[ad_1]

Accounts payable (AP) is a vital sign in understanding the monetary well being of a enterprise. By optimizing your accounts payable workflow, you may acquire perception into money move, make higher enterprise choices, and guarantee robust relationships with distributors and suppliers.

To optimize your accounts payable workflow, automation is vital. An automated accounts payable course of allows visibility into your organization’s monetary wellbeing and might unlock insights that assist your small business develop.

What’s the right accounts payable workflow?

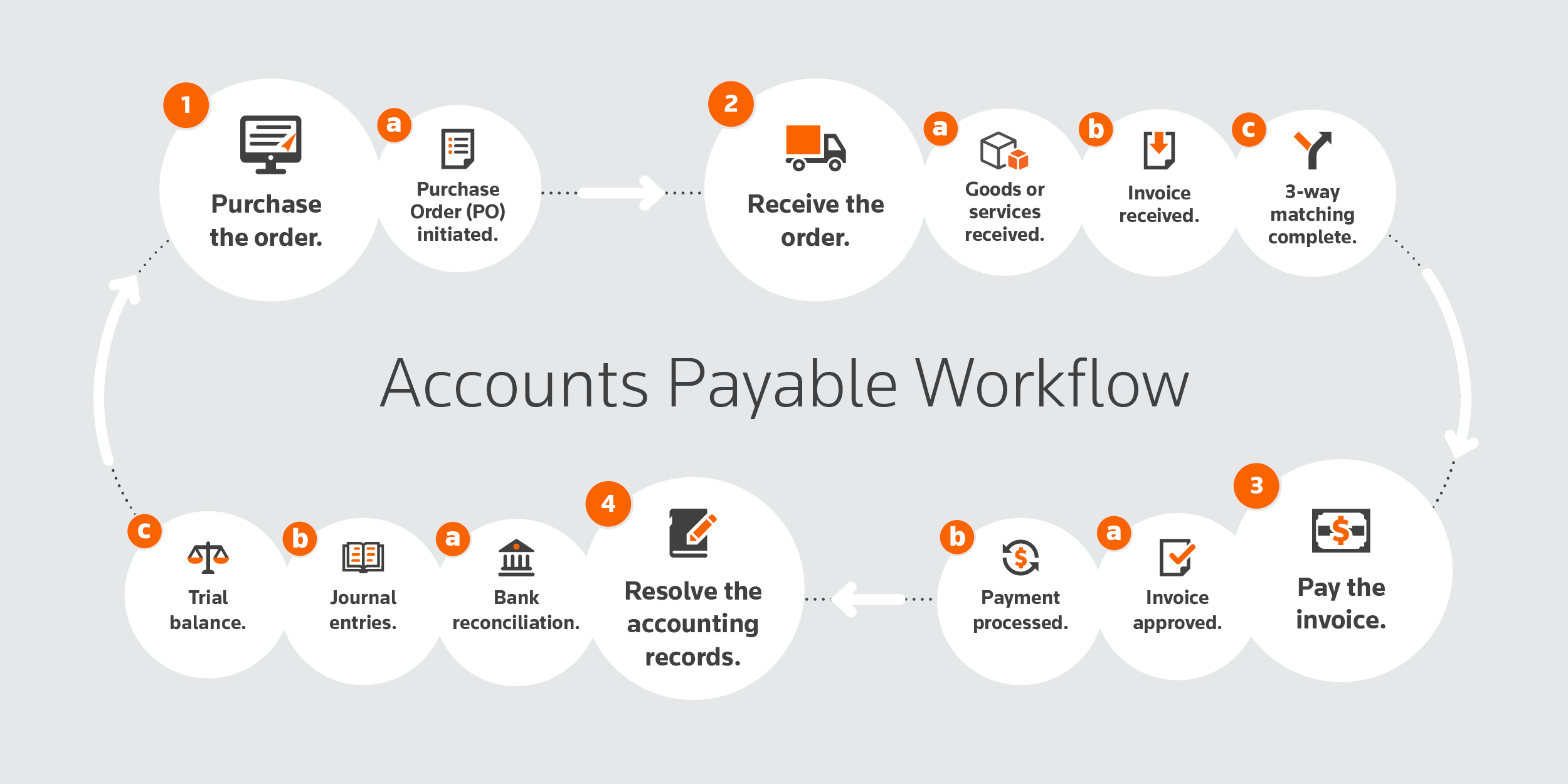

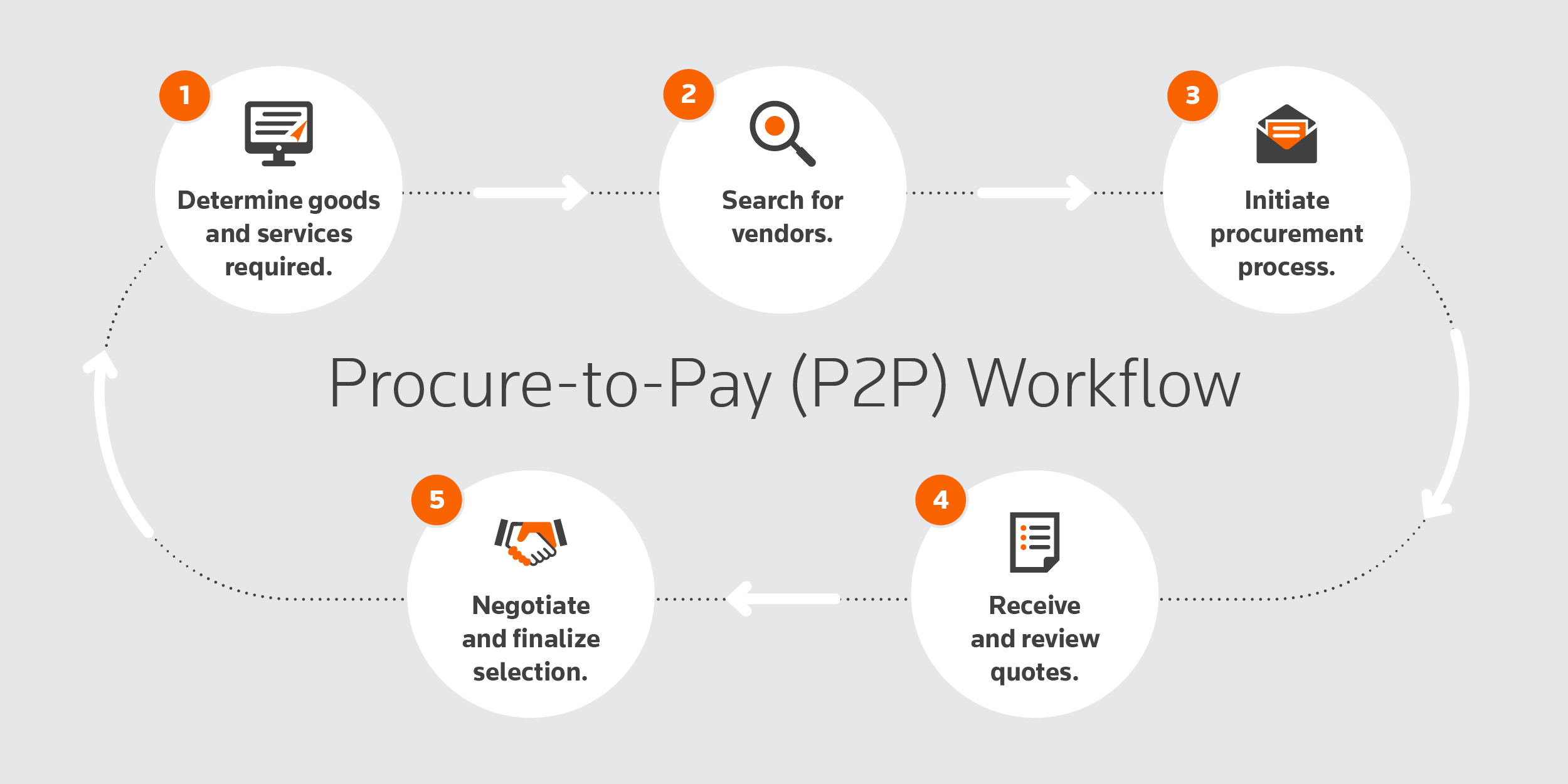

The accounts payable workflow consists of upstream and downstream processes. Upstream processes guarantee robust vendor choice, relationship administration, and mutually helpful contracts. When upstream processes are included within the accounts payable workflow, it’s generally generally known as Procure-to-Pay (P2P).

Downstream processes are the extra conventional accounts payable processes that guarantee services are paid for and the seller is notified of any points.

By automating your accounts payable workflow, you may overcome the challenges related to tedious, handbook duties and optimize the accounts payable course of from begin to end.

What’s P2P in accounts payable?

P2P stands for Procure-to-Pay and is utilized by companies to outline your complete set of processes regarding sourcing, negotiating, requesting, and buying. The P2P course of spans procurement right through to paying for items and companies by the account payable course of.

What are AP workflow finest practices?

To make sure accuracy and transparency in your accounts payable course of, observe these finest practices.

1. Implement 3-way matching

As a part of the accounts payable workflow, 3-way matching matches up the acquisition order, items or companies obtained, and bill particulars to validate the acquisition previous to issuing a fee to a vendor or provider.

Equally, 2-way matching ensures the main points on solely the acquisition order and bill are aligned.

2. Separate AP and AR duties

The segregation of accounts payable and accounts receivable is taken into account a elementary accounting precept and reduces the chance of fraud. With two totally different people dealing with accounts payable and accounts receivable, discrepancies can usually be instantly recognized and resolved on account of using double checks on all sides.

3. Overview your information often

Constant visibility into your monetary information supplies perception into your organization’s money move and helps to determine bottlenecks or traits within the account payable course of. It could possibly additionally mitigate danger by offering an audit path. With superior reporting and analytics, your organization is empowered to make higher enterprise choices.

4. Automate the accounts payable course of

Profitable companies optimize accounts payable by simplifying their workflow by automation.

Accounts payable automation mechanically finds and verifies monetary data and integrates it with different functions mechanically, so companies spend much less time trying to find and coming into information. This makes monitoring and retrieving accounts payable particulars straightforward.

By following these accounts payable finest practices, your small business can set up controls, prioritize invoices, get rid of fraud, strengthen vendor/provider relationships, get rid of paper-based processes, and simply reconcile accounts.

How one can handle accounts payable successfully

An accountant’s fingers are sometimes full with the day-to-day work that retains your observe working. That doesn’t depart a lot time for constructing new enterprise or providing extra high-value companies. To take a extra strategic strategy, it’d make sense to show to know-how to streamline your agency’s accounts payable and higher serve your shoppers.

For accountants who serve enterprise shoppers, skilled accounting software program allows you to present your shoppers with accounting, bookkeeping, and monetary help—with most effectivity by automation.

With the correct instruments and know-how, you and your shoppers can:

- Cut back or get rid of handbook information entry

- Confidently tackle new enterprise

- Standardize agency information and keep consistency of monetary statements throughout all shoppers

- Entry real-time monetary transactions and reporting to make knowledgeable enterprise choices

Accounts payable workflow options

With smarter approval workflows and simplified vendor onboarding and fee, accounts payable workflow options present whole information transparency and completeness, making certain an correct steadiness sheet and the power to optimize information for monetary evaluation and reporting.

With the most recent know-how, an clever interface mechanically finds and verifies monetary data and integrates with different functions mechanically, so that you spend much less time trying to find and coming into information. Cloud-based accounting helps you to work securely with others in actual time from wherever.

With an accounts payable workflow resolution, your agency can higher serve enterprise shoppers by:

- Pulling information immediately out of your shoppers’ spreadsheets or QuickBooks® and integrating transactions with their monetary establishment.

- Working with totally different entity varieties, reporting intervals, and locational and departmental shoppers.

- Processing a number of shoppers without delay and having a number of customers inside your agency working inside a single consumer venture on the identical time.

- Organising controls so that you select how a lot data your shoppers can see. Plus, monitor exercise by date, time, and workers member.

- Customizing studies based mostly on consumer wants, whereas additionally sustaining standardized reporting and monetary assertion formatting.

- Collaborating together with your shoppers in actual time, utilizing this shared on-line portal to deal with their bookkeeping duties.

Whether or not you’re an accountant or a small enterprise proprietor, automating your accounts payable workflow allows you to optimize essential monetary information for higher decision-making.

For extra details about automating AP in your agency, go to the Accounting CS contact web page.

Nonetheless produce other questions on accounts payable? Try our Accounts payable FAQ.

[ad_2]