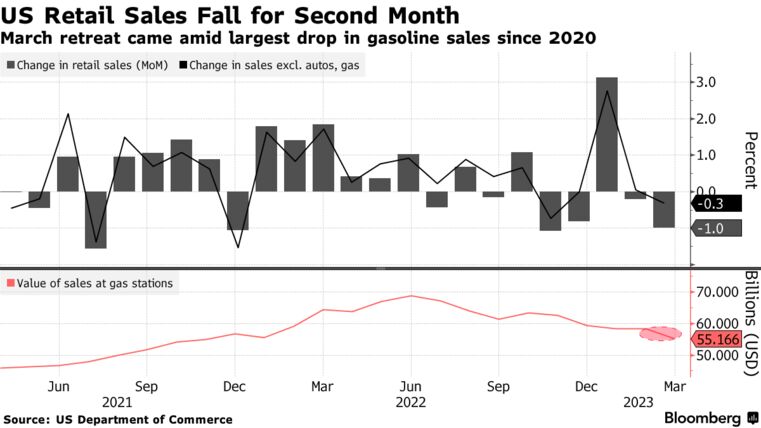

Retail gross sales slipped 1%, manufacturing output dropped 0.5%

-

Michigan knowledge confirmed bounce in year-ahead inflation expectations

The US economic system moderated progressively as the primary quarter drew to a detailed, with elevated inflation and borrowing prices proscribing family spending and manufacturing exercise.

March retail gross sales slid by probably the most in 4 months, largely defined by a droop in receipts at gasoline stations and a slowdown at auto sellers. A drop in manufacturing facility output exceeded expectations, although upward revisions to the prior two months allowed manufacturing to squeeze out a modest advance within the first quarter.

Taken along with indicators of moderating inflation, the newest batch of information is according to a gradual cooling of financial exercise late within the quarter quite than a extra vital droop in gentle of stress within the banking sector. Merchants nonetheless count on the Federal Reserve will go for one other quarter-point hike in charges at its subsequent assembly, however some policymakers have just lately hinted that they’d be open to a pause.

bullsnbears.com/2023/04/14/us-economy-is-cooling-steadily-as-consumers-factories-pull-back/

This will likely be like 2008 however 10x worse.

Yellen says US banks could tighten lending and negate want for extra charge hikes

WASHINGTON, April 15 (Reuters) – U.S. Treasury Secretary Janet Yellen mentioned banks are more likely to grow to be extra cautious and should tighten lending additional within the wake of current financial institution failures, probably negating the necessity for additional Federal Reserve rate of interest hikes.

www.reuters.com/markets/us/yellen-says-us-banks-likely-pull-back-credit-cnn-interview-2023-04-15/

Common Retail Investor is down 27% since November 2021 regardless of the S&P 500’s rally in 2023 pic.twitter.com/AmIqDMsaor

— Barchart (@Barchart) April 15, 2023

h/t mark000

[ad_2]