[ad_1]

The brokerage agency NordFX has summed up the outcomes of its purchasers’ buying and selling transactions for Might 2023. The social buying and selling providers, CopyTrading and PAMM, in addition to the revenue earned by the corporate’s IB companions, had been additionally evaluated.

– The chief for the month was a dealer from Western Asia, account quantity 1692XXX, who made a revenue of 130,874 USD. This substantial consequence was achieved by way of trades with gold (XAU/USD) and the British pound (GBP/USD).

– The second step of the rostrum was taken by a consultant from Southern Asia, account quantity 1679XXX, with a results of 33,895 USD, additionally made by way of trades with gold (XAU/USD).

– In third place was one other dealer from Southern Asia, account quantity 1549XXX, who earned 24,857 USD in Might by way of trades with the euro (EUR/USD) and the British pound (GBP/USD).

In NordFX’s passive funding providers, the scenario was as follows:

– In CopyTrading, we proceed to trace the destiny of the “veteran” sign KennyFXPRO – Prismo 2K. It continues to recuperate from the shock of November 14, 2022, when its most drawdown exceeded 67%. As of in the present day, it has achieved a revenue of 348% over 757 days. One other sign beneath the identical “model” additionally attracts consideration: KennyFXPRO – Variables_RBB 35. In its 175 days of existence, it has proven a comparatively modest revenue of 40%. Nonetheless, what makes this sign attention-grabbing is that this revenue was achieved with a reasonably average drawdown of 24%.

One notable start-up sign is Future Foreign exchange, whose supplier managed to attain a 91% revenue from GBP/USD trades over 68 days, with a most drawdown of about 30%.

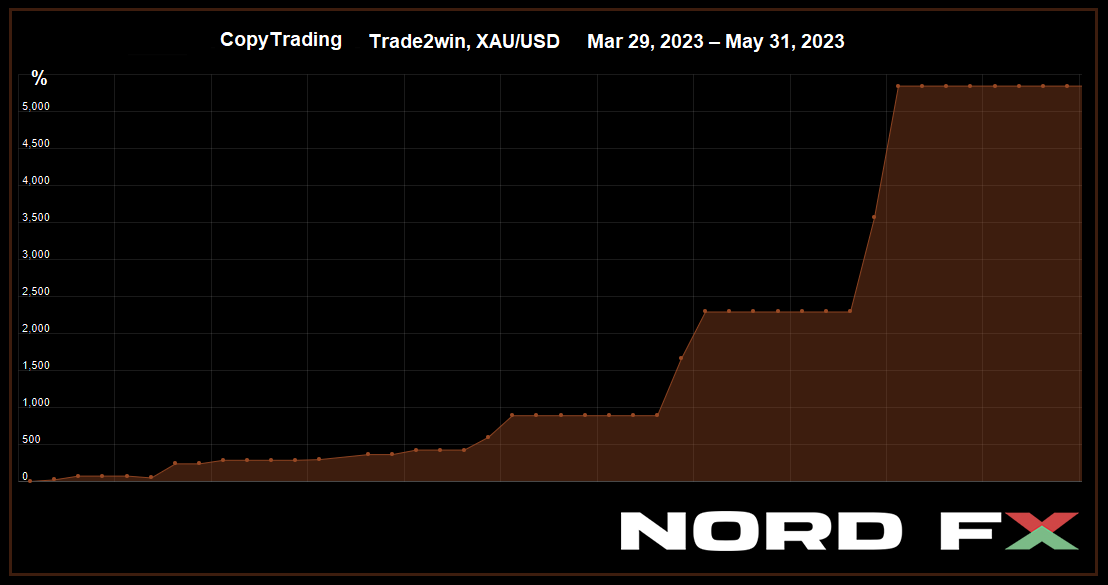

Lastly, the super-hit of the final two months: Trade2win. In simply 62 days, this sign has achieved an exceptional revenue of 5,343% from gold (XAU/USD) trades, with an equally outstanding drawdown of lower than 15%. Trade2win‘s buying and selling type isn’t overly aggressive: there are few trades, and the common leverage is much from the utmost attainable, ranging between 50 and 150. Regardless of these spectacular achievements, it is necessary to keep in mind that previous efficiency does not assure future success, and that buying and selling in monetary markets is dangerous. Thus, to keep away from dropping funds, subscribers ought to train most warning and all the time adhere to cash administration ideas.

– The PAMM service showcase nonetheless options two accounts we have now talked about a number of instances in earlier opinions. These are KennyFXPRO-The Multi 3000 EA and TranquilityFX-The Genesis v3. On November 14, 2022, like their CopyTrading colleagues, they suffered important losses – drawdown approached 43% at that time. Nonetheless, the PAMM managers determined not to surrender, and as of Might 31, 2023, the revenue on the primary of those accounts exceeded 100%, and on the second, 66%. We additionally proceed to observe the Commerce and Earn account. It was opened greater than a 12 months in the past, however lay dormant, awakening solely in November. Consequently, over the previous 7 months, its return has exceeded 100% with a really small drawdown of lower than 10%.

Amongst NordFX’s IB companions, the Prime 3 seems as follows:

– The biggest fee reward of the month, amounting to 10,370 USD, was credited to a companion from Western Asia, account No. 1645XXX.

– In second place is a companion from Southern Asia, account No. 1668XXX, who obtained 9,093 USD.

– The highest three is rounded off by a companion from Japanese Asia, account No. 1218XXX, who earned 7,456 USD in Might.

Discover: These supplies should not funding suggestions or tips for working in monetary markets and are supposed for informational functions solely. Buying and selling in monetary markets is dangerous and can lead to an entire lack of deposited funds.

[ad_2]