[ad_1]

Overpayments and repayments are two of the commonest anomalies that would complicate year-end and W-2 processing. Now is a good time to type out any potential difficulties.

Leap to:

What’s an overpayment on taxes?

In easy phrases, an overpayment on taxes is paying greater than what’s owed. Overpayments and repayments could appear difficult, however they typically boil down to 1 easy rule of thumb: Recuperate web from overpayments which can be repaid within the present yr and gross from overpayments that aren’t repaid till a subsequent yr.

What are the IRS pointers on overpayment of wages?

As outlined by the IRS within the Publication 15, (Round E), Employer’s Tax Information, in case your worker repays you for wages they obtained in error, don’t offset the repayments towards present yr wages except the repayments are for quantities obtained in error within the present yr.

To additional clarify, let’s take a look at each overpayments and repayments within the present and subsequent years.

Overpayments and repayments within the present yr

Overpayments are thought-about paid when obtained and have to be included within the worker’s earnings when obtained. If the worker repays the advance or overpayment throughout the identical yr they obtained it, the employer ought to exclude the quantity from the worker’s earnings when submitting the W-2.

The worker ought to repay the online quantity and the employer might want to submit correctly amended federal and state returns. In these instances, it’s additionally vital to look at state and federal unemployment, as they might be overstated. If this occurs, amendments might have to be filed for the affected quarters.

Let’s take a look at an instance:

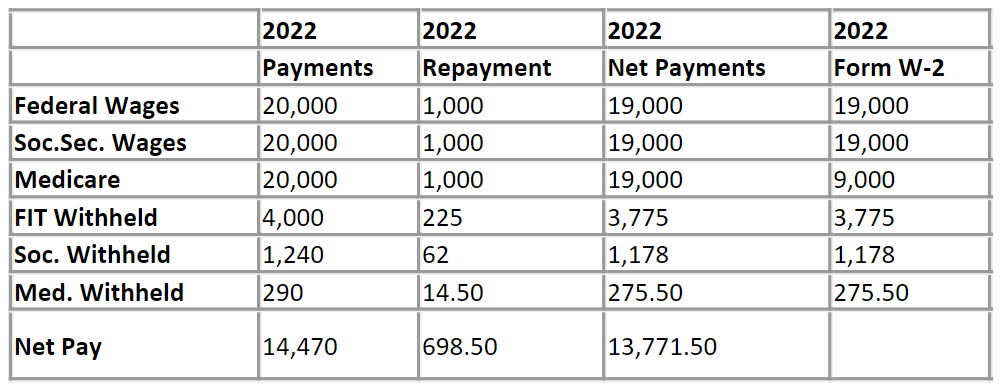

ABC Firm hires Mike on Might 1, 2022 at a wage of $3,000 per thirty days. Mike receives a sign-on bonus of $1,000 that he should repay if he leaves ABC inside one yr of rent. Mike resigns on December 2, 2022 and repays the sign-on bonus. As a result of he repaid the bonus in the identical yr it was initially paid, he owes solely the online quantity of $698.50. ABC will situation the online transaction on Mike’s W-2.

Right here’s how Mike’s W-2 would seem on this situation:

Reporting reimbursement of present yr wages

In keeping with the IRS, if an organization receives repayments for wages paid throughout a previous quarter within the present yr, they need to report changes on Type 941-X to recuperate earnings tax withholding and social safety and Medicare taxes for the repaid wages.

Overpayments and repayments in subsequent years

Issues get a bit extra difficult when an overpayment isn’t repaid till a subsequent yr. Once more, overpayments are thought-about paid when obtained and have to be included within the worker’s earnings when obtained.

If the worker doesn’t repay the advance or overpayment till a subsequent yr, they’ll have to repay the gross quantity — the online quantity they obtained plus any federal or state earnings tax. The employer can not gather federal or state earnings tax withheld in a previous yr, so no correction may be made for earnings taxes withheld. The worker can, nevertheless, declare a deduction on their private earnings tax return for the tax they repaid.

Let’s take a look at an instance:

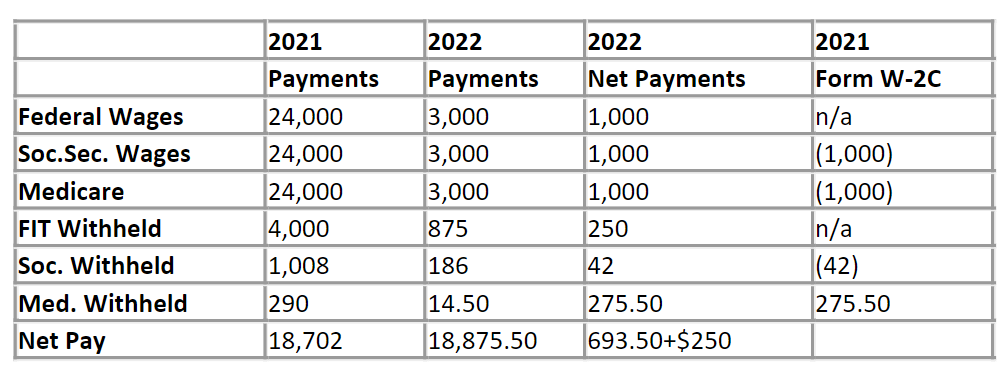

ABC Firm hires Mike on Might 8, 2021 at a wage of $3,000 per thirty days. Mike additionally receives a sign-on bonus of $1,000 that he should repay if he leaves ABC inside one yr of rent. Mike resigns on January 31, 2022 and repays the sign-on bonus. As a result of the reimbursement befell in a special yr than the unique fee, Mike owes the online quantity of $693.50, plus the $250 in federal tax that was withheld and remitted to the IRS. ABC will situation the gross transaction on Mike’s W-2C. Mike will deduct the $250 from his 2022 earnings tax return.

Reporting reimbursement of prior yr wages

As defined by the IRS, if an organization receives repayments for wages paid throughout a previous yr it should report an adjustment on Type 941-X or Type 944-X to recuperate the social safety and Medicare taxes. The employer can not make an adjustment for earnings tax withholding as a result of the wages had been earnings to the worker for the prior yr, the company famous.

The IRS additionally states that an employer additionally can not make an adjustment for Further Medicare Tax withholding as a result of the worker determines legal responsibility for Further Medicare Tax on the worker’s earnings tax return for the prior yr. The corporate should additionally file Varieties W-2c and W-3c with the Social Safety Administration (SSA) to appropriate social safety and Medicare wages and taxes. Present the worker with a replica of Type W-2c.

Stopping tax overpayments

Recuperate web from current-year repayments and gross from subsequent-year repayments. Remembering this one easy rule may help ease confusion and complications when tax season rolls round.

Nonetheless, it’s clearly greatest to stop tax overpayments and different payroll errors from taking place within the first place. This implies having the suitable instruments and assets in place comparable to a full-service payroll software program resolution.

It is very important needless to say tax overpayments, in addition to underpayments, may come up within the oblique tax course of. That is very true when firms take a guide method to the P2P tax course of, which may contain dozens of time-consuming steps that drain assets.

When you’re a payroll skilled, watch a demo of Thomson Reuters Accounting CS® Payroll in motion. When you work in oblique tax, leverage a international tax willpower software program to stop tax overpayments, underpayments, and penalties that may accumulate and weaken your organization’s monetary energy. Attempt the software program out with a free demo.

[ad_2]