[ad_1]

The temporary’s key findings are:

- Grandparents elevating grandchildren are sometimes beneath monetary stress however – with out authorized custody – are inclined to get little formal help.

- Importantly, Social Safety little one advantages are solely obtainable to those that are authorized dependents of Social Safety beneficiaries.

- In distinction, the IRS does not require authorized custody to assert a baby as a dependent for tax functions.

- The evaluation estimates the impression of aligning Social Safety’s guidelines with the IRS standards on grandparent caregivers.

- The outcomes present that this modification would considerably enhance the incomes of half of all grandparent caregiver households.

Introduction

Round two million grandparents are answerable for the essential wants of their grandchildren, with such caregiving concentrated in traditionally deprived communities. Whereas these grandparent caregivers are sometimes beneath nice monetary strain, they’re typically ineligible for formal help as a result of they elevate their grandchildren outdoors of the foster care system with out taking authorized custody. In consequence, they usually don’t obtain the subsidies supplied for foster dad and mom, housing help, or Social Safety little one advantages.

This temporary, based mostly on a current paper, explores the financial standing of grandparent caregivers by specializing in two questions: 1) To what extent do grandparent caregivers differ from extra typical grandparents when it comes to financial sources? and a couple of) How would their funds enhance in the event that they have been eligible for Social Safety little one advantages?

The dialogue proceeds as follows. The primary part offers background on the sources of help at present obtainable to grandparent caregivers. The second part describes the information and methodology for the evaluation. The third part presents the outcomes. The ultimate part concludes that increasing eligibility for Social Safety little one advantages may very well be an essential software to enhance the well-being of grandparent caregivers who’ve already claimed their very own advantages.

Background

Grandparents usually turn out to be caregivers to grandchildren after an grownup little one is not obtainable on account of dying, incarceration, or substance abuse. The calls for of elevating grandchildren can drain financial savings, whereas time-consuming caregiving tasks create obstacles to working longer and should pressure grandparents to retire early. Unsurprisingly, given these circumstances, grandparent caregivers are significantly susceptible financially.

Most grandparent caregivers obtain little formal help as a result of they don’t legally undertake their grandchildren. With out authorized custody, they’re usually not eligible for state advantages, corresponding to subsidies for foster dad and mom, housing help, and counseling. Grandparents with low incomes can apply for child-only advantages supplied by the Short-term Help for Needy Households (TANF) program. Nevertheless, doing so requires grandparents to assign to the state their rights to little one help funds from non-custodial dad and mom..

One other supply of presidency help – Social Safety little one advantages – is out there solely to authorized dependents of Social Safety beneficiaries. Thus, kids can obtain advantages as a dependent of a grandparent beneficiary if: 1) they aren’t already receiving survivor or little one advantages via a dad or mum; 2) the grandparent formally adopts them; and three) the grandparent offers at the very least half of their help. Nevertheless, only a few grandparent caregiver households declare Social Safety little one advantages, probably as a result of adoption requirement.

The one federal help for grandparents who don’t undertake their grandchildren comes from private earnings tax preferences for dependents. The Inner Income Service (IRS) permits grandparents who file taxes to assert their grandchildren as dependents if the youngsters dwell within the family for at the very least half the 12 months and the grandparents present at the very least half their help, so authorized custody just isn’t required.

The final lack of help for grandparent caregivers mixed with the large monetary pressure of child-rearing has sparked coverage curiosity in serving to this group. Therefore, the objective of this research is to evaluate how Social Safety little one advantages may enhance the monetary well-being of grandparent caregivers if the guardianship requirement have been loosened to be on par with the IRS standards for claiming a dependent grandchild.

Information and Methodology

This research makes use of the Well being and Retirement Examine (HRS) linked with the U.S. Social Safety Administration’s earnings knowledge and Grasp Beneficiary File (MBR) to establish grandparent caregivers, assess their monetary well-being, and calculate potential Social Safety little one advantages beneath relaxed eligibility necessities. The HRS comprises wealthy data on caregiving, family funds, and Social Safety advantages for households over age 50.

The evaluation proceeds in two levels. The primary stage identifies grandparent caregivers within the HRS and compares their monetary well-being to extra typical grandparents. Particularly, we outline caregivers as those that report “elevating” a grandchild residing within the family and establish 1,465 such households within the HRS pattern between 2002 and 2020. Our pattern of non-caregivers comprises 14,575 grandparent households. We consider monetary well-being by evaluating the monetary wealth, retirement plan wealth, and Social Safety wealth of grandparent caregivers to non-caregivers. All through, we deal with traditionally deprived teams, as a result of older Black and Hispanic households usually tend to find yourself caring for his or her grandchildren.

The second stage of the evaluation examines how increasing entry to Social Safety little one advantages would enhance the well-being of grandparent caregivers. We begin by inspecting the share of caregiver households that may be eligible for little one advantages beneath looser eligibility standards. Then, we estimate the quantity of kid advantages that newly eligible households would obtain beneath expanded entry, utilizing linked administrative knowledge on claiming and profit quantities. The kid advantages would equal 50 p.c of the highest-earning grandparent’s Main Insurance coverage Quantity, capped at a household most. Lastly, we estimate how the family’s substitute fee – retirement earnings relative to pre-retirement earnings – modifications ought to the family achieve entry to little one advantages.

Outcomes

This dialogue begins with an summary of the traits of the grandparent caregiver inhabitants. It then turns to how expanded eligibility for Social Safety little one advantages may assist.

Who Are the Grandparent Caregivers?

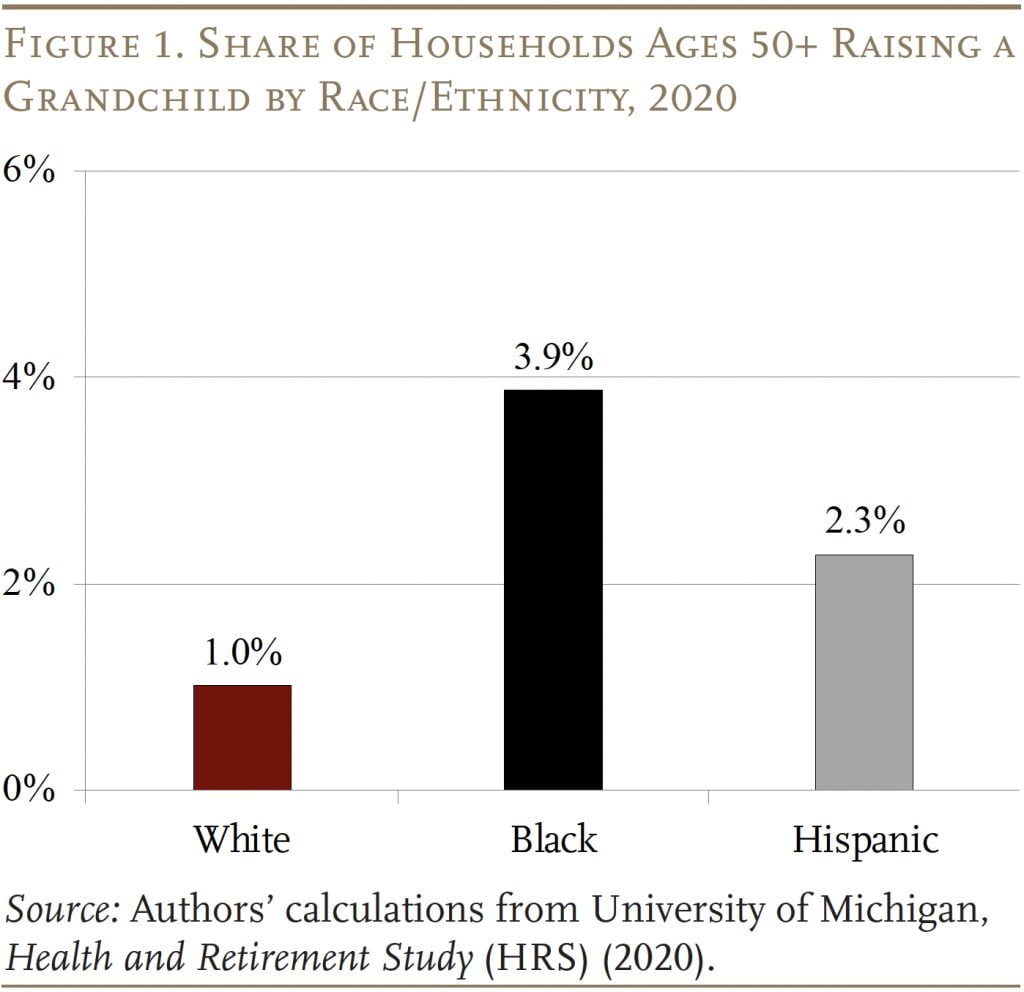

According to prior literature, we discover that grandparents of coloration, significantly Black grandparents, usually tend to turn out to be caregivers. In 2020, solely round 1 p.c of White households over age 50 reported elevating a grandchild, in comparison with 4 p.c of Black and a couple of p.c of Hispanic households, respectively (see Determine 1). In comparison with typical grandparents, caregivers are additionally much less prone to have a university diploma and extra prone to be single ladies.

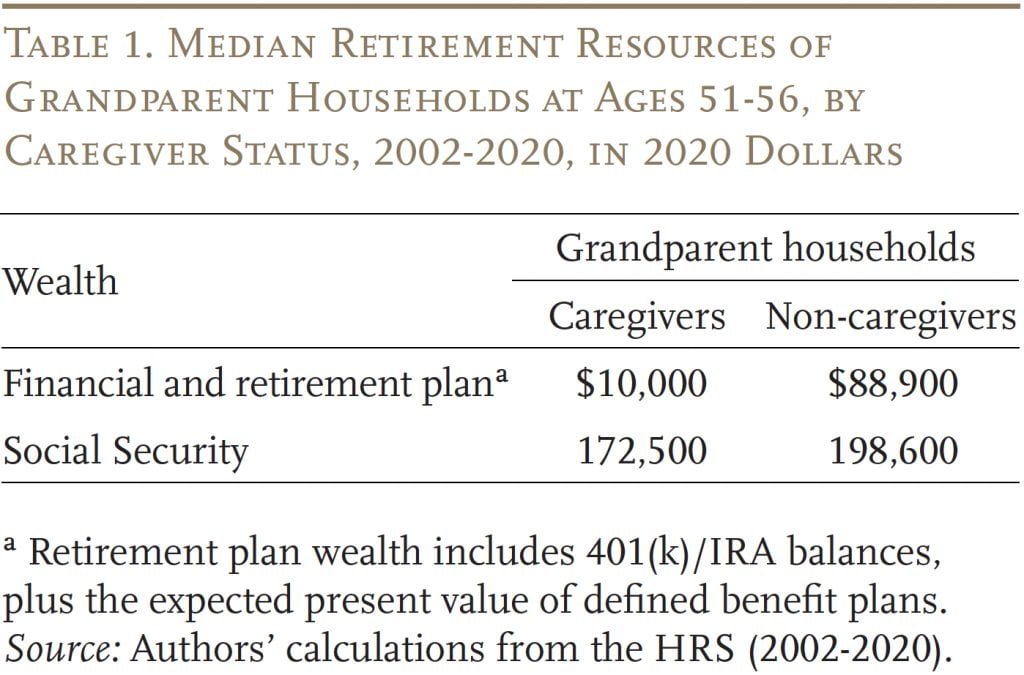

Not surprisingly, grandparent caregivers have considerably fewer financial sources previous to retirement in comparison with non-caregivers. Whereas the median non-caregiver family has $89,000 in monetary and retirement accounts, the median caregiver has simply $10,000 (see Desk 1). Thankfully, Social Safety is a superb equalizer, offering practically as a lot in retirement wealth for caregivers as for non-caregivers.

How A lot Can Increasing Entry to Baby Advantages Assist?

We subsequent flip to our thought experiment: how aligning the eligibility standards for Social Safety little one advantages with the IRS standards for claiming a dependent grandchild would enhance the family’s monetary well-being. Even beneath the extra lenient IRS standards, caregiver households would nonetheless solely be eligible for little one advantages as soon as the grandparents have themselves claimed retirement or incapacity advantages. So, step one is to find out the timing and period of caregiving to see the way it aligns with profit receipt.

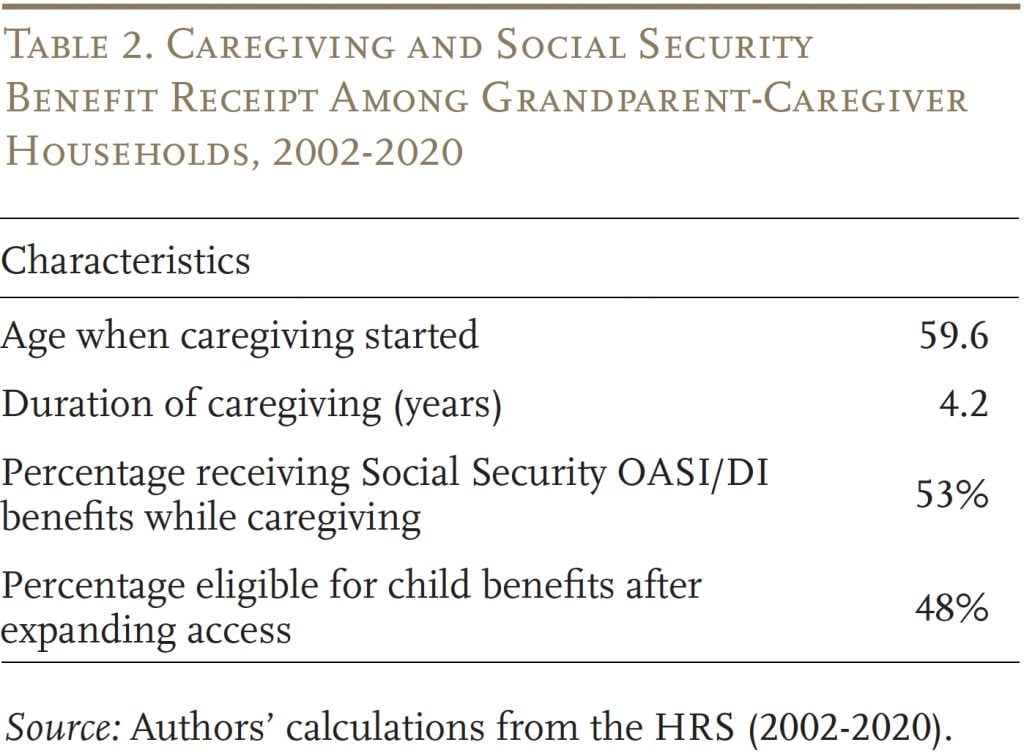

A typical grandparent caregiver raises their grandchildren for 4 years, starting round age 60 (see Desk 2). Though many of those grandparents are nonetheless comparatively younger, greater than 50 p.c obtain Social Safety advantages whereas caring for his or her grandchildren – both as a result of they declare retirement advantages early or are receiving incapacity advantages. Since few beneficiary households have grandchildren who’re already receiving Social Safety advantages via a dad or mum, near half of grandparent caregiver households would qualify for little one advantages if the eligibility standards have been aligned with the IRS guidelines. The share of eligible households is even increased amongst Black and Hispanic caregivers.

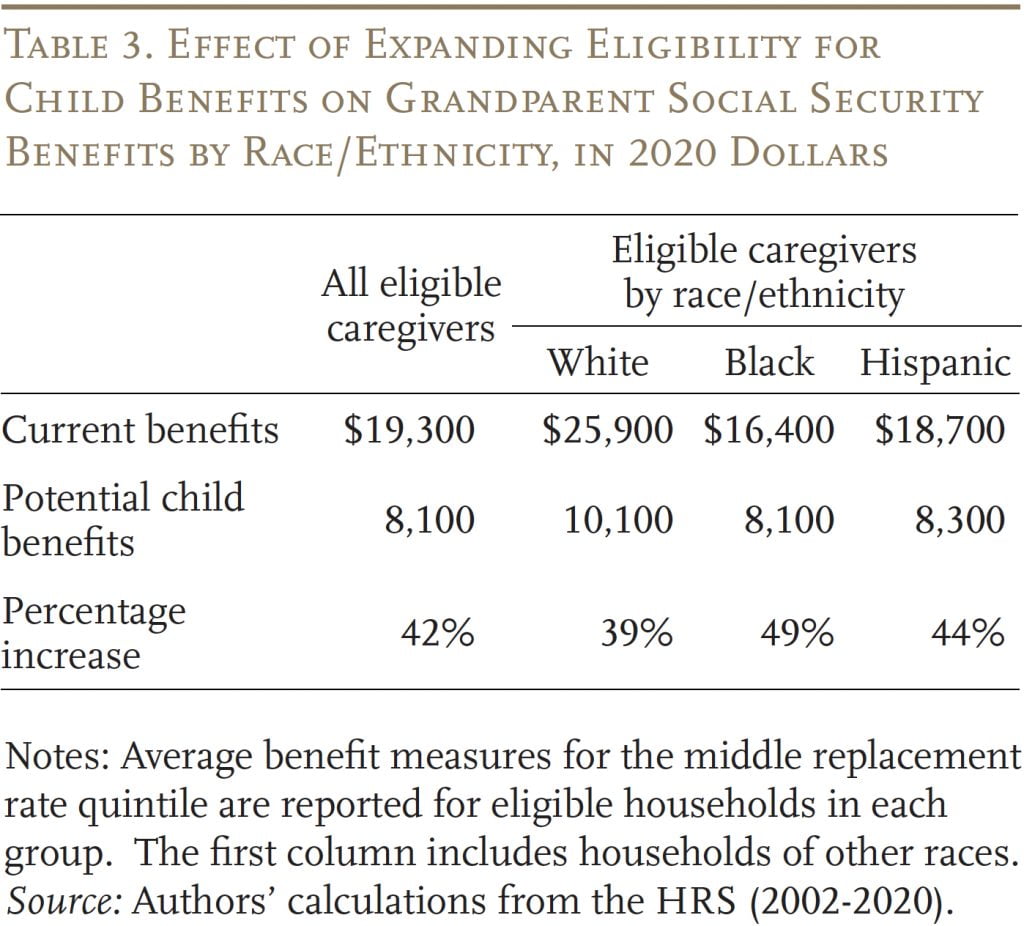

The subsequent step is to find out how a lot grandparent caregivers would get if their family have been eligible for little one advantages beneath the extra expansive eligibility standards. The quantities grow to be substantial – the standard eligible family would obtain $8,100 in little one advantages on high of their present annual advantages of $19,300 (see Desk 3). Whereas Black and Hispanic caregivers would obtain decrease greenback quantities than White caregivers, each teams would take pleasure in a better share improve in annual advantages.

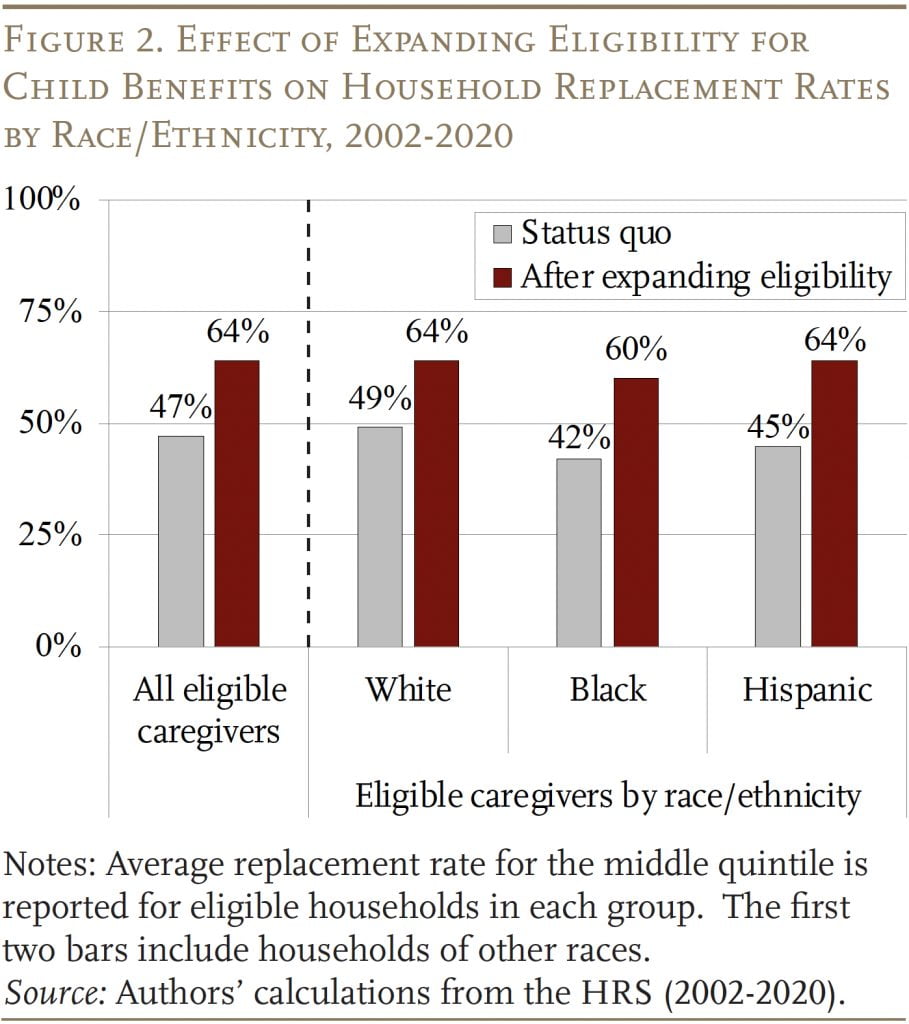

The extra earnings from expanded little one advantages would notably enhance households’ substitute charges (see Determine 2). The everyday caregiver’s substitute fee would rise from 47 p.c to 64 p.c. Once more, Black and Hispanic households would see larger enhancements than White households, as they might expertise will increase of 18 and 19 share factors, respectively.

Conclusion

Grandparents who elevate grandchildren are disproportionately Black and Hispanic, and have virtually no private financial savings. Regardless of being extra susceptible to monetary insecurity, most of those caregivers obtain little formal help as a result of they don’t have authorized custody of the grandchildren of their care.

To cut back the monetary pressure of grandparent caregiving, Social Safety little one advantages may very well be a precious software. The obvious strategy can be to substitute the present IRS necessities for the SSA’s present requirement of adoption. Round half of caregiver households would profit from expanded entry to those advantages, and substitute charges for these affected are estimated to extend by 17 share factors, on common. Notably, Black and Hispanic households would take pleasure in a considerable improve in earnings.

An essential caveat is {that a} significant share of grandparent caregivers would nonetheless not be helped by such a coverage change as a result of they haven’t but retired and claimed their very own Social Safety advantages. Consequently, Social Safety little one advantages can finest be considered as a complement to different current types of help.

References

Advisory Council to Help Grandparents Elevating Grandchildren. 2021. “Supporting Grandparents Elevating Grandchildren (SGRG) Act, Preliminary Report back to Congress.” Washington, DC.

Baker, Lindsey A., M. Silverstein, and N. M. Putney. 2008. “Grandparents Elevating Grandchildren in america: Altering Household Kinds, Stagnant Social Insurance policies.” Journal of Social Coverage 7: 53-69.

Chen, Anqi, Alicia H. Munnell, and Laura D. Quinby. 2023. “Why Do Late Boomers Have So Little Wealth and How Will Early Gen-Xers Fare?” Working Paper 2023-6. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

Fuller-Thomson, Esme, Meredith Minkler, and Diane Driver. 1997. “A Profile of Grandparents Elevating Grandchildren in america.” The Gerontologist 37(3): 406-411.

Hadfield, J. C. 2014. “The Well being of Grandparents Elevating Grandchildren: A Literature Evaluate.” Journal of Gerontological Nursing 40: 32-42.

Inner Income Service. 2015. “Income Process 2015-53.” Washington, DC.

Liu, Siyan and Laura D. Quinby. 2023. “How Can Social Safety Kids’s Advantages Assist Grandparents Elevate Grandchildren?” Working Paper 2023-9. Chestnut Hill, MA: Heart for Retirement Analysis at Boston Faculty.

Munnell, Alicia H., Abigail N. Walters, Anek Belbase, and Wenliang Hou. 2020. “Are Homeownership Patterns Steady Sufficient to Faucet Dwelling Fairness?” The Journal of the Economics of Ageing 17: 100277.

Murray, Julie, Jennifer Ehrle Macomber, and Rob Geen. 2004. “Estimating Monetary Help for Kinship Caregivers.” Washington, DC: City Institute.

Radel, Laura, Matthew Bramlett, Kirby Chow, and Annette Waters. 2016. “Kids Dwelling Aside from Their Mother and father: Highlights from the Nationwide Survey of Kids in Nonparental Care.” Washington, DC: U.S. Division of Well being and Human Companies, Workplace of the Assistant Secretary for Planning and Analysis.

Thompson Gina A., Diana Azevedo-McCaffrey, and Da’Shon Carr. 2023. “Will increase in TANF Money Profit Ranges Are Important to Assist Households Meet Rising Prices.” Coverage Temporary. Washington, DC: Heart on Finances and Coverage Priorities.

College of Michigan. Well being and Retirement Examine, 2022. Respondent Cross-12 months Advantages Restricted Dataset. Produced and distributed by the College of Michigan with funding from the Nationwide Institute on Getting older (Grant Quantity NIA U01AG009740). Ann Arbor, MI.

U.S. Division of Well being and Human Companies. 2022. “Traits and Monetary Circumstances of TANF Recipients Fiscal 12 months (FY) 2019.” Washington, DC.

U.S. Authorities Accountability Workplace. 2020. “HHS Might Improve Help for Grandparents and Different Relative Caregivers.” Washington, DC.

Venti, Steven F. and David A. Smart. 2004. “Getting older and Housing Fairness: One other Look.” In Views on the Economics of Getting older, edited by David A. Smart, 127-180. Chicago, IL: College of Chicago Press.

[ad_2]