[ad_1]

The foreign exchange market isn’t as complicated as it might sound. Sure, it is extremely unpredictable. Nonetheless, there are particular traits that many merchants have found to be recurring and have traded round these recurring market situations.

Considered one of these is the idea of Imply Reversal. Imply Reversal is the belief or concept in buying and selling whereby value would normally reverse again to its mathematical common after transferring to an excessive value degree.

We will consider the foreign exchange market as a robust elastic band. Think about this sturdy elastic band tied round your waist whereas it’s tied on a set level. Think about your self making an attempt to run whereas this elastic band is tied to your waist. Ultimately your energy could be exhausted and the sturdy elastic band would pull you again in. The identical is true with the foreign exchange market. Value would usually transfer away from the typical value because the market good points some momentum. This could trigger value to both be overbought or oversold, that are excessive value factors. Because the momentum weakens, value would then be pulled again in in direction of its imply.

Merchants made cash buying and selling imply reversal methods. Entries are made every time value is at a degree which will be thought-about as overbought or oversold with the hope that value would revert again to its imply, because it normally does. At occasions value would reverse straight away. At occasions value would barrel by means of the entry level. Nonetheless, as value turns into increasingly more overextended on an excessive value degree, the tendency that it could reverse turns into stronger and stronger. Quickly sufficient, value would revert again to its imply permitting merchants who’ve entered on the proper degree to generate profits.

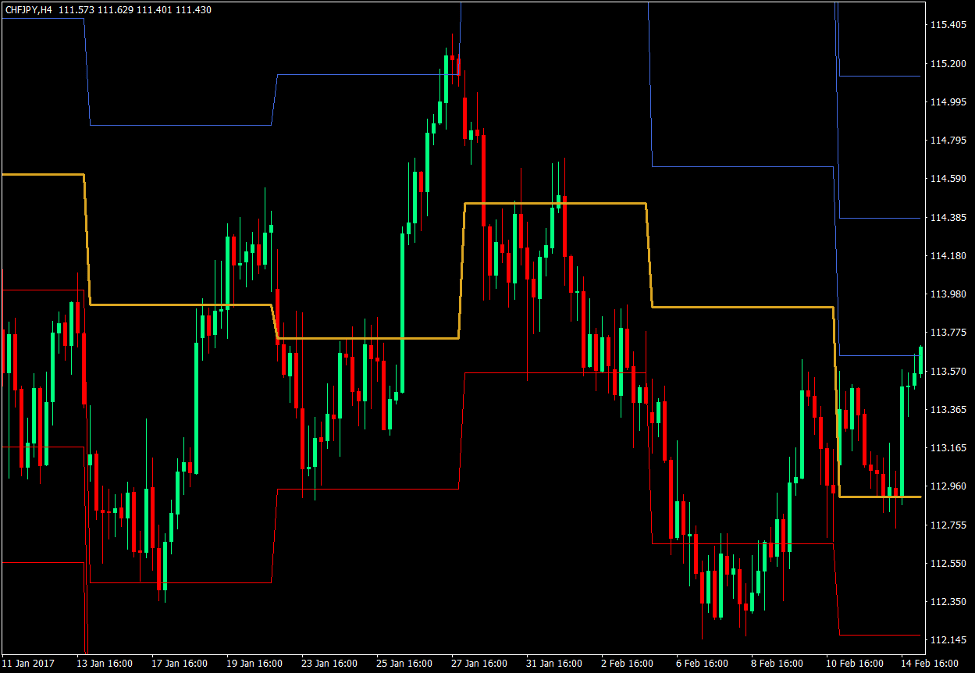

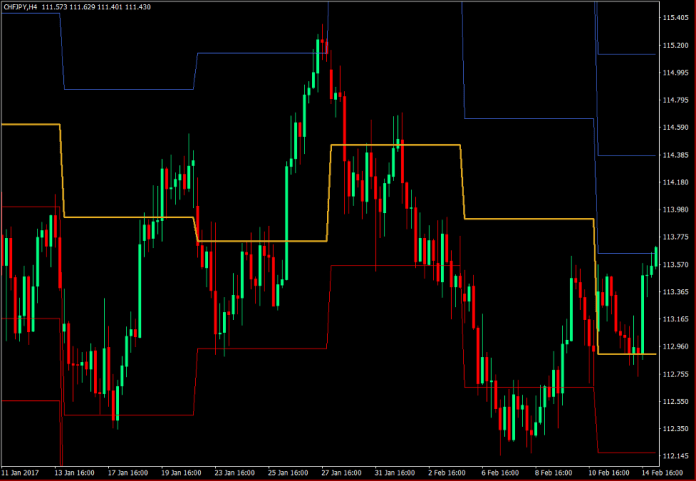

Imply reversal banks on value reversing because it reaches an excessive value level. Pivot Level indicators establish excessive value factors the place value can reverse making it perfect for a imply reversal technique, which we are going to discover right here.

Pivot Level Indicator

The Pivot Level indicator is a staple technical evaluation indicator which {many professional} merchants use.

This technical indicator identifies key ranges on a value chart the place value could discover help or resistance based mostly on key value factors from the prior interval. These durations could also be each day, weekly or month-to-month.

The Pivot Level indicator identifies the Pivot Level (PP) degree, Help ranges 1, 2 and three (S1, S2 and S3), in addition to Resistance degree 1, 2 and three (R1, R2 and R3).

The Pivot Level degree is mainly the typical of the excessive, low and shut of the earlier interval. The Help and Resistance ranges then again are derived from the Pivot Level degree based mostly on a set mathematical formulation.

Value would usually bounce off from a Help degree going up again in direction of the Pivot Level degree. The tendency for a reversal additionally turns into stronger as value goes deeper in direction of S3.

Inversely, value would additionally normally bounce again down in direction of the PP degree because it reaches a resistance degree, with the tendency of a reversal growing because it goes larger in direction of R3.

Merchants usually commerce imply reversal methods round these key ranges. Some would place restrict entry orders on these ranges and purpose for the PP degree, whereas others would commerce solely when value motion reveals indicators of reversing round these ranges.

Price Averaging

Price Averaging is a method used largely by traders and long-term merchants in an effort to common down their entry degree.

Lengthy-term traders normally use a value averaging methodology based mostly on a month-to-month funding with the identical greenback funding. This permits them to common out their entry ranges as they make investments on a inventory or index. It additionally permits them to mechanically restrict the variety of shares they’d buy in periods when value is excessive and enhance the variety of shares they’d buy every time costs are low. It’s because they’re utilizing a set funding quantity.

Swing and day merchants then again do price averaging based mostly on a set pip increment as value reverses in opposition to their positions. For instance, a dealer could have a purchase commerce setup as an preliminary entry. He might then choose to set purchase restrict entries on a 20-pip increment under his entry level. This fashion, as value reverses, he might simply get better from the paper loss.

Price averaging could also be an efficient commerce administration methodology. Nonetheless, it isn’t as environment friendly as value don’t normally bounce off the degrees of the restrict entry orders. It’s extra environment friendly to position the restrict entry orders on ranges the place value is extra more likely to bounce, which is why Pivot Level ranges are glorious for Price Averaging strategies.

Pivot Level Price Averaging

As stated earlier, Pivot Level ranges are key ranges the place value usually reverses from to revert again to the imply value, which is the Pivot Level degree. Price averaging ranges are additionally extra environment friendly when positioned at key ranges the place value could reverse, thus making Pivot Factors and Price Averaging an excellent mixture.

Help Stage Price Averaging Entry Factors

- Set Purchase Restrict orders on S1, S2 and S3.

- Set the Take Revenue goal on the Pivot Level degree.

- Choice 1: Exit the commerce as quickly as the overall earnings of the commerce entries are optimistic.

- Choice 2: Look ahead to value to succeed in the Pivot Level take revenue goal.

Resistance Stage Price Averaging Entry Factors

- Set Promote Restrict orders on R1, R2 and R3.

- Set the Take Revenue goal on the Pivot Level degree.

- Choice 1: Exit the commerce as quickly as the overall earnings of the commerce entries are optimistic.

- Choice 2: Look ahead to value to succeed in the Pivot Level take revenue goal.

Conclusion

Pivot Factors and Price Averaging are an ideal match.

Pivot Level ranges are glorious reversal factors the place value is extra more likely to reverse. Nonetheless, we can’t all the time predict which degree value would bounce from. By doing this kind of setup, there could be no have to anticipate which degree value would bounce from as a result of all ranges are positioned with an entry degree. If value does bounce from the primary help or resistance degree, then good. We will make one other commerce subsequent week. If not, then we’ve got pending orders on the second and third ranges.

At occasions, value could proceed by means of S3 or R3, particularly throughout trending markets. On this case, we could place a brand new set of restrict entry orders subsequent week and hope it could bounce for an exit at greater than breakeven. Nonetheless, there are occasions when the other pattern would proceed fairly longer. For this reason it is very important conservatively measurement your commerce positions to ensure that the account to deal with the paper loss correctly.

It is a distinctive method to buying and selling whereby merchants could keep away from losses by means of price averaging. Nonetheless, it isn’t danger free. If traded with giant place sizes relative to the account measurement, the account could not be capable of deal with the floating loss. So, handle your place sizes properly and follow earlier than making an attempt this system.

Foreign exchange Buying and selling Methods Set up Directions

Learn how to Commerce Pivot Level Reversals with a Price Averaging Approach is a mixture of Metatrader 4 (MT4) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the collected historical past information and buying and selling alerts.

Learn how to Commerce Pivot Level Reversals with a Price Averaging Approach supplies a possibility to detect numerous peculiarities and patterns in value dynamics that are invisible to the bare eye.

Based mostly on this info, merchants can assume additional value motion and modify this technique accordingly.

Really helpful Foreign exchange MetaTrader 4 Buying and selling Platform

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

Click on Right here for Step-By-Step XM Dealer Account Opening Information

Learn how to set up Learn how to Commerce Pivot Level Reversals with a Price Averaging Approach?

- Obtain Learn how to Commerce Pivot Level Reversals with a Price Averaging Approach.zip

- *Copy mq4 and ex4 information to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you need to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out Learn how to Commerce Pivot Level Reversals with a Price Averaging Approach

- You will note Learn how to Commerce Pivot Level Reversals with a Price Averaging Approach is accessible in your Chart

*Notice: Not all foreign exchange methods include mq4/ex4 information. Some templates are already built-in with the MT4 Indicators from the MetaTrader Platform.

Click on right here under to obtain:

[ad_2]