[ad_1]

Not all borrowing is dangerous. Somebody with a low-rate mortgage of modest measurement on an appreciating home has a really worthwhile asset. And a few retirees repay their bank cards each month with out breaking a sweat.

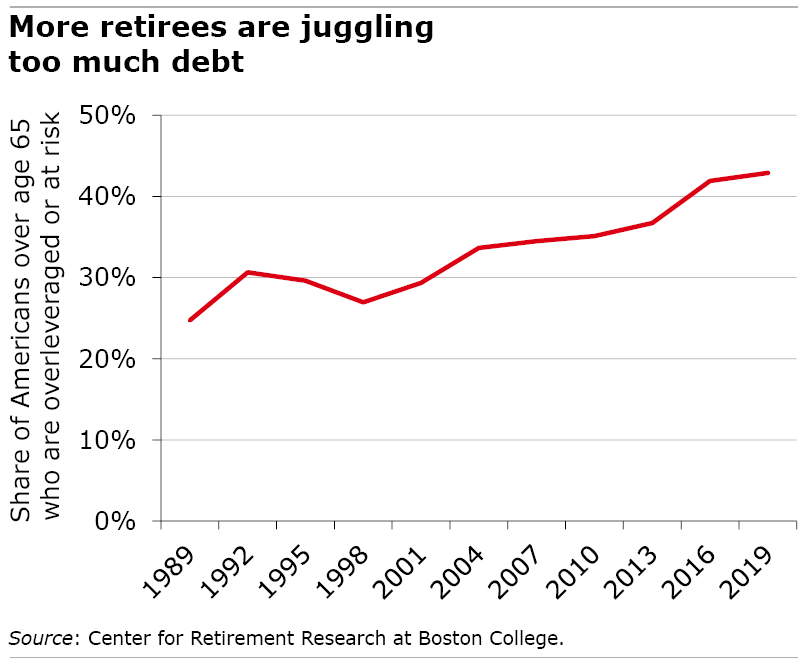

However about 4 out of each 10 older U.S. households are falling into the lure of getting an excessive amount of debt, a new research finds.

These high-risk households, principally retirees, are typically burdened by low incomes or massive balances on unsecured debt like bank cards, which accumulate curiosity at a fast tempo. Some are overleveraged and could also be unable to afford their houses.

The low-risk debtors are their mirror picture: no unsecured debt and comparatively low debt funds and debt-to-asset ratios.

The share of U.S. households over age 65 that carry some debt has risen sharply because the late Eighties, from 38 % to 63 % at present. And most of that progress has been pushed by the high-risk debtors, who have already got an excessive amount of debt or are at risk of changing into overleveraged, the researchers on the Middle for Retirement Analysis discover.

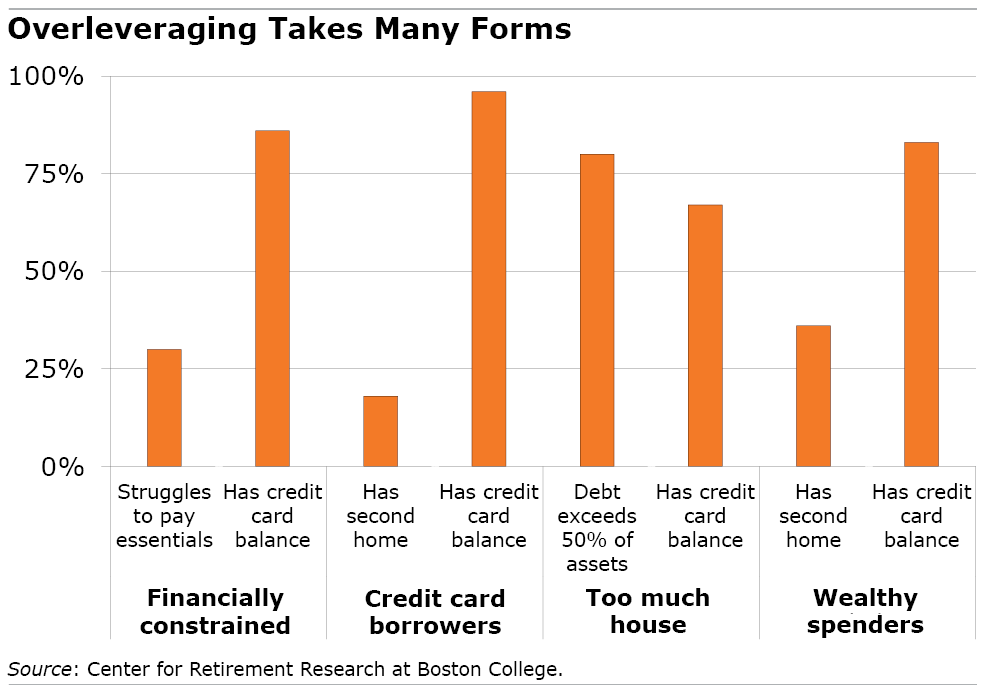

They grouped these high-risk debtors into 4 fundamental sorts within the chart beneath:

Financially constrained. Their issues begin with low incomes, they usually could also be pressured to make use of their bank cards “simply to get by,” the researchers mentioned. They’re the one largest group, amounting to a 3rd of all high-risk older debtors, and the overwhelming majority have bank card debt. One in 10 additionally has medical debt. A 3rd of them are individuals of coloration.

Bank card debtors. These retirees are prone to be center class “with no apparent must borrow,” the researchers mentioned. They don’t battle with paying for necessities to the extent low-income households do. However just about all of them are carrying bank card debt and two out of 10 have second houses.

An excessive amount of home. They could possibly be both low- or middle-income. Two issues set them other than the opposite high-risk debtors. First, almost half have a lot debt that the funds are absorbing not less than 40 % of their month-to-month family revenue. Additionally they owe massive quantities on their mortgages, which equal 60 % of the house’s worth, on common. Almost a 3rd are individuals of coloration.

Rich spenders. The label speaks for itself. Despite the fact that they’ve excessive incomes, a big majority have debt within the type of revolving balances on their bank cards. They usually have a second house. One in 4 of those households spends not less than 40 % of their ample revenue paying their mortgages and different money owed.

All these retirees, who’re at excessive danger of entering into monetary hassle, are a trigger for concern. However the researchers mentioned one of the best ways to assist them can be by means of focused approaches that acknowledge the range of economic points that particular person households face.

Whereas low-income debtors may have extra federal help to cowl their important bills, monetary counseling may fit higher for higher-income individuals who overuse their bank cards.

“A one-size-fits-all resolution doesn’t exist,” the researchers mentioned.

Squared Away author Kim Blanton invitations you to comply with us on Twitter @SquaredAwayBC. To remain present on our weblog, please be part of our free e-mail record. You’ll obtain only one e-mail every week – with hyperlinks to the 2 new posts for that week – whenever you enroll right here. This weblog is supported by the Middle for Retirement Analysis at Boston School.

[ad_2]