[ad_1]

The ultimate levels of main financial cycles are at all times accompanied by the utmost quantity of unhealthy information in addition to heinous occasions. This time isn’t any totally different because the West is within the technique of committing Harakiri (Seppuku).

As Elon Musk mentioned:

“My mentality is that of a Samurai. I’d slightly commit Seppuku than fail.”

Sadly, the issue for the West is that it’s each committing Harakiri and failing.

For at the very least half a century, the world has been in a technique of self-destruction.

Because the decline accelerates, the following section of 5-10 years will embody main political, social, financial in addition to wealth – destruction.

What will be extra heinous than a complete financial and monetary collapse accompanied by a possible World Warfare III that at worst might destroy the world completely.

A latest article of mine mentioned international fragility resulting from Warfare, Debt and Vitality Depletion.

On this article I define the main dangers at this time, monetary and geopolitical and likewise focus on one of the simplest ways to guard in opposition to these dangers. Bodily Gold is after all the last word wealth preservation funding. The following main transfer up in gold isn’t distant. See additional on.

Biden’s latest go to to Ukraine and whistle cease tour of Europe confirmed that there isn’t any need to make peace however solely battle. Extra assist of weapons and cash from the US is forthcoming. And regardless of the US dictates, Europe follows with out contemplating the implications.

On the finish of his Warsaw handle Biden acknowledged about Putin:

“For God’s sake, this man can not stay in energy”.

Hmmm…. Hardly the discuss of a peace maker

China however is making an attempt to behave as peacemaker however their proposal final Friday was chilly shouldered by the West.

Extra importantly, the Chinese language Ministry of Overseas Affairs issued an essential coverage doc this week which is a really sturdy assault on the US hegemony known as:

“US Hegemony and Its Perils”.

The assault begins within the introduction:

“Since turning into the world’s strongest nation after the 2 world wars and the Chilly Warfare, the USA has acted extra boldly to intrude within the inside affairs of different nations, pursue, preserve and abuse hegemony, advance subversion and infiltration, and wilfully wage wars, bringing hurt to the worldwide neighborhood.

It then goes on intimately to assault all of the areas of US Hegemony like: Political – Throwing its Weight Round, Army – Wanton Use of Power, Financial – Looting and Exploitation, Technological – Monopoly and Suppression, Cultural – Spreading False Narratives.

The doc exemplifies intimately the hegemonic insurance policies and assaults of the US. Though US politicians will completely reject its contents, it’s troublesome to argue with the details put ahead by China.

As I point out often, I very very similar to America and its individuals however have difficulties accepting the insurance policies of the Neocons who dominate US politics.

Right here is an extract from the Conclusion on this Chinese language doc:

“The USA has been overriding reality with its energy and trampling justice to serve self-interest. These unilateral, egoistic and regressive hegemonic practices have drawn rising, intense criticism and opposition from the worldwide neighborhood.

Nations have to respect one another and deal with one another as equals. Huge nations ought to behave in a way befitting their standing and take the lead in pursuing a brand new mannequin of state-to-state relations that includes dialogue and partnership, not confrontation or alliance. China opposes all types of hegemonism and energy politics, and rejects interference in different nations’ inside affairs.” (Here’s a hyperlink to the complete doc.)

It’s troublesome to argue with this conclusion. However we have to put on the moccasins of the US and remainder of the world and have a look at China from that perspective. That is to observe my adage to stroll three moon laps in someone’s moccasins earlier than you decide him.

China isn’t attacking numerous nations on the planet by power, however primarily utilizing investments and commerce routes to dominate the world just like the Trendy Silk Highway known as the Belt and Highway Initiative. It units out to attach 65% of the world’s inhabitants to China by making a community of sea routes and land hyperlinks. China is estimated to have spent $1 trillion to date however whole estimates are as excessive as $8 trillion. It can most probably take many years to attain and would possibly grow to be too pricey because the world financial system declines.

Nonetheless, what is evident is that China is investing closely in infrastructure world wide each in Europe, Africa and South America. For instance China is shopping for up ports in a considerable variety of nations. They’re additionally investing closely within the useful resource sector globally.

One other downside that the West has with China is their human rights report.

Regardless, the development is evident. The West is in a long run structural decline and the shift to China and the remainder of the East and the South is inevitable as I mentioned within the article“AS WEST, DEBT & STOCKS IMPLODE, EAST, GOLD & OIL WILL EXPLODE”

THE STRUCTURAL DECLINE OF THE WEST

All empires are ephemeral and that is what the US and Europe are at present experiencing.

The ultimate levels of empires, just like the Han, Roman, Mongol, Ottoman, Spanish and British at all times embody the identical components a few of that are:

- Extreme Money owed and Deficits

- Foreign money Collapse

- Collapse of asset costs together with property, bonds and shares

- Hyperinflation within the remaining levels, particularly in meals, commodities & companies

- Migration

- Excessive Crime Charges & Breakdown of Regulation & Order

- Ethical Decadence

- Social Unrest, Civil Warfare

- Wars

Because the West is now falling (& failing), we are able to tick all of the above occasions additionally within the present collapse.

International debt has exploded since 1971 to $2-3 quadrillion as I’ve defined in lots of articles like right here.

If it wasn’t for the Petrodollar, the US would have collapsed years in the past. However as extra nations are contemplating buying and selling oil in different currencies like Yuan, the greenback will first Step by step lose its worth after which Instantly to paraphrase Hemingway.

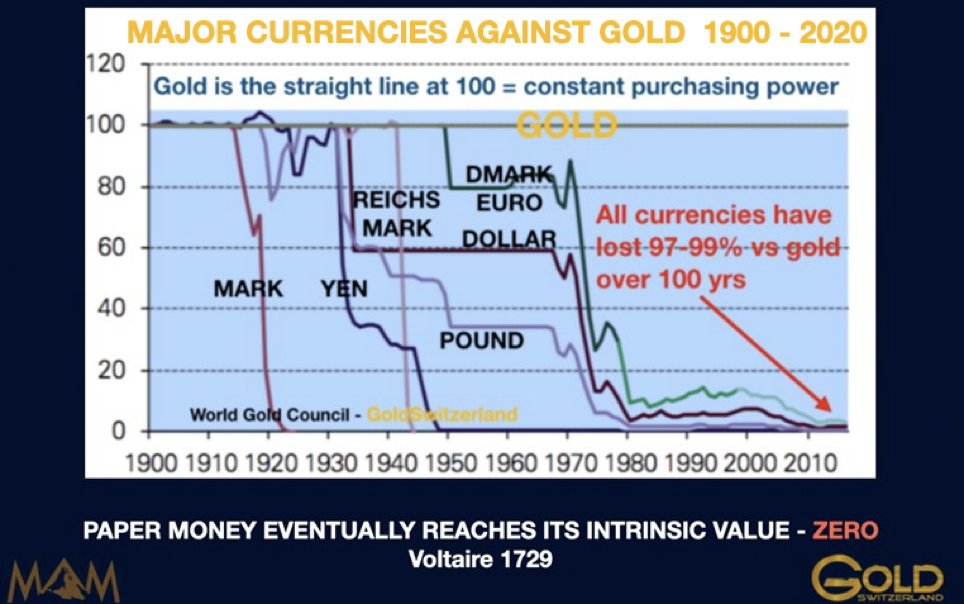

However do not forget that since Nixon closed the Gold Window in 1971, all currencies have misplaced at the very least 97-99% of their worth in actual phrases which is in opposition to gold.

Empires seldom die in a single day so this course of which began in 1971 might take one other 5-10 years. However since we at the moment are within the remaining levels, it might additionally occur Instantly.

So let’s paint a possible situation for the following 5-10 years.

In easy phrases will probably be extra of the identical if we have a look at the 9 factors above.

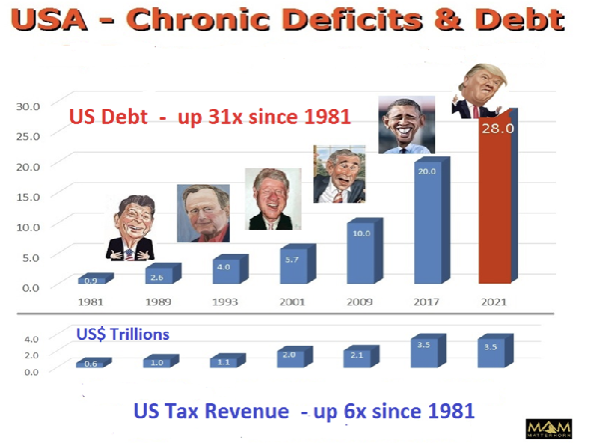

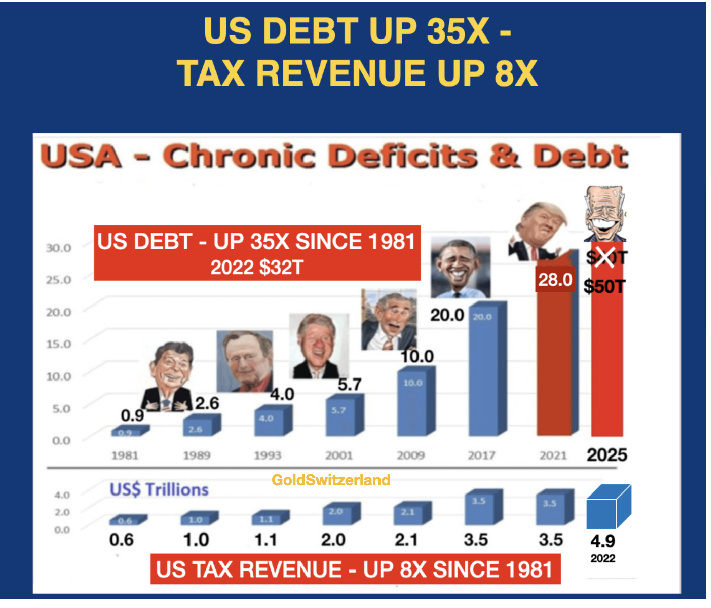

Money owed and deficits will improve exponentially. I’ve for a few years proven the expansion in US debt which on common has doubled each 8 years since Reagan turned president in 1981.

On December 6, 2016, the chart under was included in a Household Workplace presentation I gave in London:

I projected then in 2016 that when Trump would attain the tip of his first time period in January 2021, US debt could be $28 trillion on the best way to $40 trillion 4 years later in 2025.

Curiously, the debt was $28T in Jan. 2021. It doesn’t require a genius to undertaking this determine as it’s a straight extrapolation of the development courting again 40 years. Nonetheless, I didn’t see anybody forecasting anyplace close to the $28T debt in 2016.

A few years in the past, I raised my $40T debt in 2025 to $50T because the chart under exhibits:

So how is the US going to go from $32T to $50T in 3 years. Effectively, in the identical means as bankrupt nations collapse with tax income falling precipitously and expenditure exploding.

THE ROAD TO PERDITION FOR THE US & THE WEST

As the worth of the greenback collapses, suppose:

- A lot increased battle prices, social safety, and pensions. As pension fund property implode, there in all probability received’t be any pensions.

- Debt collapse each non-public and public with $2-3 quadrillion of derivatives turning into debt.

- All bubble property of shares, bonds and property, solely held up by faux cash, collapsing by 75-95% in actual phrases.

- Banks and monetary establishments failing after initially having acquired $100s of trillions in printed, thus nugatory, authorities assist.

- With excessive inflation or hyperinflation, rates of interest going to at the very least 20% or in all probability a lot increased. Financing a debt within the quadrillions at 20%+ will after all result in much more cash printing. The Fed and different central banks will clearly lose management of rates of interest which might be decided by a market in panic..

WILL THERE BE A GLOBAL NUCLEAR WAR?

The US has at this level pressured that there might be no uniformed US navy in Ukraine. Each Russia and Ukraine has misplaced round 150,000 troopers every. The issue for Ukraine is that that is round 50% of their common troopers while for Russia it’s 13%. Additionally, a serious a part of the weapons and ammunition from the West isn’t forthcoming or considerably delayed. There simply isn’t the spare capability accessible to fulfil these guarantees.

At this level, it appears to be like like this battle at finest might be a really lengthy drawn native battle though Ukraine will discover it troublesome to maintain the battle. In January 2022 the Ukraine inhabitants was 41 million and now 14 million are estimated to have left the nation.

In a battle of this nature between two tremendous powers, it’s unimaginable to forecast the end result. An “accident” or false flag can simply set off the beginning of a nuclear battle.

Do not forget that it is a battle between the US and Russia. So if there was a nuclear battle, most missiles could be directed in the direction of these two nations and doubtlessly Ukraine.

But when the world will see a nuclear battle, all bets are off since some components of the world would then be destroyed for many years. Subsequently, it isn’t price hypothesis about.

WEALTH PRESERVATION & CBDCs

So assuming that this battle stays a neighborhood battle in Jap Europe, how ought to individuals outdoors the battle zone put together financially?

Many nations are planing to introduce Central Financial institution Digital Cash or CBDC.

As the present financial system within the West collapses, CBDC will solely be one other type of fiat cash. The worst half about it’s the means to spy on and management folks that it provides governments. As Western governments’ funds implode, CBDC is the proper system for the seemingly socialist or Marxist economies that many Western nations are more likely to have.

For people who’ve the liberty to maneuver, it could be preferable to go away the closely indebted USA and Europe (particularly the EU nations).

One nation in Europe nonetheless stands out as in all probability one of the best on the planet each politically, economically and socially. That is after all Switzerland.

Sure, I’ve pores and skin within the recreation right here! I’m Swiss from beginning and happy that I’m. I used to be born and educated in Sweden and likewise like Sweden.

However while Switzerland has remained a really sound nation, Sweden has deteriorated dramatically. It now has one of many highest crime charges in Europe. As within the final 10-15 years Europe opened its borders for refugees from many poor and battle struck nations, this has completely modified Swedish society.

There may be nothing unsuitable with immigration. The world has at all times had migration. However till latest years, migrants needed to take care of themselves with no authorities subsidies. However in lots of nations in Europe and particularly in Sweden, migrants arrive and get free housing and cash to reside. For a lot of, there isn’t any incentive to work and or to be taught Swedish. Sadly an essential share of males flip to crime and particularly drug dealing. Deadly shootings between the immigrants at the moment are occurring day by day in Sweden while 20 years in the past, non-public weapons didn’t exist.

The most effective proof of a sound nation and financial system is the forex.

Once I, as a youthful man, got here to Switzerland within the late Nineteen Sixties, 1 Swiss Franc value 1.10 Swedish Kroner. At the moment it prices 11.20 Swedish Kroner to purchase one Franc. So the Krona has misplaced 90% within the final 50+ years.

The Swiss Franc has after all been sturdy in opposition to all currencies. The greenback for instance has misplaced 80% in opposition to the Franc over 50 years.

THE SUPERIOR SWISS ECONOMY AND POLITICAL SYSTEM

However Switzerland has a lot greater than a powerful forex and financial system like:

- Low debt, usually no deficits

- Lowest crime charge in Europe and on the planet (excluding some Center East nations. It is without doubt one of the few nations the place you’ll be able to stroll safely in any city at evening.

- Rule of Regulation

- Direct Democracy permitting the inhabitants to have a referendum on nearly any subject. If the referendum is accredited by a majority, it turns into a part of the structure and can’t be modified by authorities or parliament however solely by one other referendum. That is completely distinctive on the planet.

- For instance there might be a referendum on stopping Switzerland from turning into cashless

- While all EU nations have determined to confiscate Russian property, Switzerland has declared: “The expropriation of personal property of lawful origin with out compensation isn’t permissible below Swiss regulation,” the federal government mentioned on Thursday. “The confiscation of frozen non-public property is inconsistent with the structure,” it added, and “violates Switzerland’s worldwide commitments”.

- The usual and high quality of every little thing may be very excessive, companies, building, communications and many others

- Switzerland additionally has stunning nature, and wonderful meals.

RISK OF WAR IN EUROPE

Some nations are worrying a couple of battle in Europe. Aside from a nuclear battle which might be international, the danger of a battle on the bottom in Europe is for my part minimal.

Russia has been invaded many occasions with probably the most well-known examples being Karl XII of Sweden within the early 1700s, Napoleon within the early 1800s and Hitler within the Forties. However Russia has by no means made any critical invasion into Europe. Their curiosity lies primarily inside their former empire. There was a short entry into Finland originally of WWII which lasted 3 months. Additionally on the finish of WWII the Russians drove the invading Germans again to Berlin.

So for my part, there may be completely no cause to concern a Russian invasion of Europe.

WEALTH PRESERVATION & GOLD

To guard your wealth in opposition to all of the dangers that I’ve outlined above is totally very important. Anybody invested in typical property like shares, bonds and property, which have been artificially inflated by printing faux fiat cash will within the coming 5+ years expertise a serious collapse of their wealth.

As I already mentioned, for anybody who has the power to maneuver to a rustic outdoors the US and the EU, that may be the most secure choice. It’s seemingly that these areas could have the largest issues each within the financial system and the monetary system in addition to socially. In that area, Switzerland might be an essential exception.

Components of South America like Uruguay also needs to keep away from most of the issues within the West however sadly crime is excessive in lots of of those nations. Many People reside in Central America however with the approaching financial downturn, many nations will grow to be much less protected and likewise poor. In Asia, nations like Singapore and Thailand are superb but when there’s a battle between the US and China after a potential Chinese language invasion of Taiwan, these areas might grow to be extra precarious.

The issue with Australia and New Zealand is that they’re extremely indebted with large asset bubbles, particularly in property. The socialist insurance policies will not be a plus both. However the largest danger is {that a} battle in Taiwan might make these nations very dangerous with Chinese language aspirations.

Many individuals are shifting to Dubai at this time for tax causes. Russians are shifting there since Dubai doesn’t sanction them. The issue with the UAE is that conflicts within the Center East happen with common intervals.

For those who can’t transfer for job or household causes, a second passport is advisable.

However an important asset safety is having wealth preservation property outdoors your nation of residence.

There isn’t a completely protected nation at this time in an unsafe world.

For buyers who need to protect their wealth, one of the best asset is bodily gold adopted by the extra risky silver. Gold and silver shares have had a horrible 35 years however the good corporations ought to carry out spectacularly. Since most shares are held by custodians inside the monetary system, they aren’t the identical diploma of wealth preservation as bodily metals that you’ve got direct management of.

So my very own desire could be to personal bodily gold and silver that I’ve direct management of and might withdraw or promote with very quick discover.

It is usually essential to cope with an organization that may transfer your metals at very quick discover if the safety or geopolitical state of affairs would necessitate it.

Our gold vault within the Swiss Alps is the largest non-public gold vault on the planet and can also be nuclear bomb proof which is completely distinctive. That is for larger buyers. We additionally retailer gold in Zurich. Our second desire is Singapore with the reservations I’ve talked about. We even have vaults in lots of components of the world and as I’ve acknowledged, this may be essential if the state of affairs on the planet adjustments and the gold/silver must be moved.

The world is now shifting in the direction of troubled occasions.

Do not forget that household and mates are your most essential asset and treasure them profoundly.

Additionally, apart from household and mates, most of the finest issues in life are free like books, nature, music, and sports activities.

[ad_2]