[ad_1]

Prodoct hyperlink:

Introduction

The Superior CCI buying and selling robotic supplies customers with absolute freedom to commerce their most popular devices their very own method by observing and analyzing them. The principle sign is derived from the CCI indicator, and the robotic gives a number of choices, comparable to trailing cease, dynamic lot dimension, buying and selling session, MA filter, dynamic stop-loss ranges, Kelly Criterion calculator, and extra. This implies that you would be able to scalp, day commerce, or interact in another sort of buying and selling that fits your type.

Whereas the robotic gives a number of choices to select from, discovering worthwhile methods could be difficult initially. Nonetheless, because the saying goes, “much less is extra,” and you may uncover a whole bunch, if not 1000’s, of worthwhile setups for every asset. On this article, we are going to analyze a setup that has been profitable for the previous two years on the EURUSD H1. We are going to preserve issues easy and offer you the mandatory instruments to enhance this technique additional.

The important factor to bear in mind is that utilizing this technique supplies you with full management. You aren’t counting on an unknown technique that will blow up your account in the future with out your information. As an alternative, it is possible for you to to pinpoint the reason for any potential drawdowns – which each and every wholesome technique will need to have – and alter your technique accordingly to adapt to the brand new market circumstances.

Inputs

Let’s now see the technique collectively:

- Easy sign. Purchase when the CCI crosses beneath -50 degree (after the bar closes) and promote if the value crosses above the 50 degree.

- Shut any reverse open positions when a brand new sign seems.

- CCI Interval set to 80. CCI methodology is ready to Open Worth.

- We are going to begin with a Mounted lot dimension, and because the demo account begins with 10,000, we are going to test the 1.00 lot per commerce. Later we are going to discover the Lot in Share utilizing the in-built Kelly Calculator.

- SL and TP strategies might be calculated utilizing the ATR. It will likely be 6 for each. Which means that we are going to give house for each SL and TP ranges round 6 bars above and beneath the entry worth.

- We’re additionally going to make use of a trailing stoploss. It is gonna be triggered after 100 factors in revenue, it’ll place the SL 50 Factors beneath the present worth – that implies that if the trailing SL is triggered, we’re in profit- and it’s gonna have a step of 20.

- Most Purchase and Promote orders on the similar time might be 1. You’ll be able to add extra if you’d like.

- We’re not gonna use a buying and selling window or an MA filter. In all probability we might try to keep away from buying and selling when the market has a breakout however on this case I would wish to see the way it performs full time.

We’re prepared!

Outcomes

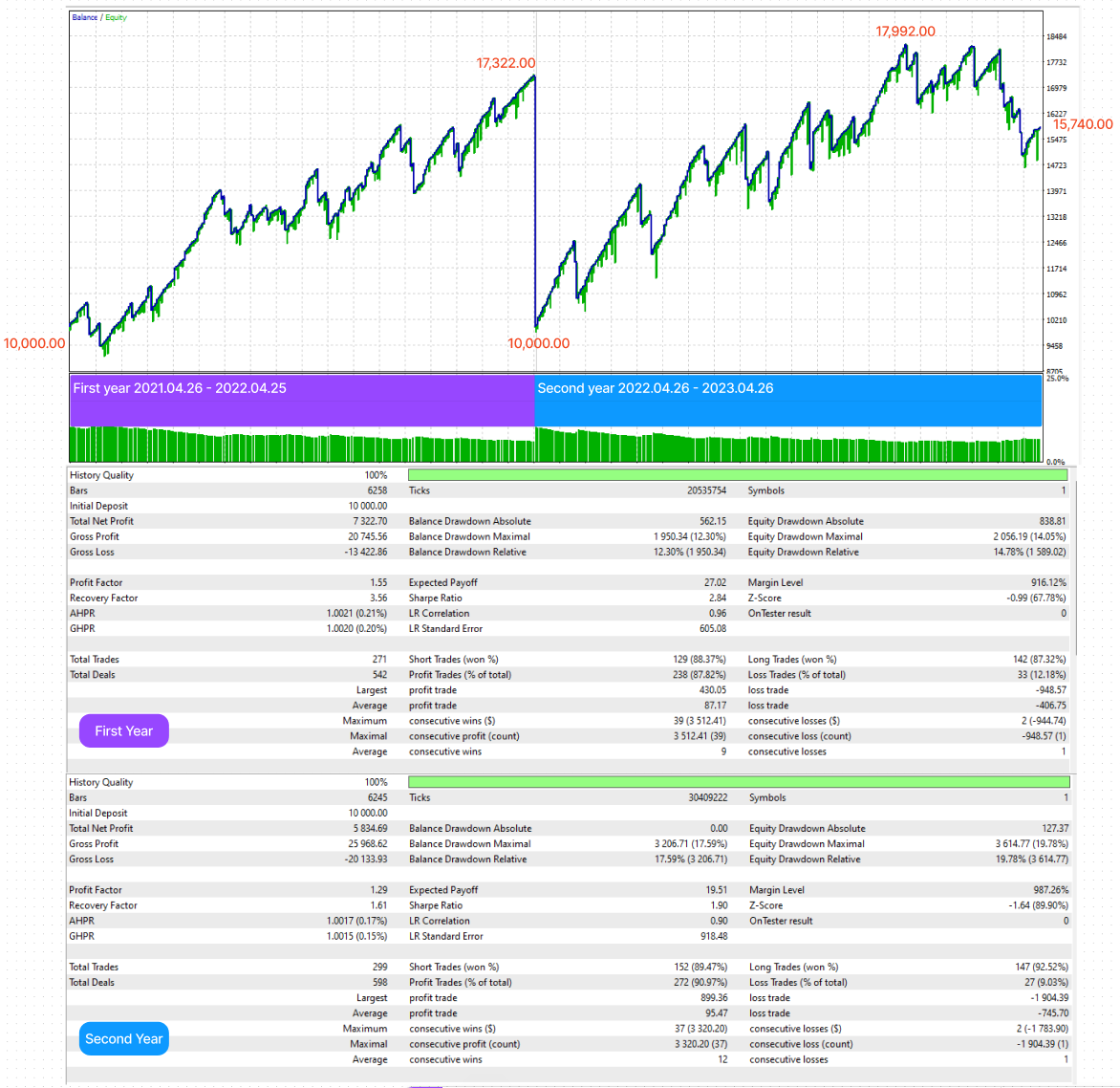

Now let’s break up our ends in half. Let’s have a look at these years separated.

To begin with comes the graph. I at all times test the graph to find out if a method is nice with the bare eye.

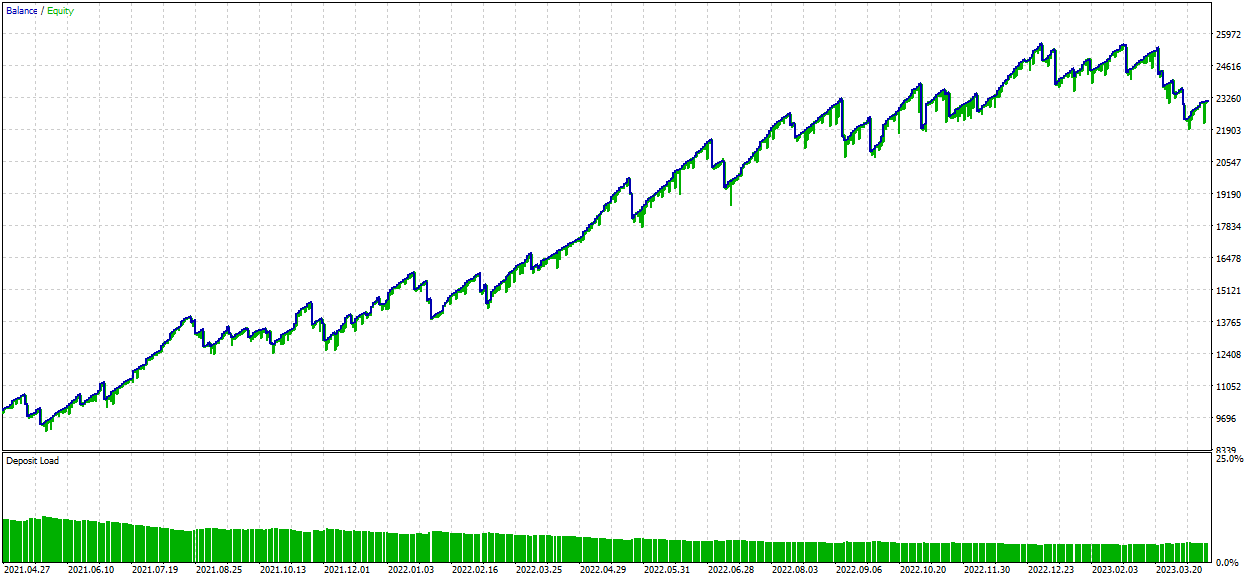

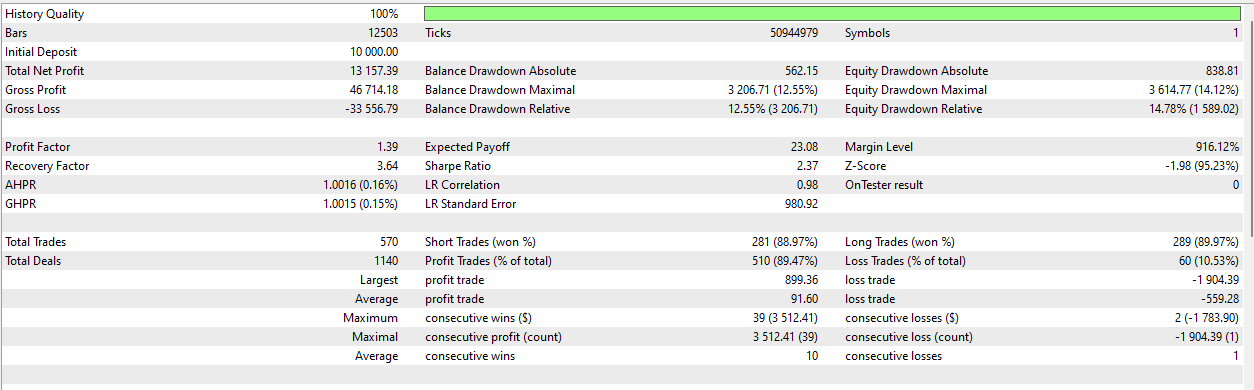

Now let’s test the general efficiency for these two years:

Kelly Calulator

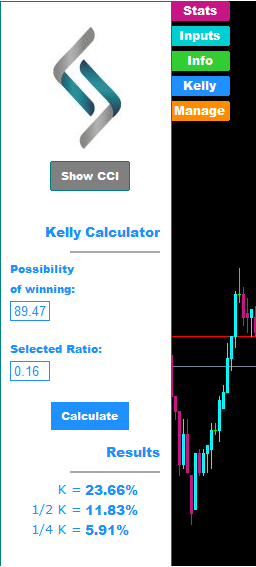

However this outcome comes after we commerce the identical quantity, it doesn’t matter what our account steadiness is. Let’s attempt a extra dynamic approach to calculate our lot dimension, threat and potential revenue. As talked about earlier than, this EA comes with a built-in Kelly Criterion Calculator. Let’s use it and mix it with the Lot in Share mode.

Earlier than doing so, let’s add our statistics on the Kelly Calculator. We want the potential for profitable and the ratio between the Revenue and the Loss.

From the backtest we are able to see that the proportion of the revenue trades is 89.47%. Additionally we are able to test the typical revenue commerce and the typical loss commerce. If we make the division, the result’s: 91.60/559.28 = 0.16.

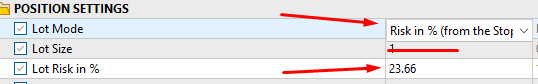

Kelly says that the optimum threat per commerce is 23.66%. I’ve to confess that that is fairly excessive, and it’s at all times beneficial to make use of the fractions of Kelly, with probably the most generally was the 1/4.

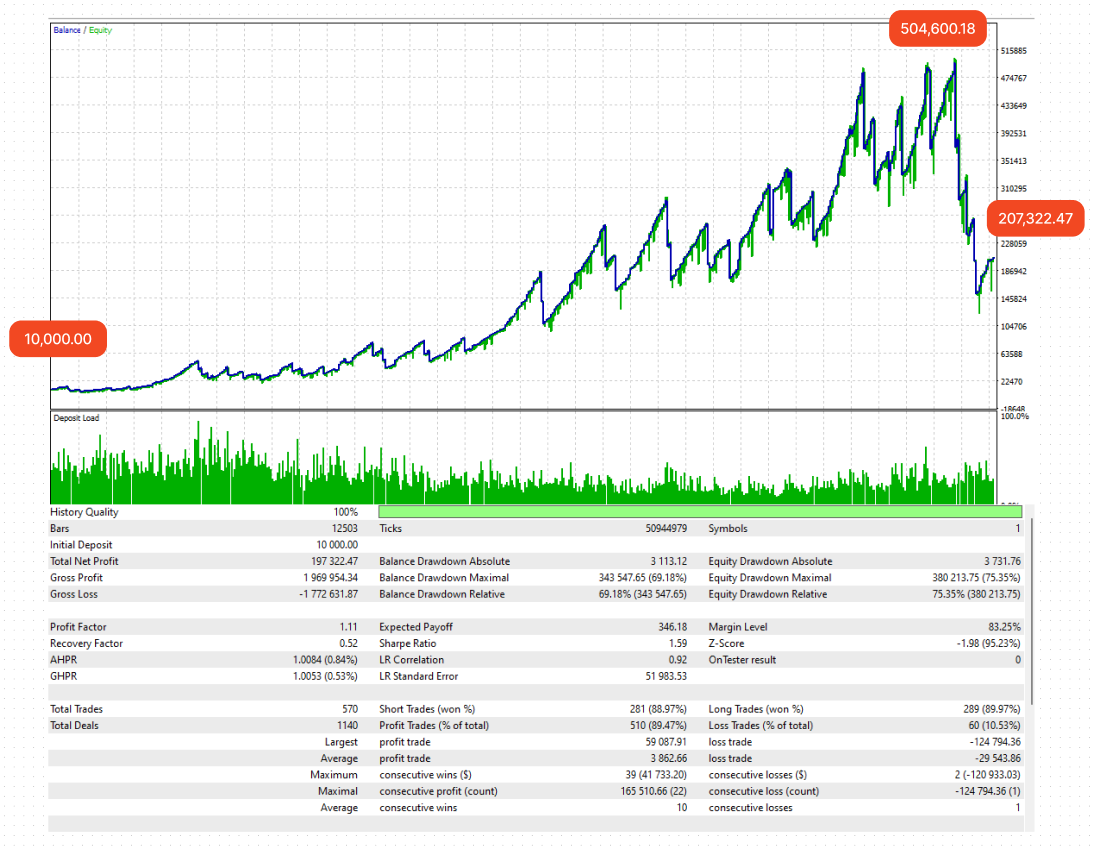

However from curiosity and solely, let’s test what is occurring after we threat the complete Kelly in every commerce.

The “Lot Measurement” discipline on this case just isn’t used.

Listed below are the outcomes:

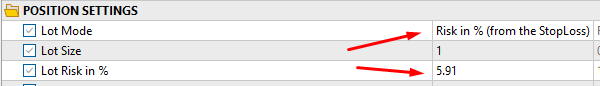

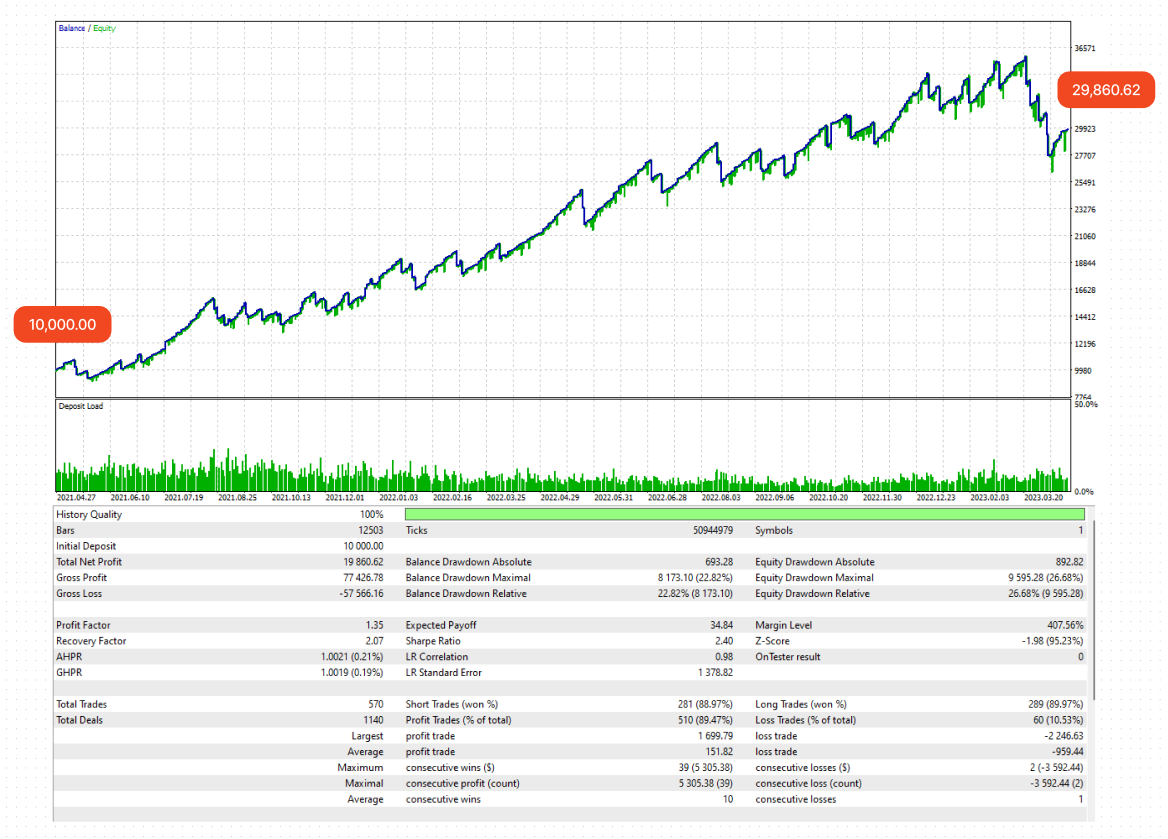

And now that we’re scared sufficient from the latest drawdown, but additionally pumped up by seeing how highly effective the Kelly Criterion may very well be, let’s be disciplined and give attention to the 1/4 Kelly that would most likely have an awesome influence on our technique.

You’ll be able to experiment with the 1/2 Kelly or different threat percentages to seek out your individual distinctive setup. Enjoying round with totally different inputs, devices, and timeframes may help you uncover what works greatest for you.

Handle Tab

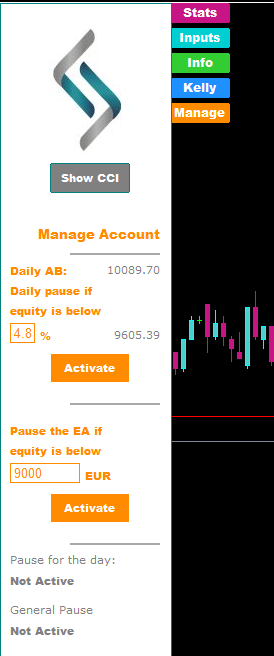

That can assist you safe your buying and selling additional, there’s one other built-in performance obtainable within the “Handle” tab. There are two other ways to handle your threat. The primary is a % every day cease, the place you possibly can choose a proportion of your every day account steadiness (it modifications day by day on dealer’s time or GMT time -you can change it from the inputs), and if this proportion is reached, the robotic will cease buying and selling for the remainder of the day.

Secondly, there’s one other cease you should utilize. Merely choose a certain quantity (if you happen to do not like math and percentages), and if the account fairness drops beneath this quantity, the robotic will cease buying and selling till it’s reactivated by the person.

This fashion, for many who are taking the FTMO Problem, you possibly can set the every day drawdown to five% and the overall pause to 9000+ with the intention to deactivate the automated buying and selling earlier than being stopped out by the dealer.

Conclusion

You’ll be able to experiment with the 1/2 Kelly or different threat percentages to seek out your individual distinctive setup. Enjoying round with totally different inputs, devices, and timeframes may help you uncover what works greatest for you. Bear in mind, the one surefire method to reach the markets is to teach your self and study out of your losses.

I hope you discover this instrument helpful and that it helps you succeed within the markets. At all times keep in mind to be disciplined.

Cheers!

[ad_2]