[ad_1]

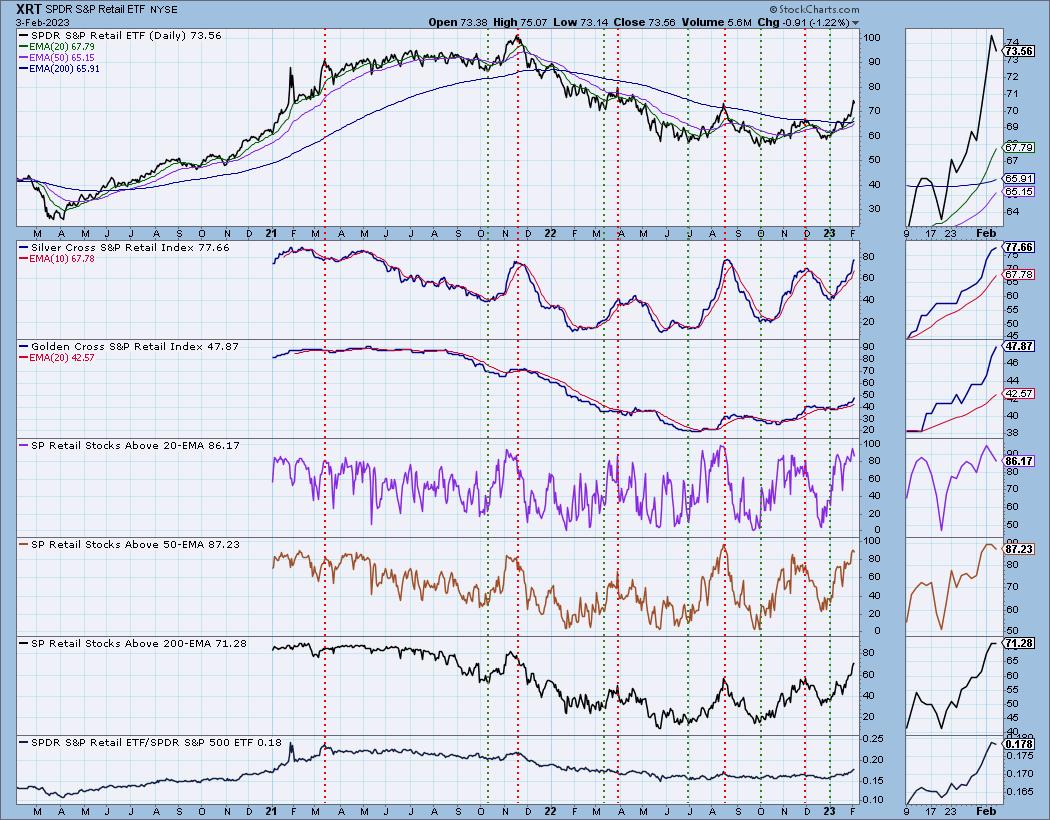

We now have begun amassing Silver Cross Index and Golden Cross Index information for 4 new business teams, and StockCharts.com back-calculated information for 2 years: Biotechnology (IBB), Regional Banking (KRE), Retail (XRT), and Semiconductors (SMH).

First let’s cowl what the Golden/Silver Cross Indexes are:

- The Golden Cross Index (GCI) exhibits the share of shares on LT Development Mannequin BUY alerts (50-EMA > 200-EMA). The alternative of a Golden Cross is the “Demise Cross” — these shares are in a bear market.

- The Silver Cross Index (SCI) exhibits the share of shares on IT Development Mannequin BUY alerts (20-EMA > 50-EMA). The alternative of the Silver Cross is a “Darkish Cross” — these shares are, on the very least, in a correction.

Let’s have a look our new business group Golden/Silver Cross Indexes:

Since mid-January, now we have seen the relative power line falling. Nonetheless, discover what was happening ‘underneath the hood’. Participation was rising and the Silver Cross Index was rising. Relative power was deceptive. Throughout this similar interval, IBB has been in a rising worth pattern.

Regional Banks (KRE) has seen participation taking pictures skyward. The relative power line is in settlement with participation, which suggests total power. Discover the Silver Cross Index shifting vertically larger. That is an business group to concentrate to.

The Silver Cross Index and Golden Cross Index are rising properly on XRT. Participation is strong. Discover that, when the Silver Cross Index turned up, the relative power had not begun to rise a lot. Participation started to enhance even earlier than the Silver Cross Index would have gotten us into the rally sooner.

The SMH chart is bit disjointed, primarily as a result of there are fewer members on this business group ETF. We all know this group has proven superb management and, wanting on the participation numbers, it is nonetheless going robust. Discover we simply received a LT Development Mannequin “Golden Cross” BUY sign on SMH because the 50-day EMA crossed above the 200-day EMA. That is one purpose we see the vertical rise within the Golden Cross Index. If the group itself is getting a Golden Cross, the shares inside are probably seeing the identical factor. At the moment, all of them have worth above their 20-/50-day EMAs, and that has pushed the Silver Cross Index to 100% as effectively. What this tells us is that we should always see a rally continuation. As quickly because the participation numbers start to crack, we can be warned.

Conclusion: Including participation to charts offers you advance discover of inside power. We now have Golden Cross Indexes and Silver Cross Indexes for the entire main indexes, all sectors, and, now, six business teams (Gold Miners (GDX), Transportation (IYT) and now Regional Banks (KRE), Semiconductors (SMH), Retail (XRT) and Biotechs (IBB)). These annotated charts are solely accessible for each day overview by DecisionPoint.com subscribers.

Wish to give us a strive? Use coupon code: DPTRIAL2 and get two weeks to verify us out for FREE!

Watch the newest episode of DecisionPoint on StockCharts TV’s YouTube channel right here!

Technical Evaluation is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Useful DecisionPoint Hyperlinks:

DecisionPoint Alert Chart Listing

DecisionPoint Golden Cross/Silver Cross Index Chart Listing

DecisionPoint Sector Chart Listing

Worth Momentum Oscillator (PMO)

Swenlin Buying and selling Oscillators (STO-B and STO-V)

DecisionPoint will not be a registered funding advisor. Funding and buying and selling choices are solely your duty. DecisionPoint newsletters, blogs or web site supplies ought to NOT be interpreted as a suggestion or solicitation to purchase or promote any safety or to take any particular motion.

Erin Swenlin is a co-founder of the DecisionPoint.com web site alongside together with her father, Carl Swenlin. She launched the DecisionPoint each day weblog in 2009 alongside Carl and now serves as a consulting technical analyst and weblog contributor at StockCharts.com. Erin is an lively Member of the CMT Affiliation. She holds a Grasp’s diploma in Data Useful resource Administration from the Air Drive Institute of Know-how in addition to a Bachelor’s diploma in Arithmetic from the College of Southern California.

Subscribe to DecisionPoint to be notified each time a brand new submit is added to this weblog!

[ad_2]