[ad_1]

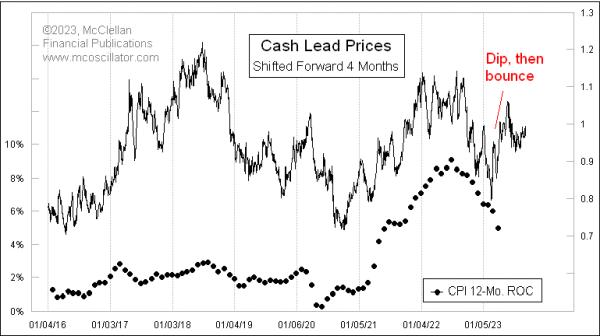

Inflation charges have been coming again down from their massive post-COVID spike to above 8%. However they’re prone to see a short upturn, if this week’s visitor fortune-teller is appropriate.

The actions of the value of lead are inclined to get repeated about 4 months later within the Shopper Worth Index (CPI). That’s the message on this week’s chart. Lead is an industrial steel which most of us don’t take into consideration, now that it has been taken out of gasoline, nevertheless it nonetheless finds makes use of in lead-acid automobile batteries, automobile radiators, and in some electronics parts. Its value goes up and down with demand, like plenty of different industrial metals, and it does a reasonably good job of foretelling the actions of different costs.

That is related proper now as a result of lead costs bottomed on September 27, 2022 and spiked as much as a prime on December 30, 2022. We have now not but seen the CPI replicate that upswing in lead costs, and we should see some echo of it over the following 1-2 months. That up transfer in lead costs in late 2022 didn’t go very far nor for very lengthy, nevertheless it was nonetheless a noticeable up transfer that should see its echo get felt in client costs. Notice that, within the chart above, I’ve shifted ahead the plot of lead costs as a way to permit us to higher see how the CPI information echo lead’s actions after that quantity of lag time.

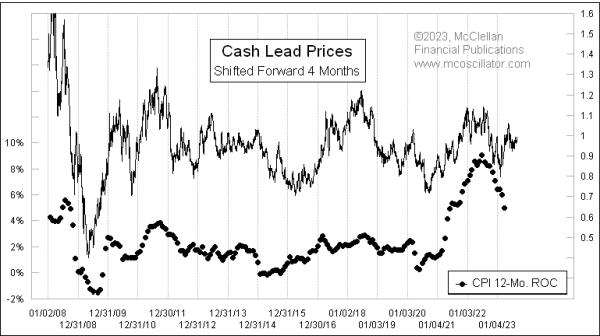

This isn’t a brand new phenomenon; it has been occurring for years. Here’s a longer-term chart going again to 2008, once more with the 4-month offset employed.

The actions of the CPI charge of change don’t completely echo all of lead’s value actions. And that is every day pricing for spot lead versus month-to-month information for the CPI, and so the lead value plot understandably has extra noise.

Why this specific lag time is 4 months is an enchanting query, however not a really helpful one. An individual doesn’t have to have a solution for that query as a way to reap the benefits of the insights that this comparability provides us. If a phenomenon has been occurring constantly for lengthy sufficient, we should not have to have the ability to completely clarify it as a way to discover it and use it. It’s also price noting that the magnitudes of lead’s value actions don’t at all times get completely replicated within the CPI information. I’m not bothered by that, as a result of I discover that if I get the path and the timing of the turns appropriate, the magnitudes can maintain themselves.

Search for the CPI to make a little bit of an inflationary resurgence over the following 1-3 months, and for the Fed and others to get a bit enthusiastic about that. But in addition know that it ought to simply be a short lived resurgence.

Subscribe to High Advisors Nook to be notified each time a brand new put up is added to this weblog!

[ad_2]