[ad_1]

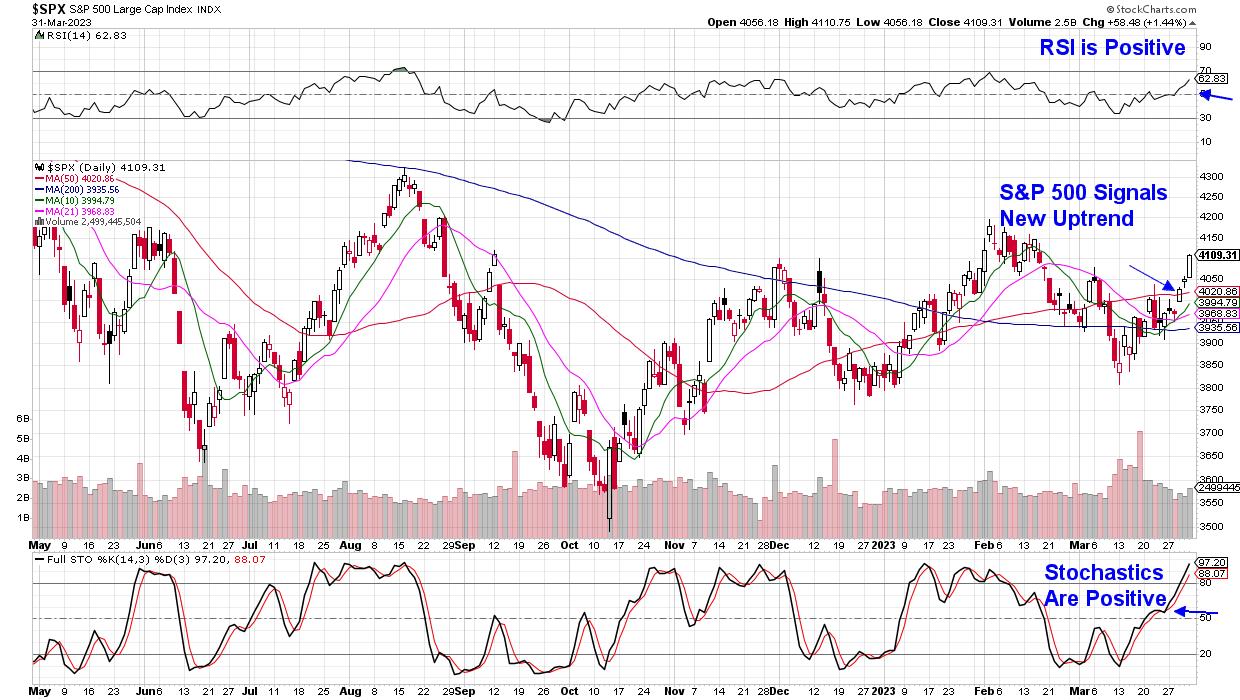

Final week, the S&P 500 put in a backside following Wednesday’s rally of 1.4% on quantity, which was better than the prior day. Recognized by followers of William O’Neil’s work as a “follow-through day”, the worth motion occurred on the twelfth day of a rally try and alerts a brand new uptrend.

Along with a brand new uptrend happening, final week noticed the equal-weighted S&P 500 dash into an uptrend, following a interval of dormancy because of the markets being led by a slim group of Tech shares. Elevated breadth within the markets was additionally signaled by the variety of shares above their 50-day transferring common, which elevated by over 100% final week (utilizing $SPXA50).

DAILY CHART OF S&P 500 INDEX

What Course Of Motion Ought to Traders Take Now?

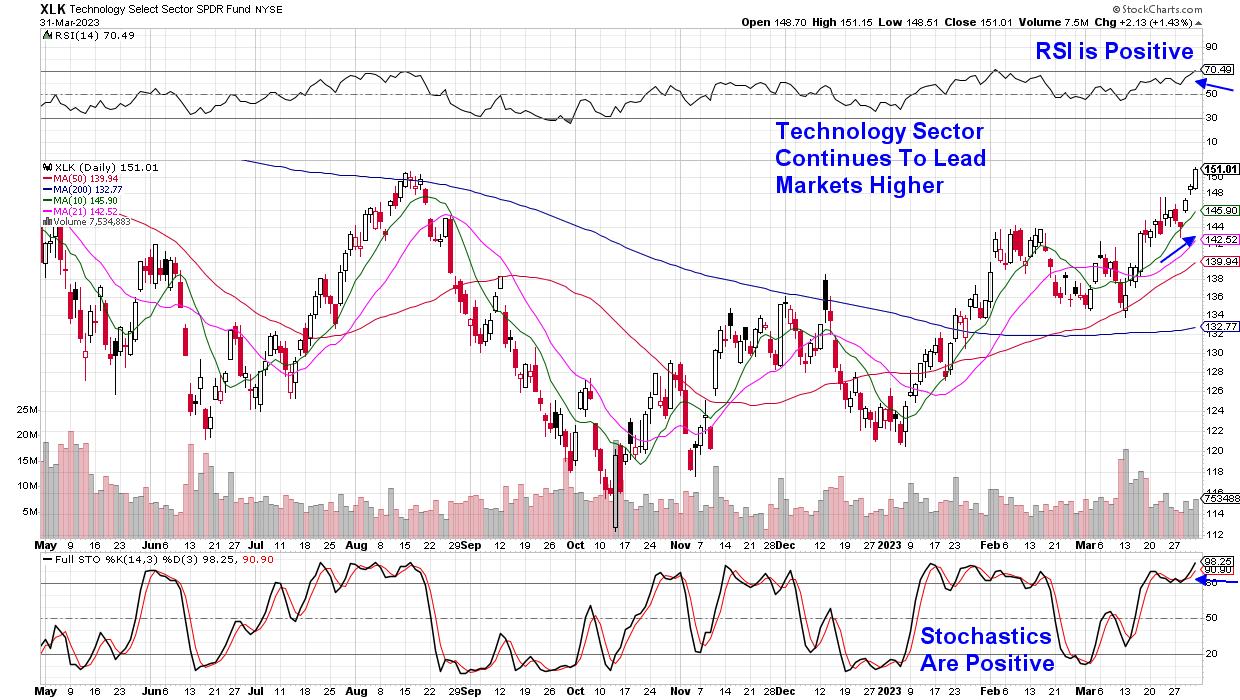

There are a number of methods to capitalize in the marketplace’s new uptrend. A method can be to take a place in management names that entered an uptrend previous to final week. This path will lead you towards Know-how shares which were trending larger on account of a constructive progress outlook on the heels of reporting sturdy quarterly outcomes. Most of those high-quality names stay in an uptrend and are poised to commerce larger.

DAILY CHART OF TECHNOLOGY SECTOR

A second method can be to purchase essentially sound corporations that pulled again sharply amid the latest financial institution disaster, however have recaptured their uptrends after final week’s rally. This is able to put you in entrance of extra economically delicate areas, resembling Industrials, that faltered amid financial institution associated recession fears. Downtrend reversals are widespread amongst shares as soon as the markets enter a brand new uptrend, and scooping up falsely depressed names at a discount will be an effective way to spice up your portfolio.

DAILY CHART OF INDUSTRIAL SECTOR (XLI)

Together with subscribers to my MEM Edge Report, I’ve already taken up positions in a number of management Know-how shares — extra particularly, choose Semiconductor and Software program names which were in uptrends since as early as final January. That is along with 2 prime FAANMG names which might be poised to commerce larger. You may entry that record by utilizing this hyperlink right here to trial my twice weekly MEM Edge Report.

As for compiling candidates amongst Industrial or Discretionary shares which have entered new uptrends, you will need to slim your record to incorporate corporations which have not too long ago reported sturdy earnings and gross sales, whereas additionally posting a constructive outlook concerning progress going ahead. Research have confirmed that sturdy earnings are the first driver of shares that go on to outpace the markets. As well as, you will want the business group of that inventory to even be in an uptrend. Sector and business group affiliation account for nearly 50% of your shares appreciation or deterioration, so getting this proper is one other essential part.

Under is a chart of Rockwell Automation (ROK), a producer of motor and automation energy programs that is within the Industrial sector (XLI). The corporate reported 4th quarter earnings that have been 26% above estimates in late January, on account of excessive demand for industrial automation amid a decent labor market. As well as, ROK raised its revenue outlook for 2023 amid a slowdown in provide chain points.

DAILY CHART OF ROCKWELL AUTOMATION (ROK)

On this Sunday’s MEM Edge Report, I anticipate including choose Shopper Discretionary shares to the Prompt Holdings Listing after this sector turned constructive. Whereas the sector was given a lift by features in heavyweight shares Tesla (TSLA) and Amazon (AMZN), a 5% rally in Retail shares (utilizing XRT) put this group on a path to reversing its sharp 20% decline, which occurred over the previous 2 months.

Whereas the markets have entered a brand new uptrend, roadblocks stay, as inflation ranges stay elevated regardless of hints of a slowdown that have been reported final week. In different phrases, proceed to maintain your stops tight till additional proof that the Federal Reserve has slowed their price hike marketing campaign. The subsequent FOMC assembly will happen in early Might.

Warmly,

Mary Ellen McGonagle, MEM Funding Analysis

Mary Ellen McGonagle is an expert investing guide and the president of MEM Funding Analysis. After eight years of engaged on Wall Avenue, Ms. McGonagle left to grow to be a talented inventory analyst, working with William O’Neill in figuring out wholesome shares with potential to take off. She has labored with purchasers that span the globe, together with huge names like Constancy Asset Administration, Morgan Stanley, Merrill Lynch and Oppenheimer.

Study Extra

Subscribe to The MEM Edge to be notified every time a brand new put up is added to this weblog!

[ad_2]