[ad_1]

2023’s third quarter disrupted the development of slowing funding within the local weather tech sector. A complete of $16.6 billion was invested in Q3, in response to a lately launched BloombergNEF evaluation, due largely to curiosity in decarbonization and low-carbon startups. In accordance with the report, that is the best quarterly funding in local weather tech since This autumn of 2021.

Whole local weather tech funding within the first half of 2023 peaked at $13.1 billion, a full 40 p.c lower than the identical time interval in 2022, in response to CTVC. This dip fearful the enterprise group, with a number of media retailers masking the as soon as impenetrable sector’s obvious fall from grace.

However the catalyst for local weather tech’s rocky begin to 2023 doesn’t seem like local weather tech-related.

“I feel it’s a perform of the broader macro atmosphere,” mentioned Shayle Kann, a associate at Power Influence Companions, to GreenBiz, “Funding is down throughout the board, in every single place.” Kann cites excessive rates of interest and a difficult home financial scenario as main elements, and he’s not alone in his evaluation.

Throughout a latest keynote handle at GreenBiz’s VERGE23, Sophie Purdom, co-founder of CTVC and managing associate at Planateer Capital, referenced a “non-zero curiosity phenomenon” as a purpose for local weather tech funding offers falling by means of.

Each Kann and Purdom are referring to the Federal Reserve’s choice to drop rates of interest right down to zero through the top of the COVID-19 pandemic. The Fed’s motion was a bid to stabilize a quickly declining economic system by incentivizing {the marketplace} to spend and develop with minimized threat. Since then the central financial institution has aggressively raised rates of interest to curb sharply rising inflation. Now, virtually 4 years on from the preliminary rate of interest lower and lots of fee hikes later, inflation has settled to 5.33 p.c and no additional will increase are on the horizon.

Within the “world of tech coming again to actuality,” local weather tech investing has remained comparatively robust, Kann mentioned: “There’s solely a few sectors which can be outperforming the general funding world, and it is mainly AI and local weather.”

Though the entire quantity invested in local weather tech firms decreased in H1’23, the entire variety of offers within the house truly elevated. A complete of 633 local weather tech startups raised cash, in comparison with 586 from H1’22. Startups receiving funding for the primary time elevated by 34 p.c from 2022.

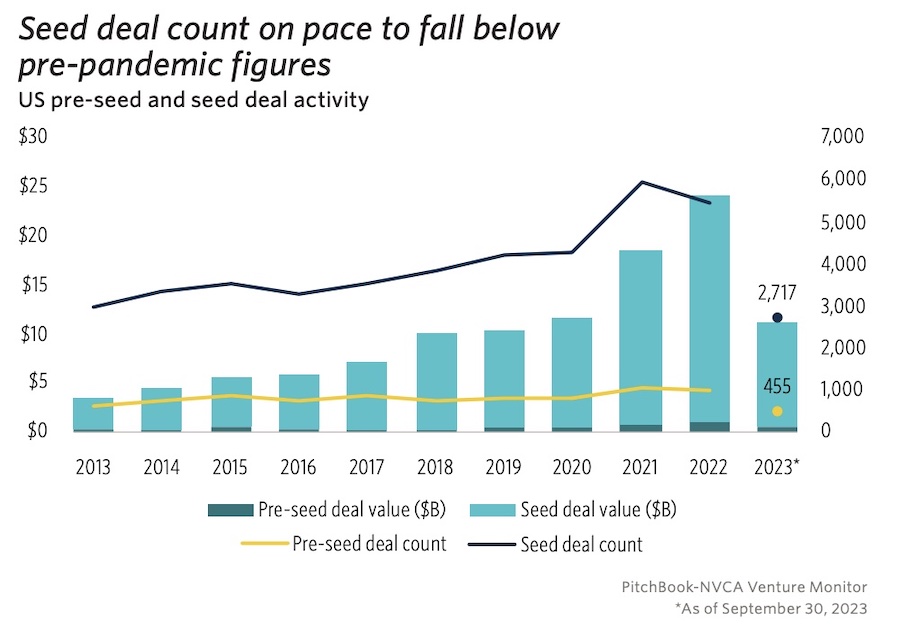

That contrasted sharply with the broader enterprise capital panorama. In Pitchbook’s lately launched evaluation of Q3 enterprise capital tendencies, early-stage exercise has slumped in 2023, with a complete of two,717 offers by means of September.

The most recent tendencies from Q3 present a robust rebound by way of cash flowing into the sector.

Whereas the entire variety of offers fell to 241, in response to BloombergNEF’s Funding Radar Q3 2023, just a few large offers secured the quarter’s monetary rebound. They included H2 Inexperienced Metal’s $1.6 billion spherical, lithium-ion battery producer Northvolt’s $1.2 billion spherical, and battery recycling firm Redwood Supplies $1 billion Collection D spherical. These offers all came about in sectors typically linked to larger ranges of emissions which can be onerous to abate, as famous by PWC.

The shift towards bigger, mid- to later-stage offers will proceed, mentioned John MacDonagh, senior analyst at Pitchbook: “The battery areas, [and] a few of the clear gas areas, [like] hydrogen, for instance, I feel we’ll see comparable tendencies over the following few quarters.”

CTVC’s evaluation of the primary half of 2023 concluded {that a} return to larger numbers in Q3 might point out a market restoration. With federal rates of interest settling and the necessity for local weather mitigation expertise extra urgent than ever, a bubble burst – like what occurred to Clear tech 1.0 – isn’t a robust chance.

“I don’t assume there are any [climate tech] sectors that I might say are actually falling behind,” concluded MacDonagh.

[ad_2]