![Purchase This ‘Massive 5’ Canadian Financial institution to Sidestep the U.S. Banking Mess [PREMIUM PICK] Purchase This ‘Massive 5’ Canadian Financial institution to Sidestep the U.S. Banking Mess [PREMIUM PICK]](https://bizagility.org/wp-content/uploads/2022/05/GettyImages-623615678.jpg)

[ad_1]

Fellow Fools,

One minute you’re having fun with a fantastic sunny day, snowboarding with your loved ones in Quebec.

The subsequent … a financial institution you’ve really useful to 1000’s of paying members has an unprecedented run on deposits and evaporates earlier than your very eyes.

That was me final week as SVB Monetary grew to become the second-largest financial institution to go “growth” in U.S. historical past.

Not ultimate. To say the least.

We’d by no means skilled that earlier than in Inventory Advisor Canada — our flagship, members-only advisory service that I lead – and naturally we’d choose to by no means reside by way of that once more.

Since then, it’s been a wild trip for U.S. financial institution shares, the banks themselves, and even their prospects.

And we’ve been given a second to take a deep breath, puff out our chests, and take pleasure to be Canadian.

Go, Canada

All through historical past, as financial institution failure after failure has occurred within the U.S., we Canadians have been in a position to sleep straightforward, realizing our system is as sound as may be.

It will not be flashy, but it surely works.

Proper?

Not so quick.

It’s properly understood that the “Massive 5” Canadian banks spent many years consolidating the monetary providers panorama in Canada.

When that was finished, they turned their sights past the Canadian border. In spite of everything, shareholders demand development, and with consolidation full, the Canadian panorama had turn out to be comparatively barren.

By way of a string of acquisitions that started in earnest with TD Financial institution’s (TSX:TD) majority acquisition of Boston’s Banknorth in 2004, many Canadian banks have diversified slightly considerably away from their geographic roots.

Right here’s the place every of the Massive 5 derived their 2022 revenues:

| BMO | TD | Royal Financial institution | CIBC | Scotia | |

| Canada | 47.40% | 59.64% | 59.11% | 74.48% | 59.25% |

| U.S. | 50.37% | 37.61% | 24.18% | 14.88% | 6.86% |

| Different | 2.23% | 2.75% | 16.71% | 10.64% | 33.88% |

Stunned?

And this desk doesn’t even inform the complete story.

TD is trying to amass Memphis-based First Horizon (NYSE:FHN) in a deal that was supposed to shut in February however has been pushed to Could.

First Horizon had revenues of $2.7 billion in 2022, all from the U.S. If we assume this transaction closes, then TD’s share of U.S.-derived revenues shoots as much as 41%.

(By the way, TD has agreed to pay $25 per share for First Horizon. The widespread malaise over the previous week has these shares buying and selling at simply ~$15 as I write.)

The message is, as prospects, we Canadians can be ok with our banks.

Nevertheless, as traders, publicity to the Canadian banks signifies that we’re additionally uncovered to the chaos that’s taken maintain in different international locations’ monetary sectors.

That’s, publicity to most of the Massive 5 Canadian banks.

Financial institution of Nova Scotia (TSX:BNS), come on down!

With a mere 7% of its 2022 revenues derived from the U.S., suffice it to say that Scotia is a relative beacon on the subject of avoiding all the messy scenario south of the border.

However wait – the story will get higher.

You see, on the subject of financial institution stress-test eventualities, we don’t assume we’ll ever encounter a worse scenario than the Nice Monetary Disaster of 2008-2009. What’s occurring proper now smells like a bouquet of roses as compared.

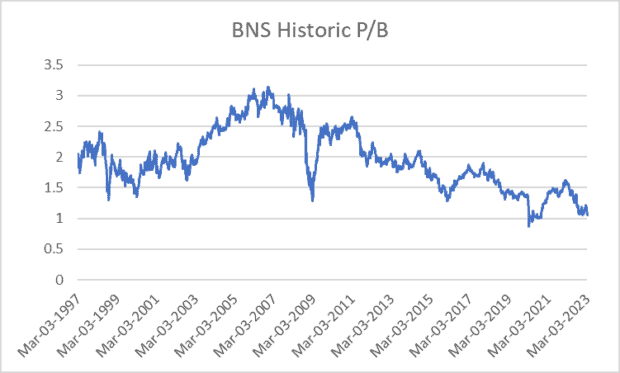

But … Scotia trades for a valuation, as proven within the historic Value/E-book Worth chart under, that’s decrease than it was throughout probably the most burdened interval banks anyplace are prone to ever encounter once more.

This doesn’t make any sense to us, which is why we’ve made Scotia the lone “Massive 5” Canadian financial institution that we’ve ever really useful in Inventory Advisor Canada on a standalone foundation. (We now have one other angle to play the Canadian banks, however out of respect to our paying members, I’ll hold that one below wraps.)

That Scotia is the “Massive 5” Canadian financial institution with the least publicity to the U.S. merely provides intrigue to this funding.

Silly Backside Line

Let’s be clear.

The Canadian banks have been bedrock positions within the portfolios of generations of Canadian traders. This could proceed. In spite of everything, they’re fantastic corporations that take pleasure in an enviable aggressive scenario.

Proper now although, I feel one stands above the remainder on the subject of warranting an funding of your hard-earned financial savings.

And heck, I haven’t even talked about the 6.3% dividend yield that Scotia at present presents.

I don’t throw the time period “no-brainer” round with a lot frequency. But it surely’s actually within the dialog on the subject of this case. Idiot on!

[ad_2]