[ad_1]

There may be way more to buying and selling than simply opening up your charts and on the lookout for an entry sign. In reality, (don’t inform anybody this) a great worth motion dealer is aware of how you can arrange and analyze his or her charts so nicely that they might not even want a worth motion “sample” or “sign” for a commerce entry. Certainly, the underlying market bias, which is outlined by the construction of the market, i.e. pattern, key horizontal ranges, and many others. can typically present us with sufficient clues to identify a possible entry. Therefore, studying to determine and plot these items of the technical evaluation “puzzle”, could be very, crucial.

There may be way more to buying and selling than simply opening up your charts and on the lookout for an entry sign. In reality, (don’t inform anybody this) a great worth motion dealer is aware of how you can arrange and analyze his or her charts so nicely that they might not even want a worth motion “sample” or “sign” for a commerce entry. Certainly, the underlying market bias, which is outlined by the construction of the market, i.e. pattern, key horizontal ranges, and many others. can typically present us with sufficient clues to identify a possible entry. Therefore, studying to determine and plot these items of the technical evaluation “puzzle”, could be very, crucial.

In immediately’s lesson, I’m mainly going to stroll you thru how I do my day by day and weekly chart evaluation which you’ll be able to see in my market commentaries. The first items of this puzzle are: Clear black and white worth charts, key ranges, tendencies, worth motion, market bias and indicators. Because of this, these items are my principal focus when doing my evaluation and market commentaries, as a result of studying how you can correctly map a market is significant to understanding how you can correctly commerce with worth motion.

Why I Use “Clear” Charts & The best way to Set Them Up

Clear charts, or indicator-free charts, are the spine of my technical evaluation and worth motion strategy. When you don’t but know why I choose clear, bare worth charts, take a look at my article on why indicators will destroy your buying and selling. Suffice it to say, I subscribe to a easy, much less is extra buying and selling philosophy, and for some very, superb causes, which I’ve written about typically.

When you don’t but use clear, indicator-free worth charts, I’ve a superb tutorial on how you can arrange your charts right here that you simply undoubtedly want to take a look at. You may also the obtain the metatrader buying and selling platform we use right here.

Right here is an easy method to arrange your charts correctly:

First, you’ll proper click on on the chart after which choose “properties” on the backside of the pop up menu. When you try this, you will note the next display for chart choices. First set the colours and different choices how I’ve them on this picture:

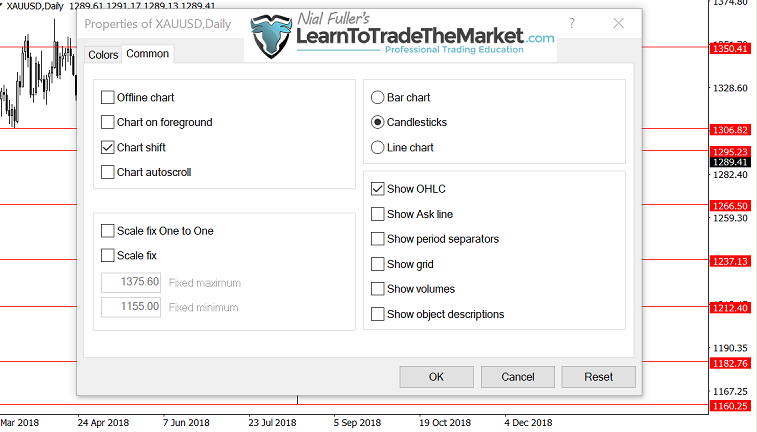

Subsequent, you’ll choose “widespread” and set the choices as follows:

That’s a primary overview of how you can shortly set your candlestick charts up precisely as mine are. Bear in mind, there’s a motive why I set them up this merely; as a result of easy is best in buying and selling and we are attempting to remove variables which will confuse us or trigger doubt, worry, and many others.

How I Analyze Clear Value Charts

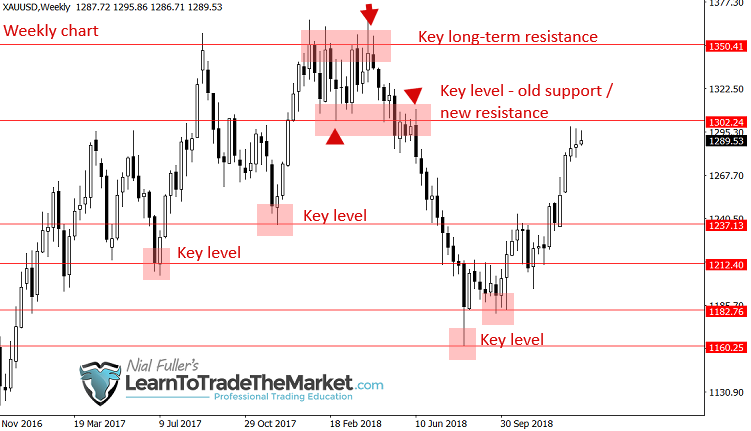

When writing my weekly members market commentary, the very first thing I do is zoom out on the weekly chart, as a result of I wish to get that chook’s eye top-down view, this offers me a good suggestion of what has occurred and the way which will affect what presently is occurring.

Within the chart under, discover I’ve zoomed out to the weekly view of the present Gold charts. I’ve marked the obvious key ranges of help and resistance. Notice, typically these ranges will “flip” from help to resistance or vice versa, as worth strikes up or down:

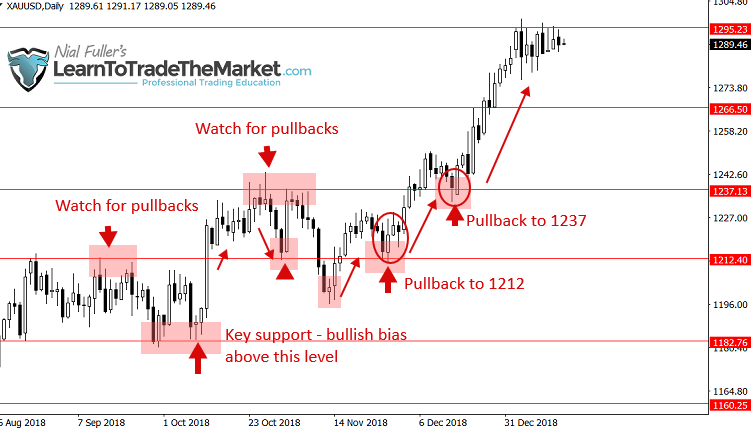

Within the chart picture under, discover I’ve zoomed out so I’m trying in regards to the final yr’s value of information on the day by day charts. This provides me loads of time to see how the earlier yr’s ranges and tendencies, in addition to worth motion, as led us to the present level. You will notice what I’ve drawn in under on the chart, these are the degrees I view as probably the most related in addition to the areas of consolidation and trending worth motion, these are the primary issues I’m on the lookout for once I do my worth motion evaluation…

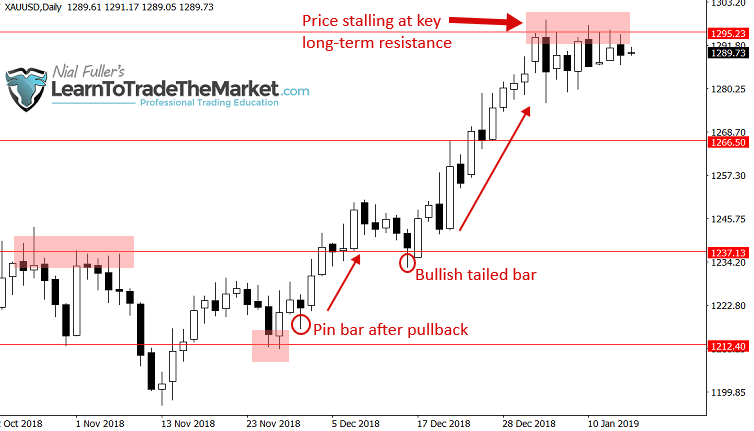

Within the subsequent chart, we have now zoomed in a bit extra, however you’ll discover the identical ranges are there. We’re going to dissect issues a bit extra right here.

First, discover the bullish tailed bar on the far left of the chart, this was clearly an necessary turning level from all the way down to up, so we are going to draw a horizontal degree on the low of that bar; this degree would as soon as once more be related if worth fell again all the way down to it. Then, discover worth entered right into a interval of sideways consolidation for nearly two months, earlier than breaking apart and out of it. Nevertheless, after the breakout, worth chopped slowly larger after which fashioned a bearish pin bar at 1237.00 space; a resistance degree we had beforehand marked on the chart. Now, while this is able to be thought-about a “counter-trend” pin bar, which often i don’t like, because it was at an necessary degree we already had on the chart, and there was a transparent goal under on the earlier breakout degree of 1212.00 space, savvy worth motion merchants might have thought-about a short-term commerce concentrating on a transfer into that degree. Notice: 1212.00 or actually 1215.00 – 1205.00 space was a really sturdy zone of help as a result of earlier breakout and I might have been seeking to get lengthy on a pull again to that space after the upside breakout.

Within the subsequent chart, we’re taking a look at how when a market swings, it leaves behind a degree, and we then watch these ranges for pull backs to commerce in-line with the present momentum.

Discover the areas marked “look ahead to pullbacks”, we might have been waiting for worth to drag again to those ranges after it broke above them, to get lengthy and commerce in-line with the bullish momentum that was clearly creating. Ideally, we might get a worth motion sign at these ranges after worth pulls again to it, however this isn’t at all times obligatory, as I’ve written about, typically all you want is a degree and a pattern for an entry, see my T.L.S. article for extra…

Lastly, we have now zoomed in to the latest worth motion of the day by day Gold chart.

From this chart, we will see a few potential entry indicators that fashioned after pullbacks to 1212.00 space and 1237; once more, we had already marked these ranges on our charts and have been ready to “assault” ought to worth rotate again into them. At the moment, as of this writing, worth is hovering just below the important thing resistance space up close to 1305 – 1295 space.

Conclusion

I at all times consider analyzing a market from the “prime, down”. This implies, you wish to begin with the longest time-frame, zoomed out, and you then progressively shorten the timeframe and zoom nearer in. You do that to get a “chook’s eye” view of the market in order that what is occurring not too long ago makes extra sense throughout the longer-term context. Consider performing your weekly and day by day market evaluation like studying a e book; so as so that you can perceive what’s occurring on web page 100, you need to have learn and comprehend pages 1-99. It’s actually no totally different in buying and selling; you need to construct a story in your head from the market you’re analyzing, and also you do that by trying again in time, plotting ranges, analyzing the value motion after which maintaining with the market every day on the shut, adjusting ranges or including information ones as obligatory.

When you begin doing this frequently, it’ll begin to develop into your worth motion buying and selling routine and ultimately it’ll flip right into a behavior. Quickly, you’ll completely take pleasure in it as a result of let’s face it, maintaining with the markets is enjoyable (in case you’re a buying and selling nerd like me anyhow). So, take pleasure in it, but additionally notice that what you’re doing is getting in-tune with the market and its worth motion, and this really is a requirement if you wish to have any likelihood at studying to buying and selling professionally.

Please Depart A Remark Beneath With Your Ideas On This Lesson…

If You Have Any Questions, Please Contact Me Right here.

[ad_2]