[ad_1]

I’m frightened a few vital decline (or crash) in industrial actual property valuations, particularly together with multifamily, in 2023 and 2024. I really feel that the crimson flags are so clear and all pointing in the identical route that I’d be neglecting my responsibility to this neighborhood to fail to make my stance as clear as doable and to defend that stance in nice element.

On this article, I’ll stroll via my thesis, outlining 4 major threats to multifamily valuations, following the abstract under:

- Half 1: Cap Charges Are Decrease Than Curiosity Charges

- Half 2: I’m Not Betting On Significant Lease Development In 2023

- Half 3: I’m Betting On Curiosity Charges Rising In 2023

- Half 4: Excessive Curiosity Charges Put Stress On Valuations And Debt Underwriting

- Half 5: Information, Anecdotes, And Additional Studying

- Half 6: Concepts To Defend Wealth And Make Cash In This Surroundings

Please be aware that actual property is native. My evaluation on this article is reflective of the common throughout the USA, although I do dive into a pair massive areas.

Lastly, I wish to handle upfront that I contemplate myself an novice in understanding industrial actual property markets, maybe approaching “journeyman” standing. I’m on no account an professional in them. I invite debate and would welcome evaluation from any readers able to current a “bull case” to my factors right here. Please be at liberty to supply that within the feedback or electronic mail me at [email protected].

Half 1: Cap Charges Are Decrease Than Curiosity Charges

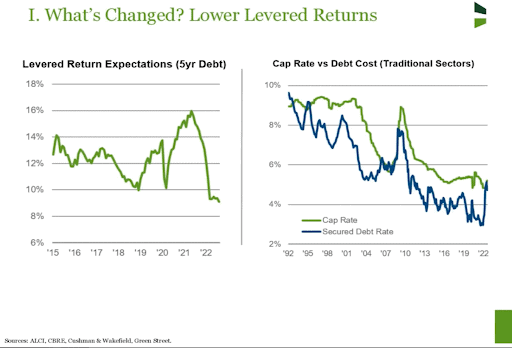

On common, rates of interest are greater than cap charges proper now within the multifamily house in the USA. Visually, that may be represented as the 2 strains within the chart under crossing:

Buyers getting into industrial multifamily achieve this as a result of they wish to generate a return. Return is not expressed as a capitalization price (cap price), which is extra of a metric used to worth properties in relation to at least one one other, however fairly as an inside price of return (IRR). One can generate a powerful IRR in excessive and low cap price environments, simply as they’ll generate a powerful IRR in excessive and low rate of interest environments.

IRR depends on two major components: the amount of money stream the property produces (and the timing of these money flows) and exit/sale of the property (and the timing). Enhance rents rapidly and promote at a premium value, and the IRR soars. Accomplish that slowly and promote at a better cap price than on the time of acquisition, and IRR plummets.

Cap charges have been comparatively low in a historic context for the final 10 years. This hasn’t been a problem for people in producing nice IRR as a result of rates of interest have been so low. In actual fact, low cap charges, in some ways, make it simpler for buyers to generate returns as a result of every incremental greenback of NOI added to a property will increase the valuation by a larger a number of. Enhance NOI by $1 in a ten% cap price surroundings, and the property worth will increase by $10. Enhance NOI by $1 in a 5% cap price surroundings, and the property will increase in worth by $20.

Nevertheless, driving IRR turns into a lot, a lot more durable in a “unfavorable leverage” state of affairs the place cap charges are greater than rates of interest. For causes we’ll talk about all through this text, greater rates of interest make it more durable for patrons to qualify for enticing financing, rising seemingly exit cap charges and placing downward strain on IRR. And, a lot of the idea for an IRR projection will come from rising rents rapidly.

In different phrases, the market is extra dependent right now than at any level within the final decade on cap charges remaining low, rents persevering with to rise rapidly, and/or a return to the traditionally low rates of interest we noticed within the final 5 years. “Unfavourable Leverage” is the market’s method of speaking that it’s “all-in” on appreciation or falling rates of interest.

And, as I’ll spell out, I believe both end result has a low chance.

Whereas it’s all about IRR for the asset in query ultimately, I discover it attention-grabbing that even with out having to run the numbers on a particular deal or a market of offers, we will already make a simplistic statement about industrial actual property simply by analyzing the historic unfold of cap charges vs. rates of interest (which incorporates all actual property, not simply multifamily in isolation — however be aware that multifamily cap charges are sometimes decrease, on common, than different varieties of industrial actual property).

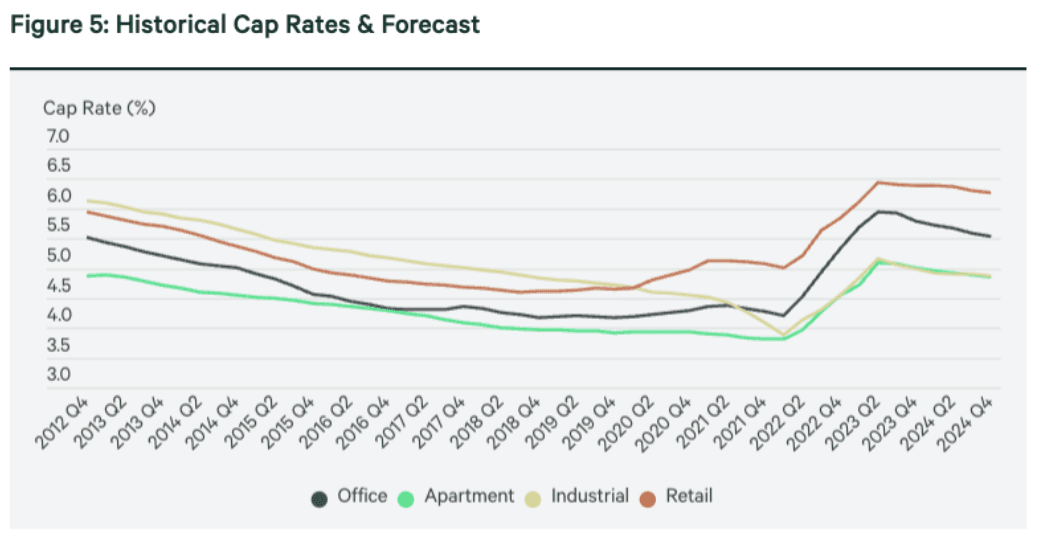

Except one has a stronger thesis for hire development and/or rate of interest discount than has been the case for the previous decade or so, a variety between rates of interest and cap charges of about 150 bps is the norm. That means cap charges rising from 5% to six.5%. Whereas that will not look like a giant deal, if this have been to normalize rapidly, it’s equal to a few 23% discount in asset values.

That appears like this forecast supplied by CBRE:

Half 2: I’m Not Betting On Lease Development In 2023

To know how rents could be impacted this 12 months, now we have to consider each provide and demand. I’ve dangerous information on the availability entrance and a combined bag for demand.

Let’s begin the dialogue by provide.

Provide

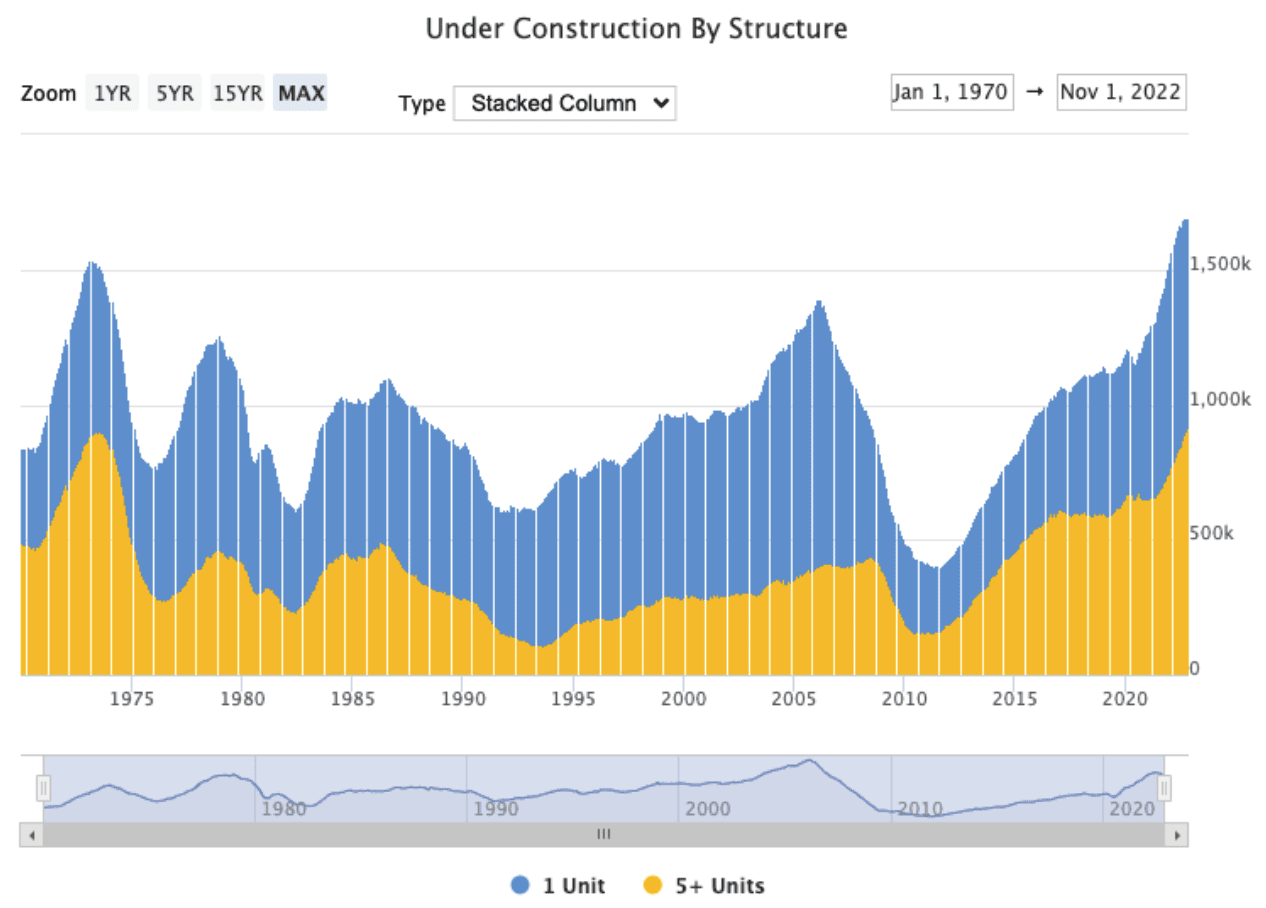

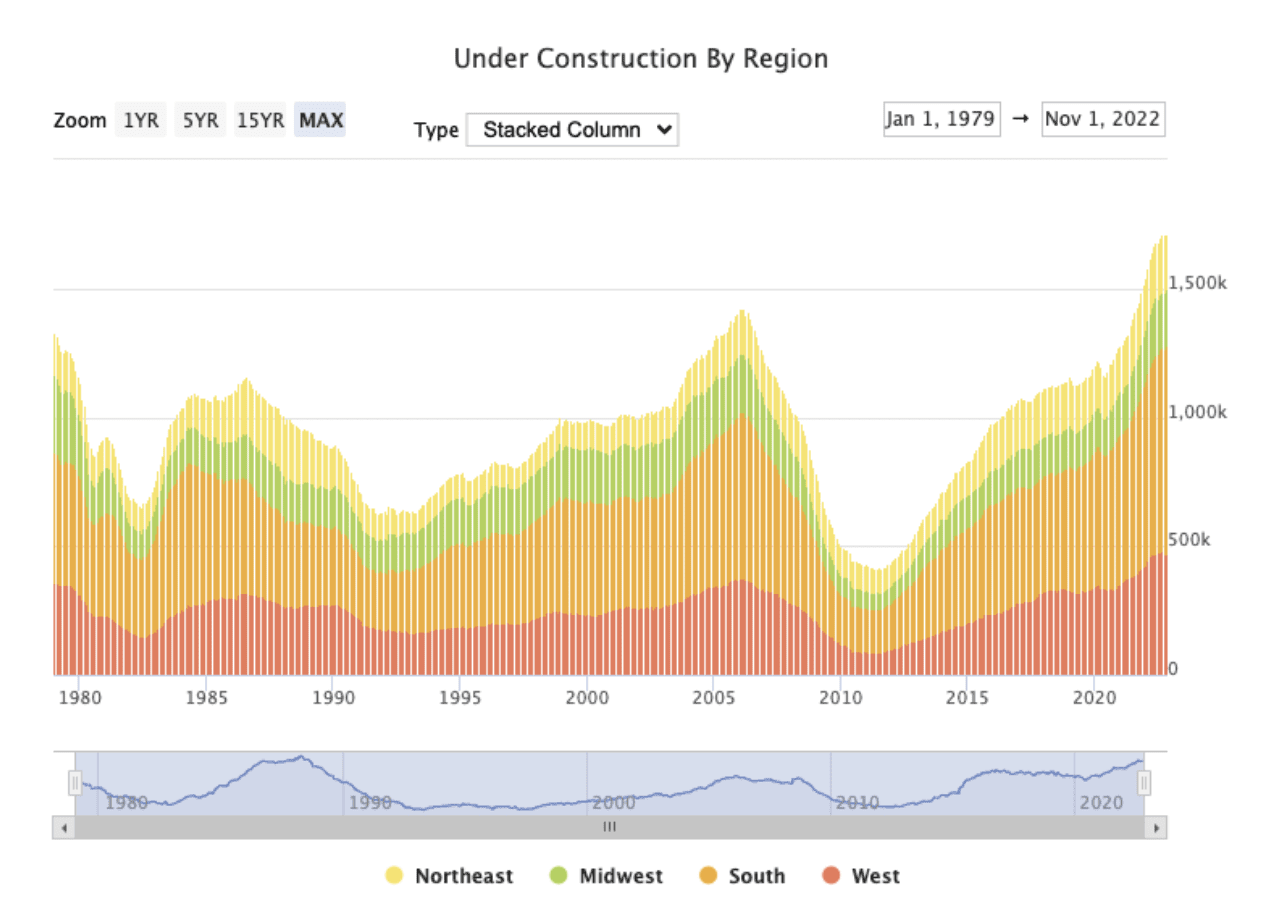

Backlogs for brand new development in multifamily are on the highest ranges because the Seventies. Backlogs for complete houses beneath development are on the highest ranges now we have knowledge for:

Specialists like Ivy Zelman take the stance that builders will monetize this stock as quickly as it’s accomplished — primarily, come hell or excessive water. The holding prices and bridge debt (much like exhausting cash loans for industrial growth) builders use to finance tasks are very costly and thus are a robust incentive to complete development and refinance or promote as quickly as doable.

As Brian Burke of Praxis Capital talked about on our On the Market podcast, growth takes time and can affect numerous areas in another way. Some markets could not see a lot new provide. Some markets will see a ton of provide come on-line however have a lot new demand that there might be no battle with absorption. And a few markets will see provide come on-line and battle to fill the models, placing downward strain on rents as vacancies enhance.

The South and West are on the highest danger of seeing huge new provide coming on-line:

Be aware that whereas you will have heard about permits or housing begins declining, do not forget that growth takes time. Allowing and growth tasks that have been began in late 2021 and early 2022 will come on-line in 2023 and 2024. Tasks can take years and even many years to allow, begin, and eventually full. A scarcity of latest housing begins does little to stem the onslaught of latest stock already underway that’s about to hit the market. The consequences of this new development increase are simply getting began.

And it doesn’t take a giant stretch of the creativeness to extrapolate that this glut of latest housing will put downward strain on actual property costs of all kinds, in addition to downward strain on rents, as extra housing inventory is competing for a similar pool of renters.

Let’s discuss demand subsequent.

Demand

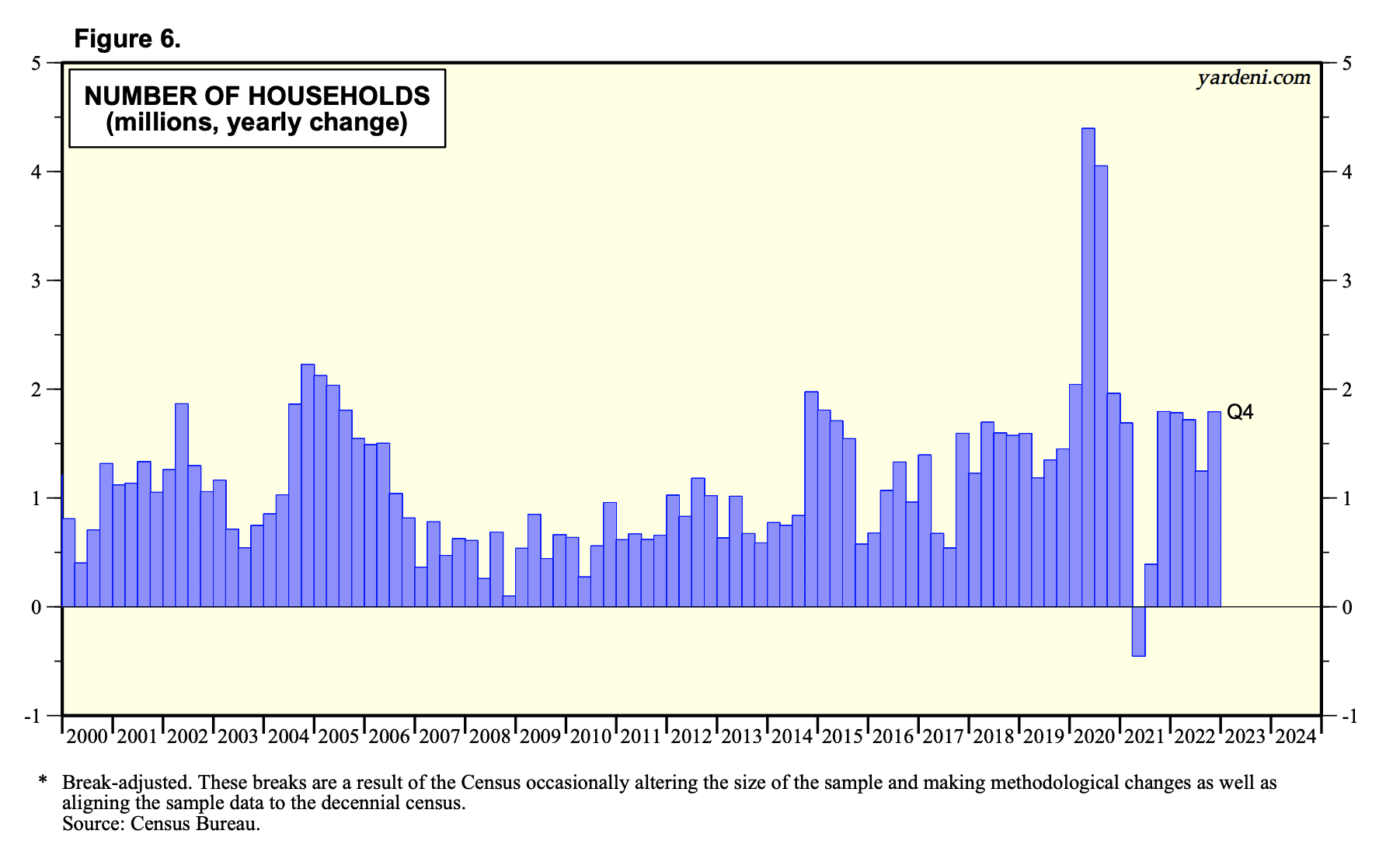

The largest demand query, in my view, is round family formation. 1.6M new models coming on-line is not any huge deal if we predict 1.6M new households to type, proper? That enables for these models to be rented or occupied (absorbed) with none kind of pricing shock. And everybody’s been speaking a few huge housing scarcity for years, proper?

And it’s true — America sometimes provides households at a sooner price than we add stock. And there may be a housing scarcity. That’s why actual property costs and rents have skyrocketed over the previous few years. There are simply two issues with this place as a protection of rising rents going ahead:

First, family formation knowledge was thrown method off throughout the pandemic, with over one million Covid-19-related deaths and an enormous reshuffling of households. This makes it actually tough for any economist to foretell family formation.

Second, the housing scarcity has already been priced in to present rents and residential costs. The scarcity, coupled with low rates of interest, led to just about 40% appreciation in residence costs and a 26% enhance in rents throughout the pandemic.

Diving deeper into family formation. Throughout the pandemic, we see that tens of millions of “households” apparently shaped:

What’s happening right here?

The reply shouldn’t be clear to me, and I haven’t discovered a very compelling evaluation of the state of affairs from an economist I like. I’d admire it if a commenter may level me to a examine or evaluation that is sensible and permits us to extrapolate the longer term nicely.

Within the absence of a top quality evaluation that I can entry, my guess is that folks merely moved round. I believe this distorted the info in ways in which we don’t totally perceive but. Folks moved again in with Mother and Dad. Maybe of us who dwell and work in locations like New York Metropolis, San Francisco, and Los Angeles saved paying their leases but in addition moved out of town to a second residence, and maybe this was counted as a second family formation. Maybe divorces and breakups spiked, and when a pair splits up, that magnifies “family” formation (two individuals every needing a spot to dwell, every head of family, as a substitute of 1 household unit).

However it’s apparent that we didn’t really see tens of millions of latest households type. My guess is that now we have an artificially excessive estimate of the variety of present households on this nation proper now, and that scares me when making an attempt to challenge hire development subsequent 12 months.

Moreover, be aware that even with out the craziness on this metric, family formation knowledge can wax and wane with the financial system. In good occasions, of us could purchase a number of homes and transfer out from shared residences with roommates or transfer out of their mother or father’s basement. In recessions, of us can transfer again residence with Mother and Dad or usher in roommates once more. “Family” formation can decline rapidly.

The potential offset — rents may rise once more in 2023

There are all the time a number of variables in any essential financial metric, and hire is not any exception. Whereas I’m afraid of the downward strain from huge rental will increase over the previous two years, provide development, and the query marks round family formation, I do wish to acknowledge that there’s a main tailwind (upward strain) to hire costs: rates of interest.

With mortgage charges doubling in a 12-month interval, affordability in buying houses, the choice to renting for tens of millions of Individuals, has spiked. One examine from ATTOM concluded that only a 12 months in the past, it was extra inexpensive to personal than to hire in 60% of U.S. markets, a stat that has flipped with the 40-50% enhance in month-to-month funds as a result of greater rates of interest. That affordability change will put upward strain on rents.

It’s due to this strain that I believe rents are a coin flip in 2023. I don’t belief any financial forecasts about hire development proper now. And, with out the upward strain on rents from excessive rates of interest, I’d be keen to make a significant guess that rents would decline on common throughout the nation.

Half 3: I’m Additionally Not Betting On Pursuits Charges Declining In 2023

Keep in mind, cap charges are decrease than rates of interest. That implies that for buyers to earn cash, rents need to develop (rapidly), or rates of interest need to fall. As I discussed, I believe there are a variety of causes to be skeptical about any hire development projections nationally in 2023 and each cause to suppose that rents are a coin flip with a major potential draw back.

Now, it’s time to show our consideration to rates of interest. A reversion of economic charges to the historic lows of the previous few years would bail out many industrial actual property and multifamily syndicators and their buyers.

Is that seemingly? I don’t suppose so. Right here’s why.

The “unfold” (vs. the 10-year Treasury) defined

When banks, establishments, or people lend cash, they wish to be compensated for the danger they’re taking. How a lot they cost in curiosity can usually be considered a “unfold” towards a low-risk various.

It’s broadly accepted within the lending house that the U.S. 10-year Treasury invoice is a superb benchmark to measure “unfold” towards. Different benchmarks embody the London Interbank Supplied Fee (LIBOR) and the Secured In a single day Financing Fee (SOFR).

In actual fact, a variety of non-public industrial debt comes with charges which can be pegged to SOFR plus a variety, not the Treasury. However, the 10-year U.S. Treasury bond is the usual that most individuals examine spreads to and is the largest affect on multifamily financing.

Many establishments contemplate lending cash to the U.S. authorities to be the lowest-risk funding on this planet. Lending to anybody else comes with extra danger. Due to this fact, everybody else must be charged with greater curiosity.

However how way more? That’s the place the thought of a “unfold” is available in.

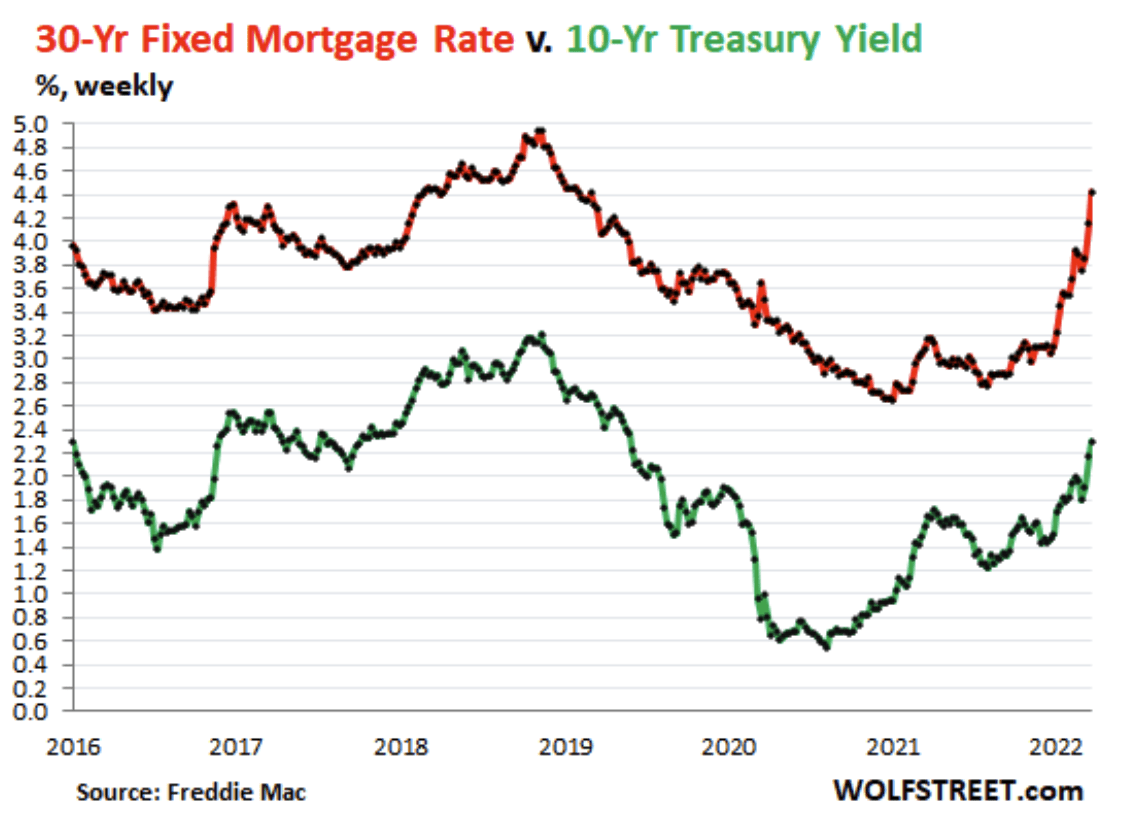

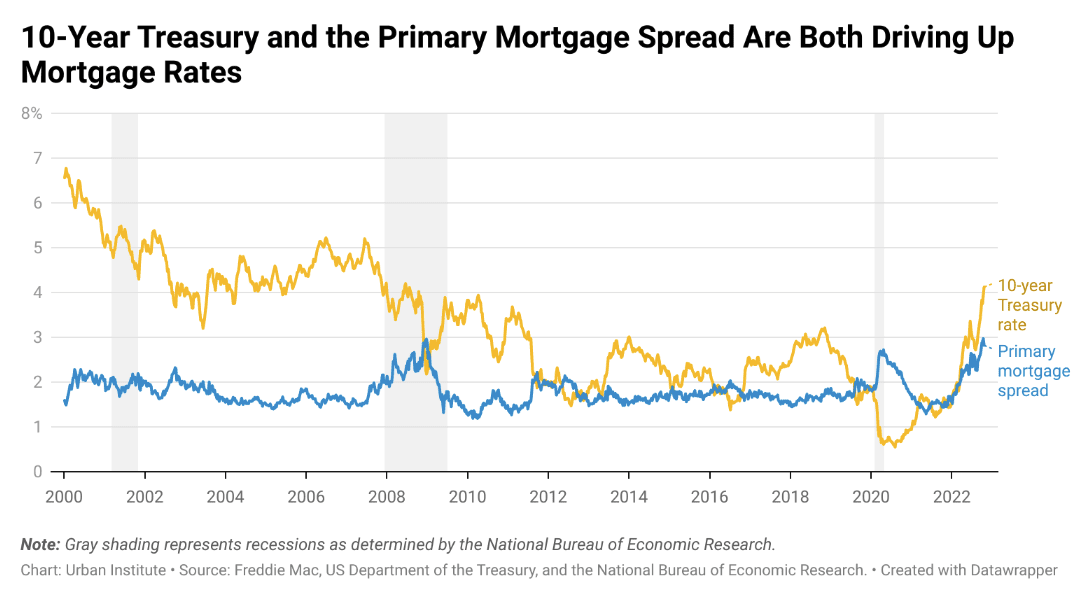

Simply how a lot “unfold” a lender costs will depend on the lender, the financial system, and the demand for loans. In some markets, resembling 30-year mortgages for homebuyers, this unfold could be very nicely established. For instance:

That is clearly a very sturdy correlation, to the purpose the place we will take it as a right that if the 10-year Treasury goes up, mortgage charges go up, and vice versa. Nevertheless, it’s not an ideal correlation, and generally, the unfold does, in reality, change.

At the moment is a kind of occasions. The unfold between the 10-year Treasury and 30-year mortgage charges is comparatively excessive, as you’ll be able to see under:

Many pundits count on 30-year mortgage charges to say no in 2023 due to this excessive unfold. They consider that if the unfold between the 10-year Treasury and 30-year mortgage charges have been to normalize to the historic common of roughly 180 bps, then mortgages may come again down nearer to the 5.5% vary as a substitute of 6.3%, the place we’re on the time of this writing.

This is sensible in idea, besides for 2 issues.

First, the 10-year Treasury yield is at present depressed as a result of buyers suppose we’re in or are about to be in a recession. That is generally expressed by saying that the yield curve is inverted. The development in the direction of an inverted yield curve is represented very nicely on this excellent visualization from Visible Capitalist.

Of us are fleeing to safer investments like 10-year treasuries out of recessionary fears. It’s extremely seemingly that because the financial system begins to get well, the yield curve will normalize, and the 10-year Treasury price will enhance.

Second, the Fed is clearly signaling that they intend to extend charges all year long in 2023. Betting that charges will come down is a guess towards the official stance of the Fed. The one method I see charges coming down and staying down is that if there’s a recession that’s so deep and dangerous that the Fed is pressured to reverse course rapidly.

In different phrases, charges are going to extend for actual property buyers (and anybody else who borrows cash utilizing debt that tracks to the 10-year Treasury) until there’s a horrible recession the place tens of millions of individuals lose their jobs.

So, let’s flip a coin:

If it’s heads (a significant recession), jobs are misplaced, rents decline, and industrial multifamily actual property values decline.

If it’s tails (a brighter financial outlook), rates of interest rise rapidly, and industrial multifamily actual property values decline.

This isn’t a really enjoyable recreation.

Whereas it’s doable that you simply see mortgage charges bounce round and briefly plunge as little as the mid-5s, I’d guess we finish the 12 months with charges even greater than the place they’re right now, once more, until there’s a deep recession.

Aren’t industrial loans totally different than residential loans? Why aren’t we speaking about them particularly?

Whereas there are all kinds of nuances to industrial lending, proper now, most people are more likely to be utilizing Freddie Mac loans to buy small to medium-sized house complexes, the asset class I’m discussing on this article.

If they’ll qualify for a Freddie Mac mortgage, buyers are seemingly to make use of them. Freddie Mac loans are the straightforward button for multifamily buyers as a result of they’ve low rates of interest, 30-year amortization, and 5, seven, or 10-year phrases. Proper now, the rates of interest on a Freddie Mortgage could be south of 5%! It’s the multifamily equal of the traditional loans that tens of millions of actual property buyers and owners use to purchase single-family houses insured by Fannie Mae.

Freddie Mac’s charges are tied to the 10-year Treasury. So, these house loans don’t see the identical rising unfold towards the 10-year be aware that we’re seeing within the residential (typical mortgage) house. That leaves them with much more danger, in my opinion, to rise if the yield curve normalizes in contrast with 30-year Fannie Mae mortgages. It additionally explains why charges are a lot decrease in multifamily than in single-family housing proper now.

Whereas there’s a non-public marketplace for industrial actual property debt that was maybe extra generally used a couple of years in the past, that seems to have dried as much as a big diploma. It’s both a government-sponsored enterprise (GSE) like Fannie Mae or Freddie Mac or bust for many syndicators proper now.

However, the actual distinction between industrial debt and typical single-family debt is the Debt Service Protection Ratio (DSCR). We’ll get into why that is so essential within the subsequent part.

Half 4: Excessive Curiosity Charges Put Stress On Valuations And Debt Underwriting

Industrial debt, together with Freddie Mac Residence Loans, as mentioned earlier, isn’t fairly the identical as typical lending within the single-family residential house. A typical Freddie Mac mortgage, for instance, may need a 30-year amortization schedule, however with a balloon fee — the steadiness comes due after 5, seven, or 10 years. This isn’t a problem for buyers in typical markets. They will merely promote the asset after a couple of years to repay the mortgage or refinance with a brand new mortgage and begin the method over again.

However, as talked about earlier, there may be one other underwriting take a look at with these loans: the Debt Service Protection Ratio. A DSCR is multifamily’s model of a debt-to-income take a look at that many owners must go when qualifying for a house mortgage.

If the money stream of the enterprise or house advanced is precisely equal to the principal and curiosity (the debt service) of a mortgage, then the DSCR can be 1.0. Decrease, and the money stream produced by the enterprise shouldn’t be enough to cowl the mortgage. Larger, and there may be extra money stream.

Freddie Mac Loans sometimes require a DSCR of 1.2 to 1.25.

Industrial debt negotiated between lender and borrower privately, with debt that isn’t backed by a GSE, could have extra strict covenants like greater DSCR ratios or debt covenants that require debtors to take care of a DSCR ratio all through the lifetime of the mortgage.

Whereas Freddie Loans can measurement to as much as 80% LTV, in follow, many get protection constrained in underwriting to 65% to 75%.

In regular markets, this stuff aren’t a problem. However let’s study what occurs when rates of interest rise rapidly like they did this previous 12 months.

Think about an investor purchased a property with a $1,000,000 Freddie Mac Mortgage in late 2021. The mortgage has a 3% rate of interest. The principal and curiosity on 30-year amortization is $4,216 monthly, or $50,592 per 12 months. Quick ahead to right now. This identical mortgage would include a mortgage at 5.5% curiosity. That greater rate of interest would enhance the debt service on a $1M mortgage to $68,136, a rise of 35%.

Now, our investor used a Freddie mortgage (and an estimated two-thirds of the market makes use of fixed-rate debt) and certain gained’t run into actual strain for 5-10 years, relying on their mortgage time period. However, it is very important acknowledge that if that investor have been to reapply for that very same mortgage right now, they seemingly wouldn’t qualify. They’d seemingly need to carry considerably more money to shut the deal (lowering LTV), or else they must pay much less for the property.

Much more problematic, there’s a sector of the market that makes use of variable price debt and different varieties of inventive finance like bridge debt (much like exhausting cash loans) to finance multifamily and different industrial actual property. Based on the Wall Avenue Journal, about one-third of the market makes use of variable rate of interest debt, and a few (unknown) share of that cohort makes use of bridge debt and different non-agency debt.

These debtors will face rising strain to make their funds with greater rates of interest. Going again to our instance from earlier, think about that the property generated $62,500 (5% cap price at acquisition) in NOI with $50,592 in debt service at a 3% curiosity. At the moment, these funds are, once more, $68,136. This fictional borrower is now going to need to cowl the distinction with funds aside from these generated by the property.

Many of those variable-rate loans have price caps in place (usually required by their lenders) that briefly stop rates of interest on their debt from rising too excessive. Nevertheless, the price of renewing these price caps is skyrocketing, by as a lot as 10X, in gentle of rising charges. That is already beginning to put strain on debtors who usually need to put aside funds for this insurance coverage each month.

As I discussed, Ben Miller, CEO of Fundrise, has termed this phenomenon the “Nice Deleveraging” — a flip of phrase that I really feel sums up this drawback very succinctly.

Take heed to his look on On the Market and listen to a few of the examples which can be already hitting the industrial actual property world (beginning with retail and workplace).

Brian Burke says that this drawback has the potential to be acute with growth loans, the place re-margin necessities could drive debtors to pay the mortgage steadiness down if the lease-up isn’t hitting targets.

Is a panic doable?

When operators can’t meet their mortgage covenants, they might default and hand the asset again to the financial institution (a foreclosures). In these conditions, the creditor will liquidate the property, promoting it as quick as doable. Some of us could tout a liquidated property that sells for much under market worth as a “shopping for alternative” — and it might be.

However it additionally units a comp for belongings similar to it. Along with DSCR covenants, multifamily properties are appraised, similar to homes. If value determinations don’t are available, patrons must carry more money to closing.

If strain mounts over 2023, comps for multifamily complexes may very well be pushed decrease and decrease by distressed foreclosures gross sales, making borrowing more durable and more durable in a unfavorable suggestions loop.

Half 5: Information, Anecdotes, And Additional Studying

What I’m discussing right here shouldn’t be information to business insiders. REIT valuations plunged 25% in 2022. Rents are falling in lots of main cities like Minneapolis and Chicago, the place hire costs are down 9% and 4%, respectively, year-over-year.

Landlords are additionally beginning to supply extra “concessions” to renters, within the type of one month’s hire free, or free parking, to entice new tenants. These concessions hit the underside line for house buyers in the identical method that emptiness or decrease itemizing value rents would, however could masks the diploma to which hire declines could also be reported in sure markets.

The institutional purchasers of huge non-public fairness funds have been withdrawing funds to the purpose the place these funds are bumping up towards withdrawal limits for his or her buyers, beginning with probably the most well-known non-traded REIT on this planet: Blackstone.

Brian Burke discusses this subject at size in On the Market’s “The Multifamily Bomb is About to Blow” episode with Dave Meyer. He believes that we’re on the cusp of “repricing” within the sector and that there’s a huge bid/ask unfold between patrons and sellers. The few offers being accomplished, for now, are by 1031 alternate members and those that have raised massive funds and need to deploy these belongings rapidly. These of us are motivated to maneuver quick, and with many sellers holding on for expensive life for now, costs stay elevated.

This gained’t final for much longer. Sellers who have been extremely levered with variable price debt might be pressured out by their DSCR compliance points. And, there might be regular mounting strain for buyers to refinance their balloon debt, strain that can enhance with every passing month as increasingly of the market is pressured to behave by both promoting, refinancing, or bringing vital chunks of money to scale back debt balances and keep away from foreclosures.

Half 6: Concepts To Defend Wealth And Make Cash In This Surroundings

Cap charges are decrease than rates of interest. Lease development and rate of interest reduction are every a coin flip. Stress is mounting on the debt aspect for a large chunk of the market, and underwriting new offers is far more durable finally 12 months’s costs.

This can be a robust surroundings, however there may be nonetheless quite a few methods which will make sense for savvy buyers who nonetheless wish to take part within the multifamily and different actual property sectors. Listed here are a few of the issues I’m contemplating:

Lend

Rates of interest are greater than cap charges. Which means more money stream, no less than within the first 12 months(s), for the lender per greenback invested than the fairness investor, with decrease danger. Let another person take the primary 20-30% of the danger. I’m personally contemplating investing in debt funds that do exhausting cash lending, as I just like the quick–time period nature of these loans and really feel that the single-family market is extra insulated from danger than the multifamily market.

Purchase with zero leverage

In case your objective is really to personal multifamily for the lengthy haul, and near-term danger shouldn’t be one thing that bothers you, contemplate merely not utilizing leverage in any respect, when you have the means. This reduces danger and, once more, as a result of rates of interest are greater than cap charges, will enhance money stream. You’ll be able to all the time refinance in a couple of years if you wish to put extra capital to work.

Wait and watch

That is timing the market and isn’t my fashion. However, should you consider this evaluation, we may see costs shift significantly in 2023. Sitting on money for 6-12 months may put some savvy patrons ready to accumulate belongings at an important cut price, particularly if a panic drives the cap price very, very excessive.

Overview the phrases of any investments you’re in

Some syndicators have the correct to make capital calls. If a DSCR covenant is damaged on a deal, the syndicator could have very unattractive choices of promoting at an enormous loss, getting foreclosed on, or bringing an enormous pile of money to the desk to stop foreclosures.

The phrases of your syndication funding could enable the syndicator to require buyers to place in further capital or danger dilution of their shares. Whereas the ability is probably going within the sponsor’s arms, it’s no less than inside your management to grasp if this can be a risk in your deal or not and to arrange your money place accordingly. Don’t be blindsided.

Carry a wholesome skepticism to any new investments

I’m clearly skeptical of the market in a systemic method, but when offered with a particular deal that was capable of intrigue me sufficient to take a re-assessment, I’d wish to ensure that the deal made sense even with a major rise in cap charges.

I’d be skeptical about claims of “value-add” (each deal marketed by each sponsor is “value-add”) or that the property is a “nice deal” (what sponsor goes to let you know that the deal shouldn’t be an important one?). My curiosity would even be piqued if a sponsor dedicated a major quantity of their very own capital – one thing significant within the context of their web value. ). I’d wish to really feel assured that their very own hard-earned capital was in danger, alongside mine, not simply that they’ve the chance to earn upside from acquisition charges, administration charges, and carried curiosity.

Take a brief place on … one thing?

I’m wondering if there are any public REITs which can be significantly uncovered to the dangers outlined right here. A fabric quantity of analysis may reveal portfolios which can be significantly concentrated in markets with low cap charges, huge provide danger, and with a excessive share of variable price debt or who might be seeing skyrocketing price cap prices. If anybody decides to go digging right here, I’d be very excited about speaking via your findings.

Conclusion

This was a protracted article. If you happen to made it this far, thanks for studying!

As I discussed within the introduction, I contemplate myself between an novice to journeyman in understanding the world of economic actual property and huge multifamily.

Nevertheless, what I’m able to comprehend makes me fearful for valuations. I really feel like there are various dangers right here, and I plan to be very conservative in 2023. Nevertheless, I could purchase one other single-family rental or perhaps a small multifamily property like a duplex, triplex, or quadplex, as I love to do each 12-18 months.

I hope that, on the very least, this text helps buyers make extra knowledgeable choices if they’re exploring multifamily funding alternatives and do only a bit extra due diligence.

And once more, I’m nonetheless on the lookout for somebody with a bull case for multifamily. In case you are studying this, please remark under or electronic mail me at [email protected]. I’d love to listen to your take.

New! The State of Actual Property Investing 2023

After years of unprecedented development, the housing market has shifted course and has entered a correction. Now could be your time to take benefit. Obtain the 2023 State of Actual Property Investing report written by Dave Meyer, to search out out which methods and techniques will revenue in 2023.

Be aware By BiggerPockets: These are opinions written by the creator and don’t essentially symbolize the opinions of BiggerPockets.

[ad_2]