[ad_1]

The US inventory market closed the week bearish, following Fed Chair Jerome Powell’s testimony (his assertion can be supported by some Fed officers) which signaled extra fee hikes within the coming months, “the central financial institution has not reached the top of its tightening cycle”. The return of recession concern ended the successful streak of main US inventory indices, with US500 posting weekly losses -1.61%, whereas US100 down -1.64% and US30 down -1.91%.

Nonetheless, within the know-how companies sector, Meta.Inc outperformed its friends (equivalent to MSFT, GOOG, NFLX). For the previous six months, Meta achieved good points almost +145%, in distinction to MSFT and NFLX which accrued good points over +40%, whereas GOOG at almost +37% (Supply: barchart).

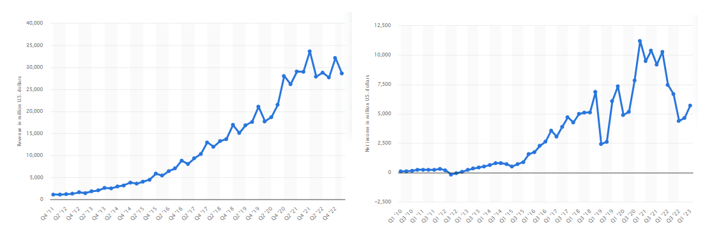

Meta.Inc: International Income and Internet Revenue. Supply: Statista

In Q1 2023, Meta Inc. reported gross sales income at $28.6B, down -10.94% from the earlier quarter, however up +2.64% from the identical interval final 12 months. Internet earnings continued to recuperate to $5.7B. Most of its income had been generated by way of promoting. Actually, the corporate’s web promoting revenues had been ranked second highest globally final 12 months, at $112.68B, simply after Google ($168.44B). Analysts forecast its promoting income to develop over +8% (y/y) to $121.9B in 2023, after which $134.72B in 2024. On the draw back, a shift of advertisers from social into retail media (the latter enable advertisers attain shoppers “nearer to the purpose of buy”) might pose a menace, and “Meta has but to totally confront this menace”.

Regardless of difficult macroeconomic circumstances, Meta has been doing nicely this 12 months. Yr-to-date, the corporate’s share value has rebounded strongly and recovered greater than 60% of the decline from Sep 2021 to the top of 2022. Current surge of the value might be attributed to Meta leveraging on its generative AI instruments, to the newest human-like I-JEPA (filling in lacking items of photos through background information in regards to the world) and Voicebox (replicating voices and obtainable in 6 languages – nonetheless in controversy that it’s “too dangerous to launch”). It has been a bumpy highway for Meta in AI Innovation since a decade in the past. Throughout the early levels, there are vital setbacks equivalent to layoffs and a notable exodus of AI researchers (which was as a consequence of burnout, insecurity and sense of disillusionment with the corporate’s AI technique). Right this moment, AI has turn out to be a pattern. May Meta’s inventory value return to its historic peak and even larger? We’ll wait and see.

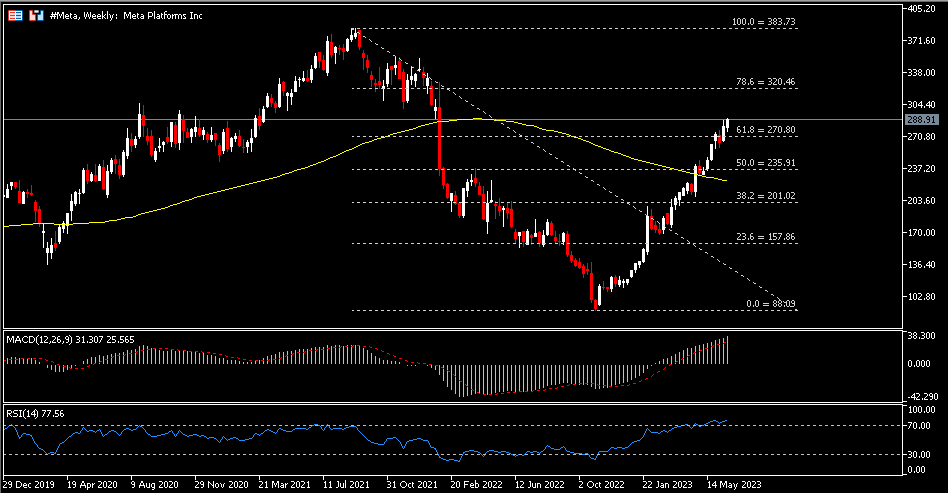

Technical Evaluation:

#Meta (META.s) share value rides on a bullish pattern since gaining floor in November 2022, at $88.09. It’s at the moment traded above 100-week SMA and FR 61.8% ($270.80). The latter serves as the closest assist. So long as it stays intact, main course factors northward, with resistance at $320.50, adopted by ATH $383.73 seen in September 2021. In any other case, if value breaks under $270.80, there can be draw back danger in the direction of $235.90 (FR 50.0%) and the dynamic assist 100-week SMA. MACD stays constructive, whereas RSI (14) at overbought zone (77.56).

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst

Disclaimer: This materials is offered as a normal advertising and marketing communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or needs to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]