[ad_1]

The Relative Rotation Graph for US sectors continues to indicate a shift out of defensive sectors into extra offensive and economically delicate ones.

The advance for XLC (communication providers, XLY (shopper discretionary), and XLK (know-how) continues and is seen contained in the enhancing quadrant. All three tails are travelling at a optimistic RRG-Heading. XLC and XLK are coming very near crossing over into the main quadrant, whereas XLY continues to be the sector with the bottom RS-Ratio studying however quickly selecting up now.

Communication Companies

XLC managed to interrupt away from its falling development channel on the finish of final 12 months. Since then, a double backside formation was accomplished, out of which a rally adopted that introduced the sector again to resistance close to 60. The decline that adopted after setting a peak towards that resistance degree is the primary critical pull-back after breaking away from the bottoming formation.

On the again of that enchancment in value, the relative power for XLC towards SPY has quickly improved, and the tail on the RRG is now near crossing over into the main quadrant. General, the present setback appears to supply a very good new entry level, particularly when the tail on the every day RRG will rotate again right into a optimistic RRG-Heading. Affirmation shall be given when XLC can take out resistance at 60.

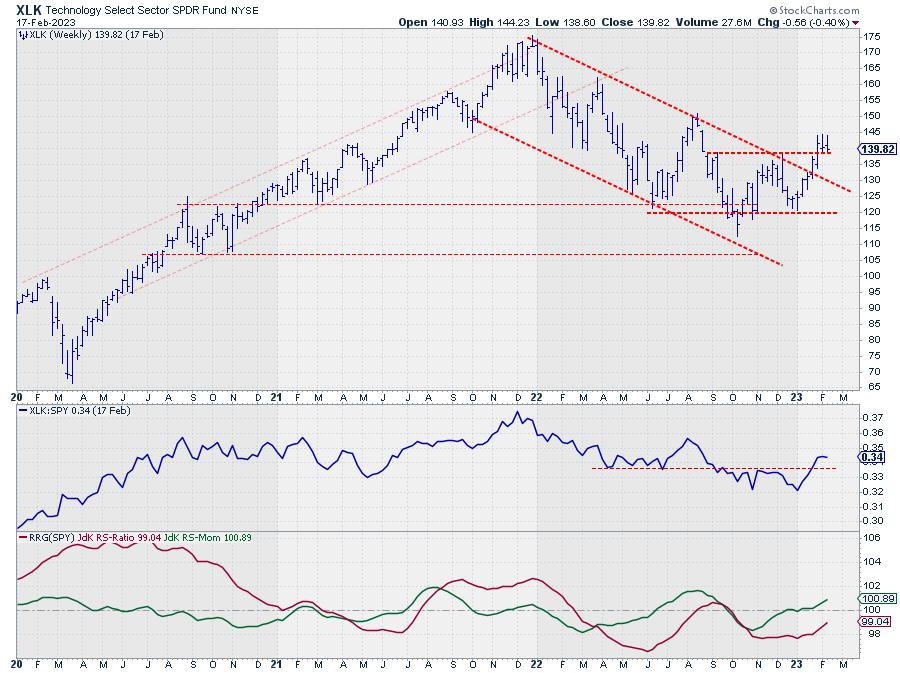

Expertise

After breaking above its falling resistance and out of the declining channel, XLK is managing to carry up effectively above its earlier excessive, now performing as help. This confirms {that a} new sequence of upper highs and better lows is now in place.

Relative power towards SPY has simply damaged above its earlier excessive, signalling an finish to the relative downtrend as effectively.

On the RRG, the tail for XLK is inside enhancing, travelling at a robust RRG-Heading and able to cross over into the main quadrant.

Even when XLK dropped again beneath help between roughly 135-137, it could not instantly harmn the brand new development. There may be nonetheless a little bit of room to manoever.

Right here additionally, a rotation again to a optimistic RRG-Heading on the every day RRG tail would be the affirmation for additional relative enchancment over SPY.

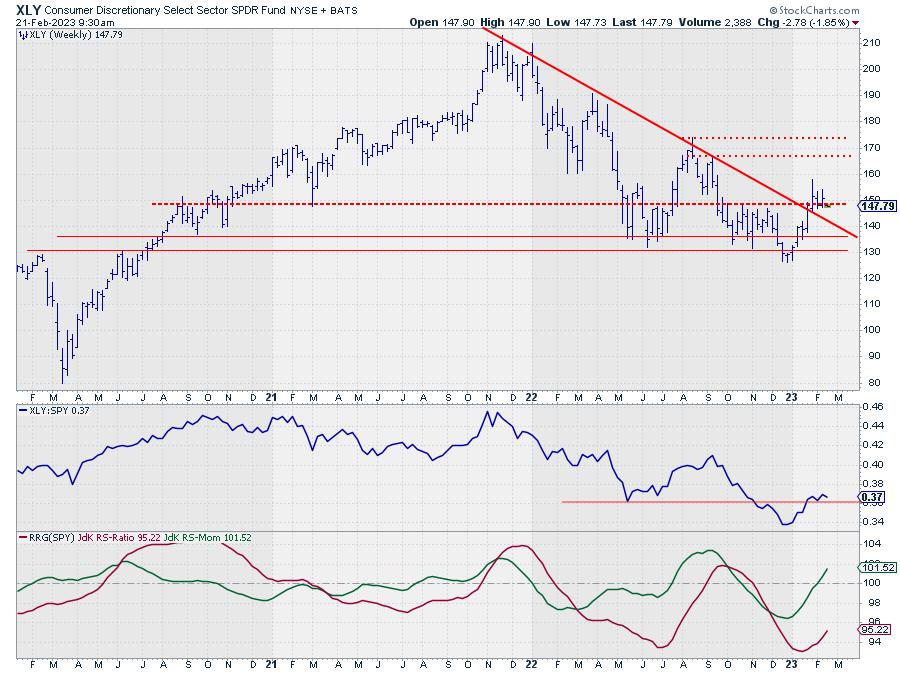

Shopper Discretionary

The break above the falling resistance line marked the top of the downtrend that began on the finish of 2021. For the final three weeks, XLY remained above its breakout degree round 147, the place falling trendline resistance co-incided with the horizontal resistance supplied by the latest peaks in H2-2022. This in itself is an indication of power.

Mix this with an extra enchancment in relative power and the weekly tail transferring additional into the enhancing quadrant, and issues are trying good for XLY. The one issues that makes XLY a bit extra dangerous than XLK and XLC is the truth that it has the bottom Jdk RS-Ratio studying on the weekly RRG. This implies there’s nonetheless some danger for this tail to roll over whereas inside enhancing and never making all of it the best way to main.

Identical to for XLC and XLK, right here additionally a rotation again up on the every day RRG will present help for an extra enchancment in coming weeks.

Rotation out of Protection

On the other aspect of those rotations, at a optimistic RRG-Heading we’re nonetheless seeing cash flowing out of the defensive sectors. Their tails proceed to journey at a unfavorable RRG-Heading. XLU has already crossed into the lagging quadrant. XLV and XLP are nonetheless inside weakening however quickly transferring in direction of lagging.

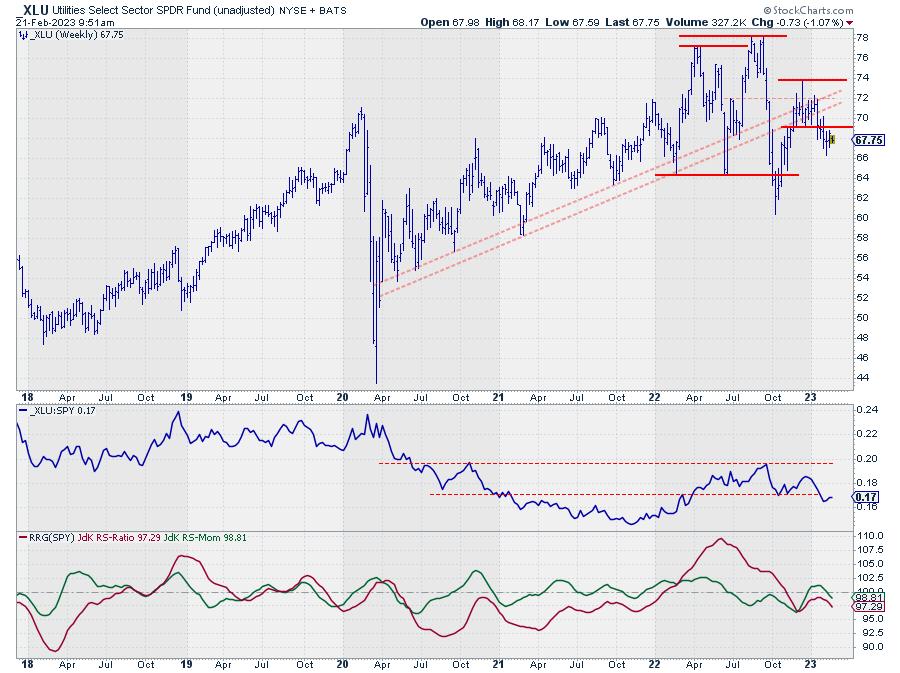

Utilities

This sector has been exhibiting a really uneven chart because it got here down off its excessive close to 78. In that transfer, trendline help was damaged, in addition to help coming from two earlier lows. The rally then tried to interrupt again above resistance, sending some complicated messages within the course of. However lastly that try failed, and a small double high formation was accomplished in that resistance zone, and the market is now working its manner decrease from that top.

Relative power has began to maneuver inline and lately broke beneath its former low, signalling {that a} downtrend is now in place. This places the tail on the weekly RRG again into the lagging quadrant whereas at a unfavorable RRG-Heading, suggesting that there’s extra relative weak spot forward in coming weeeks.

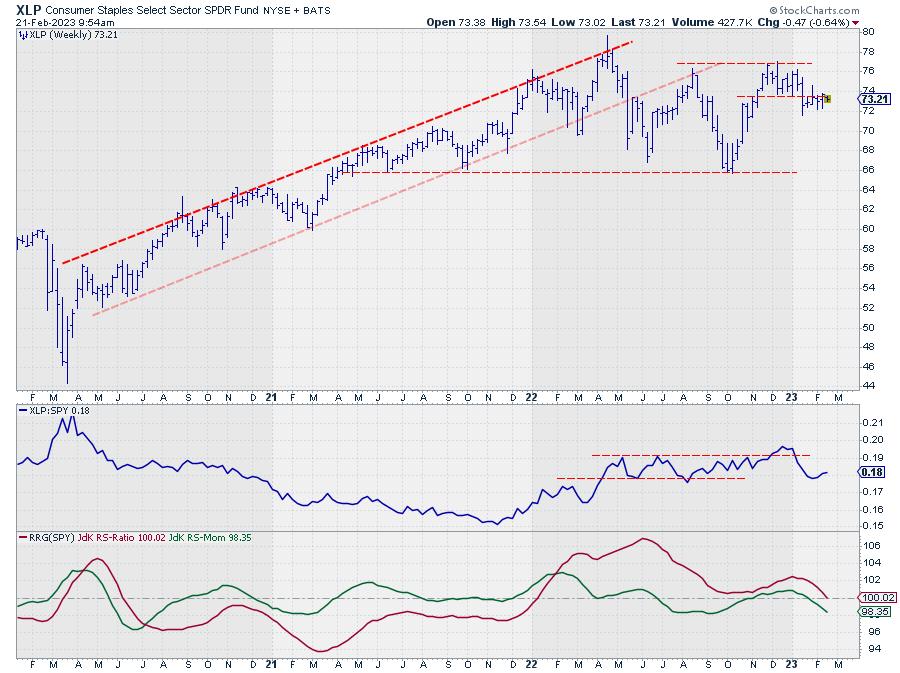

Shopper Staples

XLP dropped out of its rising channel within the first half of 2022. Since then, a buying and selling vary has developed between 66 and 77. The final rally to this higher boundary resulted in one other take a look at of resistance and a failure to interrupt. Out of this current excessive a brand new sequence of decrease highs and decrease lows is growing, and XLP appears to be underway to the decrease finish of the vary once more.

This sideways value efficiency has additionally brought about relative weak spot for this sector, ensuing within the tail on the weekly RRG to maneuver quickly in direction of the lagging quadrant, at the moment inside weakening, at a unfavorable RRG-Heading.

Well being Care

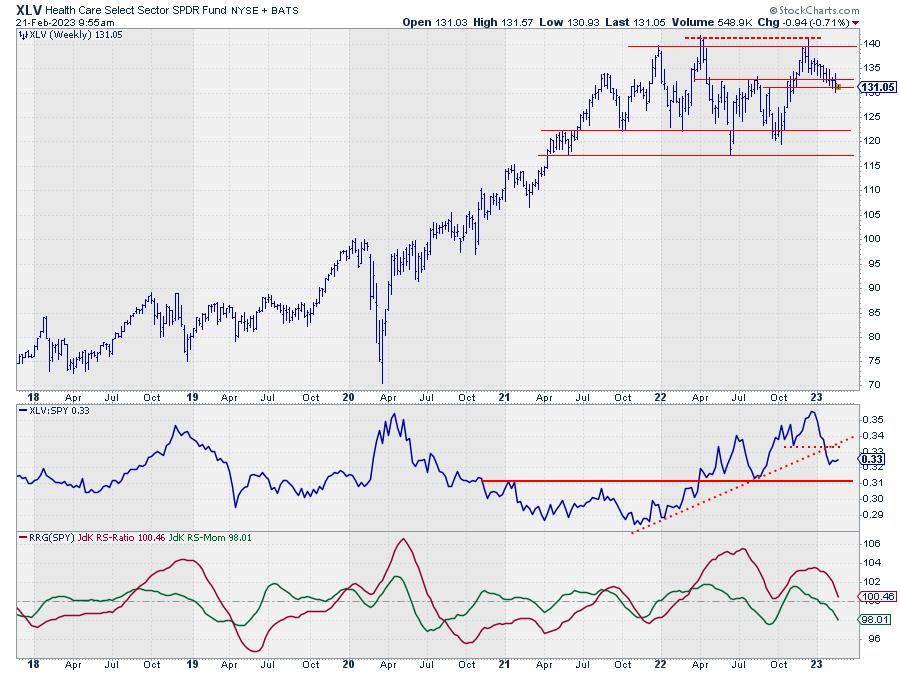

The third and last defensive sector is Well being care. This sector already began buying and selling in a spread late 2021, beginning 2022. The higher boundary is marked round 140 whereas the decrease boundary is coming in round 122.50 with two to 3 dips in direction of 117.5.

This sideways motion brought about actually robust relative power throughout 2022, when the S&P 500 moved considerably decrease. Nonetheless, XLV has not been capable of sustain with the current power within the S&P, and relative power is now rolling over. On the weekly RRG the XLV tail is following XLP in direction of the lagging quadrant.

All-in-All, rotation out of defensive sectors continues, and a extra pronounced transfer into extra offensive and delicate sectors is beginning to form up. This means underlying power for the broader market.

#StayAlert, –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels underneath the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can’t promise to reply to every message, however I’ll definitely learn them and, the place moderately potential, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive methodology to visualise relative power inside a universe of securities was first launched on Bloomberg skilled providers terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Army Academy, Julius served within the Dutch Air Power in a number of officer ranks. He retired from the navy as a captain in 1990 to enter the monetary business as a portfolio supervisor for Fairness & Legislation (now a part of AXA Funding Managers).

Study Extra

Subscribe to RRG Charts to be notified at any time when a brand new submit is added to this weblog!

[ad_2]