[ad_1]

However expenditures stay excessive – primarily as a consequence of excessive well being care prices, not program generosity.

This yr I, with my sidekick Michael Wicklein, took a more-careful-than-usual look on the Trustees Report for the Medicare program. In any case, Medicare – like Social Safety – depends on payroll tax revenues, so it’s helpful to grasp the competing wants.

Conventional Medicare consists of two applications. The primary – Half A, Hospital Insurance coverage (HI) – covers inpatient hospital providers, expert nursing amenities, house well being care, and hospice care. The second – Supplementary Medical Insurance coverage (SMI) – consists of two separate accounts: Half B, which covers doctor and outpatient hospital providers, and Half D, which covers prescribed drugs. The preparations are barely extra difficult as a result of Medicare additionally consists of Half C – the Medicare Benefit plan choice, which makes funds to personal insurance coverage that present each Half A and Half B providers.

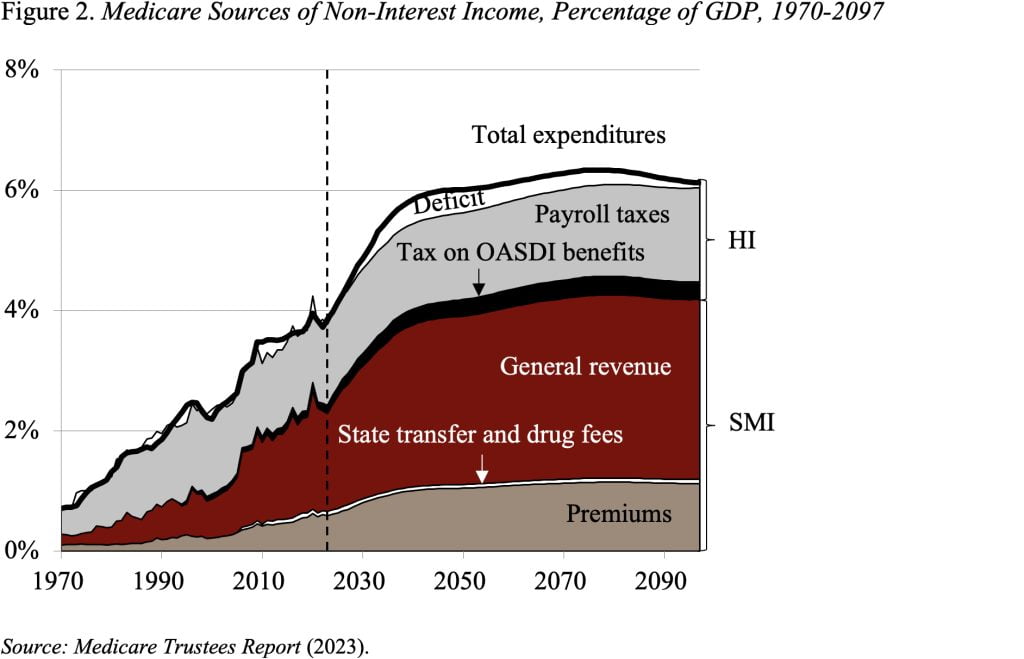

Every Medicare program has its personal belief fund and its personal supply of revenues. Half A (HI), which accounts for 38 % of Medicare expenditures, is the portion primarily depending on payroll tax revenues. Elements B and D are financed primarily by basic revenues, supplemented by income-tested premiums.

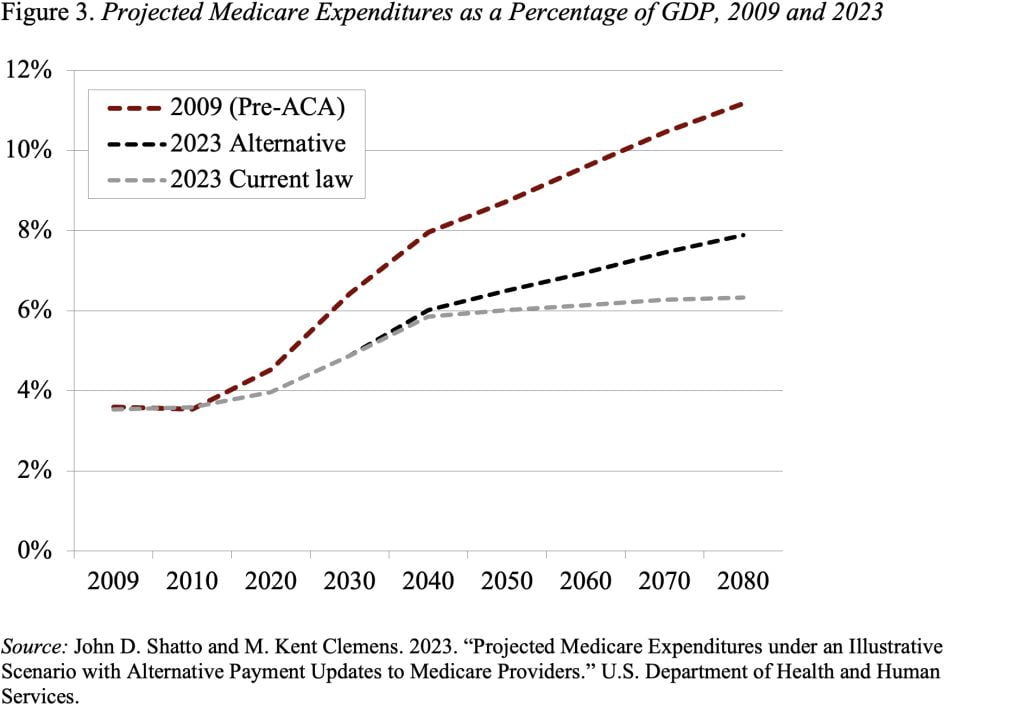

The Medicare Trustees subject an annual report projecting this system’s funds underneath present regulation. As well as, the actuaries put together another state of affairs that limits the extent to which Medicare funds to hospitals and physicians fall under these made by non-public insurers.

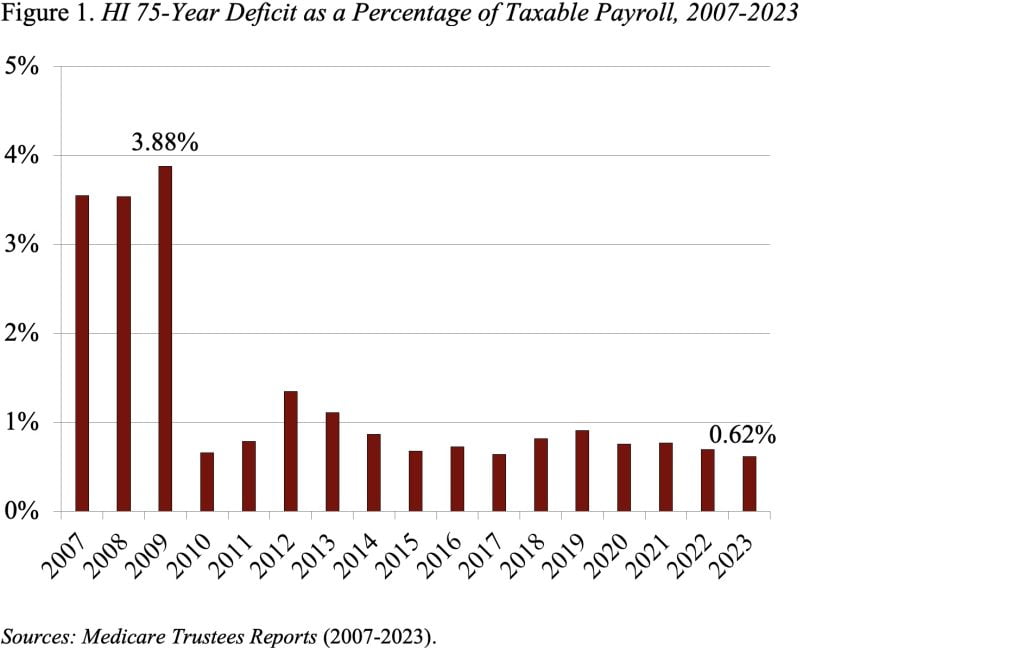

When it comes to the HI program, assuming present regulation, the Trustees undertaking a 75-year deficit of 0.62 % of taxable payrolls. This deficit is definitely on the low finish of the diminished deficits that emerged within the wake of the Inexpensive Care Act (ACA) (see Determine 1).

For the HI belief fund to stay solvent all through the 75-year projection interval, the two.90-percent payroll tax would have to be instantly elevated by 0.62 share factors. Social Safety, which represents a competing demand on payroll tax revenues, would require an extra 3.44 share factors to realize 75-year solvency.

Because the headlines indicated, the HI belief fund is projected to deplete its reserves in 2031. In that yr, revenues can be adequate to cowl solely 89 % of program prices, so advantages can be diminished instantly by 11 %. Whereas the projected depletion is an action-forcing occasion for the Congress, the outlook has improved by three years since final yr’s report.

Half B and Half D are each adequately financed for the indefinite future, as a result of the regulation pro- vides for basic revenues and participant premiums to satisfy the subsequent yr’s anticipated prices. After all, rising premiums place a rising burden on beneficiaries (see Determine 2). Apparently, these prices are additionally considerably decrease than within the earlier report.

As famous, the actuaries additionally put together another set of projections that loosen up the cost-saving provisions in present regulation. Below these different assumptions, by 2090, the whole price of Medicare is about 2 % of GDP greater underneath the choice than underneath the current-law provisions. Notice, nevertheless, that even these greater expenditures are approach under the pre-ACA projections (see Determine 3).

The underside line is that the 2023 Medicare Trustees Report contained no dangerous information. In reality, in Half A, the depletion of the HI belief fund was pushed out three years and the HI deficit was on the low finish of post-ACA numbers, whereas expenditures for Elements B and D have been truly barely under these within the 2022 report. Furthermore, Medicare’s demand on the payroll tax is modest in comparison with the rise required for Social Safety. That mentioned, Medicare does face vital financing challenges: it operates in a rustic with terribly excessive well being care prices and it has some critical gaps in safety.

[ad_2]