[ad_1]

When you’ve got cash, then you’re searching for a chance to take a position it as worthwhile as potential. Or vice versa, as dependable as potential. It might appear that IPO is a chance that’s nearly that. Usually talking, IPO shouldn’t be for traders. This is why.

An preliminary public providing is among the choices for businessmen to profitably increase cash for the event of their enterprise. It is a mechanism utilized by corporations to challenge their very own shares and provide them to market individuals.

Easy methods to borrow cash

Suppose a sure firm wants to boost capital to develop its personal enterprise. Then it has a number of methods. If any financial institution permits, the agency can borrow from the financial institution and repay it over a subsequent time frame with financial institution curiosity. A agency can challenge bonds to the market and select the coupon quantity to pay out to traders who purchase these bonds. Once more, the funds should be returned with curiosity. To not the financial institution, however to traders.

There’s a third choice as properly. It’s to challenge and promote its personal shares available on the market, exchanging them for part of the corporate itself. That’s, the corporate has to share with the investor part of the potential revenue by way of the cost of dividends. However the firm doesn’t must return the cash, it may well use it to develop its enterprise.

Who takes all of the dangers

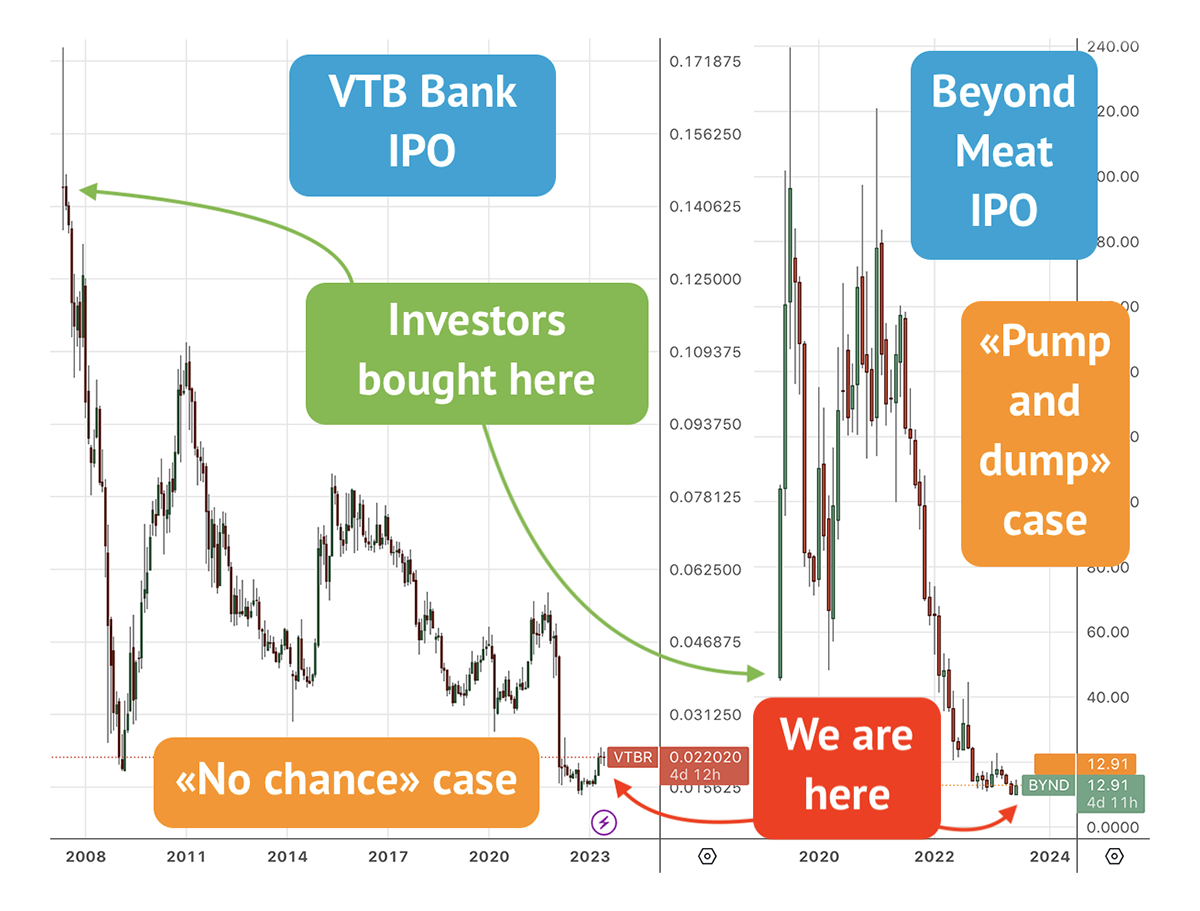

Thus, the investor assumes all dangers when shopping for shares. And the corporate issuing shares is sort of threat free. It goes with out saying that in trade for threat, the investor expects to obtain dividends. As well as, he hopes his shares will rise in worth. However right here we’ve nuances. An important factor is at what worth you purchase these shares. The actual fact is that corporations select to conduct an IPO through the progress of markets. That is executed with the intention to promote at a better worth.

Nonetheless, the investor has different choices in that interval. For instance, there are various rising well-known and dependable shares within the secondary market. Such shares have historical past of quotes, and you’ll depend on it when making selections. It’s potential to take a position there with a sure diploma of threat. Provided that IPO is virtually a lottery.

Double threat lottery

Furthermore, you threat twice by collaborating within the IPO. First, the worth should go up instantly. It does not at all times occur that method. Secondly, even if you’re fortunate, it’s essential get out in time to keep away from getting pumped and dumped.

Thus, IPO is simply one of many choices to become profitable available on the market. And this feature is way from essentially the most dependable. Maintain your cash! Take good dangers.

My options: Vladimir Toropov’s merchandise for merchants

[ad_2]