[ad_1]

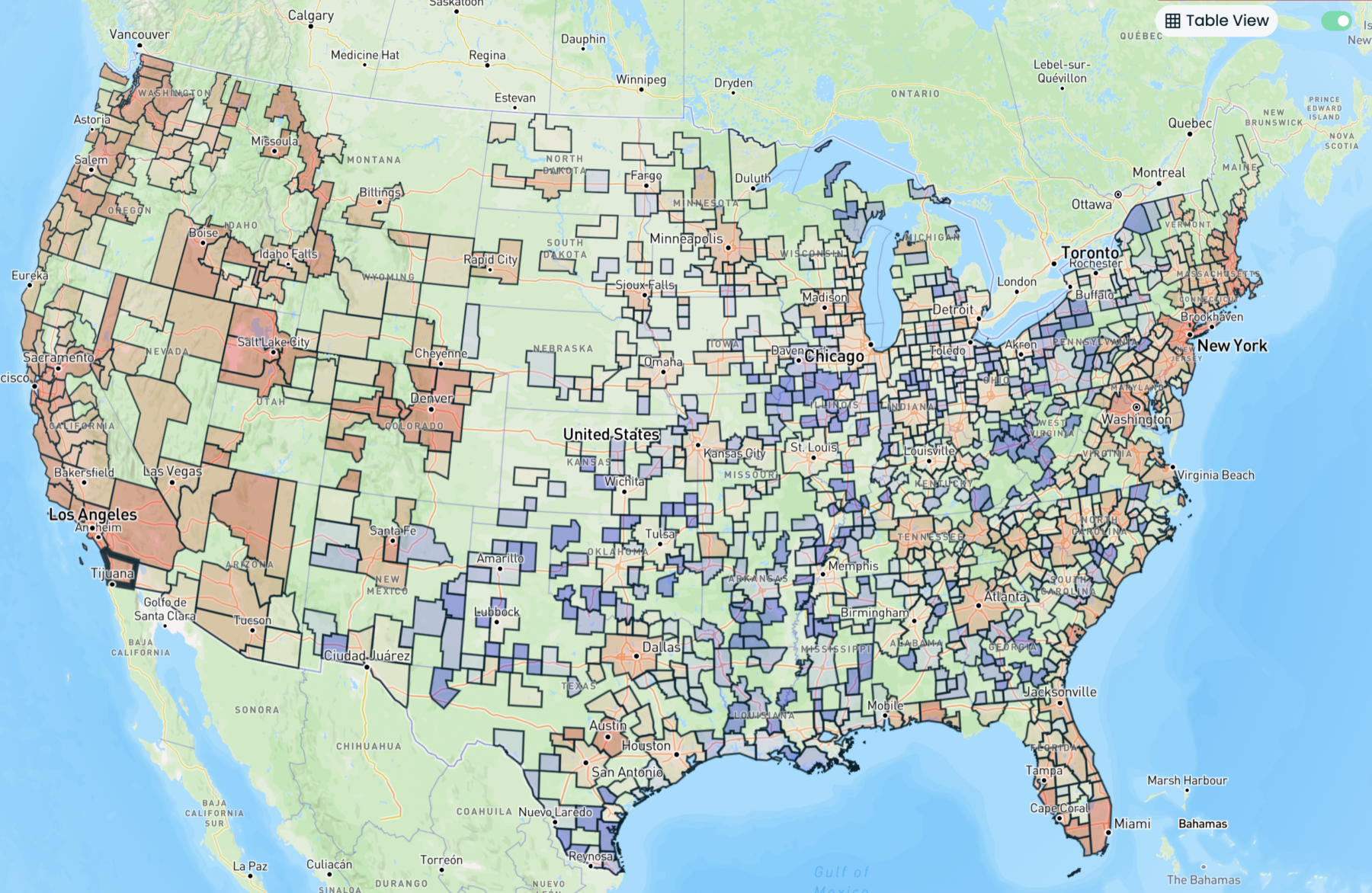

Supply: Reventure

Let’s get to the caveats up entrance: Re:Ventures has been fairly bearish on housing the previous few years forecasting a crash; their touchdown web page claims “The US Housing Market is in a document Bubble in 2023,” and this publish “90% Probability: RECESSION in 2022?” has not panned out and stands inapposite of my views.

That stated, I’m keen to disregard their opinions as a result of I discover their knowledge analytics so intriguing.

Take a look at the map above displaying “House Values.” They generate these maps utilizing Zillow knowledge (as decided by the Zillow House Worth Index (“ZHVI”). It’s onerous to inform how Zillow assembles this knowledge (see if you can also make any sense of their methodology; I couldn’t).

I get the concept that contemplating not the combination of pricey and low-cost properties collectively to find out worth is much less fascinating than how dwelling costs change inside every worth level. Does Zillow use the promoting costs of properties that had been bought and never listings or estimates? I actually can not inform from the methodology disclosures.

With that weasely preface out of the best way, contemplate the assorted methods these maps can present adjustments in residential actual property on a nationwide, state, metro-area, county, and zip code degree:

House Worth, House Worth Development (YoY), House Worth Development (MoM), For Sale Stock, Sale Stock Development (YoY), Worth Reduce Share (%), Days on Market, Days on Market Development (YoY), Month-to-month Home Fee, Property Tax Charge, Constructing Permits, Constructing Allow (%), Mortgaged House (%), Housing Items, Housing Items Development Charge, Gross sales Stock Development (MoM), Stock as a % of Homes, Lease for Residences, Lease for Homes

There are related instruments for analyzing inhabitants adjustments: Inhabitants, Median Family Earnings, Median Age, Homeownership Charge, Poverty Charge, Payroll Jobs, Migration Whole, Migration % of inhabitants.

Additionally they provide a collection of premium analytic mapping instruments that cowl: Over/Beneath Valued %, Worth/Earnings Ratio, Home Fee as % of Median Earnings, % Crash from 2007-2012, Shadow Stock %, Cap Charge, Purchase vs Lease Calculator %, Lease as a % of Earnings.

I’ve not subscribed, however I’ve been enjoying round with the assorted instruments, they usually appear fairly fascinating. The important thing problem, after all, is whether or not the underlying knowledge from Zillow is worth it or not. If its good REAL gross sales knowledge and never simply modeled opinion, it seems prefer it has a variety of potential use.

As to the approaching crash, my pal Jonathan Miller observes: “In case you discuss to brokers on the bottom, there are far fewer traders than the prior growth. Heavy major and second dwelling demand.” This, plus the scarcity of single-family properties as a consequence of underbuilding and cheaper mortgage lock-in suggests {that a} housing crash is unlikely any time quickly…

Beforehand:

Are We in a Recession? (No) (June 1, 2022)

What Information Makes NBER Recession Calls? (September 1, 2022)

The Submit-Regular Economic system (January 7, 2022)

What Recession? (June 26, 2023)

How All people Miscalculated Housing Demand (July 29, 2021)

[ad_2]