![Property tax 101 [infographic] Property tax 101 [infographic]](https://bizagility.org/wp-content/uploads/sites/17/2023/02/AdobeStock_419592372-scaled.jpg)

[ad_1]

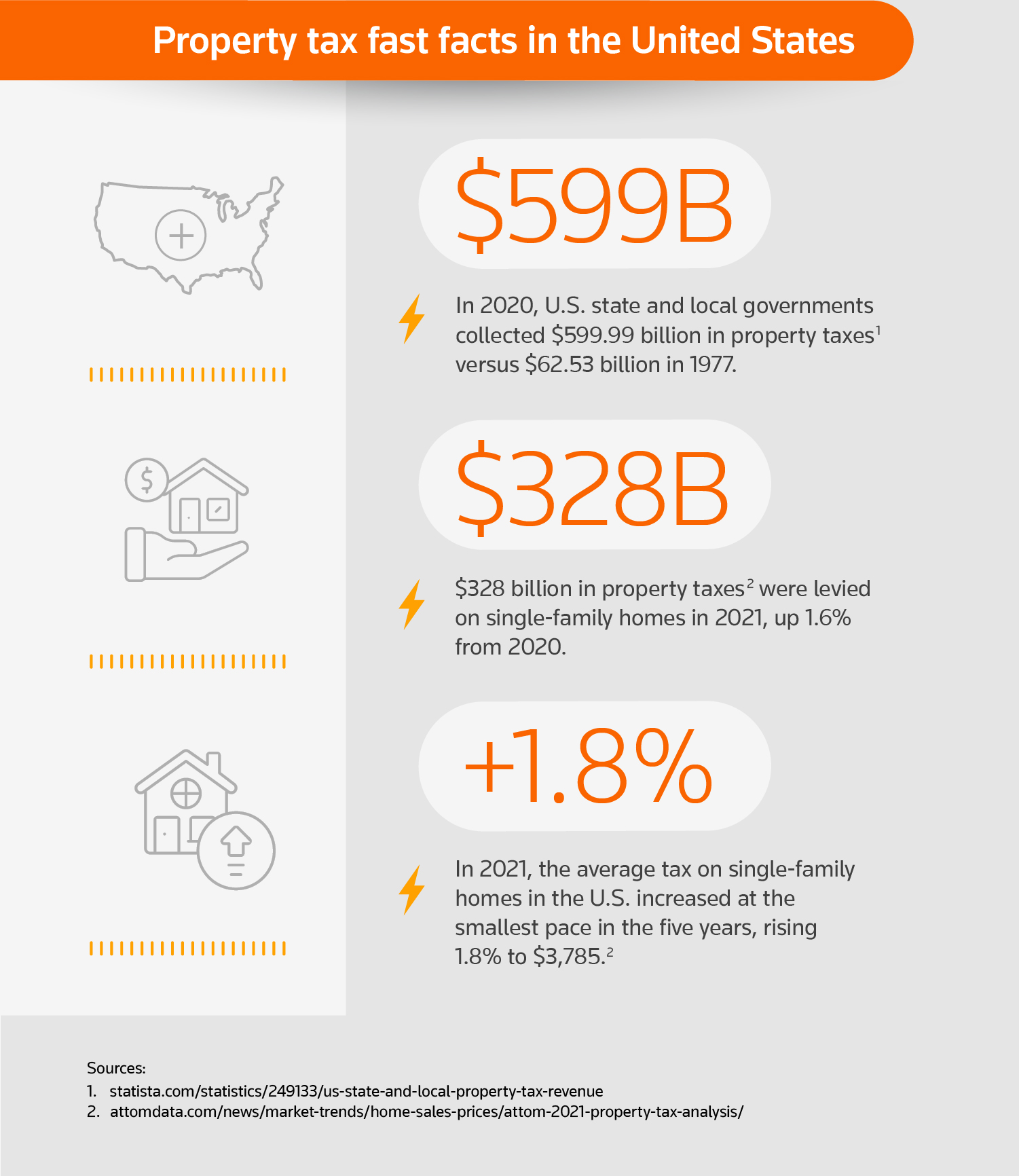

Serving to purchasers navigate the complexities of property tax is vital for accounting companies. Property taxes and tax charges, which differ significantly amongst states and localities, will be complicated and are a significant space of tax publicity and danger. Corporations can strengthen their position as a trusted advisor by serving to purchasers successfully handle their property taxes and mitigate danger.

Under is an infographic masking the present state of property taxes in the US, however first, let’s take a short take a look at the historical past of property tax.

Historical past of property tax

The origination of property taxes in the US dates again to colonial instances. Throughout this time, the rise of property tax was intently tied to political and financial plights on the frontier.

When tensions between colonists and British authorities hit a boiling level and the Revolutionary Conflict broke out in 1775, American colonies had a tax construction in place that assorted from colony to colony.

By 1796, seven of the 15 states levied uniform capitation taxes, which had been taxes (also called a “ballot” or “head” tax) levied on people no matter their earnings or assets. Twelve states taxed some or all livestock. In the meantime, land was taxed in a wide range of methods, however solely 4 states taxed the mass of property by valuation. No state structure required that taxation be by worth or required uniformity on charges on all types of property; nonetheless, that might quickly start to vary.

In 1818, Illinois adopted the primary uniformity clause and extra states quickly adopted go well with. Tennessee changed a provision requiring that land be taxed at a uniform quantity per acre with a provision that land be taxed based on its worth. Increasingly states started adopting uniformity clauses and, by the top of the century, 33 states had included uniformity clauses, which required all property be taxed equally by worth.

Fashionable reforms of property tax

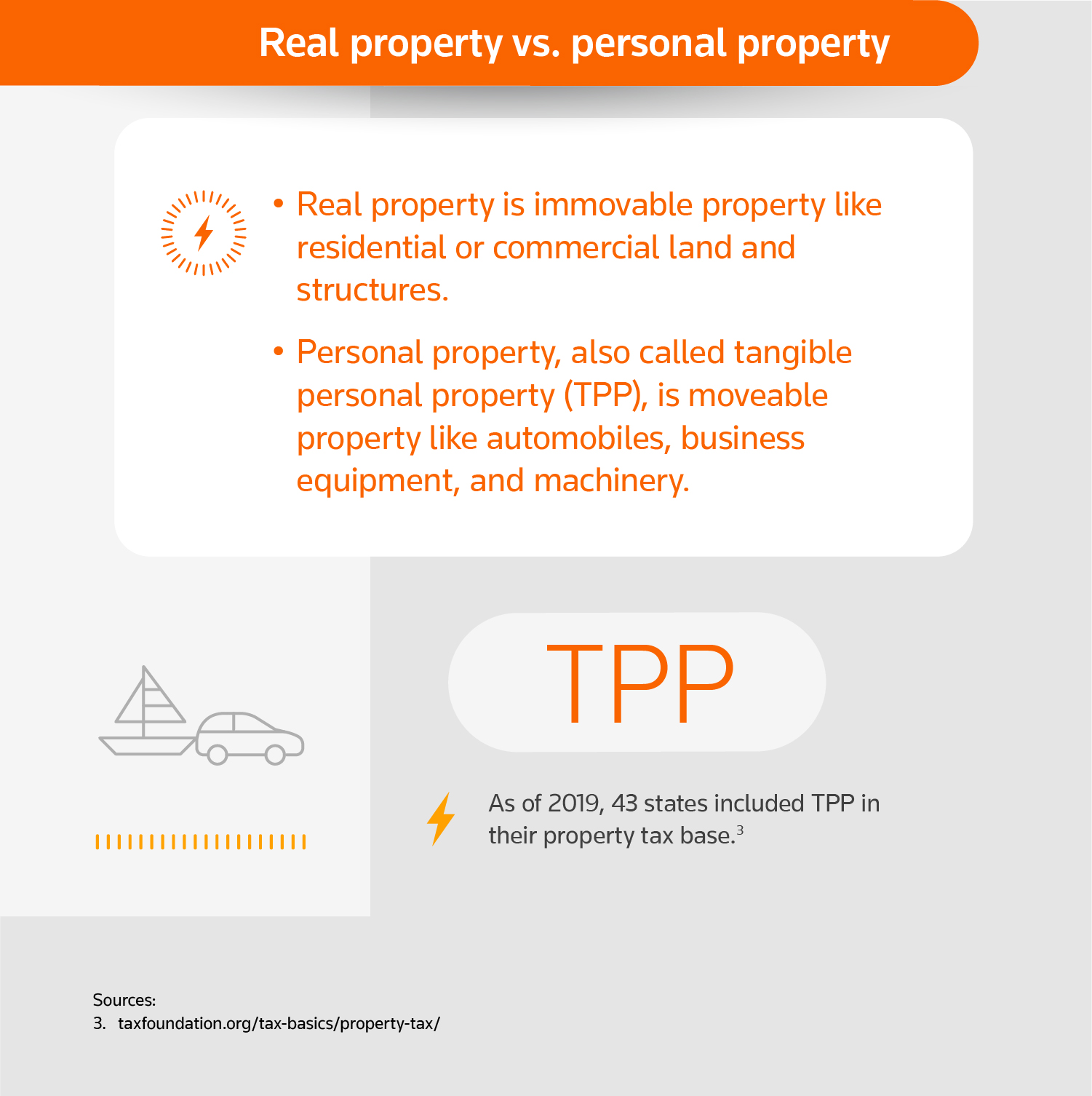

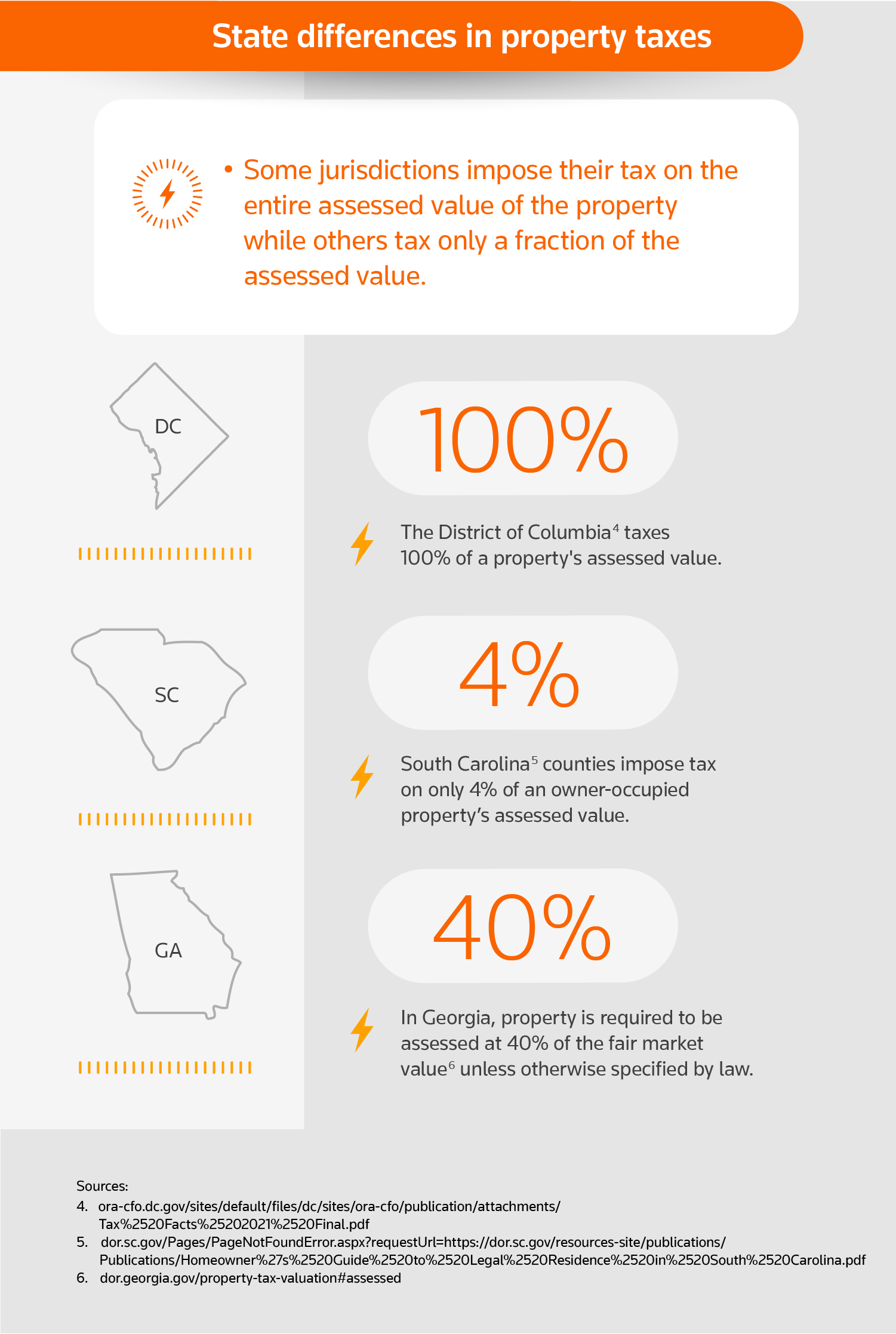

Going ahead, measures to reform the property tax had been completely different relying on the state, however normally included exemption or classification of some types of property. Intangibles like mortgages had been normally taxed at decrease charges, however in a number of states tangible private property and actual property had been additionally labeled.

In the course of the 1900s, some states exempted owner-occupied residence from taxation. Nevertheless, these homestead exemptions would later be criticized.

Following World Conflict II, many states changed the homestead exemption with state financed “circuit breakers” to restrict or scale back taxes for sure people. By 1991, 35 states had some type of circuit breakers in place.

Within the late Nineteen Seventies, a taxpayer revolt swept the nation. Essentially the most publicized was Proposition 13, a constitutional modification handed in California in 1978. Beneath Proposition 13, all actual property has established base yr values, a restricted fee of improve on assessments of no larger than 2% annually, and a restrict on property taxes to 1% of the assessed worth (plus further voter-approved taxes).

Right this moment, developments in know-how have improved state evaluation methods to assist make moderately correct property. Now, let’s flip to the infographic for a fast overview of how property taxes look at present.

Study extra about property taxes

Property taxes are distinctive to state and native governments, so serving to purchasers can develop into sophisticated shortly. For extra info and solutions to continuously requested questions on property taxes, read our information “

[ad_2]