[ad_1]

Patient21, a four-year-old German startup that mixes a digital healthcare platform with real-world brick-and-mortar clinics, has raised €100 million ($108 million) in a Collection C spherical of funding led by Israeli VC agency Pitango, constituting a mixture of fairness and debt.

Based out of Berlin in 2019, Patient21’s platform spans just about the entire affected person cycle, from on-line bookings by way of digital case histories, check-ins, billing, insurance coverage, and extra.

Nonetheless, whereas telemedicine has been on one thing of an upwards trajectory in recent times, accelerated considerably by the worldwide pandemic, Patient21’s platform is notable insofar because it doesn’t provide a distant healthcare possibility like its U.S. counterpart Carbon Well being. As a substitute, the corporate has developed proprietary software program for managing sufferers, after which steers them towards its 50-plus outpatient clinics throughout Germany.

That is partly as a result of Patient21 is basically targeted on dentistry for the time-being, with greater than 80% of its clinics presently focusing on oral well being, with the remaining break up between gynaecology and GP practices.

“Dentistry inherently requires in-person consultations for complete prognosis and remedy,” Patient21 co-founder and CEO Chris Muhr advised TechCrunch. “The character of dentistry entails visually inspecting oral well being, using diagnostic instruments like x-rays, and addressing emergencies promptly. These features are finest served by way of onsite consultations to make sure the best requirements of care.”

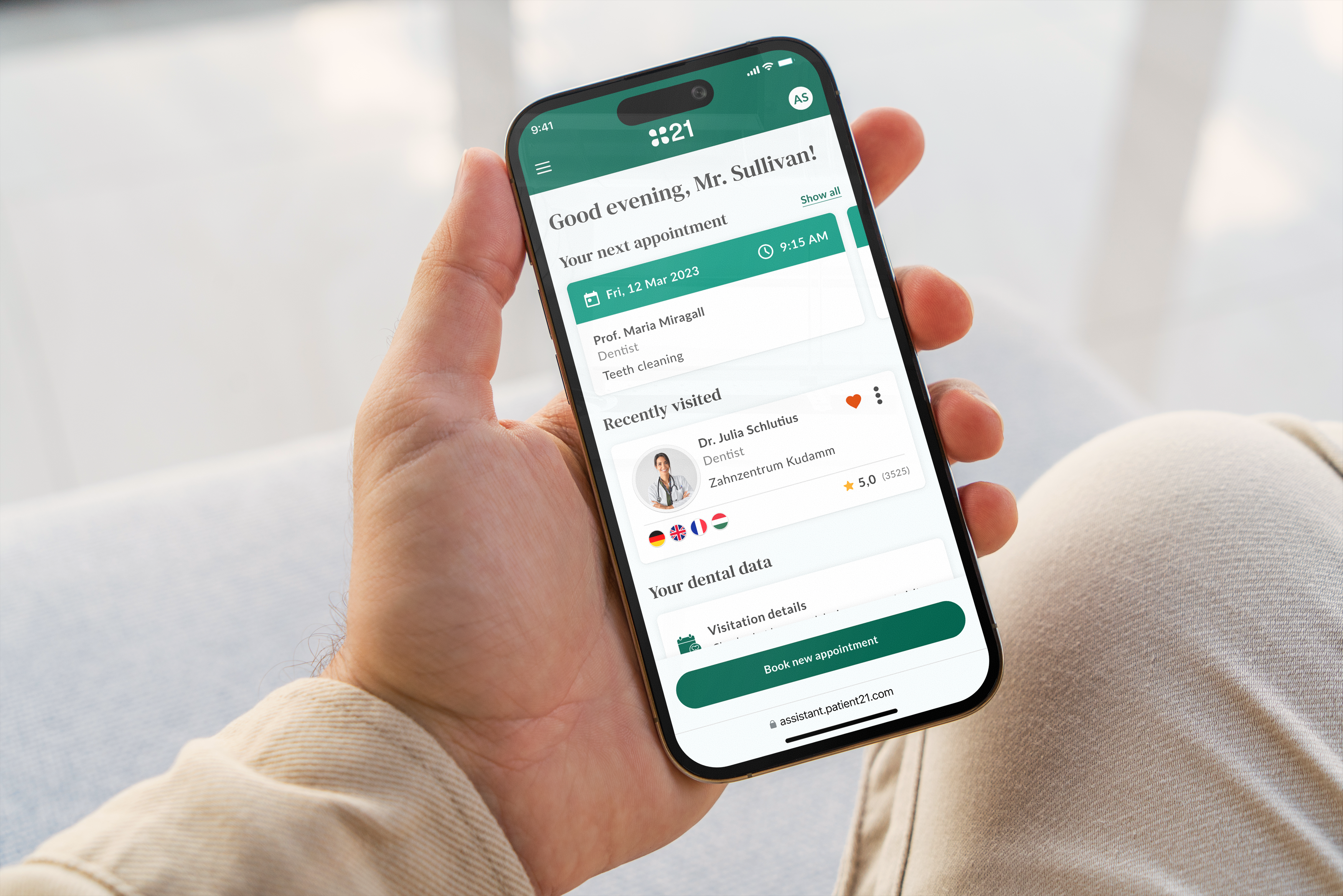

Patient21 client app Picture Credit: Patient21

The corporate says it’s presently dealing with greater than 300,00 affected person visits annually, and it plans to develop to cowl further areas of healthcare sooner or later — at which level it might lengthen into digital healthcare.

“As we proceed to develop and develop our presence in human medication, we’re actively exploring the combination of telehealth options into our choices,” Muhr stated.

It’s value noting that there are a number of aspects to Patient21’s software program, with the patient-facing app only one aspect. Certainly, the corporate additionally has an app for medical doctors and a clinic administration system.

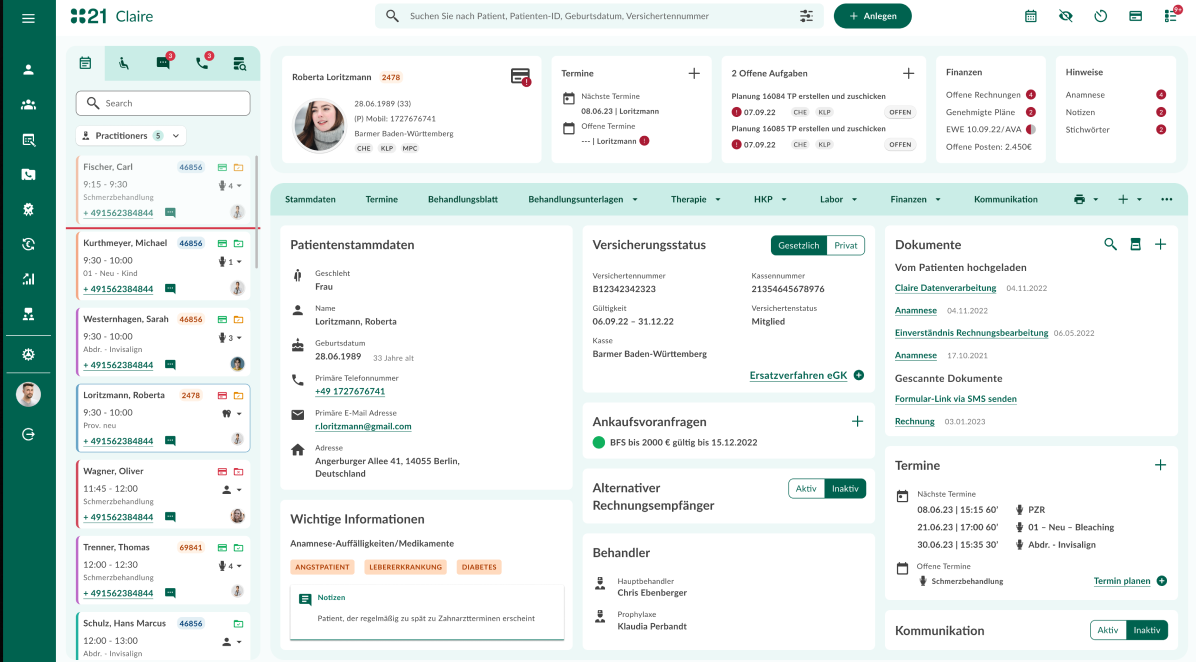

“In a sector that’s more and more supply-constrained on account of employees shortages, an getting older well being workforce, and surges in continual diseases, our focus is on supporting healthcare professionals and ensuring their time is used as correctly as doable,” Muhr continued. “We’ve developed a collection of clinic-facing software program that accommodates the wants of our healthcare professionals and native clinics — it frees our scientific groups up from tedious administrative duties in order that they’ll deal with what they’re finest at: taking good care of sufferers.”

Patient21 clinic administration system Picture Credit: Patient21

Wholesome enterprise

Patient21 had beforehand raised round €66 million ($71 million) in funding, and with its contemporary money injection it stated that it plans to develop its software program and develop past Germany. “We anticipate to launch in two new European markets throughout the subsequent 12 months,” Muhr famous.

Opening bodily clinics additionally instinctively looks as if a resource-intensive endeavor, however Muhr stated that its clinics have grow to be “operationally worthwhile” fairly shortly.

“Consequently, we develop with minimal fairness funding wanted to roll out new clinics,” he stated. “Thus, a lot of the funding goes in the direction of software program growth to additional improve our platform capabilities.

Furthermore, additional down the highway there might be scope for Patient21 to license out its reserving and patient-management software program.

“Lengthy-term we imagine there might be a possibility to kind partnerships or to run clinics within the type of a franchise mannequin, offering franchisees with software program and companies providing that’s distinctive out there,” Muhr added.

The corporate’s Collection C spherical was principally fairness — we’re advised “greater than 70%” — and apart from lead backer Pitango, members included PICO Enterprise Companions, Bertelsmann Investments, Artian, Goal World, Piton Capital, and several other angel buyers. The debt section was offered by IPT Companions.

[ad_2]