[ad_1]

The USDIndex rallied strongly into shut on Friday (102.50) because the UoM information confirmed vital weak point, with Client sentiment at 3- yr low and Inflation expectation the very best since 2008. Inventory markets moved broadly larger throughout Asia and Europe. Futures are transferring larger throughout US and general sentiment appears optimistic at first of the week. Yields are transferring larger on this atmosphere. Currencies have saved an in depth eye on political developments in a single day with Turkey’s election significantly in focus.

In a single day – China’s PBOC injects extra liquidity. The central financial institution supplied 135 billion yuan of medium-term funds, 25 bln greater than the quantity maturing in Might. The speed on the one-year coverage loans was saved unchanged. Japan PPI inflation moderates in April.

- FX – USDIndex had an excellent week closing at 102.50. At present correcting to 102.35. EUR fell to 1.0844 breaking 50DMA once more and trades at 1.0970. JPY spiked to 136.26 from 135.60. Sterling drifted 2-month triangle all the way down to 1.2440 from 1.2670 highs final week even because the BoE hiked 25bps and remained barely hawkish.

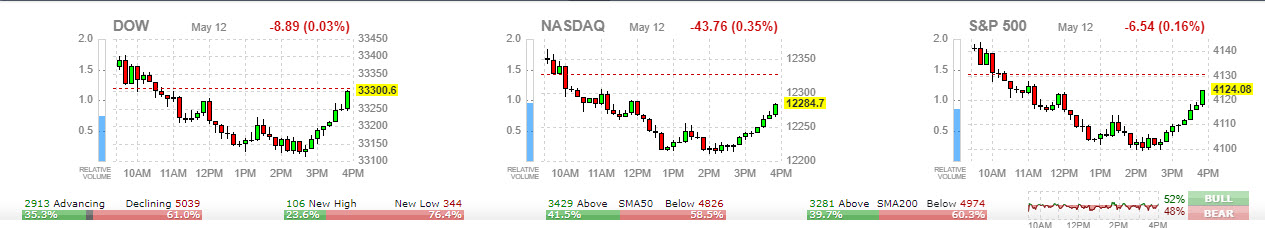

- Shares- China bourses outperforming and Dangle Seng and CSI 300 gaining 2% and 1.3%. In EU, GER40 gapped up US markets closed larger.

- Commodities – USOil – fell to $69.69 publish Chinese language information hinting restoration. GOLD – steadied above $2010.

- Cryptocurrencies – BTC recovered the $27500.

At this time – G7 summit in Japan, US Empire State Manufacturing Index and Eurogroup assembly.

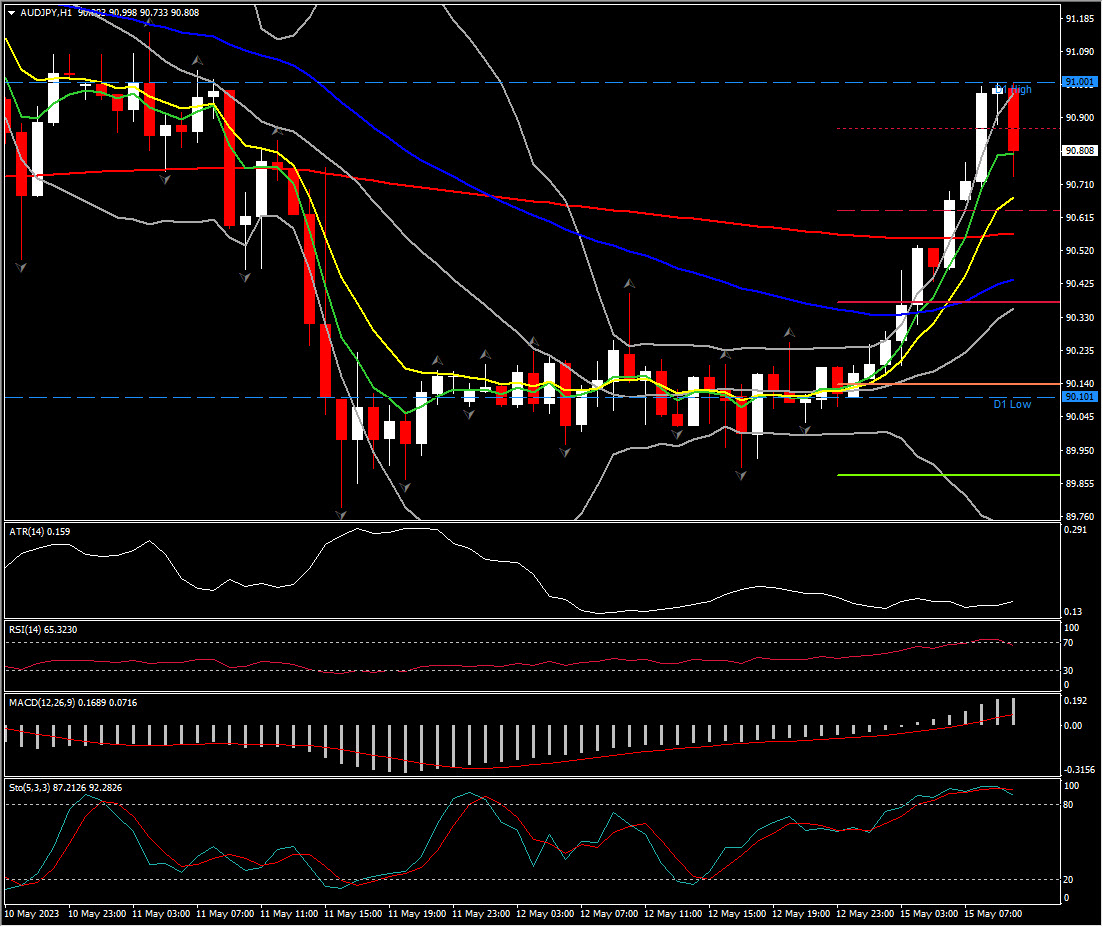

Greatest FX Mover @ (06:30 GMT) AUDJPY (+0.67%). Breached 91 breaking 200-DMA. MAs flattened, however MACD histogram & sign line optimistic & rising, RSI 66 & falling indicating correction decrease, H1 ATR 0.159, Each day ATR 1.096.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a common advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or must be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]