[ad_1]

We’ll do your taxes

and discover each greenback

you deserve

When your Full Service professional does your taxes,

they’ll solely signal and file once they understand it’s 100% appropriate

and also you’re getting one of the best end result potential, assured.

Tax Day has come and gone, and also you filed your taxes properly earlier than the tax deadline. However what occurs should you notice you left one thing out? When do you have to amend your tax return?

Do You Have to Amend Your Tax Return?

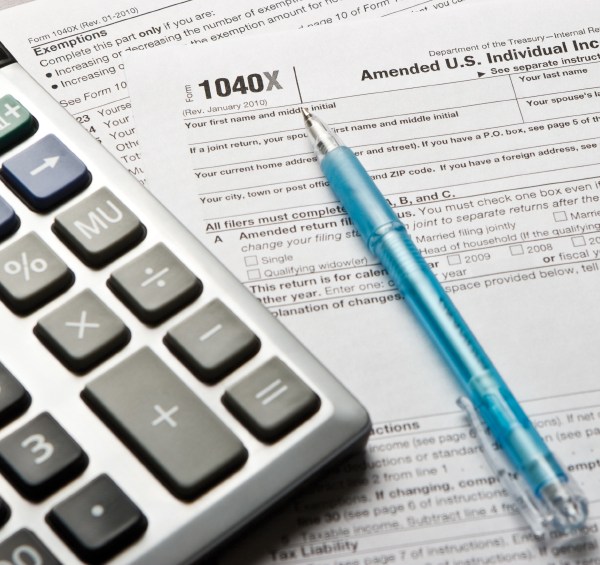

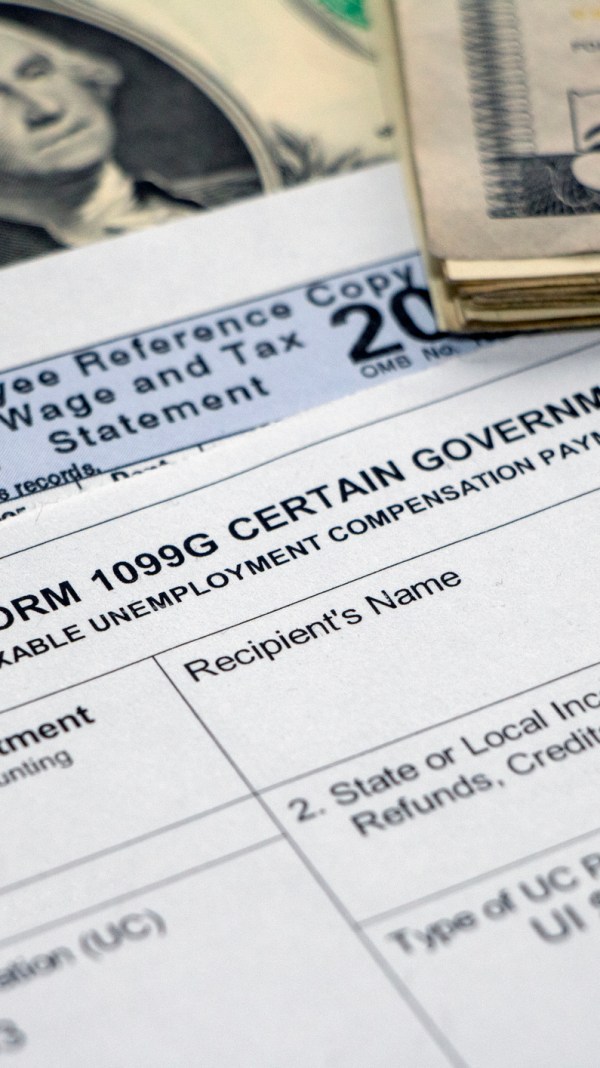

First off, be certain that it is advisable amend your tax return. In case you’ve made minor math errors, the IRS states that they may have the ability to deal with changes for minor math errors with out requiring a Type 1040-X amended tax return. Nevertheless, if it is advisable report further earnings (W2s, Unemployment, and so forth), change your submitting standing, declare missed tax credit and tax deductions, then you definitely do must amend your tax return if it hasn’t already been accepted by the IRS.

Methods to Amend Your Tax Return

So as to file a Type 1040-X Amended U.S. Particular person Revenue Tax Return, you have to to both print and signal it, after which mail it, otherwise you might be able to e-file it. Right now, you need to use e-file to file amended tax returns for tax 12 months 2020, 2021, and 2022. E-filing it is going to save on some supply time, since it could actually take as much as 20 weeks to course of amended returns after the IRS receives them.In case you’re amending a tax return and predict a much bigger tax refund, the IRS advises that you simply look ahead to the unique tax refund verify to come back in earlier than sending in your amended return (it’s possible you’ll money the verify you acquired). In case you need assistance with amending your tax returns, TurboTax can information you thru the method.

Correcting a Tax Return

However wait, don’t hit the amend button so quick! There may be one other state of affairs the place you shouldn’t have to file an modification. Did you already e-file your tax return and simply obtain a doc reporting earnings? In case you did, however your e-filed tax return was rejected by the IRS and never accepted as a consequence of a crucial correction, you don’t must amend your tax return. All it is advisable do is add the beforehand missed kinds, repair the reject error in your tax return after which it may be e-filed. And should you used TurboTax, we’ll information you thru correcting the reject standing in your tax return. Lastly, keep in mind if you amend your federal tax return it’s possible you’ll must amend your state tax return since some states observe Federal tax regulation. You possibly can verify the standing of your amended return with the IRS utilizing the The place’s My Amended Return instrument.

TurboTax Has You Lined

Don’t fear about figuring out these steps for amending your tax return. TurboTax will information you thru amending your tax return, and should you used TurboTax Reside to arrange your taxes, you may join stay by way of one-way video to a TurboTax Reside tax professional in English and Spanish to get your questions answered 12 months spherical.

We’ll do your taxes

and discover each greenback

you deserve

When your Full Service professional does your taxes,

they’ll solely signal and file once they understand it’s 100% appropriate

and also you’re getting one of the best end result potential, assured.

69 responses to “Ought to I Amend My Tax Return for A Small Quantity?”

[ad_2]