[ad_1]

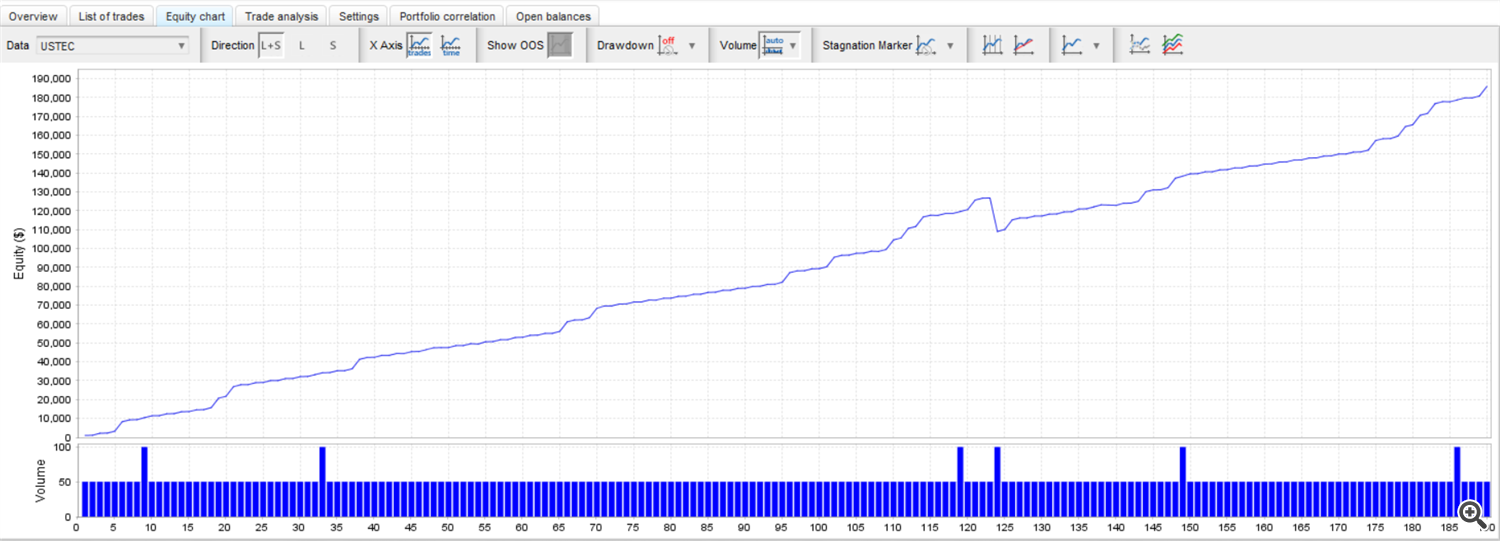

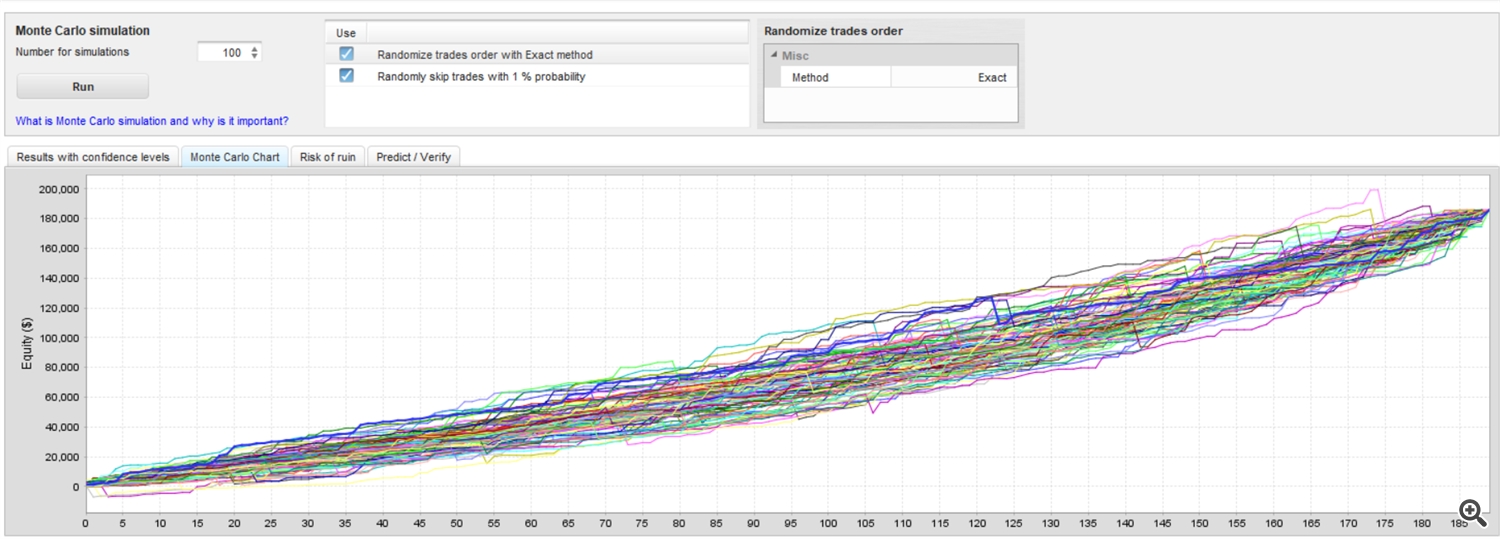

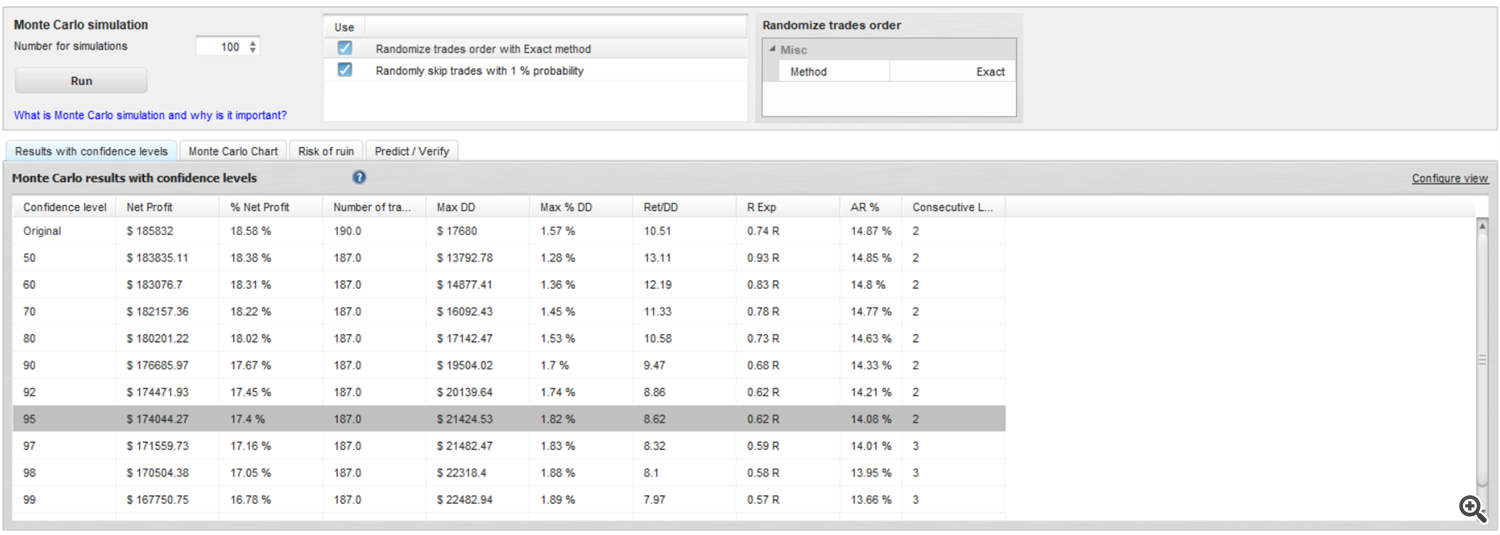

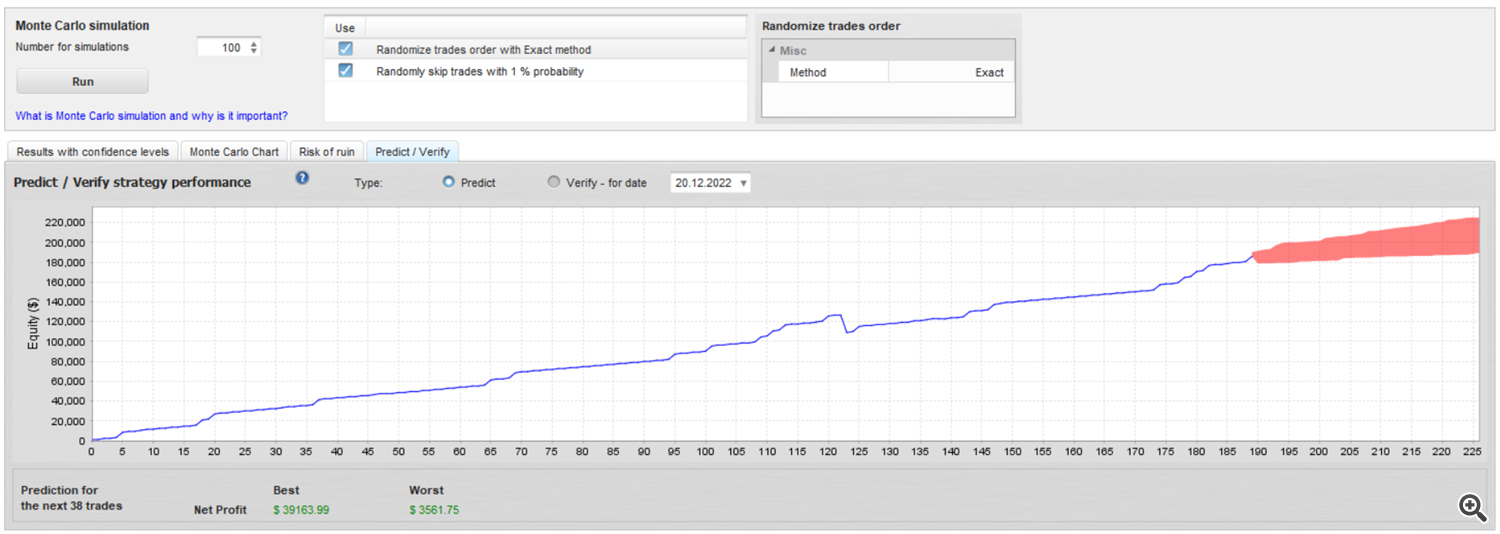

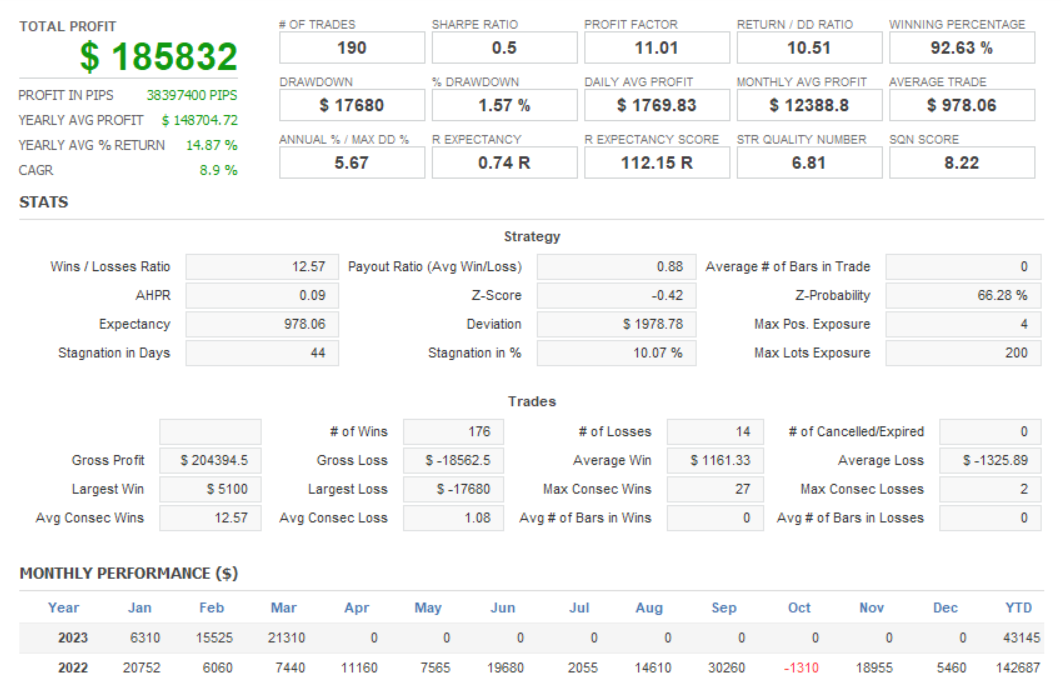

On this article we’ll discover a well-liked buying and selling technique that makes use of pivot factors that are thought-about essential psychological ranges for traders. This technique is usually utilized by technical merchants trying to reap the benefits of quick time period and long-term worth actions. Pivots Factors Grasp which has unbelievable outcomes as you will note in the remainder of this text takes benefit of this technique.

To start with, what’s a pivot level? It’s a key worth stage that’s calculated primarily based on the closing worth, the opening worth and the excessive and low of the day prior to this (week, month, …). Pivot factors are broadly utilized in technical evaluation to determine potential help and resistance ranges. A pivot level is among the many technical indicators utilized by merchants. It tells us in regards to the market’s general pattern over varied time home windows. Merchants usually contemplate pivot factors to be psychological ranges, as they will affect the selections of traders and merchants and thus affect the path of the market. When the worth of an asset bounces off a pivot level, it could point out a reversal of the pattern or a strengthening of the present pattern.

One of the crucial widespread buying and selling methods utilizing pivot factors is to put a cease order on or beneath the pivot level and watch for the worth to set off the order. This buying and selling technique could appear easy and efficient, however it doesn’t all the time work even when utilizing different indicators, as monetary markets will be unpredictable and risky.

Why does this technique not typically work?

- Contemplating traces (pivot factors) as help or resistance shouldn’t be related as it’s generally accepted that psychological ranges are materialised by worth zones reasonably than traces. The value can due to this fact break the pivot level barely or strongly earlier than reintegrating the extent.

- This technique doesn’t consider market traits and financial occasions. Monetary markets will be influenced by many elements, reminiscent of rates of interest, financial knowledge, political occasions and pure disasters. When there’s a sturdy pattern or main information, pivot factors are not efficient as help or resistance and might simply be damaged which may end up in pretty massive losses or cease loss triggers.

- Utilizing a set cease loss or no cease loss will be detrimental to this technique. If the cease loss is simply too shut, the worth could break the pivot level barely, triggering the cease earlier than rebounding. Nonetheless, if the cease loss is simply too distant, the worth could break the pivot level by a big quantity and are available again for the cease loss inflicting a big loss or the lack of the account.

Picture illustration :

Why does Pivot Level Grasp work and is completely different?

Just like the earlier technique, the Pivot Level Grasp buying and selling technique consists of opening a purchase or promote order when the asset worth bounces off a pivot level. The basic distinction that adjustments all the pieces is that Pivot Level Grasp buys or sells on the market and requires a number of ranges of affirmation via the usage of the Reinforcement Studying (RL) methods. The robotic always displays worth actions and reacts rapidly to buying and selling indicators via intensive studying from multi-asset knowledge over a number of years.

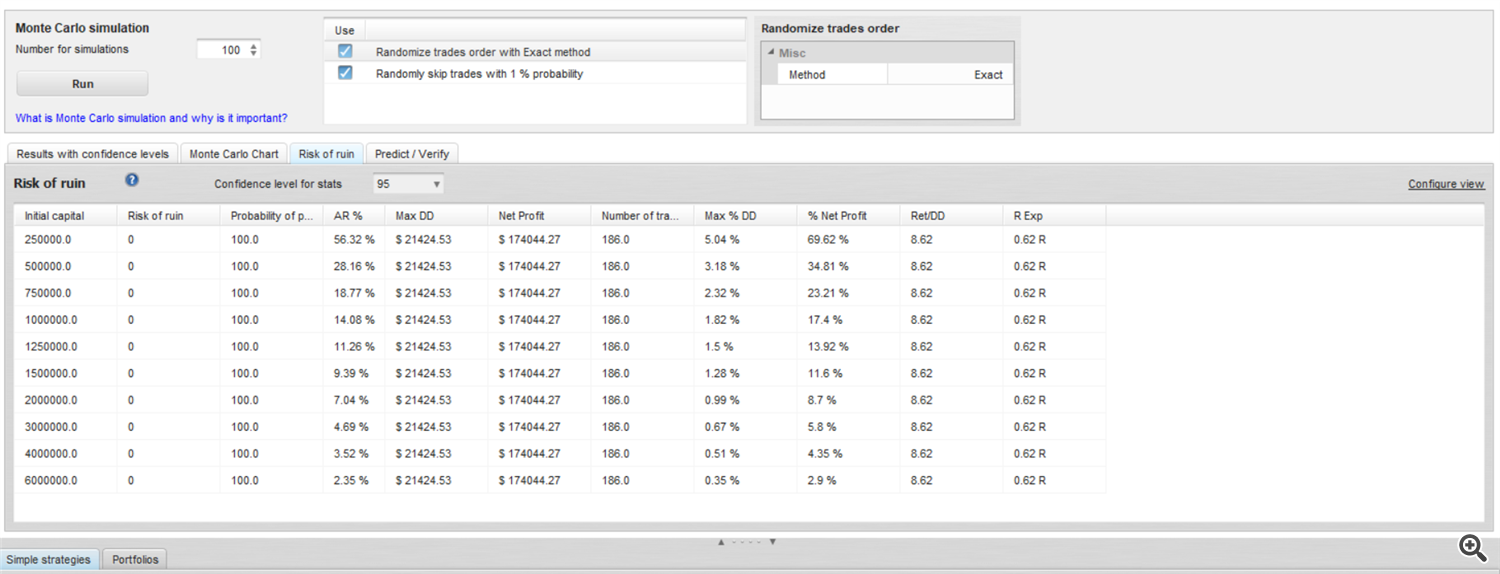

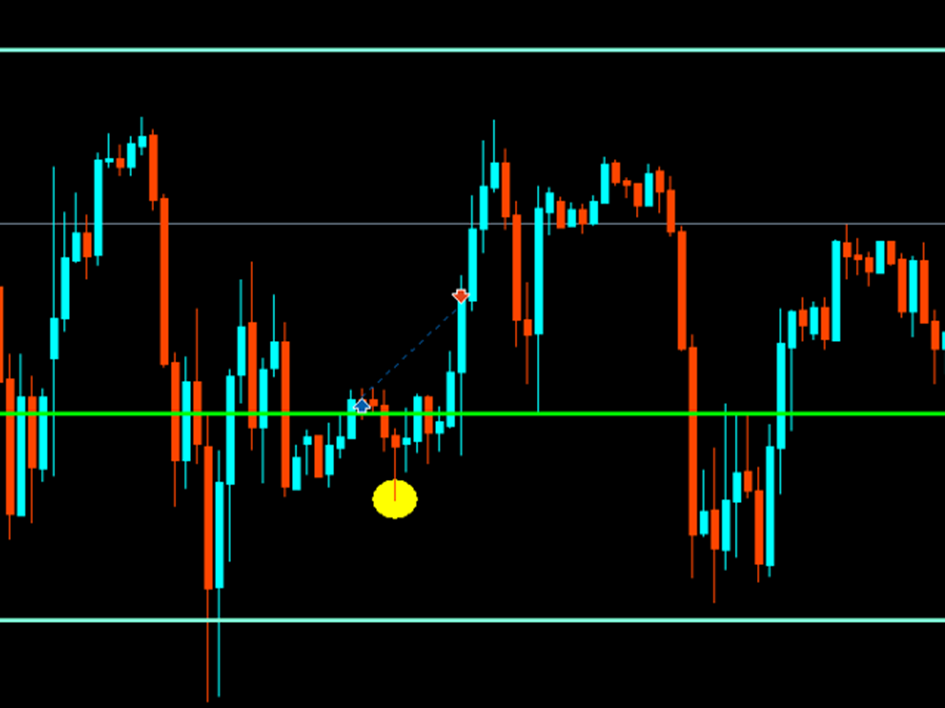

If the worth reaches a predefined pivot level, the robotic robotically opens a purchase or promote order if it has all the mandatory confirmations and robotically exits its place as quickly as doable if it goes incorrect. Certainly having designed the robotic myself I’m personally unable to foretell when the robotic will exit a dropping place, because of this this EA incorporates the usage of a cease loss permitting essentially the most danger acutely aware person to manage their losses. Nonetheless it’s essential to not put the cease loss too near the place to provide the Pivot Level Grasp algorithm sufficient room to make good selections. Beneath is an illustration of how Pivot grasp handles a place that will have been a loss if there was a cease loss beneath the earlier 5 candle low however ended up being a achieve.

If a cease loss had been positioned beneath the earlier low, it might have been executed. So, we will see that you will need to go away sufficient margin to Pivot Level Grasp to make his personal selections. This place was taken on 2023.03.14 on the S&P500 in actual buying and selling situations which you’ll verify on my sign : https://www.mql5.com/en/indicators/1891033

Clarification of the technique

I specify one factor, in order that it’s clear, I wish to clarify the system, how the EA manages the place, the way it proceeds, however I cannot clarify why it opens the place. I ensure my configuration works however should you use fully loopy setting, I don’t wish to be liable for that.

Total, there are three principal parameters for this pivot level bounce technique.

1. The selection of pivot factors

EA makes use of month-to-month pivot factors as they’re main psychological ranges and broadly utilized by asset managers who typically act on a long-term foundation. The selection is given to the person for the collection of the pivot factors that he considers related to commerce.

2. Confirmations

EA makes use of a number of ranges of confirmations however lots of them are hidden. The person is just allowed to behave on:

– Candle_back: that is an integer quantity to filter the chance of bounce as a lot as doable. The upper this quantity is, the extra spectacular the bounce high quality will probably be, however the much less trades the robotic will open. The decrease the quantity the extra trades will probably be opened however with decrease high quality bounces.

– Signal_restrictions: when the EA detects with a excessive chance a chance of bounce on the pivot level it retains the sign energetic throughout this time (in hours). The longer the time, the extra seemingly it’s that market situations will change, and the sign won’t permit a worthwhile commerce. Quite the opposite, the decrease this quantity is, the much less time the EA must make the opposite confirmations essential to execute the commerce.

– Restriction_hours: that is the variety of hours after the execution of a purchase that it’s a must to wait earlier than you can also make one other purchase. The identical applies to sells.

3. Using the breakeven

The person can select to make use of this operate to shut half of his place and to place his cease loss on the stage of his entry level as quickly as the worth may have crossed quite a lot of factors that the person may have predeterminate (set off) . The buffer permits the breakeven to be set at a sure variety of factors from the opening worth of the place.

4. The danger

The EA makes use of a set lot that the person must select and enter manually. This selection was made as a result of the EA makes use of machine studying to know when to shut the place, so it’s not doable to know this stage earlier than opening the commerce. It’s due to this fact suggested to make use of a most of 10% of the portfolio primarily based on a theoretical most cease lack of 20,000 factors on the Nasdak for instance which supplies 1 lot for a capital of $1000. Because of this, in no circumstance this EA might lose your capital (Used with the settings that’s offered to you by default and for main indices US100, US500 and US30).

A Message to Newbies in Buying and selling

Once I launched my first EA on mql5 I discovered that many individuals who purchased it had no buying and selling information and have been simply on the lookout for the miracle robotic. So some, after just one loss, began guilty the effectivity of the EA with out attempting to know the technique and methods to reap the benefits of the total potential of the EA. My query to them is: already, how can you choose an EA greater than one other, should you have no idea how the Foreign exchange works? Have you learnt methods to make the numbers converse? Ratios? Revenue elements? statistics? Slippage? are you aware that it’s not possible to have 100% Winrate in the long term?

Others have even raised the purpose that some trades have been completely different by a couple of factors between the backtest and the fact as if the backtest might reproduce the fact. I do not choose you however I invite you to find out about buying and selling and programming if it’s good to and this even in a completely free method as a result of all the data is on the market without spending a dime these days.

Having learnt from the philosophy of a few of my shoppers I made a decision to favour reside outcomes over backtesting. This is the reason Pivot Level Grasp already has a confirmed monitor document (https://www.mql5.com/en/indicators/1891033) which I imagine is much more beneficial than again testing that do not all the time align with the reside outcomes. As you possibly can see within the description it is all 100% algo buying and selling so my query to you is: do I need excellent again testing or precise regular reside efficiency?

Nonetheless, don’t hesitate to backtest as a lot as doable however know that the actual situations typically differ. It occurred to me once I made a backtest for this EA to acquire a loss on 01/01/2022 however once I use the visible mode of the backtest this loss by no means occurs.

Don’t hesitate to contact me in order for you extra data.

[ad_2]