[ad_1]

Social Safety alone is just not sufficient, new Vanguard examine confirms.

Folks usually assume that the retirement wants of low-wage staff are lined by Social Safety’s progressive profit formulation. That evaluation has by no means been right.

Social Safety was by no means supposed to be the only real supply of revenue for any group of retirees. Social Safety alternative charges – advantages as a proportion of pre-retirement earnings – fall far beneath the widely accepted benchmarks. And low earners usually tend to declare early, which ends up in an actuarial discount of their alternative price. Because of this, at age 62, Social Safety presently replaces simply 41 p.c of a low-paid employee’s pre-retirement earnings. For these low-income staff who should pay some or all of their Medicare premiums, the online alternative price from Social Safety is even decrease. Thus, low-income staff – like their middle- and higher-paid counterparts – want supplementary retirement revenue.

A new report from Vanguard drives this level residence in spades. The researchers estimate retirement readiness for various cohorts and revenue teams. The estimates incorporate inputs from Vanguard’s capital market mannequin together with empirical knowledge on family steadiness sheets, financial savings charges, and spending patterns to estimate retirement readiness.

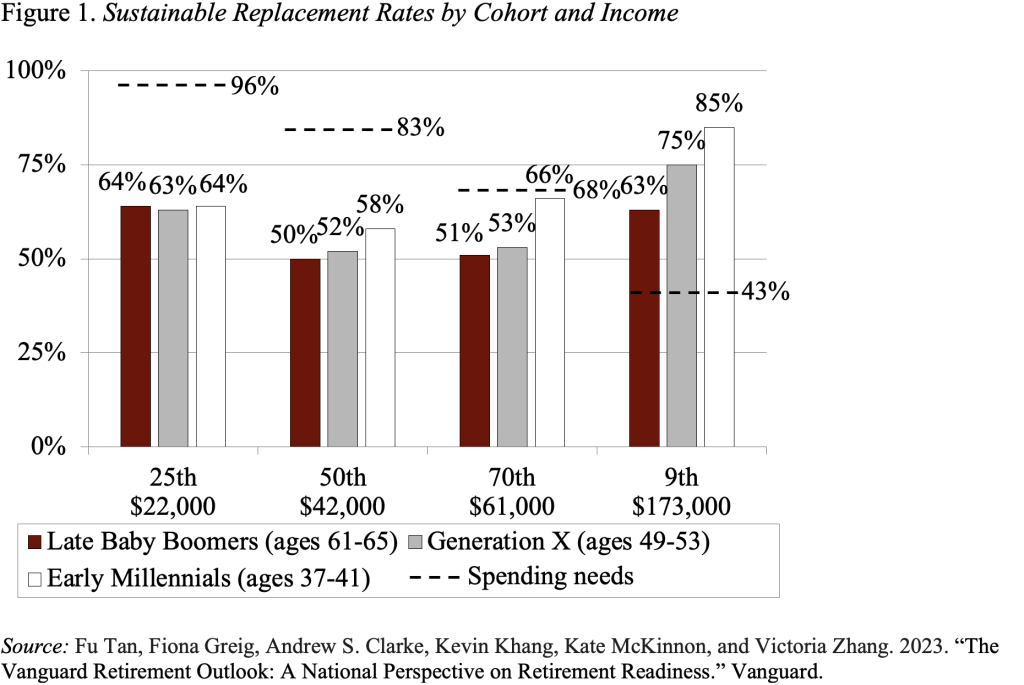

Retirement readiness entails evaluating two alternative charges. The primary is the sustainable alternative price – the very best degree of consumption as a share of pre-retirement revenue that the employee can maintain in 90 p.c of market return/mortality eventualities. The second is a goal alternative price based mostly on retirement spending wants inferred from nationwide survey knowledge. The distinction between these two alternative charges is the family’s projected financial savings hole at age 65. The essential outcomes are proven in Determine 1. Whereas high-income staff throughout all generations are on monitor to fulfill their spending wants, all different teams are projected to fall brief. The shortfall just isn’t that enormous for these on the seventieth percentile, and the image improves considerably for the youngest cohort.

The story for the underside half of the inhabitants is far grimmer. The gaps between goal and projected alternative charges are very giant for these on the 25th percentile and the 50th percentile of the revenue distribution. For the 50th percentile, the scenario seems to be enhancing barely for youthful cohorts, however no enchancment is clear throughout cohorts for low-wage staff.

Let me make two feedback. First, the Heart for Retirement Analysis has been placing out an identical – albeit much less refined – product since 2006 – the Nationwide Retirement Threat Index. This Index has constantly proven {that a} very giant share of working-age households within the backside third of the revenue distribution won’t be able to keep up their consumption in retirement. It’s great to have one other examine from such a revered supply that helps these findings.

Second, the Vanguard numbers make the case that low-wage staff want a approach to save. This concern has led to the adoption of Auto-IRA applications in 14 states for staff whose employer doesn’t supply a plan. These plans are important, and we have to do all the things to strengthen them. The plight of the low-wage employee additionally underlines the significance of the launching of the expanded Savers Credit score. Lastly, the numbers present how essential it’s to discover a resolution for Social Safety earlier than the depletion of its belief fund reserves within the early 2030s.

[ad_2]