[ad_1]

This tutorial applies to the EA ‘Multisymbol EA’ for MT5 whose product web page is accessible by clicking on the picture beneath:

This EA makes use of methods which have labored properly since 2020 on the next symbols:

GBPUSD AUDUSD EURJPY CADCHF GBPNZD NZDUSD GBPCHF

The Multisymbol EA relies on worth motion, indicators (shifting averages, RSI, MACD and others) and all the time follows the pattern, avoiding market noise. It additionally performs an entire orders administration primarily based on market actions. Lastly, for every image, when an open order is worthwhile, a brand new order for a similar image might be opened (based on the person’s selection).

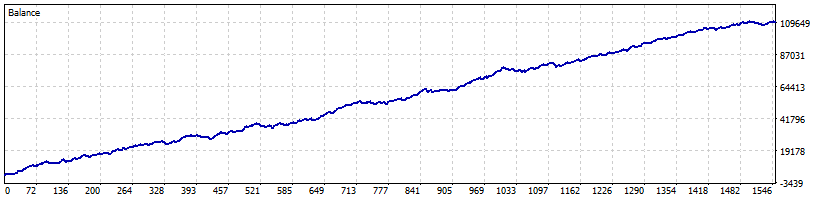

Under is the backtest of this EA with default settings (fastened heaps) from 01/01/2020:

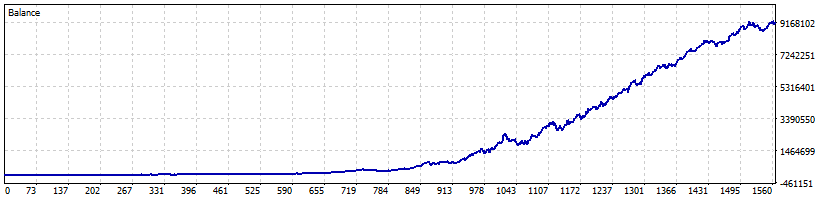

For this 2nd backtest, the default parameters have been saved aside from the scale of the heaps which is fastened based on the steadiness of the account (backtest since 01/01/2020):

Detailed options are described on the product web page. Under is the record of EA settings with explanations.

-====Basic settings====-

Dealer prefix (if mandatory): just for brokers who use prefixes. For instance, kind m for mEURUSD

Dealer suffix (if mandatory): just for brokers who use prefixes. For instance, kind m for EURUSDm

Use Timer: outline buying and selling days and hours

Orders will solely be opened on buying and selling days. Nonetheless, orders might be closed/modified even exterior of the established time if at the least one of many following parameters is enabled:

– ‘Max % misplaced/day’ ;

– ‘Max % win/day’ ;

– ‘Shut earlier than weekend’.

Monday: alerts & buying and selling on Mondays

Tuesday: alerts & buying and selling on Tuesdays

Wednesday: alerts & buying and selling on Wednesdays

Thursday: alerts & buying and selling on Thursdays

Friday: alerts & buying and selling on Fridays

Saturday (crypto): alerts & buying and selling on Saturday (usually for crypto buying and selling)

Sunday (crypto): alerts & buying and selling on Sunday (usually for crypto buying and selling)

Begin time: begin of the session

Finish time: finish of the session

Buying and selling alerts: terminal and/or smartphone notifs

-====Buying and selling settings====-

Magic quantity: should be distinctive if different EA are working

‘Max open orders’, ‘Max % misplaced/day’ and ‘Max % win/day’ are calculated from the magic quantity. For instance, when you’ve got 3 EAs with the identical magic quantity, the entire variety of orders opened would be the sum of the orders opened in these 3 EAs.

Enable further orders: opens further orders when an order is worthwhile

Relying on the image for which the order is worthwhile, as much as 3 further orders for a similar image might be opened. It’s higher to have smaller heaps for extra orders than for major orders (see heaps settings beneath).

Max simultaneous orders: max variety of orders opened concurrently (if 0, no max)

Max % misplaced/day: if max worth is reached, the EA open orders are closed and no different order is opened till the following day (if 0, no max)

The calculation relies on account steadiness + open orders advantages. In an effort to velocity up the backtests, the calculation is finished each hour throughout backtests, as an alternative of each minute for an actual buying and selling session.

Max % win/day: if max worth is reached, the EA open orders are closed and no different order is opened till the following day (if 0, no max)

Similar comment than for ‘Max % win/day’.

Shut orders earlier than weekend: shut all EA orders on Friday

Closing time earlier than weekend: if ‘Shut earlier than weekend’ is ‘true’

Use cash administration: if ‘true’, lot dimension in % steadiness

Mounted heaps dimension: lot dimension per order (if ‘Use cash administration’ is ‘false’)

Mounted heaps dimension (additionnal orders): lot dimension per additionnal order (if ‘Use cash administration’ is ‘false’)

It’s higher to have smaller heaps than for major orders.

Lot dimension in %: % steadiness per order (if ‘Use cash administration’ is ‘true’)

Lot dimension in % (additionnal orders): % steadiness per additionnal order (if ‘Use cash administration’ is ‘true’)

It’s higher to have smaller heaps than for major orders.

[ad_2]