[ad_1]

Yields have prolonged decrease as bonds appropriate from the massive selloff since late June. Wall Avenue completed with modest positive factors led by the US30 0.62% enhance. The US500 was up 0.24% and the US100 was up 0.18%. With the Fed anticipated to hike charges one other 25 bps the markets paid little consideration to hawkish Fedspeak. Asian shares rose right this moment after Beijing mentioned it will prolong measures designed to assist the nation’s indebted property sector and merchants anticipated additional stimulus. UK wage development greater than anticipated in Could. General employment numbers lifted greater than anticipated within the three months to Could, however the June studying for payrolled staff unexpectedly declined. German inflation rose in June, interrupting a gradual decline for the reason that begin of the 12 months.

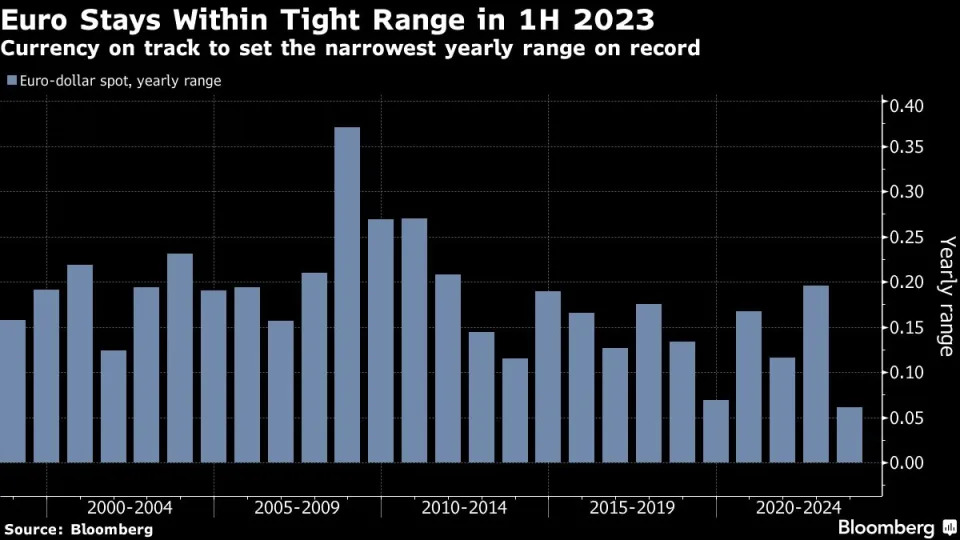

- FX – The USDIndex slumped to 101.32 from 102.56. USDJPY drifted to 140.56 from 141.46. GBP and EUR gained floor, breaking respective 1.10 and 1.29 highs.

- Shares – Hedge funds have slashed their bets on a rising US inventory market to the bottom degree in no less than a decade and pivoted to Europe over concern concerning the resilience of the US tech-led rally. The US500 was up 0.24% and the US100 was up 0.18%.

- Commodities – USOil held above 73.00. Costs supported by weak greenback and provide cuts by the world’s largest oil exporters (Saudi Arabia and Russia) set for August.

- Gold – greater at $1935.70.

Right now – German ZEW Financial Sentiment and Fed’s Bullard Speech.

Greatest Mover @ (06:30 GMT) USDJPY (-0.41%) dipped to 140.50. Quick MAs aligned decrease, MACD traces are negatively configured with RSI at 29 and flat and Stochastic at 25 however barely greater.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a common advertising and marketing communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or needs to be thought of as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]