[ad_1]

Investing a number of the Social Safety belief fund’s property in equities has at all times had apparent enchantment. Fairness funding has increased anticipated returns relative to safer property, so Social Safety may want much less in tax will increase or profit cuts to attain long-term solvency. Then again, fairness investments contain larger threat and lift issues about interference in personal markets and about deceptive accounting that means the federal government can get wealthy just by issuing bonds and shopping for equities.

The actual world gives a convincing case that governments can put money into equities in a wise method. Canada has a big actively managed fund, follows fiduciary requirements, and makes use of conservative return assumptions. In the US, the Railroad Retirement system has additionally invested in a broad array of property with out interfering within the personal market, as has the Federal Thrift Financial savings Plan, the place the federal government performs an primarily passive function.

However do the demonstrated successes imply that fairness funding must be a part of an answer for Social Safety? Two developments recommend that the time could have handed.

First, the prerequisite for such exercise is a belief fund with vital property to speculate. Social Safety’s belief fund, which emerged from the 1983 amendments, is shortly heading in the direction of zero. To recreate a belief fund would require a tax hike to cowl each this system’s present prices and to provide an annual surplus to construct up belief fund reserves.

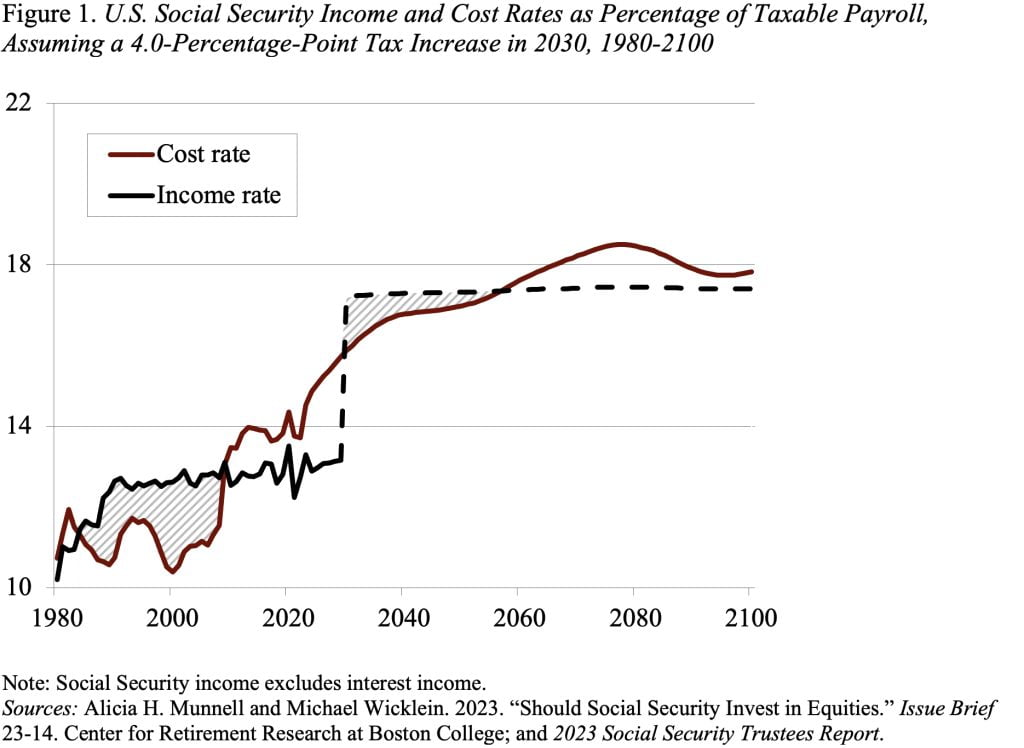

The issue is the fee curve is flattening out, so even when Congress raised the payroll tax price by 4 proportion factors beginning in 2030 – roughly the quantity wanted to pay advantages over the following 75 years – it will produce solely small momentary surpluses adopted by cash-flow deficits thereafter. For context, these surpluses can be lower than 40 p.c of these produced by the 1983 laws (see Determine 1).

After all, within the unlikely occasion that motion have been taken a lot earlier than 2030, the mixture of present belief fund balances and the quick surpluses generated by the tax improve might result in significant accumulation. However it isn’t clear that the political will exists to make such a transfer.

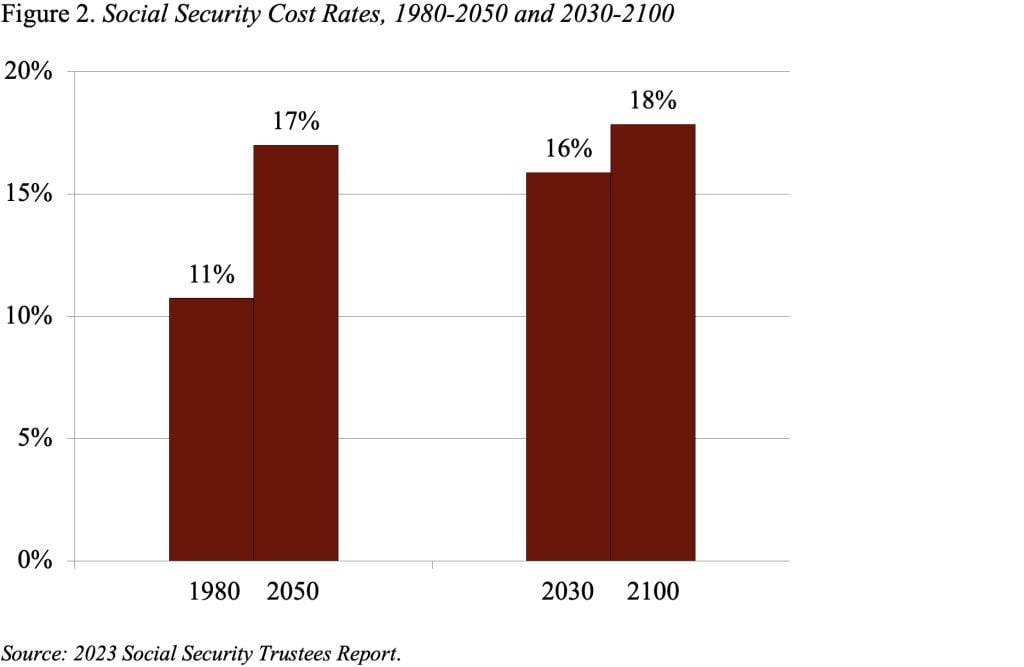

The second growth pertains to intergenerational fairness. Elevating taxes prematurely of the retirement of the infant increase served as a mechanism for equalizing the burden throughout generations. Employees in 1980 wanted to pay 11 p.c of taxable earnings to cowl program prices, and staff in 2050 have been scheduled to pay 17 p.c. It made sense to have 1980-workers pay a bit extra in order that later staff might pay a bit much less. However now prices have leveled off. Employees in 2030 face a value price of 16 p.c, and staff in 2100 a value price of 18 p.c. With prices scheduled to stage off, it’s onerous to argue that at the moment’s staff ought to pay extra to construct up a belief fund in order that tomorrow’s staff would pay much less.

The underside line is that, whereas authorities investing belief fund property in equities has been confirmed possible, secure, and efficient, rebuilding a belief fund right now will not be both possible or clever.

[ad_2]