[ad_1]

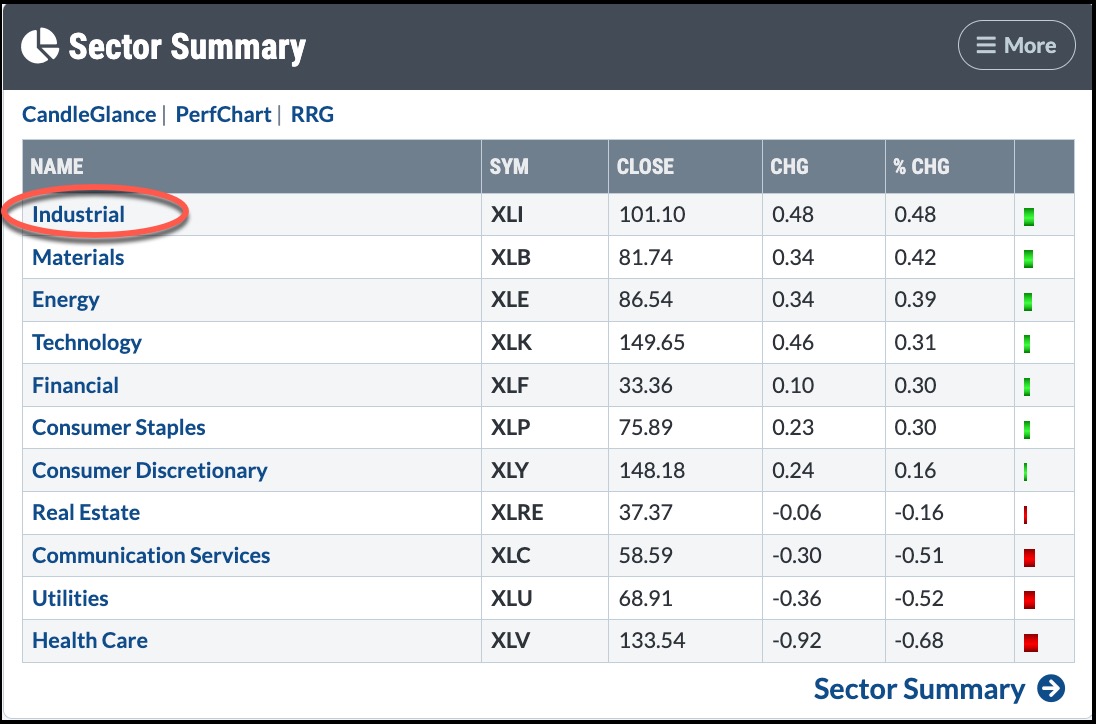

Aerospace and protection shares appear to be busting by way of turbulence. Lockheed Martin (LMT)’s better-than-expected earnings helped push its inventory value greater, and the optimistic information added upside momentum to the aerospace and protection trade. So it should not be stunning that the Industrial sector, utilizing the Industrial Choose Sector SPDR fund (XLI) as a proxy, was the main sector on Tuesday, with Supplies an in depth second.

Protection and aerospace make up an enormous chunk of the Industrial sector. And, on Tuesday, each had been the top-performing industries within the Industrials sector.

When you have a look at these industries individually, Lockheed Martin and Northrop Grumman (NOC) are two of the main shares. In aerospace, Boeing (BA) and Raytheon (RTX) are two of the bigger gamers.

Regardless of the trade’s headwinds—provide chain points, Boeing’s halting of MAX deliveries, analyst downgrades, and labor market shifts which have harm massive manufacturing industries—all 4 shares moved greater.

Zeroing in on the Business

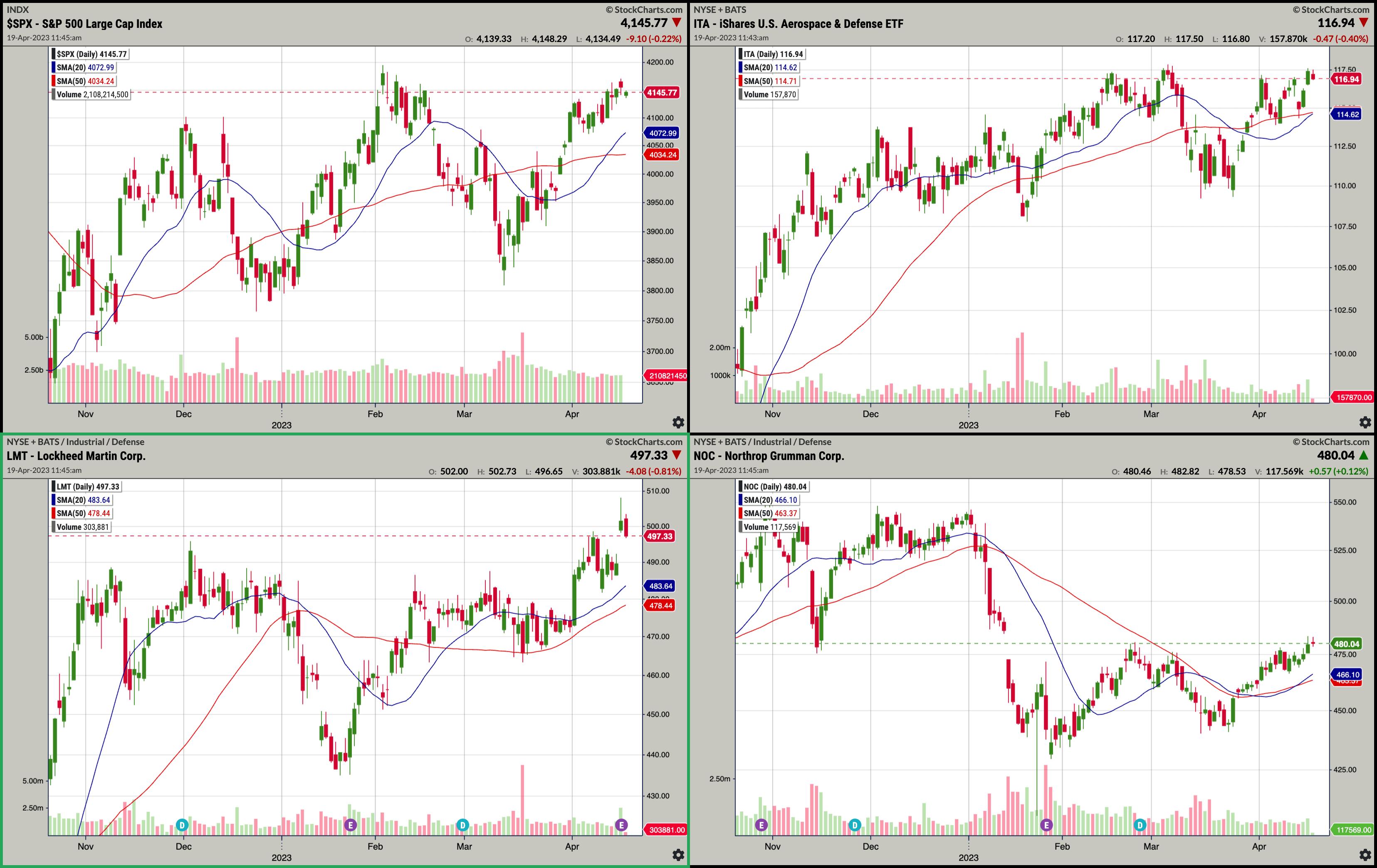

Though the trade remains to be struggling, elevated protection spending and rising house gross sales helped push the trade greater. To see how aerospace and protection shares are performing, you might pull up a chart of the iShares US Aerospace & Protection ETF (ITA). ITA has outperformed the S&P 500 index ($SPX) since mid-March, buying and selling quantity is rising, and the ETF is trying to break above its 52-week excessive (see chart under). Will it break by way of this stage or pullback?

CHART 1: AEROSPACE & DEFENSE STOCKS ARE MOVING HIGHER. Will the pattern proceed or will there be a pullback? To date, it appears like extra upward motion is probably going, however that might change.Chart supply: StockCharts.com. For illustrative functions solely.

Given the optimistic motion, it could be tempting to leap into aerospace and protection shares. However earlier than you do, it helps to do a deeper evaluation to assist verify your buying and selling plans and to make smarter buying and selling selections.

There is not any proper option to analyze a inventory, however one efficient technique many profitable merchants apply stems from Jesse Livermore’s buying and selling technique. It is a four-step course of that is just about a top-down method.

The Nuts and Bolts of the Technique

This is how you might analyze the trade and determine which protection inventory you need to purchase:

- The Market. Take a look at the present market path to make sure it aligns with the path of the shares you are contemplating. An effective way to do that is to go to Your Dashboard on the StockCharts platform. When you have a look at the broad indexes—Dow Jones Industrial Common ($INDU), S&P 500 index ($SPX), Nasdaq Composite ($COMPQ)—they’re approaching a vital stage. A breakout above that stage could possibly be a optimistic signal.

- The Business Group. Trying on the efficiency of ITA, it is trying just like that of the broader indexes—approaching a vital stage, on this case, its 52-week excessive. General the trade group appears to be trending upward, aside from some vital pullbacks. When you have a look at the previous couple of pullbacks, they typically observe a sample of upper highs and better lows.

- Comparative Evaluation. Evaluate totally different shares inside the trade group. For instance, in case you’re severely contemplating investing in Lockheed Martin, you might evaluate its efficiency in opposition to Northrop Grumman.

- Particular person Inventory Evaluation. Nonetheless suppose Lockheed can be an excellent funding? Take a look at the general market, the trade group, comparable shares (on this case, Northrop Grumman), and a chart of Lockheed inventory.

CHART 2: TOP-DOWN TRADING STRATEGY. If the general market, the trade, and shares inside the trade are all in pattern path settlement, your buying and selling selections are more likely to have the next likelihood of success.Chart supply: StockChartsACP. For illustrative functions solely.

Trying on the 4 charts on one display screen helps to see confirming and conflicting indicators. Within the above chart, you see the next:

- Beginning with the broader market, it appears as if there is a little bit of a pullback.

- The aerospace and protection trade can be displaying the same situation.

- Taking a look at Lockheed’s inventory, because the hole up in value, the inventory has pulled again. It might go low sufficient to fill the hole. If a reversal happens after the pullback, the uptrend resumes, and it is in sync with the general market and trade, it could possibly be time to think about coming into a place.

- Northrop Grumman’s inventory additionally appears to be taking a breather. If the uptrend in Lockheed resumes and Northrop additionally developments upward, it could possibly be a optimistic signal for the aerospace and protection trade.

For extra affirmation, you might throw in a couple of trend-following indicators, equivalent to shifting averages and shifting common convergence divergence (MACD), into your evaluation.

The Ultimate Phrase

Investing within the aerospace and protection sector could be a macro play because it’s linked with the worldwide financial system. Buyers ought to hold an ear open for developments within the debt ceiling this summer time. Any cuts in protection spending might harm protection trade shares. However in case you regulate the general market, trade, and a few shares, you might see reversal indicators forward of time. This might provide help to determine when to exit your place.

When you repeatedly have a look at the Sector Abstract in Your Dashboard, you’d have seen that trade teams usually go out and in of favor. As an alternative of preventing with the market, let the market let you know what to put money into.

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your personal private and monetary scenario, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Web site Content material at StockCharts.com. She spends her time developing with content material methods, delivering content material to coach merchants and traders, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Be taught Extra

Subscribe to ChartWatchers to be notified every time a brand new publish is added to this weblog!

[ad_2]