[ad_1]

Racing forward of the semiconductor pack, Nvidia (NVDA) seems to be edging towards the higher areas of a parabolic curve.

What Does This Imply for NVDA Inventory Worth?

It is a signal of confidence coming off a powerful This fall 2022 earnings efficiency on high and backside traces. NVDA shocked Wall Road, beating analyst EPS estimates by 8.53% (the most important because the first quarter of 2021).

We’ll tackle the “parabolic curve” half just a little later.

What’s Driving NVDA Inventory Forward of the Pack?

Briefly, traders see NVDA as an organization that is well-positioned to endure an financial downturn. We will say the identical factor about semiconductor shares typically, however what NVDA has going for it’s its central enterprise, which incorporates the manufacturing of AI chips.

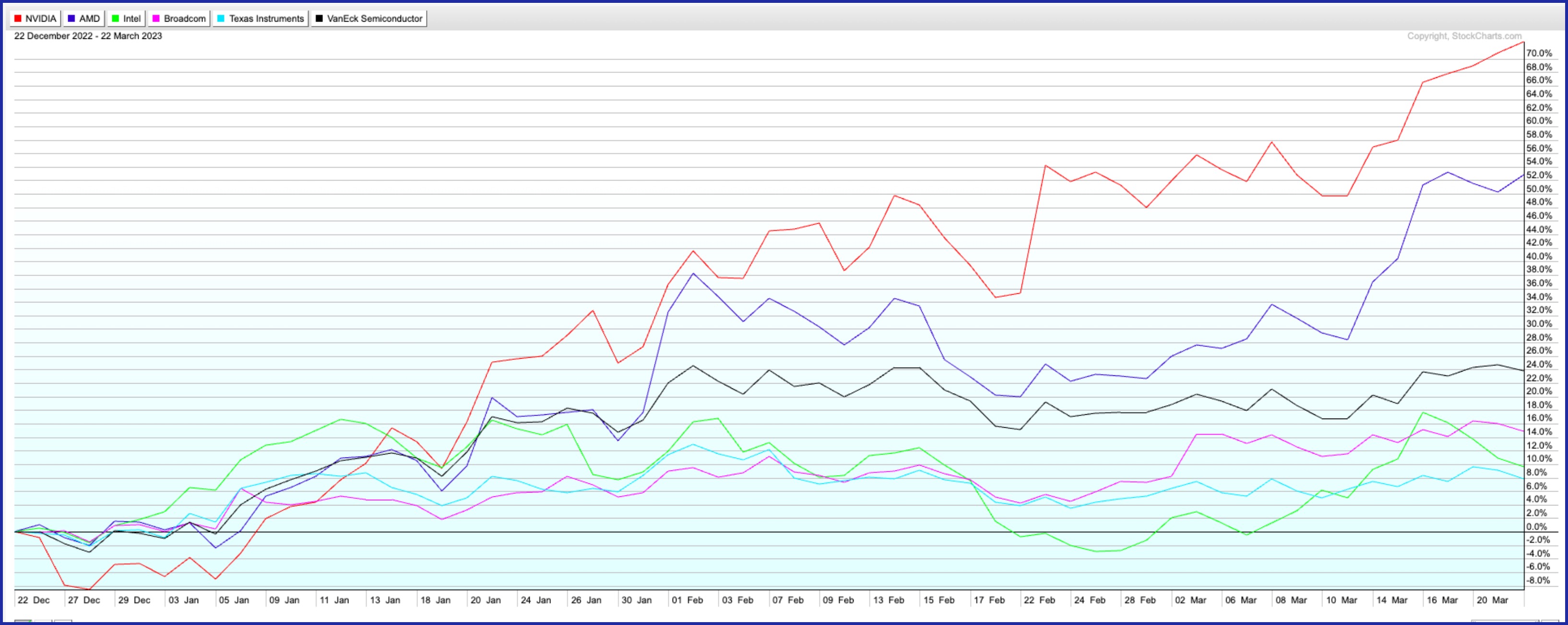

Suppose ChatGPT and Microsoft Bing’s AI chatbot. NVDA’s chips have an incredible capability to energy machine studying software program. And in the event you examine NVDA’s efficiency towards the opposite high US chip shares by market cap on PerfCharts, the image’s fairly clear.

CHART 1: SEMICONDUCTOR SECTOR PERFORMANCE. NVDA broke forward of the pack beginning in mid-January. Chart supply: StockCharts.com. For instructional functions solely.

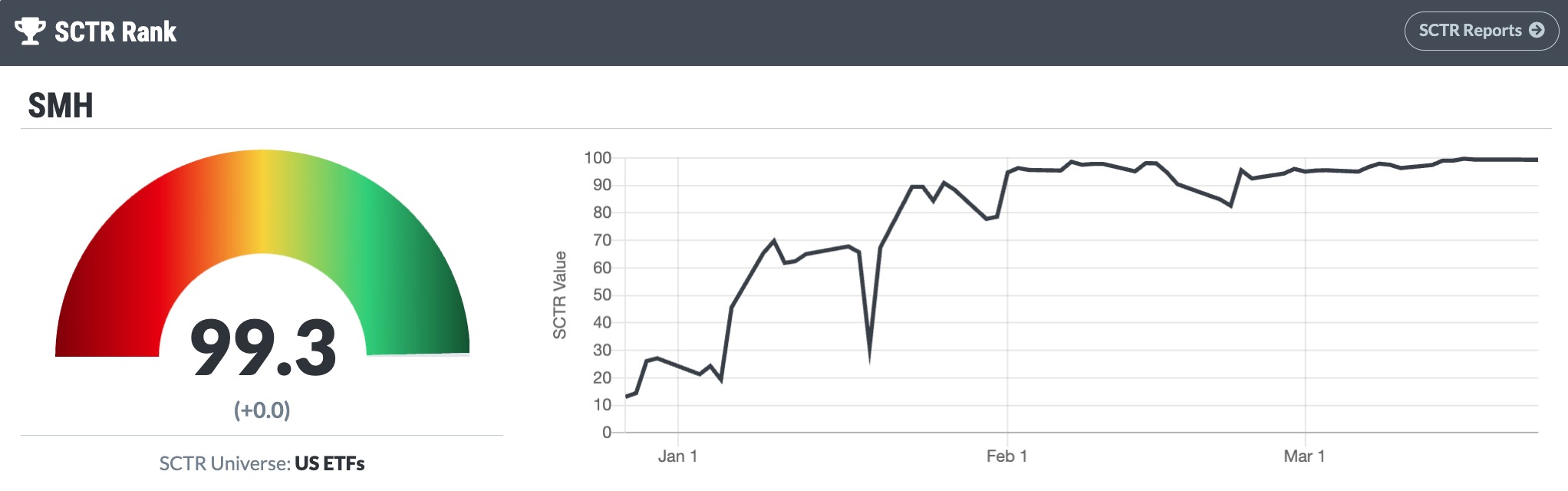

Should you had checked the StockCharts Technical Rank, evaluating NVDA to its sector efficiency through VanEck Semiconductor ETF (SMH), the distinction would not have been as clear, which is why pairing the 2 indicators proved vital on this case.

CHART 2: COMPARING SCTR FOR NVDA AND SMH. NVDA’s value and technical efficiency superior forward of SMH in mid-January as seen within the SCTR. With each belongings advancing (keep in mind that NVDA is SMH’s largest holding), PerfCharts supplied a a lot clearer image. Chart supply: StockCharts.com. For instructional functions solely.

Ought to Traders Purchase Into NVDA Power?

This is the place traders who’re curious about timing their trades are likely to get a bit wobbly, particularly if elementary knowledge is the one factor they depend on. And, by the way in which, when traders hear market pundits on monetary media say issues like “anticipate the dip,” until traders have a comparatively respectable grasp of technicals, “the dip” might be just about wherever (which is not useful in any respect).

On this case, I might watch out.

CHART 3: NVDA’S STOCK PRICE IS SKYROCKETING. How lengthy can it maintain? There is a potential resistance stage at $289.46 and there are divergences between value and the MACD and Chaikin Cash Movement indicators. The stochastics is in overbought territory. Chart supply: StockCharts.com. For instructional functions solely.

- Trajectory: Check out NVDA’s projected trendline (blue trendline) versus its present parabolic trajectory. It is skyrocketing, and usually, actions like this one can maintain themselves for too lengthy.

- Resistance: Subsequent, there is a sturdy resistance stage close to 289.46 (one-year excessive). Bullish sentiment could also be sturdy main as much as this stage, however given the vertical distance value has traveled from its October low and its January pullback, bullish conviction is more likely to be examined at these heights.

- Divergence: NVDA costs could have been advancing sharply, however be careful for divergences within the MACD and the Chaikin Cash Movement indicators, each of which paint the image of lowering conviction or shopping for stress regardless of NVDA’s skyrocketing value transfer. Plus the stochastic oscillator, which additionally reveals a slight divergence, reveals that value is properly throughout the “overbought” vary.

So, Do You Purchase the Dip (As soon as It Declines)?

The elemental case for getting shares of NVDA (or SMH, for that matter) is an inexpensive one. In spite of everything, chip demand tends to climate most financial downturns.

However given resistance overhead and the divergence readings that sign a decline in shopping for stress from a probably overbought vary, NVDA appears certain for a dip.

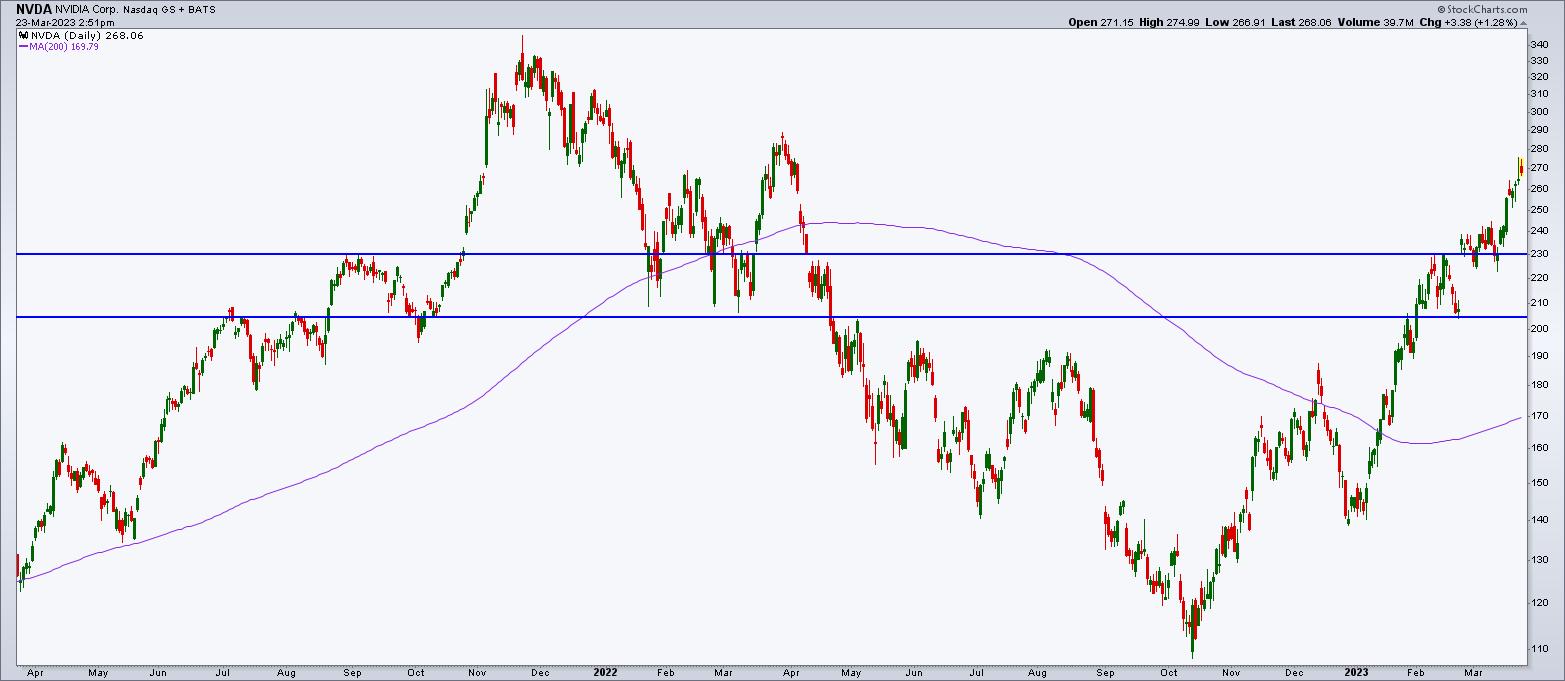

Concentrating on the vary between 205.00 and 230.00 as a possible “purchase the dip” stage would seize a number of areas of historic help and resistance. There are many different entry factors, after all, and a few, like Fibonacci retracement ranges, are contingent upon a short lived reversal.

CHART 4: WHERE WOULD A POTENTIAL DIP BE FOR NVDA STOCK? The vary between $205 and $230 might be a “purchase the dip” stage, given help and resistance ranges from previous value knowledge. Chart supply: StockCharts.com. For instructional functions solely.

NVDA inventory is price including to your ChartLists. Click on on the worth charts to see the dwell model. From there, you possibly can simply add the chart to any of your ChartLists.

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary state of affairs or with out consulting a monetary skilled.

Karl Montevirgen is an expert freelance author who focuses on finance, crypto markets, content material technique, and the humanities. Karl works with a number of organizations within the equities, futures, bodily metals, and blockchain industries. He holds FINRA Sequence 3 and Sequence 34 licenses along with a twin MFA in vital research/writing and music composition from the California Institute of the Arts.

Be taught Extra

Subscribe to Do not Ignore This Chart! to be notified every time a brand new submit is added to this weblog!

[ad_2]