[ad_1]

Shares rose final week regardless of the uncertainty in Washington. The Nasdaq Composite climbed 3.04% to an 11-month excessive, whereas the S&P 500 gained 1.65% and the Dow added 0.38%.

There are a variety of attention-grabbing themes, similar to the brand new clear divergence between ”worth” and ”progress” with the know-how index up 26% for the reason that begin of the 12 months whereas the US30 is flat (+0.8%), and the truth that essentially the most rate-sensitive index is performing higher than its friends, following a worse efficiency in 2022.

US100 vs US30, Ytd

In the present day we are going to deal with the efficiency of among the shares which have the most weight (and likewise a substantial weight within the S&P 500 – about 24.8%) and others which were among the many finest performers: we are going to take a fast have a look at their charts to see the place they stand and what data we are able to get in regards to the general index.

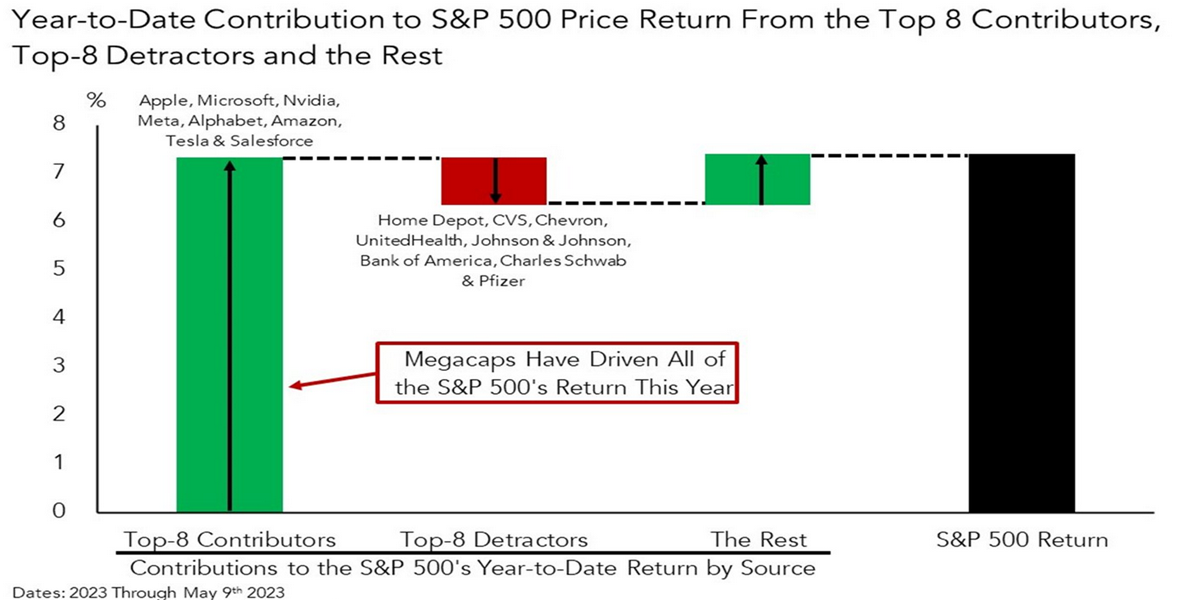

In spite of everything, it’s no thriller that a lot of the nice efficiency of not solely the US100 but additionally the US500 has been pushed by these mega names, whereas smaller corporations have struggled (much less visibility amongst buyers and possibly additionally more durable financing situations within the new price hike cycle with greater charges).

Contribution to the general US500 Worth Return

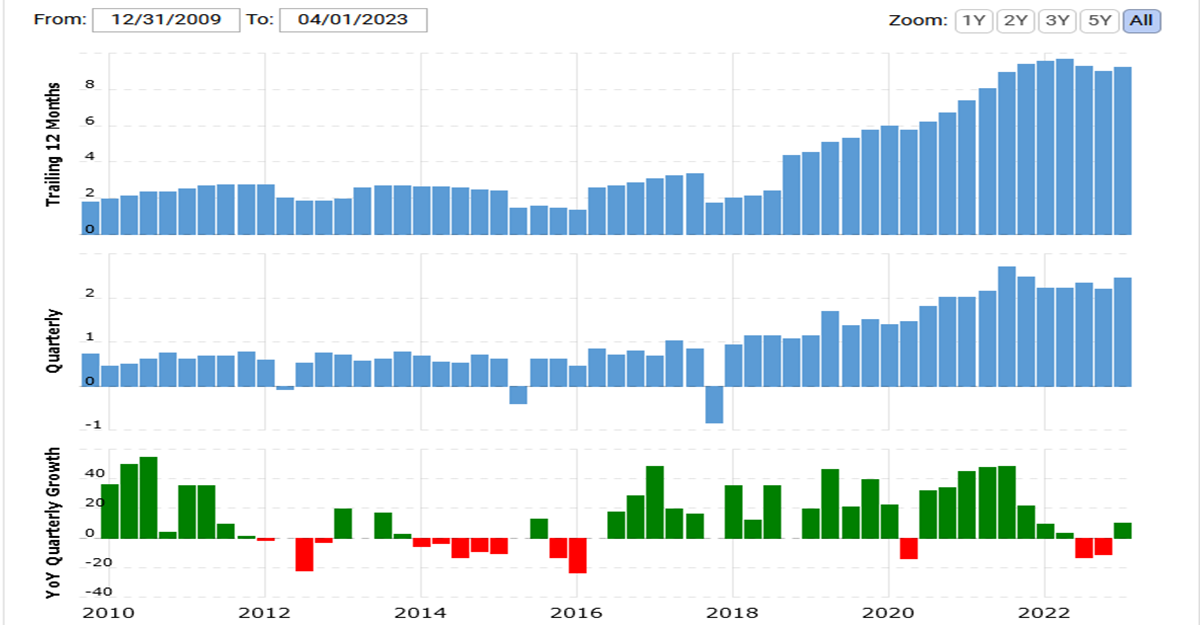

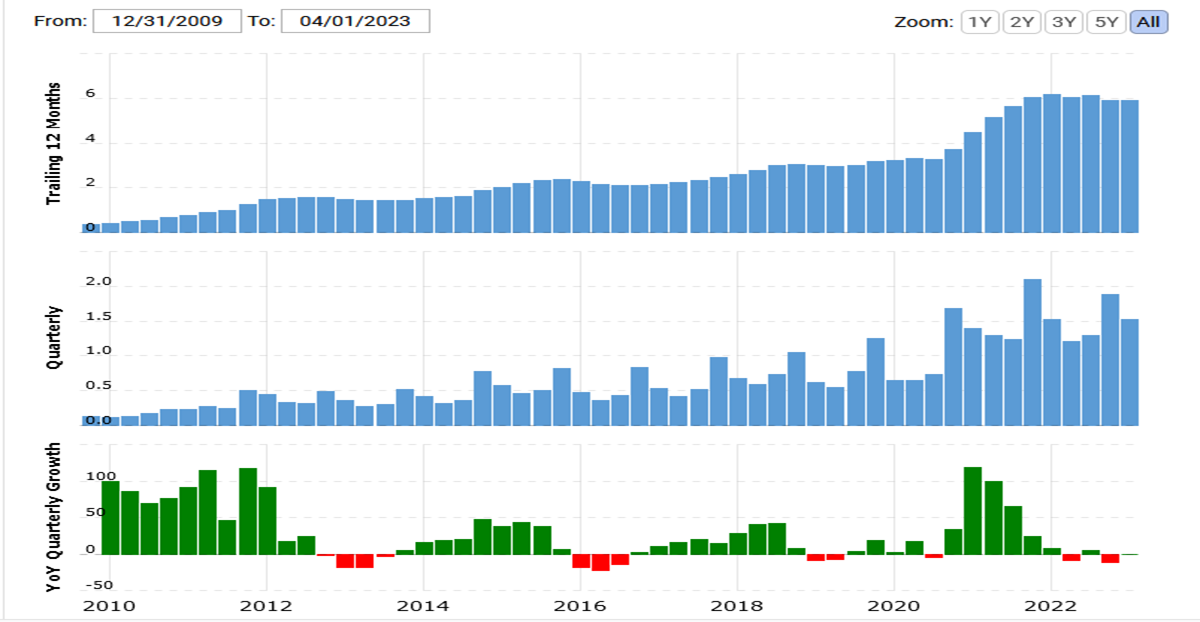

The under particular person shares have a big weight within the index, and there are a number of attention-grabbing factors to notice: these huge names had already damaged essential resistances weeks in the past, clearly displaying that the previous bear market was nearly moribund; quarterly year-on-year EPS progress has stagnated for all of the under, however these which might be buying and selling near traditionally excessive costs have managed to maintain yearly trailing EPS at fairly excessive ranges (thus justifying greater costs and the whole pullback from the earlier drop); lastly momentum is definitely very sturdy for all of the shares thought-about, however essential resistance ranges are being approached (or in some circumstances are already there) whereas the indicators are excessive and in some circumstances overbought (though not extraordinarily). To sum up, an additional improve of inventory costs -which have already gone up considerably- ought to be justified by higher anticipated future fundamentals and possibly cheaper ratios (that momentarily doesn’t appear to be the essential case state of affairs). Hold this in thoughts when buying and selling indices strongly influenced by a few of these shares.

MICROSOFT

Cyclical lows: $212.63, third Nov (+50.49%); EPS (31/03): $9.24, $9.65 in 2022, $8.05 in 2021; a slight slowdown from final 12 months’s peaks and stagnant throughout the previous couple of quarters. The bearish trendline/channel was damaged between December 2022 and February 2023. MACD very optimistic, RSI in overbought zone at 71.71. Space $320 is resistance, subsequent $330 (3.65%). Momentum is unquestionably sturdy, however we’re not within the early innings of the sport and there should be somewhat upside room. $345 space is an All-Time Excessive (ATH), about 8% greater than right here.

MSFT, worth and EPS evolution

APPLE

Cyclical lows: $123.81, third Jan (+40.45%); EPS (31/03): $5.89, $6.11 in 2022, $5.61 in 2021; a slight slowdown from final 12 months’s peaks. The broad bearish channel appears to have been damaged solely not too long ago, in the direction of the top of April. The present degree is resistance ($176), the $182.80 space is ATH (3.25% away). RSI at 67.5 nonetheless not overbought. There should be room for consolidation at these ranges. A break of the highs ought to be accompanied by a rise in future forecasts, together with EPS (which appears to have stopped going up after 2021).

AAPL, worth and EPS evolution

NVIDIA

Cyclical lows: $108.08, third Oct (+189%); EPS (31/03): $1.74, $3.85 in 2022, $1.73 in 2021, a constant decline since final 12 months (-54.81%); Nvidia has clearly damaged its 2022 downtrend originally of this 12 months and it’s displaying a particularly sturdy momentum, with MACD optimistic and RSI near overbought – however not but. $346 is the ATH (10% away) whereas there’s nonetheless a resistance space between $323 and $333. Of the shares we’re monitoring, it’s most likely the one that’s struggling essentially the most with its EPS progress – actually it’s coming off 4 quarters of damaging year-on-year progress.

NVDA, worth and EPS evolution

META

Cyclical lows: $88.09, 4th Nov (+178.85%); EPS (31/03): $8.07, $8.59 in 2022, $13.57 in 2021, displaying a transparent battle over the past 5 Quarters regardless of the current worth spike. Meta is one other inventory that has JUST damaged the downtrend and is on this case a great distance from the all-time highs (the same factor is going on with Amazon). The $250/$255 space is a robust resistance and a break by it might take it as excessive as 290$ (however that is nonetheless nearly 20% away); the RSI is diverging.

META, worth and EPS evolution

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is supplied as a normal advertising communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or ought to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]