[ad_1]

The USDIndex has moved up from 103.00 as US debt ceiling talks progressed however no deal – President Biden “”default is off the desk”, Home Speaker McCarthy “I imagine we will get a deal completed,”. US shares have been flat into shut, though FUTS are larger at present. Yields have been the primary drivers once more with 2yr & 10yr at 7-week highs. Bullard ( 2 extra hikes) & Kashkari (doable June pause however charges could should go north of 6%) remained Hawkish. Asian shares rallied however are closing decrease. USDJPY stays near 6-mth highs, Gold slipped to $1960, USOil at $72.00 and Bitcoin rallied 3.5% from yesterday’s low at $26.5k.

In a single day – AUD – PMI’s – blended, Manu. flat & nonetheless in contraction at 48.0, Providers slipped to 51.8 from 53.7 (was 52.6). JPY – Manu PMI’s grind into growth mode at 50.8 from 49.5. BOJ Core CPI beat at 3.0% vs. 2.8% & 2.9% prior. UK PSNB (Authorities borrowing) rocketed £24.7b vs £17.5b & £20.0b

- FX – USDIndex declined underneath 103.00, touched 103.20 forward off debt talks and is at 103.15 now. EUR examined into 1.0830 and pivots round 1.0800 now. JPY breached over 138.50, topped at 138.85 (excessive from November 2022) and holds again at 138.50 now. Sterling collapsed to check 1.2400 once more, is capped at 1.2450 and trades at 1.2425 now.

- Shares – US markets closed very blended (-0.42% to +0.65%). FL -8.54 after dropping 24% on Friday, Nike -4.00%, PFE +5.38%, TSLA +4.85% ZM +2.94% (rallied +5% after hours with a Income beat and elevated Gross sales forecasts – again to +1.18% after market closed). US500 closed +1.00pt, 4192, FUTS are buying and selling at 4208, above the key resistance at 4175.

- Commodities – USOil – Futures examined all the way down to $70.70 once more yesterday however maintain over $72.20 now. Gprevious – couldn’t maintain the $1975 stage and trades at $1962 with key help on the $1950 zone.

- Cryptocurrencies – BTC bounced from $26.5k lows from Thursday & Monday and pushed to check $27.5k (21-day EMA) earlier.

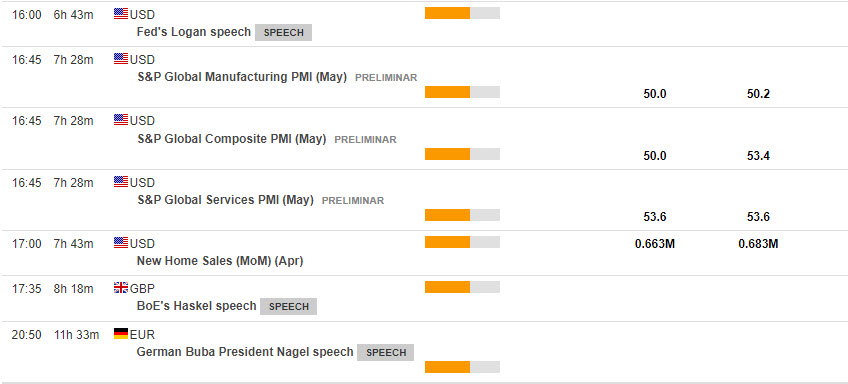

Right this moment – US, UK & EZ PMIs (Flash), US Residence-Gross sales, Speeches from Fed’s Logan, ECB’s de Guindos, Nagel, Villeroy & Enria, BoE’s Bailey, Tablet, Tenreyro & Mann. Earnings – Lowes.

Greatest Mover @ (06:30 GMT) BTCUSD (+2.12%). From Monday’s check of 26,500 lows the pair is as soon as once more testing 27,500 MA’s aligned larger, MACD histogram & sign line constructive & rising, RSI 74.51, OB & flat, H1 ATR 127.18, Day by day ATR 1030.45.

Click on right here to entry our Financial Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This materials is offered as a normal advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or ought to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]