[ad_1]

Provide and Demand… this can be a primary financial time period, which denotes availability of sellers prepared to promote and patrons prepared to purchase. Having mentioned that, provide and demand are necessary components of value motion. In reality, each provide and demand are regulating components for value, and on the similar time value regulates provide and demand.

Provided that buying and selling is all about value motion, the ideas of provide and demand must be included in foreign currency trading.

Though no bodily items or providers are exchanged in foreign currency trading, the unit that’s being exchanged is the forex pair itself. For instance, how a lot Japanese Yen are you prepared to alternate for a US Greenback? Within the banking world, these are the questions which can be being requested. Questions that drive the motion of international alternate charges. Questions that have an effect on us as foreign exchange merchants.

Nonetheless, provided that in foreign exchange there are not any items being exchanged in a bodily market, no public sale flooring accepting bids, and no open outcry of bids and presents on a buying and selling flooring, it’s fairly troublesome to evaluate at what value provide and demand is strongest. It’s as if all people desires to commerce, however nobody is aware of precisely at what value different merchants are prepared to purchase or promote. What we are able to do nevertheless is speculate. Anyway, that’s what we do as merchants.

Provide and Demand on a Foreign exchange Chart

So, how can we speculate the place provide or demand is strongest? It’s primarily based on the idea of value rallies and drops. Many provide and demand foreign exchange merchants have coined these actions as rally-base-rally, drop-base-drop, drop-base-rally, or rally-base-drop. Nonetheless, we won’t delve into that as this may take too lengthy for an article.

The fundamental idea is {that a} rally is an space within the chart the place value strongly took off from going up, whereas a drop is an space within the foreign exchange chart the place value strongly dropped from.

Many provide and demand merchants speculate that that is as a result of pending orders positioned by institutional merchants, which is smart trigger if there’s somebody who might strongly have an effect on value, it might be the institutional merchants. Some merchants even go additional and speculate that a few of these pending orders are usually not crammed as a result of sheer quantity of transactions in that space. Due to this, these merchants additionally place their pending orders in that space, speculating that value would once more rally or drop if value reaches that space due to the remaining unfilled pending orders.

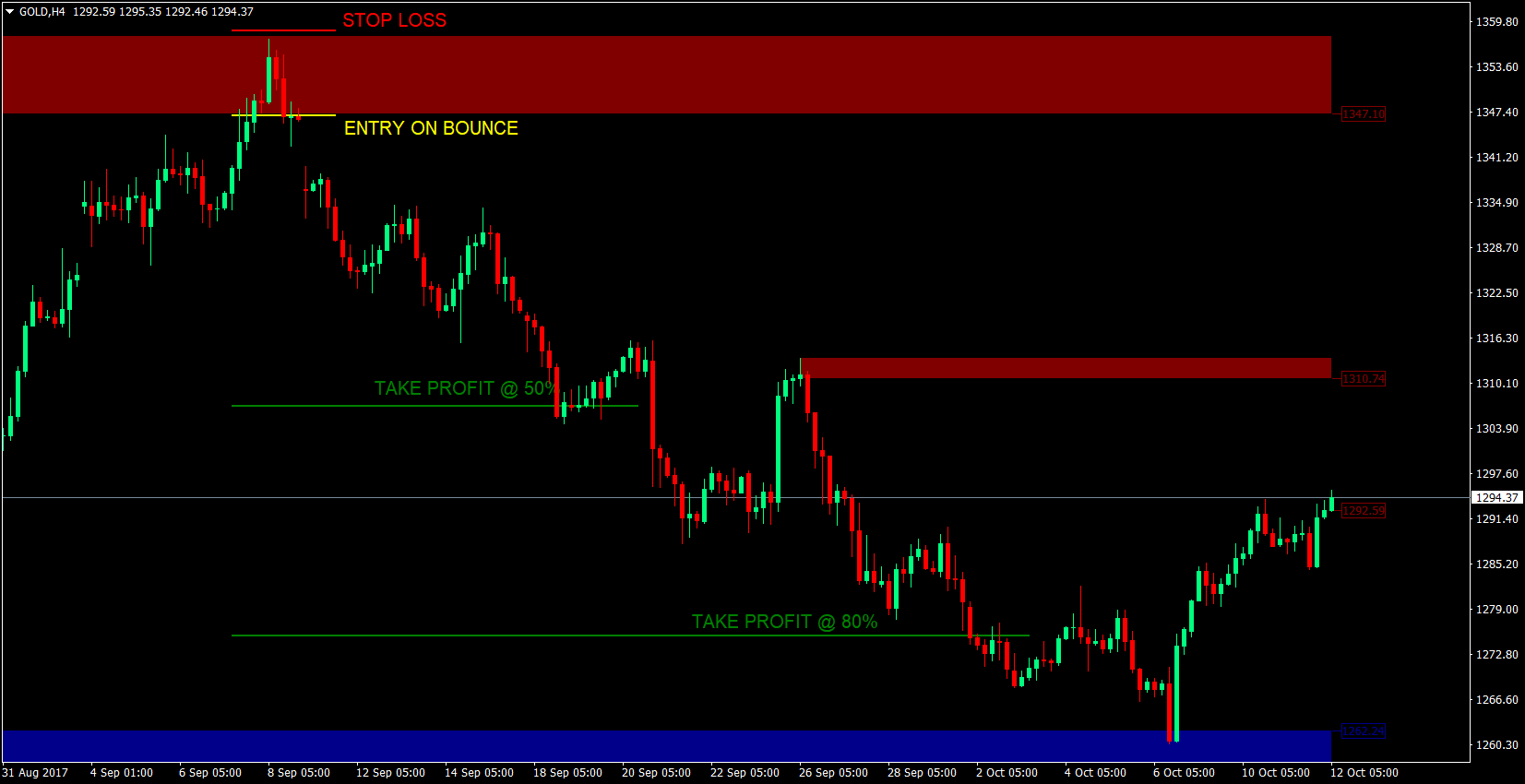

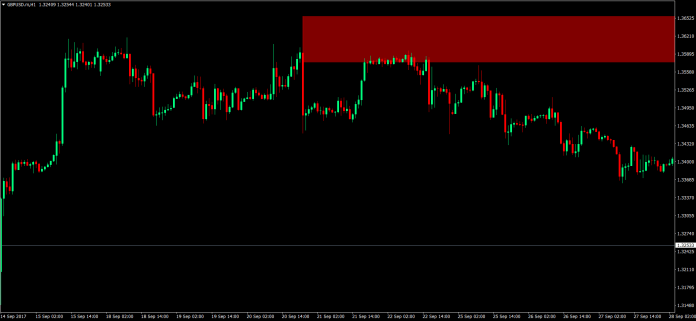

Right here is an instance of a drop in value, indicating that there’s a provide of pending orders in that space.

Discover how value strongly dropped from that space creating an extended bearish candle.

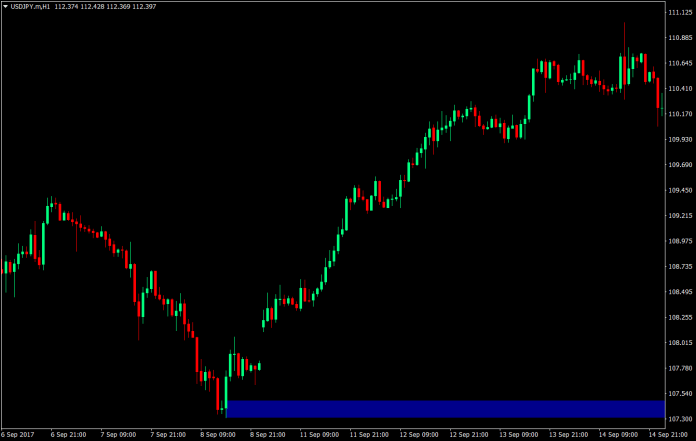

And right here is an instance of a rally, indicating demand.

Once more, an extended bullish candle, indicating demand.

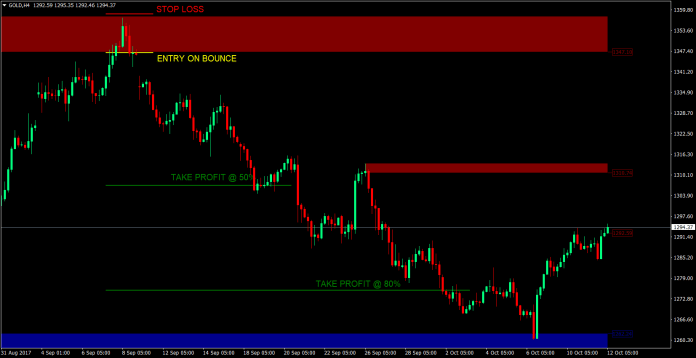

The Purchase Setup – Entries, Exits & Cease Losses

To simplify this technique, we will likely be utilizing a Provide and Demand indicator, which conveniently plots these possible provide and demand areas.

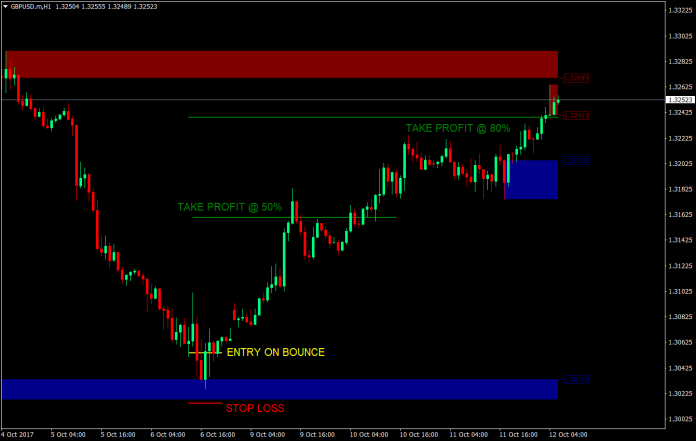

Purchase Entry: To enter a purchase setup, we should observe value because it touches the closest contemporary demand space drawn as a blue rectangle by the indicator. As quickly as value touches the world, the subsequent candle ought to bounce off the blue rectangle, indicating that value will rally again up.

Cease Loss: The cease loss must be only a few pips under the blue rectangle.

Take Revenue 1: The take revenue for the primary half of the place must be the 50% line in between the demand space (blue rectangle) and the closest provide space (crimson rectangle).

Take Revenue 2: The take revenue for the remaining half of the place must be the 80% line between the demand space (blue rectangle) and the closest provide space (crimson rectangle).

Trailing Cease: As quickly as the primary take revenue goal is hit, the cease loss must be trailed to breakeven plus a couple of pips.

The Promote Setup – Entries, Exits & Cease Losses

Promote Entry: To enter a purchase setup, we should observe value because it touches the closest contemporary provide space drawn as a crimson rectangle by the indicator. As quickly as value touches the world, the subsequent candle ought to bounce off the crimson rectangle, indicating that value will drop down.

Cease Loss: The cease loss must be only a few pips above the crimson rectangle.

Take Revenue 1: The take revenue for the primary half of the place must be the 50% line in between the availability space (crimson rectangle) and the closest demand space (blue rectangle).

Take Revenue 2: The take revenue for the remaining half of the place must be the 80% line between the availability space (crimson rectangle) and the closest demand space (blue rectangle).

Trailing Cease: As quickly as the primary take revenue goal is hit, the cease loss must be trailed to breakeven plus a couple of pips.

Conclusion

The Provide and Demand technique is without doubt one of the most logically sound methods obtainable on the market. It’s primarily based on an financial concept, which is neatly included in foreign currency trading. In reality, there are a number of provide and demand buying and selling gurus on the market with confirmed monitor information of how provide and demand methods work.

Nonetheless, even in case you might accurately establish the availability and demand areas, it doesn’t essentially imply that there are nonetheless some pending orders left on that space that might trigger value to bounce off. All of it boils all the way down to possibilities and buying and selling edges. This technique for positive does have a robust buying and selling edge, primarily based on the historic information of those that use this technique.

One other setback of provide and demand, is that it takes time to grasp. It ought to take round a yr to grasp figuring out legitimate provide and demand areas. The great factor with this although is that this technical indicator might help in figuring out provide and demand areas. Primary information of drawing provide and demand areas would nonetheless be good, as indicators are nonetheless not good.

General, this technique is a winner due to its confirmed buying and selling edge.

Foreign exchange Buying and selling Methods Set up Directions

Provide and Demand Foreign exchange Buying and selling Technique Defined With Examples is a mixture of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange system is to rework the amassed historical past information and buying and selling alerts.

Provide and Demand Foreign exchange Buying and selling Technique Defined With Examples offers a possibility to detect varied peculiarities and patterns in value dynamics that are invisible to the bare eye.

Primarily based on this data, merchants can assume additional value motion and modify this technique accordingly.

Really useful Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

set up Provide and Demand Foreign exchange Buying and selling Technique Defined With Examples?

- Obtain Provide and Demand Foreign exchange Buying and selling Technique Defined With Examples.zip

- Copy mq4 and ex4 recordsdata to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you wish to check your foreign exchange system

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick Provide and Demand Foreign exchange Buying and selling Technique Defined With Examples

- You will note Provide and Demand Foreign exchange Buying and selling Technique Defined With Examples is on the market in your Chart

*Be aware: Not all foreign exchange methods include mq4/ex4 recordsdata. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here under to obtain:

[ad_2]