[ad_1]

Defending savers from rollovers to IRAs with high-fee mutual funds is especially necessary.

President Biden has introduced that the Division of Labor will suggest a brand new rule – the Retirement Safety Rule – to increase fiduciary requirements and shut loopholes to guard individuals saving for retirement in opposition to conflicted recommendation. Making certain that monetary advisers make suggestions within the saver’s finest curiosity will improve returns and make for a safer retirement. Certainly, charges matter quite a bit: a further 100 foundation factors over a 40-year interval reduces ultimate property by about one-fifth.

Candidly, I haven’t been desirous about the entire concern of conflicted recommendation for some time. I assumed we had every thing underneath management.

DOL laws relating to recommendation to employer-sponsored plans are ruled by ERISA’s fiduciary rule, which requires that suggestions are made in the most effective curiosity of the consumer. DOL has made quite a few makes an attempt to make sure that savers would get recommendation from fiduciaries – albeit not at all times efficiently. With regard to IRA rollovers, IRS laws require that fiduciaries not “self-deal.”

Dealer-dealers are regulated underneath the Securities Alternate Act of 1934 via a self-regulatory group, the Monetary Business Regulatory Authority. In 2019, the Securities and Alternate Fee (SEC) imposed a brand new normal of conduct that went past the “suitability” of an funding to require that broker-dealers act in the most effective curiosity of their prospects – Regulation Finest Curiosity, or Reg BI.

Regardless of the progress, the Biden administration has recognized vital loopholes. The brand new DOL rule does three issues:

- Broadens the vary of merchandise topic to the “saver’s finest curiosity” requirement to incorporate commodities and insurance coverage merchandise (like annuities) – merchandise not presently lined by the SEC’s Regulation BI.

- Covers all recommendation to roll over property from employer-sponsored plans to IRAs. Underneath ERISA, recommendation offered on a one-time foundation, reminiscent of that pertaining to a rollover, isn’t presently required to be within the saver’s finest curiosity.

- Covers recommendation to plan sponsors relating to funding choices. At the moment such suggestions to plan sponsors, together with small employers, isn’t lined by the SEC’s Reg BI.

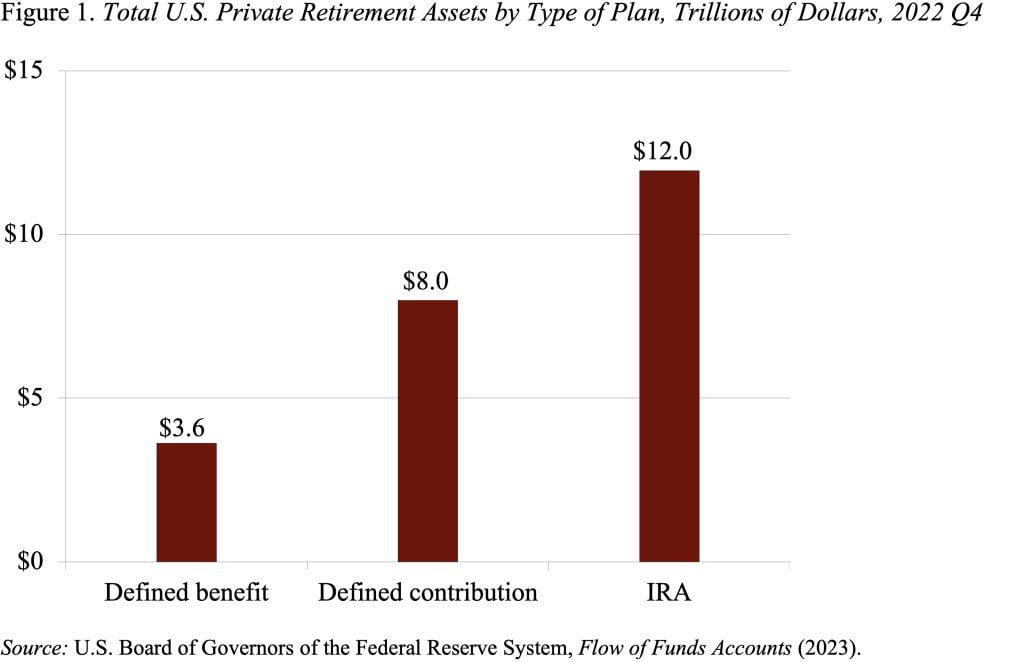

A reporter requested what I assumed was crucial of the three proposed modifications. In my opinion, it’s no contest – extending protections on rollovers from 401(okay)s to IRAs. Whereas 401(okay) plans have unfold dramatically, they’ve primarily become a set mechanism for retirement financial savings; contributors finally roll over the majority of the cash into IRAs. Right this moment, IRA property exceed these in 401(okay)s by 50 % – $12 trillion in comparison with $8 trillion (see Determine 1).

The rollover of balances from 401(okay)s to IRAs is extraordinary provided that contributors are usually passive of their interactions with their 401(okay) plans. They hardly ever change their contribution charge or rebalance their portfolios in response to market fluctuations. Thus, one would assume that the power of inertia would lead contributors to go away their balances of their 401(okay)s. The truth that contributors truly take the difficulty to maneuver their funds suggests a robust motivating power. Some households could also be attracted by the chance to acquire a wider menu of funding choices or to consolidate their account holdings. However others could also be seduced by ads from monetary service companies urging contributors to maneuver their funds out of their “previous,” “drained” 401(okay) plan into a brand new IRA.

The idea by contributors should be that the companies promoting rollovers are working within the contributors’ curiosity, however, in truth, contributors fairly often are shifting from fiduciary safety and low-fees into an unprotected area the place their property can be invested in high-fee mutual funds. So, ensuring that advisers are performing within the saver’s finest curiosity when contemplating a rollover is massively necessary.

[ad_2]