[ad_1]

The temporary’s key findings are:

- The Nationwide Retirement Danger Index captures the share of working-age households that would fall brief in retirement.

- Latest upgrades to the Index enable for extra correct measurement and evaluation.

- The retooled Index confirms earlier findings: half of households won’t be able to take care of their lifestyle after they retire.

Introduction

The Nationwide Retirement Danger Index (NRRI) measures the share of working-age households that’s “at-risk” of being unable to take care of their pre-retirement lifestyle in retirement. The train entails evaluating households’ projected alternative charges – retirement earnings as a share of pre-retirement earnings – with goal charges that might enable them to take care of their residing commonplace. The important thing discovering is that roughly half of the nation’s working-age households are prone to falling brief even when they work to age 65 and annuitize all their belongings. This result’s secure over time, with some ups and downs reflecting financial and market fluctuations.

Since its inception, the Heart has periodically made modest adjustments to the NRRI. Lately, nevertheless, we undertook a serious overhaul to include new analysis findings and methodological advances. To take care of transparency of the NRRI, this temporary summarizes the adjustments and presents outcomes for the recalculated Index.

The dialogue proceeds as follows. The primary part describes the nuts and bolts of the NRRI. The second part paperwork the key enhancements within the NRRI’s underlying methodology. The third part presents the primary outcomes, that are typically in line with these from earlier NRRI publications. The ultimate part concludes that retirement readiness stays a serious problem for a lot of of at this time’s working-age households; they should save extra and/or work longer to enhance their prospects for a safe retirement.

Nuts and Bolts of the NRRI

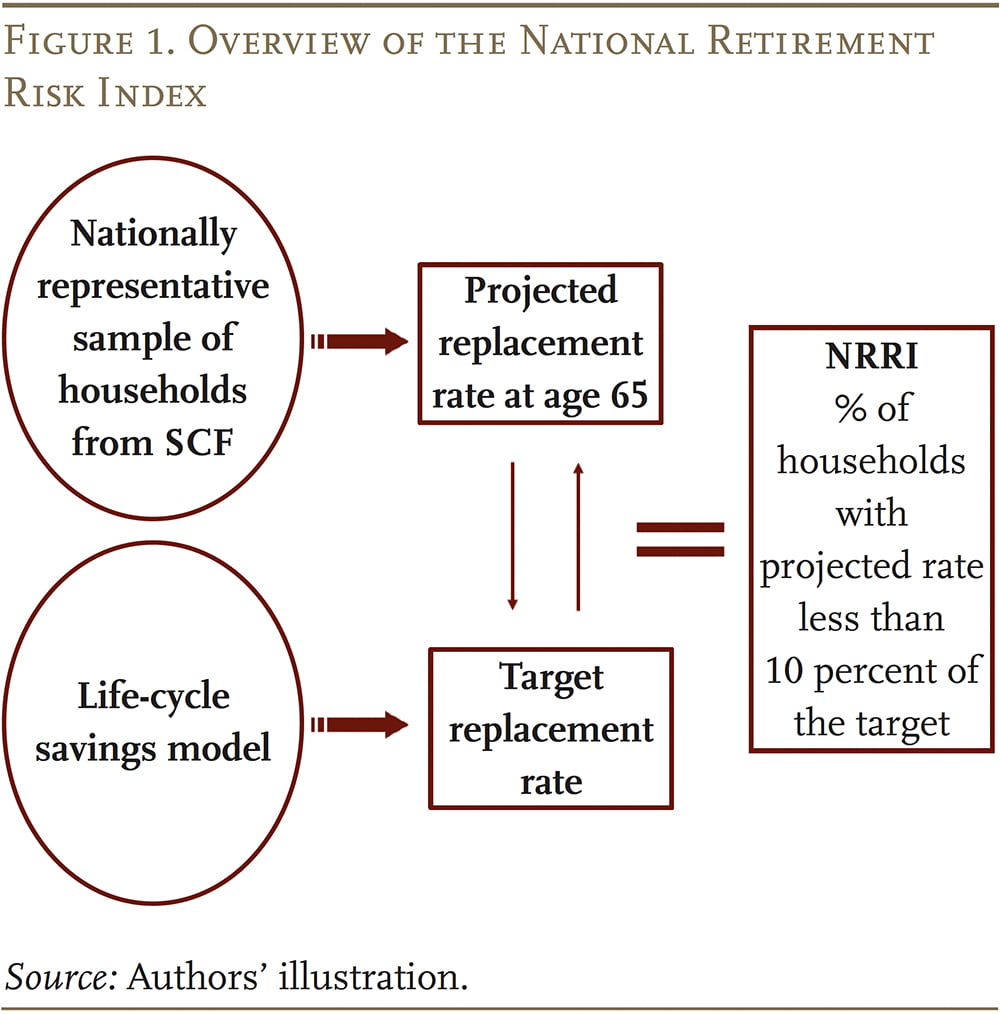

The NRRI is constructed with information from the Federal Reserve’s Survey of Shopper Funds (SCF), a triennial nationally consultant family survey. Calculating the NRRI entails three steps: 1) projecting a alternative charge – retirement earnings as a share of pre-retirement earnings – for every SCF family ages 30-59; 2) developing a goal alternative charge that might enable every family to take care of its pre-retirement lifestyle in retirement; and three) evaluating the projected and goal charges to search out the proportion of households “in danger” (see Determine 1 ).

Projecting Family Substitute Charges

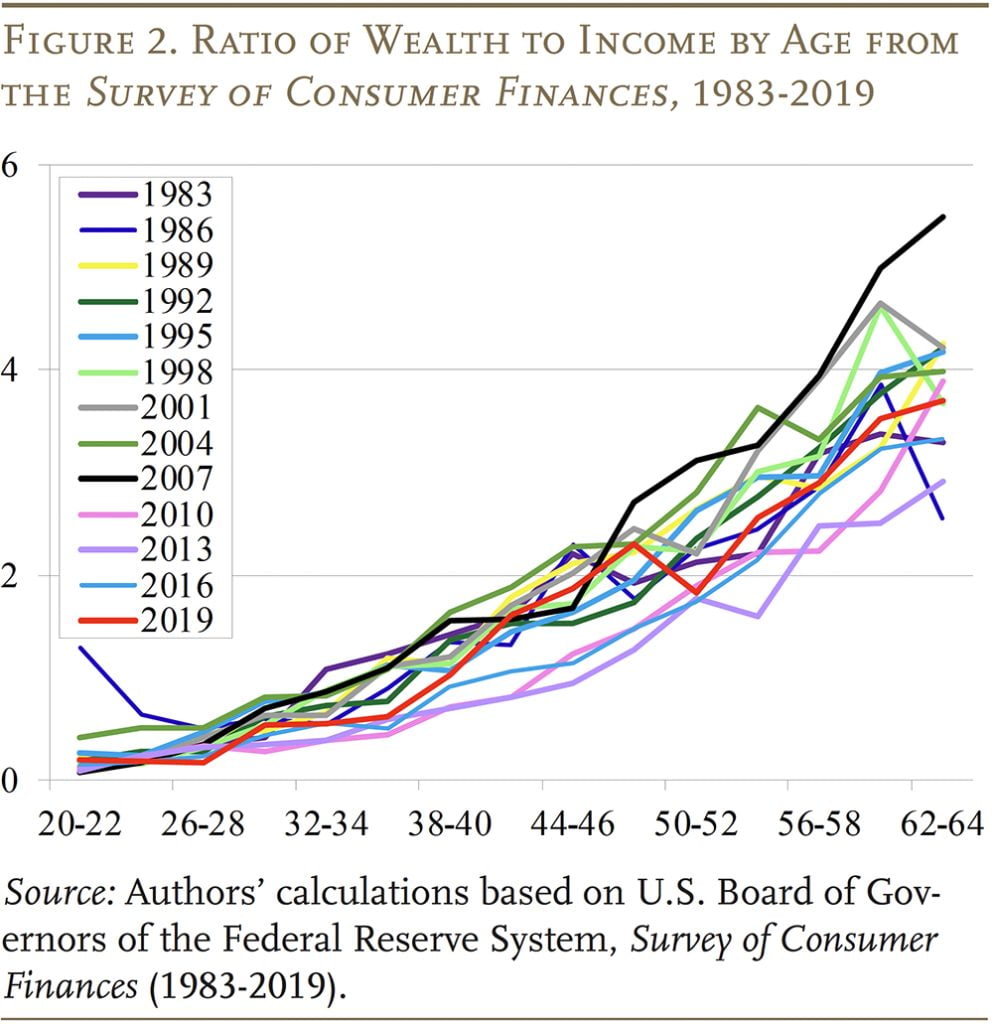

The alternative charge calculation begins with a projection of retirement earnings at age 65. This measure is outlined broadly to incorporate earnings from Social Safety, outlined profit (DB) plans; monetary belongings each in outlined contribution (DC) plans and saved immediately; and housing, which incorporates imputed lease in addition to dwelling fairness. The asset values for the latter three elements – DC belongings, non-DC monetary belongings, and housing fairness – are derived from reported wealth within the SCF. They’re every projected individually to age 65 based mostly on their respective wealth-to-income ratios by age, that are secure over time. As proven in Determine 2, the general wealth-to-income ratios from the 1983-2019 SCF surveys relaxation roughly on high of each other, bracketed by 2007 values on the excessive facet and 2013 values on the low facet.

The NRRI then assumes that households convert all their belongings, together with monetary belongings, 401(ok)/IRA balances, and proceeds from a reverse mortgage, right into a stream of earnings by buying an inflation-indexed annuity.

Sources of retirement earnings that aren’t derived from reported wealth within the SCF are estimated immediately. Particularly, Social Safety advantages are calculated based mostly on estimated earnings histories for every member of the family, listed to nationwide common wage progress. DB pension earnings relies on the quantity reported by survey respondents.

The remaining step is to calculate common lifetime earnings previous to retirement. Pre-retirement earnings for owners consists of earnings and imputed lease from housing. Common lifetime earnings (with earnings, once more, listed to common wage progress) then serves because the denominator for every family’s alternative charge. This measure excludes earnings from belongings.

Estimating Goal Substitute Charges

To find out the share of the inhabitants that might be in danger requires evaluating projected alternative charges with a benchmark charge. A generally used benchmark is the alternative charge wanted for households to take care of their pre-retirement lifestyle in retirement. Folks usually want lower than their full pre-retirement earnings since they often pay much less in taxes, now not want to save lots of for retirement, and infrequently have paid off their mortgage. Thus, a larger share of their earnings is obtainable for spending. The Index estimates the goal alternative charges for several types of households utilizing a consumption-smoothing mannequin, which relies on the idea that households need the identical stage of consumption in retirement as they’d earlier than they retired.

Calculating the Index

The ultimate step is to check every family’s projected alternative charge with the goal from the consumption-smoothing mannequin. These whose projected alternative charges fall greater than 10 % beneath the goal are deemed to be prone to having inadequate earnings to take care of their pre-retirement lifestyle. The Index is solely the proportion of all working-age households that fall greater than 10 % in need of their targets.

Main Enhancements

Though the general modeling framework described above stays unchanged, the up to date NRRI consists of the next main enhancements.

Tasks retirement earnings extra precisely. The largest change to the NRRI is modifying the projection of wealth-to-income ratios for every family to extra precisely mirror the wealth distributions noticed within the information. The earlier projection methodology was based mostly on the imply wealth progress paths estimated by a linear regression method. A downside to this method is that, given rising wealth inequality, the outcomes are more and more biased towards the buildup paths of richer households. Thus, the outdated methodology tended to overestimate the wealth of middle- and lower-income households. In distinction, the brand new methodology initiatives wealth based mostly on median values, which makes the wealth projections at retirement higher mirror the noticed distributions.

Higher displays the shift from DB to DC plans. The rising share of staff coated by DC plans because the Nineteen Eighties implies that the extent and sample of DC asset accumulation differs throughout beginning cohorts. To account for these variations, the brand new methodology initiatives DC belongings individually for 3 broad cohorts: 1) staff born earlier than 1945, who had been no less than midway into their careers when protection underneath DC plans started to broaden in 1980; 2) staff born from 1945-1955, who had been early of their careers in the course of the transition to DC plans; and three) staff born after 1955, whose careers principally fall within the years when DC plans had been already prevalent.

Fashions monetary debt individually. The unique wealth projection methodology subtracts households’ non-mortgage money owed from their monetary belongings and initiatives the ensuing internet monetary belongings as a single variable. Analyses of earlier NRRI outcomes counsel that the dynamics of economic debt could be of curiosity on their very own. For instance, middle-age and middle-income households noticed very restricted enhancements in retirement preparedness in 2016 partly because of elevated non-mortgage borrowing. The brand new methodology now initiatives monetary belongings and non-mortgage debt individually, permitting for extra in-depth evaluation in addition to counterfactual evaluation specializing in borrowing.

Refines the goal alternative charge mannequin. Within the authentic methodology, goal alternative charges had been calculated and matched to noticed households within the SCF in an approximate method: targets had been calculated for 12 family classes decided by 4 family sorts (single male, single feminine, married with two earners, and married with one earner) and three earnings teams, after which assigned to noticed households utilizing these traits. Underneath the brand new methodology, a lot richer family traits are used for calculating goal charges, permitting the projected alternative charges to be matched to a whole bunch of targets, which yields extra correct estimates. Particularly, matching is now based mostly on rather more fine-grained earnings teams and households’ precise DB protection and homeownership standing.

Incorporates the Earned Revenue Tax Credit score (EITC) in alternative charges. The outdated methodology didn’t embody the EITC within the calculation of pre-retirement earnings. Nonetheless, the EITC is necessary for low-income households throughout their working years, so the brand new methodology consists of it to raised seize the earnings these households might want to exchange in retirement.

Different adjustments embody:

- Annuity elements used to annuitize projected wealth now higher mirror the degrees and tendencies noticed within the annuity market.

- Reverse mortgage calculations now use up to date rate of interest assumptions and principal restrict issue tables.

- Key mannequin assumptions and inputs, corresponding to wage progress, rates of interest, inflation, and mortality tables are up to date.

- The NRRI codebase has been largely moved from Stata and Excel spreadsheets to Python, permitting for extra versatile mannequin improvement, improved computation, and simpler upkeep.

The New Nationwide Retirement Danger Index

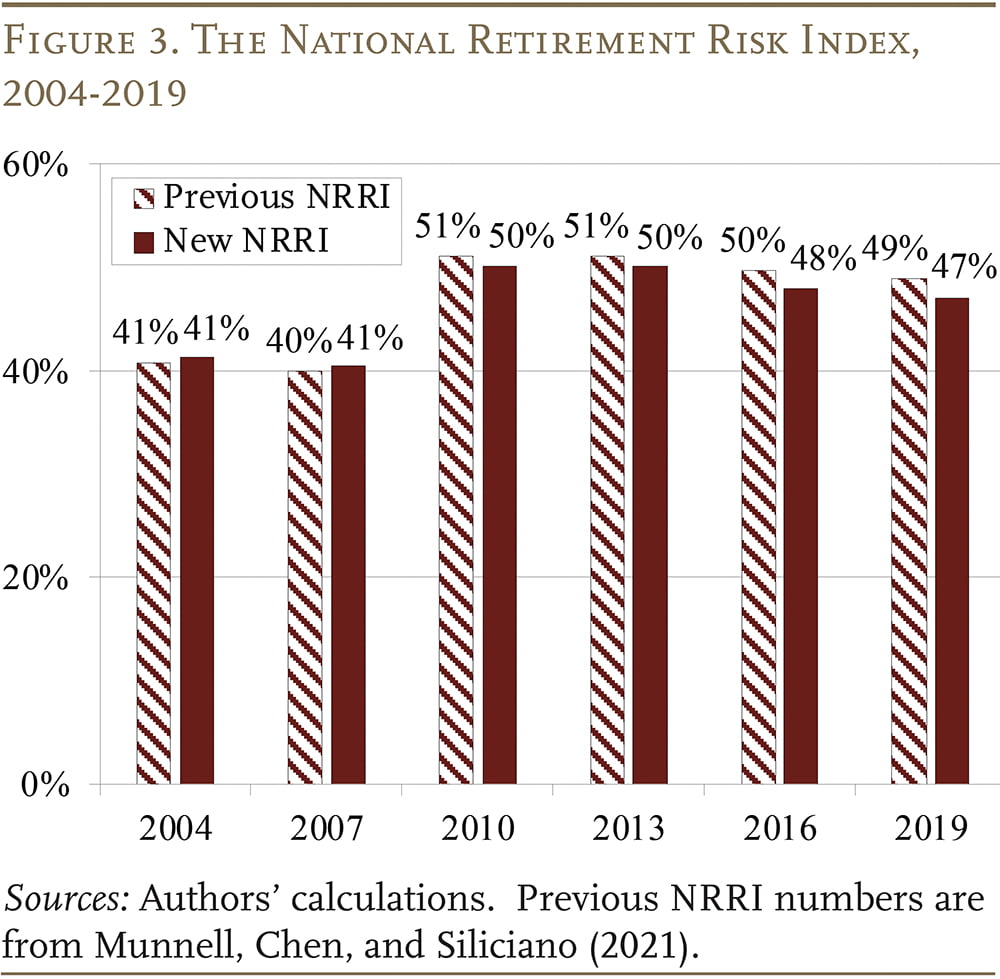

Regardless of the intensive adjustments in methodology, the general stage and time sample of the Index stay the identical as earlier than (see Determine 3). Thus, an important discovering nonetheless holds: about half of working-age households won’t be able to take care of their pre-retirement residing commonplace. Furthermore, the sample continues to mirror the well being of the economic system. The Index elevated considerably from 2007 to 2010 in the course of the Nice Recession, after which declined a bit from 2013 to 2019 because the economic system loved low unemployment, rising wages, robust inventory market progress, and rising housing costs. These enhancements had been modest because of some countervailing longer-term tendencies – such because the gradual rise in Social Safety’s Full Retirement Age (FRA) and the continued decline of rates of interest – which made it tougher for households to realize retirement readiness.

Patterns by Family Sort

Along with the time sample, the NRRI patterns by age, earnings, and wealth are additionally typically in line with our earlier publications.

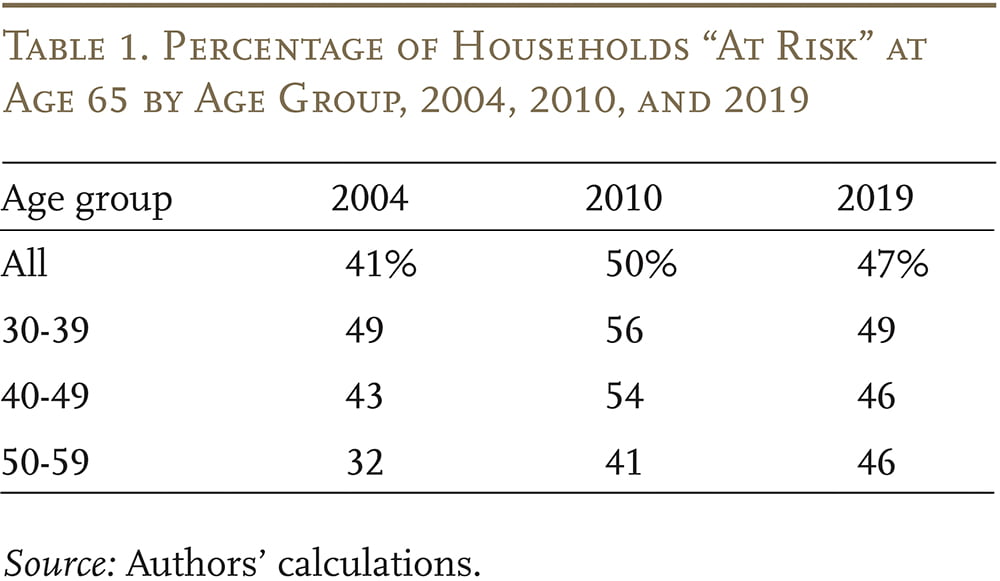

Age. The NRRI in 2004 exhibits a big discrepancy in retirement readiness by age group, which displays the dramatic adjustments within the retirement panorama such because the shift of pension protection from DB to DC plans, rising life expectancy, and the rise within the FRA (see Desk 1). Because the tendencies for these underlying elements stabilized over time and their impression absolutely materialized, the age discrepancy within the NRRI has narrowed.

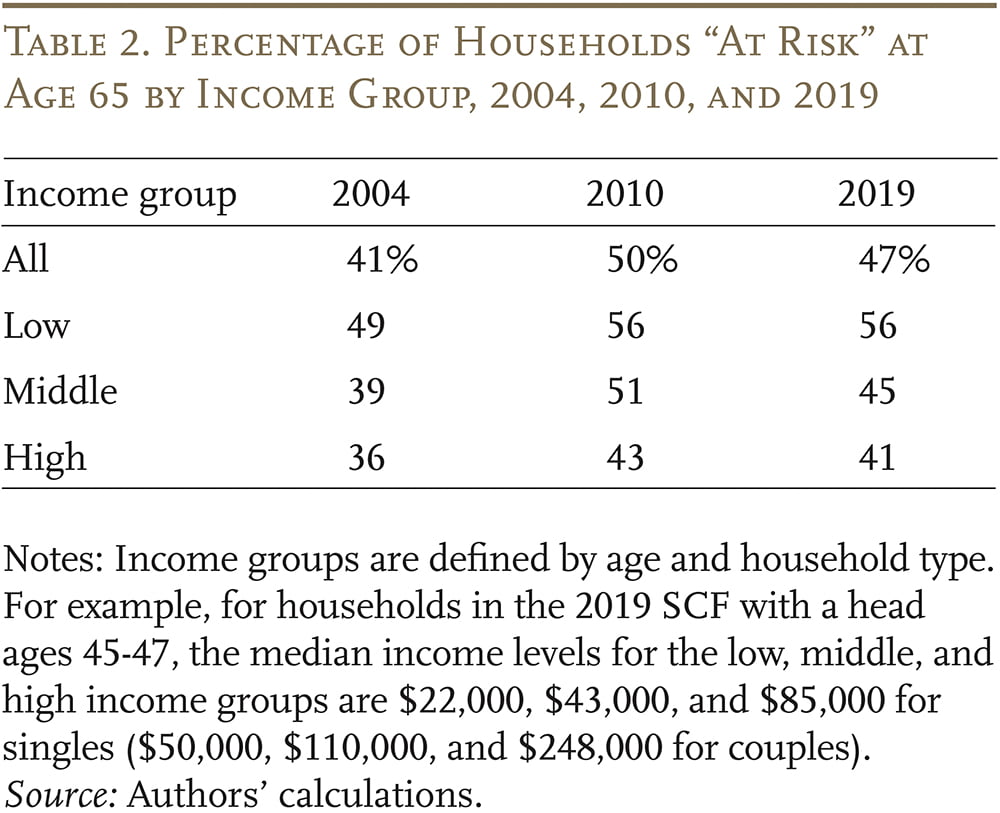

Revenue. Households’ retirement preparedness in all earnings teams was closely affected by the Nice Recession (see Desk 2). The center and the very best thirds noticed vital enchancment from 2010-2019 because of rebounding housing and fairness costs. In distinction, households within the backside third noticed just about no enchancment as they’re much less more likely to personal a home and take part in DC plans, and have few monetary belongings. As well as, the rise in wage progress for lower-income staff, which is nice information typically because it improves their present lifestyle, results in decrease projected Social Safety alternative charges as a result of progressive profit system. The rise within the FRA additionally has a very giant impression on low-income households, who rely virtually completely on Social Safety for retirement earnings.

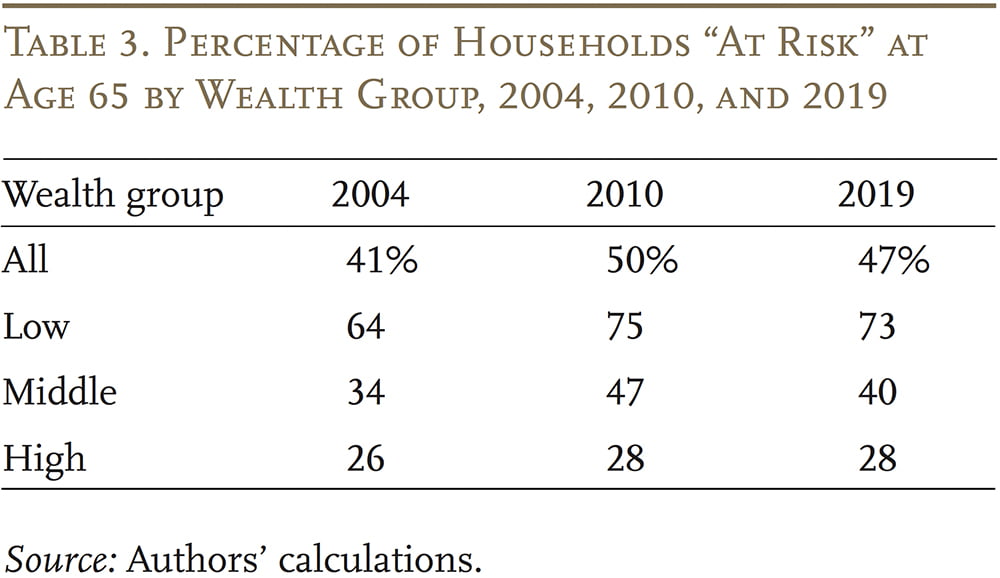

Wealth. When considered by wealth, households’ retirement preparedness typically exhibits the same sample. The discrepancy between the highest and backside wealth teams, although, is far bigger than these by earnings (see Desk 3), reflecting the truth that wealth inequality is extra extreme than earnings inequality.

Conclusion

Since its inception, the NRRI methodology has obtained many enhancements and updates, which improve the projections of households’ wealth and alternative charges at retirement and the estimations of the goal alternative charges. With the newest upgrades, the NRRI can extra precisely measure the retirement preparedness of working-age households and consider the impression of financial and coverage elements on retirement safety.

After recalculating the NRRI utilizing probably the most up to date methodology, the underside line from our earlier research nonetheless holds: about half of at this time’s households is not going to have sufficient retirement earnings to take care of their pre-retirement lifestyle, even when they work to age 65 and annuitize all their monetary belongings, together with the receipts from a reverse mortgage on their houses. The robustness of the outcomes confirms the retirement saving challenge confronted by at this time’s working-age households, and that we have to repair our retirement system in order that employer plan protection is common. Solely with steady protection will staff be capable to accumulate ample assets to take care of their lifestyle in retirement.

References

Chen, Anqi, Wenliang Hou, and Alicia H. Munnell. 2020. “Why Do Late Boomers Have So Little Retirement Wealth?” Subject in Temporary 20-4. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

Munnell, Alicia H., Anthony Webb, and Luke Delorme. 2006. “Retirements at Danger: A New Nationwide Retirement Danger Index.” Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

Munnell, Alicia H., Anqi Chen, and Robert L. Siliciano. 2021. “The Nationwide Retirement Danger Index: An Replace from the 2019 SCF.” Subject in Temporary 21-2. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

Munnell, Alicia H., Wenliang Hou, and Geoffrey T Sanzenbacher. 2018. “Nationwide Retirement Danger Index Reveals Modest Enchancment in 2016.” Subject in Temporary 18-1. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

U.S. Financial institution of Governors of the Federal Reserve System. Survey of Shopper Funds, 1983-2019. Washington, DC.

[ad_2]