[ad_1]

Certainly one of my early mentors typically remarked, “Nothing good occurs under the 200-day.”This was his approach of recognizing that, whereas shares can definitely pop greater from overwhelmed down ranges, you are extra more likely to expertise sustained advances as soon as the value is above the 200-day transferring common.

His remarks jogged my memory of profitable chartists like Tom Dorsey relating level and determine charts to soccer. Are you able to rating a landing when the protection is on the sphere? Positive. However it’s approach simpler to attain a landing when your offense has the ball!

So what does it imply that the S&P 500 index is as soon as once more testing its personal 200-day transferring common?

The Precarious Place for the SPX

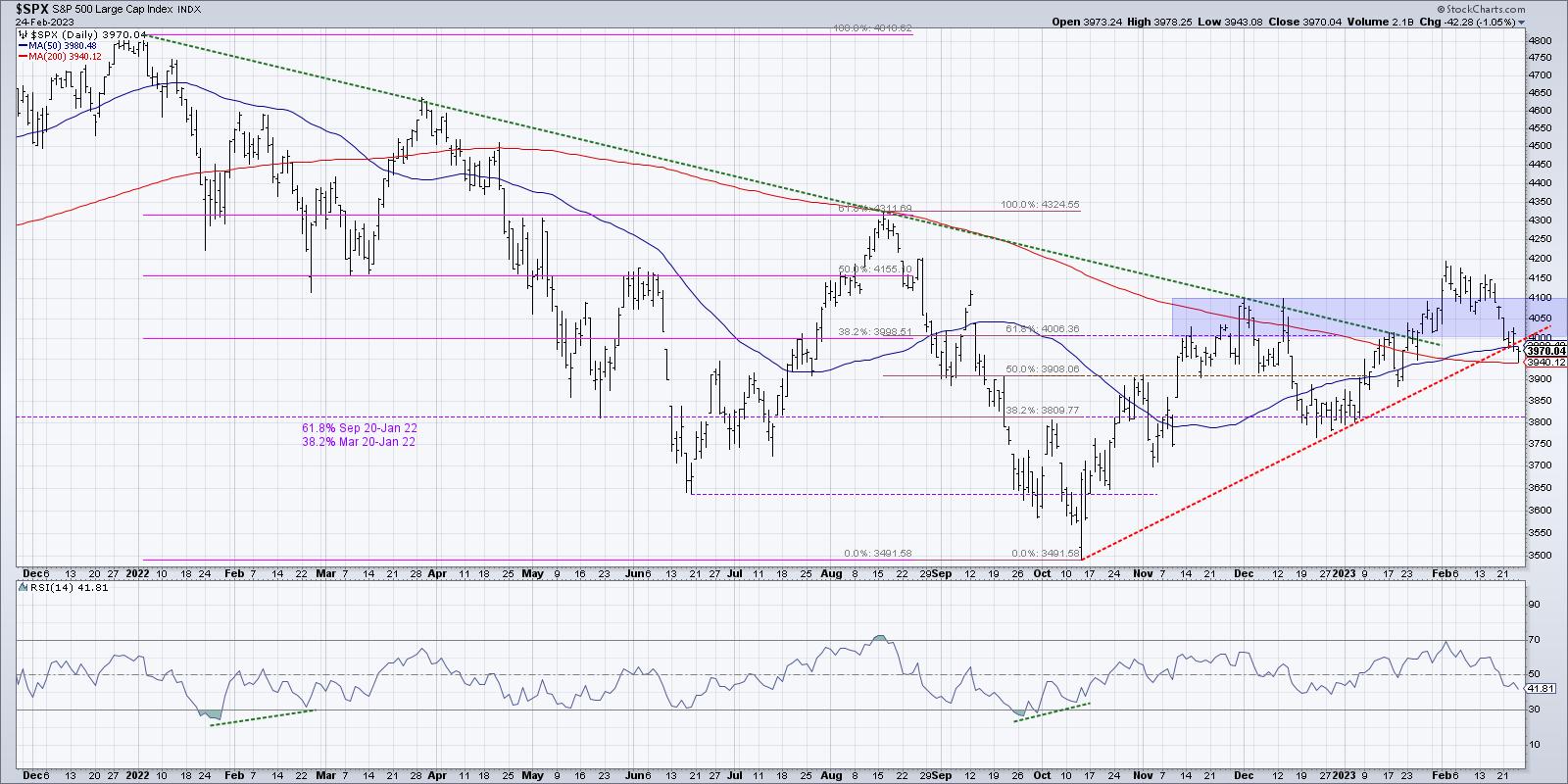

When the S&P 500 broke above its 200-day transferring common in January, this represented a major enchancment after the bear market section in 2022. As an alternative of failing at this long-term barometer because it had in August and December, the benchmark had lastly proven sufficient optimistic momentum to interrupt above this vital degree. Quickly after, the S&P additionally adopted by way of above a trendline utilizing the 2022 highs, once more confirming the energy of shopping for energy because the index made one other new swing excessive.

After lastly pushing above the 4100 degree in early February, the SPX stalled out slightly below 4200, earlier than pushing again down into the blue-shaded space on our chart (4000-4100). As of Friday’s shut, the S&P 500 had damaged under 4000, which places it as soon as once more under this “congestion space” we have been specializing in since November.

Friday’s drop additionally put the SPX under its 50-day transferring common for the primary time since mid-January, and under a trendline utilizing the October and December lows. Now this key benchmark is on the “final line of protection,” the 200-day transferring common.

Because the S&P checks this vital help degree, it is value noting that the RSI stays simply above 40. In bullish phases, the RSI often bottoms out round 40 throughout pullbacks. So the bullish thesis for shares would almost certainly want the RSI to stay at or above present ranges whereas the SPX holds the 200-day transferring common.

Confirming the Breakdown in Key Shares

Whereas the S&P 500 is testing its personal 200-day transferring common, a lot of shares have already damaged down by way of their very own 200-day. Let’s assessment a few of the most vital benchmark names, Apple and Microsoft.

The FAANG shares struggled in an enormous approach throughout this shortened vacation week (full disclosure: I presently maintain the triple quick FANG & Innovation ETN, ticker BERZ), with NFLX handing over a disappointing -8.9% transfer since final Friday’s shut. It is arduous to think about our growth-dominated benchmarks thriving whereas these key mega cap names are struggling, and that is precisely what now we have skilled thus far in February.

AAPL completed the week at its 200-day transferring common, whereas MSFT pushed under its 200-day on Friday. So whereas each names managed to hole above this long-term barometer in the beginning of February, this final week confirmed a significant short-term reversal, as each shares made a brand new low for the month.

How bullish can we wish to be if each Apple and Microsoft are failing to carry above their 200-day transferring common? Not very.

And It is Not Simply AAPL and MSFT

House Depot (HD) got here up in a lot of conversations this week, together with my interviews with Danielle Shay and Dave Landry. All of us famous the hole decrease this week after Tuesday’s earnings name, however essentially the most unfavourable proof is the shortage of patrons coming in as the value deteriorated into the top of the week.

With the 310 help degree now within the rearview mirror, in addition to the vital 200-day transferring common, the query is the place HD finds help given the bearish momentum traits. My concern is that there is not a lot from a technical perspective by way of help till you get right down to the 2022 lows round $265. That is one other 10% under Friday’s shut.

Even broader measures of transferring common help point out that shares are struggling to stay above their very own 200-day. Quite a few our 5 favourite breadth indicators have given bearish alerts in February, suggesting that the rally off the October lows was not less than prepared for a pullback, if not a deeper retracement of earlier beneficial properties.

Whereas a handful of teams (heavy development, semiconductors come to thoughts) stay on stable footing, I am involved by the truth that a few of the most vital charts to observe are actually at or under their 200-day transferring common.

And nothing good occurs under the 200-day.

Oh and yet one more factor…

Thinking about my newest tackle ARKK and a possible bullish pennant formation? Head over to my YouTube channel!

RR#6,

Dave

P.S. Able to improve your funding course of? Try my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your personal private and monetary scenario, or with out consulting a monetary skilled.

The writer doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the writer and don’t in any approach symbolize the views or opinions of another particular person or entity.

David Keller, CMT is Chief Market Strategist at StockCharts.com, the place he helps traders reduce behavioral biases by way of technical evaluation. He’s a frequent host on StockCharts TV, and he relates mindfulness methods to investor determination making in his weblog, The Conscious Investor.

David can also be President and Chief Strategist at Sierra Alpha Analysis LLC, a boutique funding analysis agency targeted on managing danger by way of market consciousness. He combines the strengths of technical evaluation, behavioral finance, and information visualization to establish funding alternatives and enrich relationships between advisors and purchasers.

Study Extra

Subscribe to The Conscious Investor to be notified each time a brand new submit is added to this weblog!

[ad_2]