[ad_1]

Optimism over a debt restrict deal was the catalyst for the reduction rally in equities after feedback from President Biden and Speaker McCarthy. Biden emphatically said “America is not going to default” and voiced confidence {that a} deal might be reached. And McCarthy stated getting a deal accomplished this week is “doable.” A combined housing begins report had little affect, however latest feedback from Fed officers noticed price lower expectations additional pared.

The USDIndex held positive aspects a breath under 103. Shares climbed and Treasuries misplaced floor as confidence that the debt restrict might be resolved in time to avert a default boosted threat urge for food. Cash flowed into shares and as haven demand was unwound. Asia headed for its largest acquire since March, and European futures adopted increased.

- FX – USDIndex spiked to 102.93. EUR right down to 1.0892. JPY breached 137.74. Sterling pull again to 1.2450. AUD weakened dragging down NZD.

- Shares – JPN225 broke 30000 and breached 30660. The US30 was 1.24% increased, the US500 superior 1.19% and the US100 surged 1.28%. #Western Alliance’s shares gained 10%, a transfer mirrored in a 7.3% acquire for the KBW Nasdaq Regional Banking Index, its largest share improve since 2021. #Goal shares climbed too, gaining 2.6%, after the retailer beat analysts’ first-quarter revenue expectations. #Tesla jumped 4%, #Amazon was up 1.5% and #Alibaba rallied by 2.16%.

- Commodities – USOil – has nudged as much as $73.61 per barrel, Brent added 2.7%.

- Gold has prolonged yesterday’s losses to 1974.98.

At this time – BOE Governor Andrew Bailey, BOC Governor Macklem & ECB President Lagarde speeches, US jobless claims and Philly Index on faucet whereas Swiss monetary markets are closed.

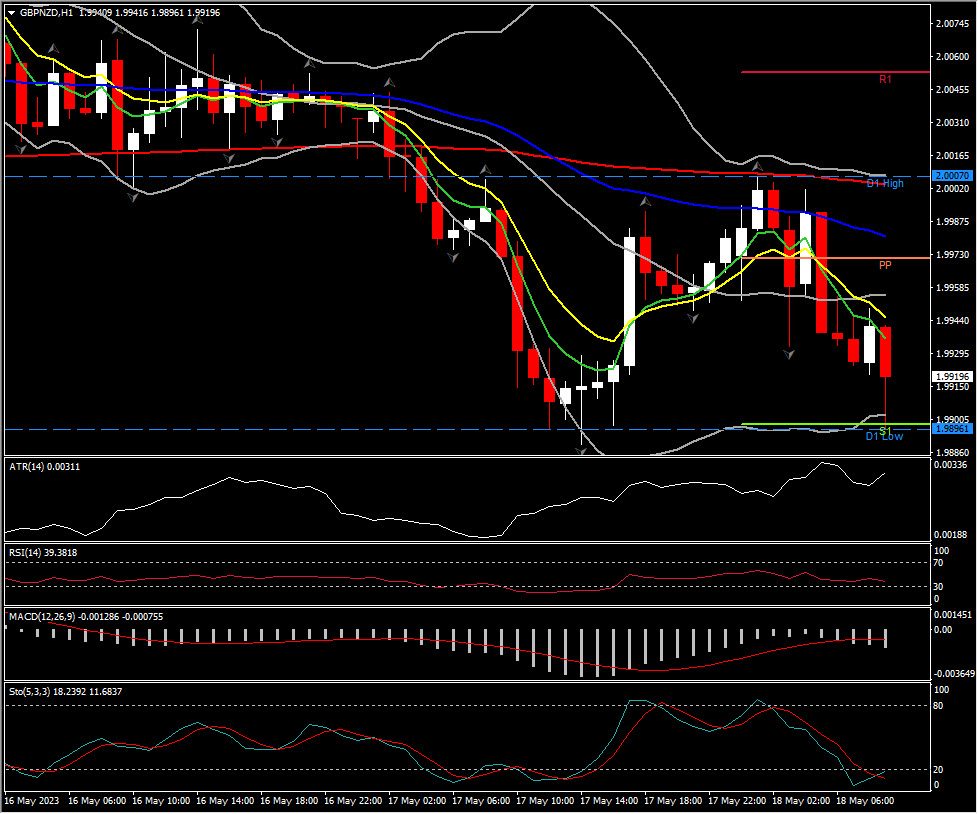

Greatest FX Mover @ (06:30 GMT) GBPNZD (+0.35%). Dipped to S1 at 1.9896. MAs aligned decrease, MACD and RSI are negatively configured. H1 ATR 0.00299, Every day ATR 0.01568.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is supplied as a basic advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or must be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]