[ad_1]

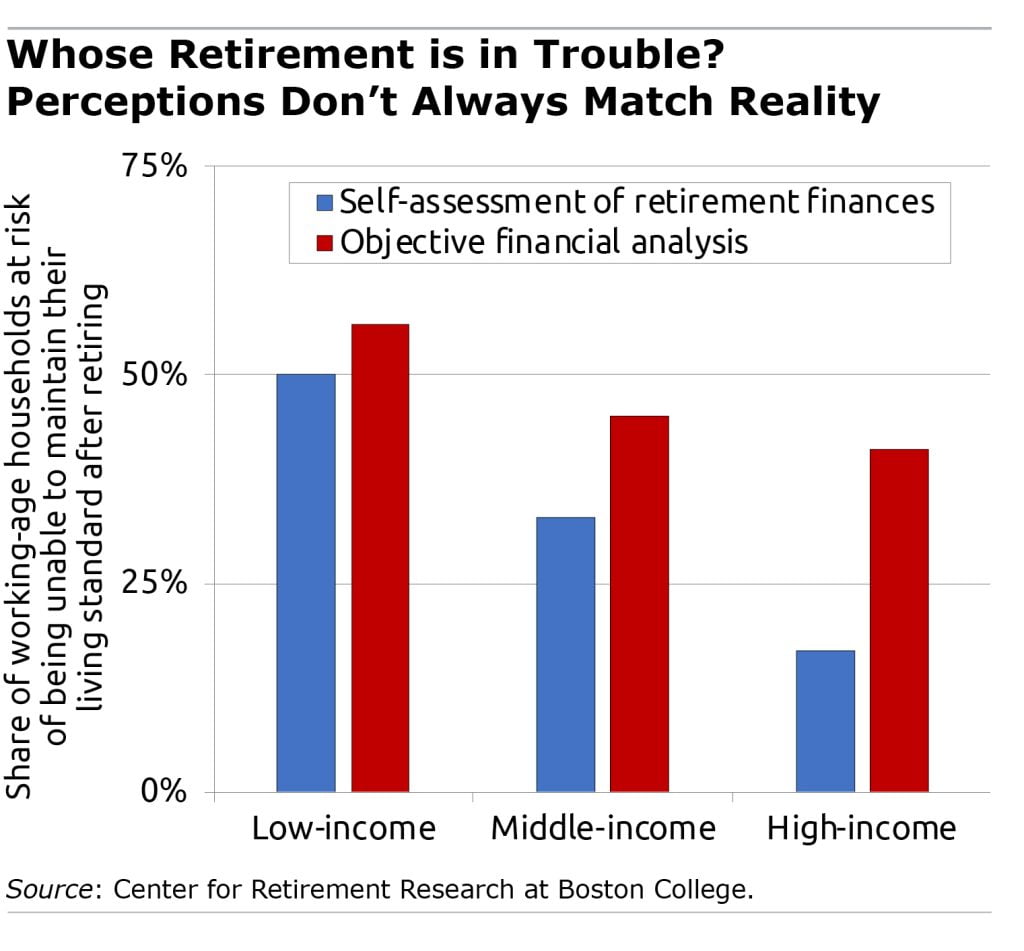

People’ retirement outlook doesn’t change all that a lot: one customary measurement constantly reveals that roughly half of working-age households might not have the ability to afford their present way of life after retiring.

However do they even perceive what situation their retirement funds are in? It is a essential query as a result of perceptions can have an effect on how a lot folks will save for the longer term.

The excellent news is that about 60 p.c of working-age {couples} and single individuals are getting it proper, the Middle for Retirement Analysis finds. In different phrases, they predict, precisely, that they’re in hassle or that they’re in fairly fine condition.

However that leaves vital numbers who’re both over- or underestimating how a lot cash they might want to retire.

On this research, the researchers used the Federal Reserve’s Survey of Shopper Funds in 2019 to gauge the accuracy of staff’ perceptions, utilizing their solutions to a query about how they really feel about their retirement funds. That they had 5 selections, starting from “completely insufficient” to “very passable.”

Their impressions had been paired up with an goal monetary evaluation, derived from the identical survey, of the proportion of U.S. households that aren’t saving sufficient to take care of their present way of life in retirement.

The 40 p.c who don’t have a superb deal with on their funds had been cut up into two teams – “not fearful sufficient” and “too fearful.” About 25 p.c are within the not-worried-enough camp and arguably worst off as a result of they don’t acknowledge the difficulty they’re in.

Employees at each revenue degree make this error, however high-income households do that greater than others. One cause for his or her over-optimism is most definitely that they personal costly homes and should put an excessive amount of inventory within the robust current rise in costs on their substantial actual property holdings.

Excessive-income {couples} additionally underestimate their retirement threat when each of them are working however just one partner is saving for retirement. They may want extra financial savings to take care of their comparatively excessive dwelling customary after they retire.

The remaining 15 p.c of households who misperceive their funds are too fearful. This generally is a drawback for anybody, and maybe extra so low-income staff, in the event that they’re making pointless sacrifices at present as a result of they’re unaware of all of the sources they’ll have in retirement.

When just one partner is working, for instance, the couple might not know the non-working partner can even obtain a Social Safety test primarily based on the employee’s earnings. House fairness is a matter for low-income staff too. It’s a disproportionately giant share of their wealth, however they most likely don’t have plans to faucet into it after they retire.

Planning for retirement is an advanced and difficult activity however about 60 p.c of households have a superb intestine sense of their monetary state of affairs. The larger problem is the one in 4 that aren’t fearful sufficient. They should get a greater deal with on what retirement will seem like. They’ll’t give you a plan until they do.

Squared Away author Kim Blanton invitations you to observe us on Twitter @SquaredAwayBC. To remain present on our weblog, please be part of our free electronic mail listing. You’ll obtain only one electronic mail every week – with hyperlinks to the 2 new posts for that week – whenever you enroll right here. This weblog is supported by the Middle for Retirement Analysis at Boston School.

[ad_2]